Traditional MCA Gets a Speed Makeover

October 24, 2012 “How about you fund me first and then you change my merchant account?”

“How about you fund me first and then you change my merchant account?”

Some account reps will testify that closing a traditional split-funding or lockbox deal can be a bumpy road. The pay-as-you-grow system sounds fantastic over fixed payments until they learn that they have to change their merchant service provider, process sales for two full days, and then wait an extra day for the ACH to arrive in their bank account. The switch could take a few days to several weeks. Have you ever tried to convert MICROS?! A good account rep can keep the customer patient, but that job gets a lot tougher when the fixed daily ACH guys interject right before the contract is signed. We’ll fund you in two days with no processing change required! The customer would have to settle for a fixed daily payment, but that may be secondary to their stress about switching processing before receiving funds. Many things could cross their mind:

- What happens if the download fails?

- What if they say I need a new credit card machine?

- What if my current processor locked my machine with a password? How long will this delay everything?

- What if I don’t process sales every day? Will I need to wait until I have two full days of activity?

- What if there are additional underwriting steps after I switch?

- Are they going to withhold a percentage from my processing before I even get the money?

- How long is this really going to take? I would prefer if I just had the money now and then I’d feel a lot more comfortable doing the rest.

- I kind of need the money by tomorrow, I really can’t risk this taking longer than they expect.

So when RapidAdvance announced their new Rapid Funding Program, we thought, “is this really what we think it is?” We had Sean Murray reach out to Mark Cerminaro, the SVP of RapidAdvance and we learned the program is real. They can and will fund merchants prior to changing the merchant account or setting up the lockbox. In the interim, they set up a temporary daily ACH repayment to protect themselves should the conversion experience any hiccups. Murray asked if this was perhaps a response to the fixed ACH payment phenomenon that has exploded in the last year. Cerminaro responded (We paraphrased some of his words in this story), “Variable payments offer benefits. Many merchants would prefer to set up their financing this way. Some of our biggest resellers still focus heavily on split-funding as opposed to the alternatives. We believe this program will help both them and the merchant.”

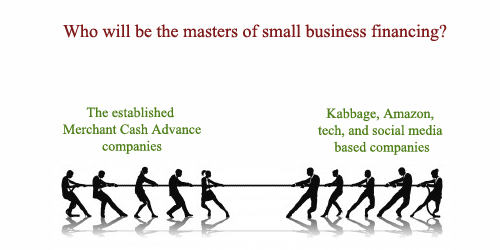

With the slew of new players in the merchant financing market, is speed just window dressing for an old product? An article in Upstart Business Journal called MCAs old! The fixed payment merchant loan seems to be all the rage these days, leaving some to wonder if traditional MCA is on the decline. Cerminaro says that assertion is false. “We’ve experienced substantial growth this year on our traditional MCA product, on all of our products actually. When big companies like American Express and Amazon came in offering their own Merchant Cash Advance or loan program, it made merchants more comfortable that our product and similar ones to it are mainstream. The New York Times even ran an article that listed Merchant Cash Advance as an acceptable form of financing for small businesses. This is all making Merchant Cash Advance more attractive than it ever was before.”

On 7/28/11, we penned an article that said the Merchant Cash Advance industry was waiting for its big moment. At that time, we believed the merchants weren’t using Merchant Cash Advance financing simply because they just hadn’t heard of it. It was the hottest thing that no one was talking about. Of course the era of anonymity is gone and businesses are rushing to get funding hand over fist. The only question now is whether or not this will continue to drive rates down. Cerminaro alluded that some funders are undercutting so much that they’re forgetting to price in the risk. Other industry insiders feel the same way and the debate over it has become the most active thread on the recently founded, DailyFunder.com forum.

Contact Mark Cerminaro for any questions or clarifications regarding RapidAdvance’s Rapid Funding Program at mcerminaro[at]rapidadvance[dot]com.

– Merchant Processing Resource

../../

Ten Days

September 28, 2012 It’s been ten days since Kabbage announced they had raised $30 million to fuel the growth of their Merchant Cash Advance (MCA) operations at home and abroad. MCA is changing faster than we can report it:

It’s been ten days since Kabbage announced they had raised $30 million to fuel the growth of their Merchant Cash Advance (MCA) operations at home and abroad. MCA is changing faster than we can report it:

Former Yahoo CEO joins Kabbage. Hello Silicon Valley takeover! Quotes from the story:

Kabbage is providing an old service, merchant cash advances, with a new twist

Did they just call merchant cash advances old?

Kabbage is rapidly reshaping the small business financing space in the same way that PayPal reshaped the payments space over the last decade

Start believing this…

Amazon enters the MCA industry with a new division called Amazon Lending. Quotes:

Amazon is lending up to $800,000 to some merchants, Wingo said, adding that this is a pretty aggressive entrance into merchant financing.

Merchant financing…quite possibly the term that will replace “merchant cash advance” in the next couple years. Notice AMEX’s advance program is called the same thing. Trend anyone?

Amazon is competing against a start-up called Kabbage, which extends cash advances ranging from $500 to $50,000

They apparently don’t feel anyone else is a threat in the online space.

“We’re flattered that Amazon is building a business modeled on ours,” said Kabbage co-founder Marc Gorlin. “It’s validating that big companies are getting into the small business financing space.”

Dear Kabbage, you did not invent this model.

The kicker to Amazon’s new program? They charge up to 13% interest annually, on pace with what a little company in California named Opportunity Fund claimed was flat out unprofitable. Does that make them yet another new company walking around with a giant Kick-Me sign on their back? Some industry insiders would argue that offering these low rate programs are like swallowing dynamite.

We did a little bit of digging on this new program to see exactly what Amazon was up to. One of their prospective merchants posted this excerpt of the fine print:

Subject to applicable law, you will be in default under this Loan Agreement if any of the following events occur: ……..

(iii) your gross merchandise sales on Amazon.com as reported in your Seller Account (“GMS”) in any month is less than 50% of your lowest GMS on Amazon.com in any of the prior 12 months,(iv) the collective value of your units stored in Amazon fulfillment centers in the US, based on your list price of those units on Amazon.com, (“FBA Inventory Value”) in any month is less than 50% of your lowest FBA Inventory Value in any of the prior 12 months,

Except as otherwise required by applicable law, if you are in default, subject to any right you may have under applicable law to receive notice of and to cure such default, you agree that we may in our sole discretion exercise any remedy available to us at law or equity or take any or all of the following actions: (I) declare the unpaid balance of your Loan to be immediately due and payable, (II) enforce our rights as a secured party by directing Amazon Services LLC to reserve, hold, and pay to us an amount up to the unpaid balance of your Loan from your Seller Account disbursements until the unpaid balance of your debt under this Loan Agreement is paid in full, (III) enforce our rights as a secured party, by taking possession of your units stored in Amazon fulfillment centers and disposing of them in accordance with the Uniform Commercial Code,……………..

If this Loan Agreement is referred to an attorney (who is not our salaried employee) to collect the amount you owe or otherwise enforce the terms of this Loan Agreement, you agree to pay our reasonable attorneys’ fees, court costs and other costs of collection to the fullest extent not prohibited by applicable law.

6. Financing Statements. You authorize us to file and, as we may deem necessary or desirable, to sign your name on any documents and take any other actions that we deem necessary or desirable to ensure that our security interest in any item of inventory or your Seller Account is properly attached and perfected.

There’s some language in there that would make a lot of MCA companies jealous, particularly the section that states a 50% drop in sales is an automatic default!

Thoughts? Share them on DailyFunder.

– Merchant Processing Resource

../../