“Bitcoin Lending As a Concept Has Problems”

March 4, 2016 As the trillion dollar alternative lending market expands, it is bringing into its fold newfangled and unproven investing practices like bitcoin lending. While bitcoin lending upstarts like LoanBase, BTCJam, Bitbond woo investors with attractive returns and push its cause for a diversified portfolio, researcher Brett Scott who studies economic systems is less convinced that bitcoin as an alternative currency will save the day. In his paper for the United Nations, Scott argues that it will still be a while until it brings about actual change in terms of financial inclusion and development.

As the trillion dollar alternative lending market expands, it is bringing into its fold newfangled and unproven investing practices like bitcoin lending. While bitcoin lending upstarts like LoanBase, BTCJam, Bitbond woo investors with attractive returns and push its cause for a diversified portfolio, researcher Brett Scott who studies economic systems is less convinced that bitcoin as an alternative currency will save the day. In his paper for the United Nations, Scott argues that it will still be a while until it brings about actual change in terms of financial inclusion and development.

AltFinanceDaily spoke to Scott about bitcoin lending and its deficiencies as a loan product. Here are the excerpts from the email interview.

On Bitcoin lending

Bitcoin lending could be very positive in principle but in practice, though, the concept still has many problems. Firstly, Bitcoin is not anchored into any national economy. A currency like the Pound is legal tender in a particular geographical area and is widely accepted by everyone within that geographical area. Indeed, if a person in Britain wants to take part in the economy they pretty much have to use the Pound, and if they don’t they will face exclusion. Bitcoin is not like this. It might be accepted but it is not required to be accepted, and a person who doesn’t accept it doesn’t face exclusion from the economy. Thus, while I can buy certain types of goods with Bitcoin – like Pizza at the Pembury Tavern in London – it is not guaranteed to command goods and services anywhere.

On Bitcoin for business needs

This is a problem if you’re borrowing Bitcoin to start a business. If you’re borrowing money, you ideally want the money to be useful for buying a wide range of goods and services that will then enable you to start the business, and you then use your business to earn money with which to pay the loan back. If I get a Bitcoin loan, I’m probably going to struggle to use it to buy all the things I need to start a business – can I buy a computer, for example, or a scooter for delivering goods?

On unstable purchasing power

Also, Bitcoin is unstable in its purchasing power. If you are borrowing money, you want to have some degree of certainty as to what amount of goods and services that money will be able to purchase. I don’t want to get the loan thinking it will be enough to cover three months of business operations, and then discover than it can only cover two months of operations.

On Bitcoin and currency conversion

While businesses might borrow in Bitcoin, it will normally be earning income in a normal national currency. This poses a currency conversion risk in which your assets produce income that is in a different currency to the one required to pay off your liabilities. One response to this is just to accept the risk that the value of the currency your income is in doesn’t depreciate relative to Bitcoin. This basically means that you’re doing currency trading in addition to trying to focus on your core business though. Your business success really should be based on how well you run your operations, rather than how lucky you are about changes in currency values.

Big corporations that operate in multiple countries using multiple currencies deal with this by entering into currency derivative contracts with big investment banks, in which they hedge their currency risk, but right now there is not a well-developed market in Bitcoin currency derivatives. This doesn’t mean such a market won’t develop, but it will take some time still.

One alternative to this is to structure the Bitcoin loan in such a way that it is tied or pegged to a national currency, such that the amount of Bitcoin you have to pay back adjusts depending on how the value of Bitcoin changes. You’re going to have to convince the person that is giving the loan that this is a good arrangement though.

On pegging bitcoin to another currency

Both the lender and the borrower might think of the Bitcoin system as more of payments system instead of a currency in itself. Thus, someone in Britain might want to lend £10 000 to someone in India, so they take £10 000 and use it to buy Bitcoin on a Bitcoin exchange, then they send that Bitcoin to the person in India, who immediately sells it on an exchange for 945000 Rupees.

Furthermore, the person who is lending prices the loan in Pounds rather than Bitcoin. What has essentially happened here is that the loan is really in Pounds but the Bitcoin system was used as a way to transfer it into Rupees, rather than using the normal bank payments system to do that. Then, when the person wants to send interest payments back, they use Rupees to buy Bitcoin and send the Bitcoin to the UK person, who immediately uses it to buy Pounds. It’s possible that this – somewhat elaborate – process might end up being cheaper than using the normal international payments system, but you’d need to investigate that further.

Loan Brokers: Here’s How to Submit a Deal to a Licensed California Lender

February 24, 2016 Brokers that wish to submit deals to a licensed California lender must also be licensed in the state. This does not apply when the lender is lending via a chartered bank relationship or if the transaction itself is a purchase of future receivables (AKA a traditional merchant cash advance). QuarterSpot for example, recently became a licensed lender (#603-K646) and will be operational to lend in the state starting on March 7th, according to the company.

Brokers that wish to submit deals to a licensed California lender must also be licensed in the state. This does not apply when the lender is lending via a chartered bank relationship or if the transaction itself is a purchase of future receivables (AKA a traditional merchant cash advance). QuarterSpot for example, recently became a licensed lender (#603-K646) and will be operational to lend in the state starting on March 7th, according to the company.

While the process wasn’t easy, they want to make sure that brokers are abiding by the rules as well. To this end, QuarterSpot EVP Mike Green posted a link on the AltFinanceDaily forum to the licensing form that brokers must complete to apply:

We will require our partners to submit their CFLL License as required by the State. Please send those in ASAP to partners@quarterspot.com

1. Licensing form outlining requirements for licensure – http://www.dbo.ca.gov/forms/Finance_Lenders/DBO_CFLL_1422.pdf

2. Article further explaining legislation – http://www.paulhastings.com/publications-items/details/?id=e867e669-2334-6428-811c-ff00004cbded

In addition to the 31 page application is the payment of a $25,000 Surety Bond. Suffice to say, the process and costs are probably not a good fit for a 2-man upstart loan brokerage with a razor thin budget working out of month-to-month office space. But for a moderately sized operation or bigger, being a licensed broker can potentially be a competitive advantage.

The reason that brokers don’t need to be licensed to send deals to lenders like OnDeck, is because OnDeck operates through a chartered bank relationship and is therefore exempt from licensing requirements. As always, ask an attorney for an opinion if you’re not sure or need help. A broker may be just as culpable for submitting a deal to an unlicensed lender as the lender would be for operating unlicensed.

You can check to see if a lender is licensed at http://www.dbo.ca.gov/fsd/licensees/ but keep in mind that the database is rarely updated (the last time was 2 months ago).

Other helpful information

Can California Lenders Pay Referral Fees to Unlicensed Brokers?

Getting a California Lender’s License

After CEO Exit, California State Probes Zenefits

February 12, 2016 The California Department of Insurance will investigate the San Francisco-based human resources software startup Zenefits after the exit of its head Parker Conrad earlier this week, amidst a regulatory compliance scandal.

The California Department of Insurance will investigate the San Francisco-based human resources software startup Zenefits after the exit of its head Parker Conrad earlier this week, amidst a regulatory compliance scandal.

Zenefits sells cloud-based human resource software for payroll, talent management and health insurance. The startup, founded in 2013, was touted to be one of the fastest growing companies in Silicon Valley with marquee investors like Andreessen Horowitz, Institutional Venture Partners and Fidelity Management.

The company, valued at $4.5 billion, let health insurance reps fake the mandatory 52-hour training course that is legally required to sell insurance. “After they faked the training course, sales reps were directed to sign a certification, under penalty of perjury, that they had spent the required 52 hours doing the work,” according to Buzzfeed News.

California Insurance Commissioner Dave Jones, in a statement, revealed that the department started probing Zenefits last year. “The recent resignation of Zenefits’ CEO Parker Conrad is an important development, but it does not resolve our ongoing investigation of Zenefits’ business practices and their compliance with California law and regulations,” said Jones.

The company’s COO David Sacks (pictured at right) has replaced Conrad as the CEO.

The Zenefits scandal brings to light Silicon Valley upstarts’ tendency to play fast and loose with regulation and compliance.

Alternative Business Funding’s Decade Club

October 22, 2015 The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

“At that time, the industry was a bunch of cowboys. It was an opportunistic industry of very small players,” says Andy Reiser, chairman and chief executive of Strategic Funding Source Inc., a New York-based alternative funder that’s been in business since 2006. “The industry has gone from this cottage industry to a professionally managed industry.”

Indeed, the alternative funding industry for small businesses has grown by leaps and bounds over the past decade. To put it in perspective, more than $11 billion out of a total $150 billion in profits is at risk to leave the banking system over the next five plus years to marketplace lenders, according to a March research report by Goldman Sachs. The proliferation of non-bank funders has taken such a huge toll on traditional lenders that in his annual letter to shareholders, J.P. Morgan Chase & Co. chief executive officer Jamie Dimon warned that “Silicon Valley is coming” and that online lenders in particular “are very good at reducing the ‘pain points’ in that they can make loans in minutes, which might take banks weeks.”

The burgeoning growth of alternative providers is certainly driving banks to rethink how they do business. But increased competition is also having a profound effect on more seasoned alternative funders as well. One of the latest threats to their livelihood is from fintech companies, like Lendio and Fundera,for example, that are using technology to drive efficiency and gaining market share with small businesses in the process.

“Established lenders who want to effectively compete against the new entrants will need to automate as much decisioning as possible, diversify acquisition sources and ensure sufficient growth capital as a means to capture as much market share as possible over the next 12 to 18 months,” says Kim Anderson, chief executive of Longitude Partners, a Tampa-based strategy consulting firm for specialty finance firms.

Of course, there is truth to the adage that age breeds wisdom. Established players understand the market, have a proven track record and have years of data to back up their underwriting decisions. At the same time, however, experience isn’t the only factor that can ensure a company will continue to thrive over the long haul.

WORKING TOWARD THE FUTURE

Indeed, established players have a strong understanding of what they are up against—that they can’t afford to live in the glory of the past if they want to survive far into the future.

“With every business you have to reinvent yourself all the time. That’s what a successful business is about,” says Reiser of Strategic Funding. “You see so many businesses over the years that didn’t reinvent themselves, and that’s why they’re not around.”

Strategic Funding has gone through a number of changes since Reiser, a former investment banker, founded it with six employees. The company, which has grown to around 165 employees, now has regional offices in Virginia, Washington and Florida and has funded roughly $1 billion in loans and cash advances for small to mid-sized businesses since its inception.

One of the ways Strategic Funding has tried to distinguish itself is through its Colonial Funding Network, which was launched in early 2009. CFN is Strategic Funding’s secure servicing platform which enables other companies who provide merchant cash advances, business loans and factoring to “white label” Strategic Funding’s technology and reporting systems to operate their businesses.

“When you’re in a commodity-driven business, you have to find something to differentiate yourself,” Reiser says.

FINDING WAYS TO BE DIFFERENT

That’s exactly what Stephen Sheinbaum, founder of Bizfi (formerly Merchant Cash and Capital) in New York, has tried to do over the years. When the company was founded in 2005, it was solely a funding business. But over the years, it has grown to around 170 employees and has become multi-faceted, adding a greater amount of technology and a direct sales force. Since inception, the Bizfi family of companies has originated more than $1.2 billion in funding to about 24,000 business owners.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Sheinbaum credits newer entrants for continually coming up with new technology that’s better and faster and keeping more established funders on their toes.

“If you don’t adapt, you die,” he says. “Change is the one constant that you face as a business owner.”

David Goldin, chief executive of Capify, a New York-based funder, has a similar outlook, noting that the moment his company comes out with a new idea, it has to come up with another one. “If you’re not constantly innovating you’re in trouble,” he says. “It’s a 24/7 global job.”

Capify, which was known as AmeriMerchant until July, was founded by Goldin in 2002 as a credit card processing ISO. In 2003, the company began focusing all of its efforts on merchant cash advances. Four years later, the company made its first international foray by opening an office in Toronto. The company continued to expand its international presence by opening up offices in the United Kingdom and Australia in 2008. The company now has more than 200 employees globally and hopes to be around 300 or more in the next 12 months, Goldin says. The company has funded about $500 million in business loans and MCAs to date, adjusted for currency rates.

THE CULTURE OF CHANGE

Five or six years ago, Capify’s main competitors were other MCA companies. Now the competition primarily comes from fintech players, and to keep pace Capify has made certain changes in the way it operates. From a human resources standpoint, for instance, Capify switched from business casual attire to casual dress in the office. The company has also been doing more employee-bonding events to make sure morale remains high as new people join the ranks. “We’ve been in hyper-growth mode,” he says.

CAN Capital in New York, another player in the alternative small business finance space with many years of experience under its belt, has also grown significantly (and changed its name several times) since its inception in 1998. The company which began with a handful of employees now has about 450 and has offices in NYC, Georgia, Salt Lake City and Costa Rica. For the first 13 years, the company focused mostly on MCA. Now its business loan product accounts for a larger chunk of its origination dollars.

This year, the company reached the significant milestone of providing small businesses with access to more than $5 billion of working capital, more than any other company in the space. To date, CAN Capital has facilitated the funding of more than 160,000 small businesses in more than 540 unique industries.

Throughout its metamorphosis to what it is today, the company has put into place more formalized processes and procedures. At the same time, the company has tried very hard to maintain its entrepreneurial spirit, says Daniel DeMeo, chief executive of CAN Capital.

One of the challenges established companies face as they grow is to not become so rule-driven that they lose their ability to be flexible. After all, you still need to take calculated risk in order to realize your full potential, he explains. “It’s about accepting failure and stretching and testing enough that there are more wins than there are losses,” says DeMeo who joined the company in March 2010.

ADVICE FOR NEWCOMERS

As the industry continues to grow and new alternative funders enter the marketplace, experience provides a comfort level for many established players.

“The benefit we have that newcomers don’t have is 10 years of data and an understanding of what works and what doesn’t work,” says Reiser of Strategic Funding. With the benefit of experience, Reiser says his company is in a better position to make smarter underwriting decisions. “There are many industries we funded years back that we wouldn’t touch today for a variety of reasons,” he says.

Experienced players like to see themselves as role models for new entrants and say newcomers can learn a lot from their collective experiences, both good and bad. Noting the power of hindsight, Reiser of Strategic Funding strongly advises newcomers to look at what made others in the business successful and internalize these best practices.

One of the dangers he sees is with new companies who think their technology is the key to long-term survival. “Technology alone won’t do it because that too will become a commodity in time,” he says.

Over the years Strategic Funding has learned that as important as technology is, the human touch is also a crucial element in the underwriting process. For example, the last but critical step of the underwriting process at Strategic Funding is a recorded funding call. All of the data may point to the idea that a particular would-be borrower should be financed. But on the call, Strategic Funding’s underwriting team may get a bad vibe and therefore decide not to go forward.

“We look at the data as a tool to help us make decisions. But it’s not the absolute answer,” Reiser says. “We are a combination of human insight and technology. I think in business you need human insight.”

Seasoned alternative funding companies also say that newbies need to implement strong underwritingcontrols that will enable them to weather both up and down markets.

The vast majority of newcomers have never experienced a downturn like the 2008 Financial Crisis, which is where seasoned alternative financing companies say they have a leg up. Until you’ve lived through down cycles, you’re not as focused as protecting against the next one, notes Sheinbaum of Bizfi. “Every 10 years or 15 years or so, there seems to be a systemic crisis. It passes. You just have to be ready for it,” he says.

Goldin of Capify believes that many of today’s start-ups don’t understand underwriting and are throwing money at every business that comes their way instead of taking a more cautious approach. As a funder that has lived through a down market cycle, he’s more circumspect about long-term risk.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

Having a solid capital base is also a key to long-term success, according to veteran funders. Many of the upstarts don’t have an established track record and need to raise equity capital just to stay afloat—an obstacle many long-time funders have already overcome.

Goldin of Capify believes that over time consolidation will swallow up many of the newbies who don’t have a good handle on their business. Hethinks these companies will eventually be shuttered by margin compression and defaults. “It can’t last like this forever,” he says.

In the meantime, competition for small business customers continues to be fierce, which in turn helps keep seasoned players focused on being at the top of their game. Getting too comfortable or complacent isn’t the answer, notes DeMeo of CAN Capital. Instead, established funders should seek to better understand the competition and hopefully surpass it. “Competition should make you stronger if you react to it properly,” he says.

Investing in the Industry: Break Out of Your Bubble

June 29, 2015 Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

Even if you’re already working in alternative lending and know a lot about your particular area, the industry is growing by leaps and bounds and you might be feeling a little overwhelmed by the multitude of investment opportunities. Amid all the options, finding the right place to invest your money can feel as challenging as picking out the proverbial needle in a haystack.

“Most people don’t know everything that’s out there. There are huge opportunities,” says Peter Renton, an investor and analyst who founded Lend Academy LLC of Denver, Colorado, a popular resource for the online lending industry.

Indeed, there are a growing number of online alternative lending sites that theoretically allow a person to invest in all shapes and sizes of loans. There are sites like Lending Club and Prosper that allow smaller investors to tap into the burgeoning P2P market. There are also a plethora of platforms that cater only to wealthier, more sophisticated investors in a host of areas like small business, real estate, student loans and consumer loans.

Even though there is a surplus of options, prudent investing is not quite as simple as depositing ample funds in an account and clicking the “go” button. Before you get started, you need to carefully consider factors such as your own finances and risk tolerance. You should also have a good handle on the specifics about the online platform—how it works, its history and track record, the types of investments it offers, the platform’s management team, technology and your ability to diversify based on available investment opportunities.

One of the first things you’ll have to think about as a potential investor is whether you have the financial wherewithal to be considered accredited by the SEC. If the answer’s yes, you’ll have a lot more choices of online marketplaces to choose from as well as types of investments. Basically, to meet the SEC’s threshold, you’ll need to have earned income that exceeded $200,000 (or $300,000 together with a spouse) in each of the prior two years, and reasonably expect to earn the same for the current year. Alternatively, you need to have a net worth over $1 million, either alone or together with a spouse (excluding the value of your home). (Check out the SEC’s website for more detailed info.)

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

If you don’t fit the definition of accredited investor, it’ll be more difficult for you to find out about all the investment possibilities that are on the market today. That’s because the platforms that cater to accredited investors aren’t allowed by SEC rules to solicit, so many online marketplaces are hesitant to say much of anything for fear their words will be misconstrued by regulators as an attempt to drum up new business. With limited exceptions, you won’t be able to get more than very basic information from and about these platforms’ unless you are accredited.

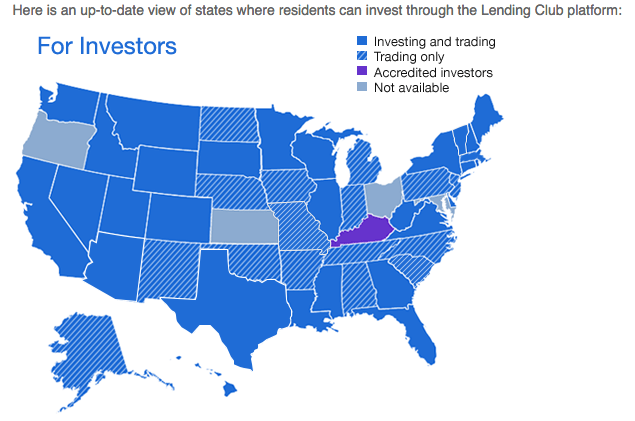

But smaller investors do have options. Two San Francisco-based online lending platforms, Lending Club and Prosper, cater to individual investors, and you can still make a pretty penny plunking down money with these venues. You’ll also find a wealth of information about investing with them by perusing their websites as well as by reading the blog posts of media-savvy financiers.

“Right now, Lending Club and Prosper provide a great entry point for people who want to get involved in investing in alternative lending,” says Renton of Lend Academy.

The caveat is that these platforms aren’t yet open to investors in every state, so if yours isn’t on the list you’re out of luck for now. However, with each marketplace you’ve got more than a 50 percent chance your state is on the approved list, so it’s worth digging deeper.

Assuming you meet their respective suitability requirements, you can choose to invest on one platform or both. To be sure, they are alike in many ways. Both allow you to invest with as little as $25 and fund one loan, however they recommend you buy at least 100 loans to be properly diversified, which you can do for as little as $2,500. You can manually choose which loans to buy, or enter your investment criteria so loan picking is automated. You can also invest retirement money in an IRA through Lending Club or Prosper.

There’s no fee to get started investing on either platform. For Lending Club, investors pay a service fee equal to 1 percent of the amount of payments received within 15 days of the payment due date. Prosper charges investors 1% per year on the outstanding balance of the loan. As the loan gets smaller, the servicing fee, which is charged monthly, gets smaller too.

To invest in Lending Club, in most cases you’ll need either $70,000 in income and a net worth of at least $70,000, or a net worth of at least $250,000. There may be other financial suitability requirements that vary slightly depending on the state you live in. For Prosper, individual investors must be United States residents who are 18 years of age or older and have a valid Social Security number.

At any given time, Lending Club has more than 1,000 loans visible on the platform and new ones get added every day, according to Scott Sanborn, chief operating officer and chief marketing officer. Prosper, meanwhile, on average has more than 200 loans for people to invest in, says Ron Suber, president.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

Returns tend to be favorable compared with other fixed income investments—a major reason investing in online loans is becoming more desirable. Of course, actual returns will depend on what loans you invest in and the level of risk you take—typically the more risk you take on, the greater your potential return will be. At Lending Club, for instance, Grade-A loans have an adjusted net annualized return of 4.89%, compared with 9.11% for Grade-E loans, according to the company’s website.

To encourage more people to start investing, some savvy investors have started to self-publish online the quarterly returns they accumulate through the Lending Club and Prosper platforms. Renton, of Lend Academy, reported a balance of $476,769 on Dec. 31, 2014 and a real-world return for the trailing 12 months of 11.11 percent. Another well-known P2P investor and blogger, Simon Cunningham—the founder of LendingMemo Media in Seattle—reported a 12-month trailing return of 12.0 percent over the same time period, with a published account value of $41,496. Both investors say they expect returns to drop back somewhat over time, however, as the online marketplaces continue to lower interest rates to attract more borrowers.

Of course, if you’re an accredited investor, you will have access to even more online marketplaces. For instance, there’s SoFi of San Francisco for student loans, Realty Mogul of Los Angeles for real estate loans and Upstart of Palo Alto, California, that focuses on loans to people with thin or no credit history. The list of possibilities goes on and on.

Generally speaking, the more money you have to invest, the more options you have. “In this country today, you’ve got well over a hundred options if you’re willing to put seven figures in,” Renton says.

The minimums at venues that focus on accredited investors tend to be more than you’d find at Lending Club or Prosper. At SoFi, accredited investors need at least $10,000 to begin investing in the company’s unsecured corporate debt. SoFi’s been in the lending business for several years now and currently focuses on student loans, mortgages, personal loans and MBA loans. Investors, however, can’t currently invest in these loans, says Christina Kramlich, co-head of marketplace investments and investor relations at SoFi. The company plans to eventually offer investment opportunities in the areas of mortgages and personal loans, she says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

At Funding Circle USA in San Francisco, accredited investors can buy into a limited partnership fund for at least $250,000. Or they can buy pieces of small business loans for a minimum of $1,000 each, though the recommended minimum is $50,000, explains Albert Periu, head of capital markets. There may also be upper limits on your investment, based on your financials. If you’re part of the pick-and-choose marketplace, you’ll pay an annual servicing fee of 1%. With the fund, you’ll also pay an administration fee of 1%. Trailing 12-month net returns for investors are north of 10%, Periu says.

Because it’s still so new, it can be hard for investors to know how to compare marketplaces. For starters, consider the platform’s historical performance. There are a lot of new marketplaces popping up, but it takes time to develop a proven track record. This isn’t to say you shouldn’t dabble with the newer platforms, but if you do, you’ll want above-average returns to balance out the higher risk, says Sanborn of Lending Club. “About three years in, we started to build a track record. At five years in, it was very solid,” he says. “You need time to see how a basic batch of loans is going to perform.”

Before investing, you’ll want to get a sense of how committed senior management is to the company and try and get a sense of whether the company seems to have enough capital for the business to run well. Try to find out about the cash position of the company, how the loans are going to be serviced, what entity is doing the underwriting and how and where your cash will be held.

“It’s not just assessing the risk of the asset and the investment, it’s assessing the risk of the enterprise that is making it available to you,” Sanborn says.

It’s also important to ask questions about the loans themselves. Where do they come from and is the volume sustainable? Ideally, a platform should offer a variety of loans so investors can properly diversify, or you might need to consider investing with multiple platforms to achieve your desired balance.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

Before you get started, you’ll also want to ask about the company’s compliance procedures and controls and how you can recover your money if you no longer want to invest. Data security is another area to explore. Not every company is as protective of customer data as perhaps they should be.

When you’re asking all these questions, try to get a sense of how receptive the platform is to the feelers you’re putting out. Investors should only work with companies that are willing to be open about how they are investing your money, their historical returns and other important data. “I can’t stress transparency enough,” says Periu of Funding Circle.

The technology the platform uses is another key element. Is the technology easy to use, or does the platform create stumbling blocks for investors? Are there ways to automate lending, or do you have to log on every day and manually invest in loans?

Suber of Prosper says investors should also consider whether platforms work with a back-up servicer in case there’s a disruption and whether they run regular tests to make sure everything works as expected. “It’s just like a backup generator and you have to test it every once in a while and make sure it goes on.”

Certainly it pays to do your homework before you invest your hard-earned cash with an online platform. Ask around, attend industry conferences and absorb all you can from publicly available data. The good news is that there will probably be even more information for you to tap into as the industry continues to grow.

“Two years ago [marketplace lending] was very esoteric. A year ago it was still esoteric,” says Funding Circle’s Periu. Now, more and more investors are hearing about marketplace lending and want to make it part of their broader fixed income bucket. Even so, more has to happen for it to become a mainstream investment. “Awareness and education need to continue,” he says.

Once more people understand the extent of what’s out there, Suber of Prosper expects investing in online marketplaces will take off even more than it already has. “A lot of people still don’t know this as an investment opportunity,” he says.

One of the clear themes of the LendIt 2014 conference was that borrowers are willing to pay extra for speed and convenience. Regulators have taken note of this trend but they’re still supportive of the alternative lending phenomenon anyway. Truth be told, the government is acting like a weight has been lifted off its shoulders. Ever since the 2008 financial crisis, the feds have prodded banks to lend more, but they’ve barely budged, especially with small businesses. Non-bank lenders have relieved them of the stress and all they need do now is make sure everybody plays nice.

One of the clear themes of the LendIt 2014 conference was that borrowers are willing to pay extra for speed and convenience. Regulators have taken note of this trend but they’re still supportive of the alternative lending phenomenon anyway. Truth be told, the government is acting like a weight has been lifted off its shoulders. Ever since the 2008 financial crisis, the feds have prodded banks to lend more, but they’ve barely budged, especially with small businesses. Non-bank lenders have relieved them of the stress and all they need do now is make sure everybody plays nice.

Breslow of course said you have to be careful with the noise of social media as there can be a lot of false signals. Does that mean there are big data problems then? Upstart’s Paul Gu said, “we have small data problems” in reference to why there seems to be so much trouble evaluating applicants that have little to no credit history. Gu believes that basic information such as where a borrower went to college, their major, and their grades can be used as an accurate predictor of payment performance and his company has acquired the data to back that up.

Breslow of course said you have to be careful with the noise of social media as there can be a lot of false signals. Does that mean there are big data problems then? Upstart’s Paul Gu said, “we have small data problems” in reference to why there seems to be so much trouble evaluating applicants that have little to no credit history. Gu believes that basic information such as where a borrower went to college, their major, and their grades can be used as an accurate predictor of payment performance and his company has acquired the data to back that up.  “The world’s greatest chess human can beat the world’s greatest chess algorithm,” said Lenddo’s Stewart. “Humans should be pulling what the algorithms can’t think of,” added Breslow. He presented an example of an applicant satisfying all of an algorithm’s criteria but sending up a red flag at the human level. “Why would the owner of a New York restaurant live in California?” Breslow asked. That’s something an algorithm might get confused about. It might mean nothing or it might mean something.

“The world’s greatest chess human can beat the world’s greatest chess algorithm,” said Lenddo’s Stewart. “Humans should be pulling what the algorithms can’t think of,” added Breslow. He presented an example of an applicant satisfying all of an algorithm’s criteria but sending up a red flag at the human level. “Why would the owner of a New York restaurant live in California?” Breslow asked. That’s something an algorithm might get confused about. It might mean nothing or it might mean something.

But questions remain. People supposedly close to Square confirm that the company had practically begged Visa and Google to acquire them. Though there were

But questions remain. People supposedly close to Square confirm that the company had practically begged Visa and Google to acquire them. Though there were  Here’s a question that every investor, lender, and underwriter asks at some point, “What is the default rate on a Merchant Cash Advance?” I personally don’t like when Merchant Cash Advance is overgeneralized since every funder offers their own variation of it, has a different tolerance for risk, and calculates under-performing or non-performing accounts in a unique way. Alas, I am not trying to avoid the question but want to make it clear that there is no one-size-fits-all financing model, nor a standard for defaults. I will quote publicly available information though…

Here’s a question that every investor, lender, and underwriter asks at some point, “What is the default rate on a Merchant Cash Advance?” I personally don’t like when Merchant Cash Advance is overgeneralized since every funder offers their own variation of it, has a different tolerance for risk, and calculates under-performing or non-performing accounts in a unique way. Alas, I am not trying to avoid the question but want to make it clear that there is no one-size-fits-all financing model, nor a standard for defaults. I will quote publicly available information though…