‘As Reality Kicks in, Companies Have to be Discplined,’ Says Fora Financial’s Dan Smith

May 25, 2016

Starting a financial company couldn’t have come at a more inauspicious time for two friends that have known each other since college. Jared Feldman and Dan Smith started Fora Financial in June 2008 and today their company has provided $450 million to over 9,500 small businesses. It recently launched PRISM, a proprietary scoring and decisioning framework and secured a credit facility. Founders Smith and Feldman spoke to AltFinanceDaily about working with Palladium, recent industry news and did some crystal ball gazing. Below is an excerpt from the interview

What does the industry look like to you, with its myriad of players and the recently surfaced problems?

JF: There are a lot of players but I don’t know how much business they are originating. It might sound greater than it actually is. While there is no doubt that competition exists, it is still from the usual cast of characters who have been around for quite some time. However the competition is driving up acquisition costs, possibly some irrational buying from some companies which then trickles down and causes some ISOs and brokers to fail.

DS: Our competitors and we have felt things change in the market in terms of regulation and capital. The influx of capital that came in with the new players is starting to contract a little bit and the lending companies like ourselves are controlling the amount they lend. There has been a lot of artificial growth in the industry – a lot of companies trying the test and learn strategy to see how deep they can buy into the market but they struggle to maintain profits.

And what will be the aftermath of these changes we see in the next six to twelve months?

DS: The reality is starting to kick in and companies will have to be disciplined about their underwriting models and be wise about where they spend their money in order to to grow and sustain profits.

What then should be the top priority for lenders now?

JF: Two top priorities that lenders should focus on is A) To build out a compliance framework and B) securing a long-term credit facility apart from the already mentioned disciplined underwriting making risk, analytics and data capabilities strong.

You started working with private equity firm Palladium last year. Tell us more about where you are with that?

DS: We got into this great partnership and a fund of theirs gave us the capital to grow our business and it aligned with everything we had in our 100 day plan – we wanted to build our regulatory compliance framework, close on a credit facility and bring some key people onboard — all of which we have accomplished. Working with Palladium teaches us how to run a disciplined company and we have already been entertaining M&A opportunities.

What do you think of the hybrid model approach that some lenders take ?

DS: Hybrid model is a great idea in theory and there are concerns with every approach — of holding everything on balance sheet and then buyers buying the loans. There is a lot that goes into capital raising and we have done what we know well and have continued to organically grow our balance sheet. It’s not to say that we have not considered other options but for now, we are focused on getting the right cost structure.

JF: If you have the credit facility with the right cost structure, that is a cheaper cost of capital than what the marketplace is selling these loans for but we are considering options for diversifying our capital sources and we would like to add some kind of market element but that might be in the future. Maybe in the first quarter of 2017.

The Dual Aura of Fora – How Two College Friends Built Fora Financial and Became the “Marketplace” of Marketplace Lending

February 16, 2016A recent Bloomberg article documented the hard-partying lifestyle of two young entrepreneurs who struck it rich when they sold their alternative funding business. The story of their beer-soaked early retirement in a Puerto Rico tax haven came complete with photos of the duo astride horses on the beach and perched atop a circular bed.

But two other members of the alternative-finance community have chosen a different path despite somewhat similar circumstances. Jared Feldman and Dan B. Smith, the founders of New York-based Fora Financial, are about the same age as the pair in that Bloomberg article and they, too, recently sold an equity stake in their company. Yet Smith and Feldman have no intention of cutting back on the hours they dedicate to their business or the time they devote to their families.

They retained a share of Fora Financial that they characterized as “significant” and will remain at the head of the company after selling part of it to Palladium Equity Partners LLC in October for an undisclosed sum. Palladium bought into a company that has placed more than $400 million in funding through 14,000 deals with 8,500 small businesses. It expects revenue and staff size to grow by 25 percent to 35 percent this year.

The deal marks Palladium’s first foray into alternative finance, although it has invested in the specialty-finance industry since 2007, said Justin R. Green, a principal at the firm. His company is appointing two members to the Fora Financial board.

Palladium, which describes itself as a middle-market investment firm, decided to make the deal partly because it was impressed by Smith and Feldman, according to Green. “Jared and Dan have a passion for supporting small businesses and built the company from the ground up with that mission,” he said. “We place great importance on the company’s management team.”

Negotiations got underway after Raymond James & Associates, a St. Petersburg, Fla.-based investment banking advisor, approached Palladium on behalf of Fora Financial, Green said. RJ&A made the overture based on other Palladium investments, he said.

The potential partnership looked good from the other point of view, too. “We wanted to make sure it was the right partner,” Feldman said of the process. “We wanted someone who shared the same vision and knew how to maximize growth and shareholder value over time and help us execute on our plans.”

It took about a year to work out the details of the deal Feldman said. “It was a grueling process, to say the least,” he admitted, “but we wanted to make sure we were capitalized for the future.”

It took about a year to work out the details of the deal Feldman said. “It was a grueling process, to say the least,” he admitted, “but we wanted to make sure we were capitalized for the future.”

The Palladium deal marked a milestone in the development of Fora Financial, a company with roots that date back to when Smith and Feldman met while studying business management at Indiana University.

After graduation, Feldman landed a job in alternative funding in New York at Merchant Cash & Capital (today named Bizfi), and he recruited Smith to join him there. “That was basically our first job out of college,” Feldman said.

It struck Smith as a great place to start. “It was the easiest way for me to get to New York out of college,” he said. “I saw a lot of opportunity there.”

The pair stayed with the company a year and a half before striking out on their own to start a funding company in April 2008. “We were young and ambitious,” Feldman said. “We thought it was the right time in our lives to take that chance.”

They had enough confidence in the future of alternative funding that they didn’t worry unduly about the rocky state of the economy at the time. Still, the timing proved scary.

Lehman Brothers crashed just as Smith and Feldman were opening the doors to their business, and all around them they saw competitors losing their credit facilities, Smith said. It taught them frugality and the importance of being well-capitalized instead of boot-strapped.

Their first office, a 150-square-foot space in Midtown Manhattan, could have used a few more windows, but there was no shortage of heavy metal doors crisscrossed with ominous-looking interlocking steel bars. The space seemed cramped and sparse at the same time, with hand-me-down furniture, outdated landline phones and a dearth of computers. Job seekers wondered if they were applying to a real company.

“It was Dan and I sitting in a small room, pounding the phones,” Feldman recalled. “That’s how we started the business.”

At first, Smith and Feldman paid the rent and kept the lights on with their own money. Nearly every penny they earned went right back into the business, Feldman said. The company functioned as a brokerage, placing deals with other funders. From the beginning, they concentrated on building relationships in the industry, Smith said. “Those were the hands that fed us,” he noted.

By early 2009, Smith and Feldman started raising capital from friends and family members so that they could fund deals themselves. About that time, they developed a computer platform to track the payments they received from funding companies where they placed deals.

Smith and Feldman’s first credit facility came from Entrepreneur Growth Capital. The stake enabled them to begin handling deals on their own instead of passing them along to funders. At the same time, they expanded their computing platform to handle entire deals.

From there, Smith and Feldman expanded their computing capability to help with accounting, underwriting and other functions. A combination of staff and outside developers guided the platform’s evolution. Today, three full-time in-house tech people handle programming.

Smith and Feldman emphasize that they don’t consider Fora Financial a tech company, but Green said the company’s platform helped cinch the deal. “We view Fora Financial as a technology-enabled financial services company,” he maintained.

While building the platform and expanding the business, Fora Financial secured mezzanine financing from Hamilton Investment Partners LLC, a company that bases its investments on the strength of management teams. “I am industry-agnostic,” said Douglas Hamilton, managing partner and and cofounder. “Dan and Jared are one of the best young teams I have encountered in my 35 years of doing private investing.”

Meanwhile, Fora Financial moved six times to larger accommodations. The company’s 116 employees now occupy 26,000 square feet in Midtown, with half of the staff working in direct sales and the other half devoted to back office, underwriting, finance, IT, customer service, collections and legal duties.

Meanwhile, Fora Financial moved six times to larger accommodations. The company’s 116 employees now occupy 26,000 square feet in Midtown, with half of the staff working in direct sales and the other half devoted to back office, underwriting, finance, IT, customer service, collections and legal duties.

Seventy percent of the company’s business flows from its inside sales staff and the rest comes from ISOs, brokers and strategic partners, Feldman said. “Most of the industry is the opposite,” he noted.

Finding salespeople presents a challenge in New York, where they’re in great demand. “We’ve invested a lot of money in finding the right salespeople,” Feldman said. “We also have to make sure that we’re right for them.” The sales staff includes recent graduates and experienced people from other sectors of financial-services or other businesses, Feldman noted.

“We don’t hire from within the industry,” Smith added. “From Day One, we’ve been training our staff our way and not bringing in tainted brokers.” That way, the company can make sure salespeople hew to the company’s ethical approach to business, he maintained. It’s part of creating a company culture, he said.

The Fora Financial culture also includes strict compliance with state and federal regulation because until recently Smith and Feldman owned the entire company, Feldman said. “Regulatory compliance is a core value with us and has been for some time,” he noted, adding that it’s also resulted in conservatism and due diligence.

Those traits have not gone unnoticed, according to Robert Cook, a partner at Hudson Cook, LLC, a Hanover, Md.-based financial-services law firm that has worked extensively with the company. “Fora was one of the first clients in this small-business funding area that took compliance to heart,” Cook said. “As time has gone on, we’re seeing more and more companies make compliance part of their culture, but Fora was one of the early adapters in this area.”

Those traits have not gone unnoticed, according to Robert Cook, a partner at Hudson Cook, LLC, a Hanover, Md.-based financial-services law firm that has worked extensively with the company. “Fora was one of the first clients in this small-business funding area that took compliance to heart,” Cook said. “As time has gone on, we’re seeing more and more companies make compliance part of their culture, but Fora was one of the early adapters in this area.”

Top management at alternative finance companies often talk about compliance, and the discussion too often ends there and doesn’t filter down through the ranks, Cook said. But that’s not the case at Fora Financial, he maintained. “It’s throughout the organization,” he said of the company Smith and Feldman founded. “From a compliance attorney’s standpoint, that’s always a great sign.”

Nurturing a penchant for compliance and dedicating a company legal and compliance department to pursuing it became a factor in Palladium’s decision to become involved with the company, Feldman said.

The focus on compliance also spread to the way Fora Financial brings brokers on board, Smith said. The company scrutinizes potential partners carefully before taking them on, he maintained.

“We probably missed out on some business as the industry grew because we were more cognizant of doing things the right way, but that paid off in the long run and some of our competitors have followed suit,” Smith said.

Compliance first became particularly important when Fora Financial added small-business loans to their initial business of providing merchant cash advances. They began making loans because lots of businesses don’t accept cards, which serve as the basis for cash advances.

On a cash basis, the current portfolio is 75 percent to 80 percent small-business loans. Loans started to surpass advances during the fourth quarter of 2014. The shift gained momentum after the company began funding through its bank sponsor, Bank of Lake Mills, in the third quarter of 2014.

Growth of loans will continue to outstrip growth of cash advances because manufacturers, construction companies and other businesses usually don’t accept cards, Smith said. If a customer qualifies for both, Fora Financial helps decide which makes the most sense in a specific case, Feldman added.

“We don’t sell our loans – we carry everything on the balance sheet and assume the risk,” Feldman said. “If it’s not good for the customer, it’s going to come back and hurt the performance of our portfolio over time,” he noted.

That thinking helped the company recognize the importance of adding loans to the mix. “We were one of the first companies (in the alternative-finance industry) to get our California lending license,” Feldman said. The company obtained the license in 2011 and got to work on lending. Offering loans required some retooling because the underwriting criteria differ so much from those in the cash advance business, Feldman said.

With the help of several law firms, they made sense of regulation from state to state and began offering the loans one state at a time, Smith said. “We wanted to make sure we rolled it out the right way,” Feldman noted.

As the company was changing, Smith and Feldman saw a need to rebrand. Initially, they called their company Paramount Merchant Funding to reflect their merchant cash advance offerings. When they added small-business loans to the mix, they used several additional names. Now, they’ve brought both functions and all of the names together under the Fora Financial brand. Fora means marketplace in Latin and seems broad enough to cover products the company might add in the future, Feldman said.

Smith and Feldman are contemplating what form those future products might take, but they declined to mention specifics. “We’re constantly getting feedback from customers on what they need that we’re not currently delivering,” Feldman said. “We have ideas in the pipeline.”

Despite changes in the business, Smith and Feldman have managed to remain true to timeless values in their personal lives. Smith grew up near Philadelphia in Fort Washington, Pa., and Feldman is a native of Roslyn, N.Y. Both now reside in Livingston, N.J. and occasionally ride the train together to work in New York. Smith is married and has two children, while Feldman and his wife recently had their first child.

“We’re at it everyday,” Feldman said of their work-oriented lifestyle. “When we’re out of the office, we’re traveling for work. So is the rest of the team. We’re only going to go as far as our people.”

And what about that other pair luxuriating in the Caribbean? As Feldman put it: “New Jersey is a long way from Puerto Rico.”

—

Learn more about Fora Financial at www.forafinancial.com

Meet Fora Financial’s Co-founders Jared Feldman and Dan Smith

February 5, 2016Entrepreneurs Jared Feldman and Dan Smith launched their company Fora Financial in 2008. Today it has placed more than $400 million in funding through 14,000 deals. Late last year, they sold part of their company to Palladium Equity Partners LLC for an undisclosed sum, but it is rumored to be quite sizable. It’s almost by coincidence that they named their company “Fora,” which means marketplace in latin, years before “marketplace lending” would become an industry buzzword.

Palladium, which describes itself as a middlemarket investment firm, decided to make the deal partly because it was impressed by Smith and Feldman, according to Green. “Jared and Dan have a passion for supporting small businesses and built the company from the ground up with that mission,” he said. “We place great importance on the company’s management team.”

The Palladium deal marked a milestone in the development of Fora Financial, a company with roots that date back to when Smith and Feldman met while studying business management at Indiana University. After graduation, Feldman landed a job in alternative funding in New York at Merchant Cash & Capital (today named BizFi), and he recruited Smith to join him there. “That was basically our first job out of college,” Feldman said.

It struck Smith as a great place to start. “It was the easiest way for me to get to New York out of college,” he said. “I saw a lot of opportunity there.”

The pair stayed with the company a year and a half before striking out on their own to start a funding company in April 2008. “We were young and ambitious,” Feldman said. “We thought it was the right time in our lives to take that chance.”

The full 4-page featured story appears in AltFinanceDaily’s January/February 2016 issue.

Subscribe FREE

to make sure you get it!

Lending Club Stock Curiously Clobbered

January 20, 2016When Lending Club’s share price was nearing its all-time lows late last year, one might think that company executives would be eager to buy, if for no other reason than to signal long-term confidence. That’s precisely what company CEO Renaud Laplanche did when he bought 60,000 shares on November 30th. And from that date until December 10th, the stock rose from $12.02 to $14.16. That put them within a dollar of their $15 IPO price, a reassuring sign even if they were still down 50% from their all-time high a year earlier.

Here’s what happened next:

- December 14th: The company’s Chief Financial Officer sold 13,950 shares

- December 15th: Board member and former US Treasury Secretary Larry Summers sold 23,421 shares.

- December 16th: The Fed raised interest rates

- December 18th: The company’s Chief Risk Officer sold 75,000 shares. (stock closed at a new all-time low of $11.48)

- January 6th: The company’s Chief Marketing/Operating Officer sold 35,000 shares. (stock closed at a new all-time low of $10.12

- January 11th: The company’s Chief Technology Officer sold 12,500 shares. (stock closed at a new all-time low of $9.24)

- January 12th: The company’s Chief Technology Officer sold 12,500 shares.

- January 13th: The company’s Chief Technology Officer sold 12,500 shares. (stock closed at a new all-time low of $8.86)

- January 14th: The company’s Chief Technology Officer sold 12,500 shares. (stock closed at a new all-time low of $8.02)

While company insiders were selling relatively small blocks of shares and likely doing it to bank just a little bit of their paper wealth, the trades coincided with the company’s plunge to oblivion and perhaps contributed to the drop in the first place. On January 14th, the date of the last insider sale, trading volume spiked to nearly 5x the daily average and the share price hit a record intraday low of $7.76.

While company insiders were selling relatively small blocks of shares and likely doing it to bank just a little bit of their paper wealth, the trades coincided with the company’s plunge to oblivion and perhaps contributed to the drop in the first place. On January 14th, the date of the last insider sale, trading volume spiked to nearly 5x the daily average and the share price hit a record intraday low of $7.76.

Lending Club finished at $7.34 on January 19th, a new all-time record low, with dips as low as $7.05 intraday. That means the stock has dropped nearly 40% since the CEO bought shares less than two months ago. By comparison, the S&P 500 is down 9.5% over that time period.

The share price death spiral has arguably made it easier to spread fear. In the Lending Club subforum on the LendAcademy website for example, a user claiming to manage a hedge fund urged members who use Lending Club’s marketplace to sell everything now and prepare for an armageddon of loan defaults. That thread was suspiciously created around the market open of January 14th, the date with the most trading volume since the IPO.

Meanwhile investors in Lending Club’s notes have remain largely unperturbed. And why wouldn’t they? They’re still enjoying very attractive returns and despite all the doom and gloom, everything is pretty much business as usual.

In a note to shareholders, Compass Point Research and Trading, LLC set a price target of $12 for Lending Club back in December on the risk of the Madden v. Midland case, Congressional investigations into terrorism finance, and the California Department of Business Oversight inquiry into marketplace lenders. While all are perhaps concerning, none seem to present an immediate threat. The most likely reason for the run on Lending Club is that general market fear is stoking reminders of the 2008 crash in which anything related to lending was toxic. As of Tuesday’s close, OnDeck, a business lender often compared to Lending Club, was down 61% from their IPO price. Lending Tree, an online consumer lending portal was down 51% from its 52 week high.

Meanwhile, Lending Club posted positive results in the 3rd quarter. Compared to the same period last year, revenue more than doubled, adjusted EBITDA tripled, and loan originations doubled. They also posted a profit. Overall, these results should not have caused the stock to drop by 50% over the next few months.

As a marketplace, Lending Club does not keep the loans it makes on its balance sheet. That’s something a lot of investors might be overlooking. They may have been clobbered these last few months but the fears might be somewhat unfounded. ..

Kabbage, Fora Financial and Square Have a Roaring Wednesday

October 15, 2015 Wednesday, October 14th was packed with exciting industry news. Right after Congressman David Scott blessed online lenders, Kabbage announced a Series E round investment led by Reverence Capital Partners for $135 million. The Wall Street Journal said the deal valued the company at over $1 billion, a figure that elevates Kabbage to unicorn status.

Wednesday, October 14th was packed with exciting industry news. Right after Congressman David Scott blessed online lenders, Kabbage announced a Series E round investment led by Reverence Capital Partners for $135 million. The Wall Street Journal said the deal valued the company at over $1 billion, a figure that elevates Kabbage to unicorn status.

At the same time, Fora Financial announced that a Palladium Equity Partners affiliate had made a significant investment in the company. In the official release, Palladium principal Justin Green said, “we believe Fora Financial has developed a highly attractive credit offering and technology platform that have made it a valued provider of financing to thousands of small businesses seeking capital.”

Palladium once held a stake in Wise Foods, the potato chip snack company, and currently counts PROMÉRICA Bank, a full-service commercial bank in its active portfolio. They have more than $2 billion in assets under management.

And then there’s Square, the payment processor and merchant cash advance company who publicly filed their S-1 for an IPO. Their registration form uses the term merchant cash advance 16 times so there is no doubt it’s a significant part of their business. “Square Capital provides merchant cash advances to prequalified sellers,” the document states. “We make it easy for sellers to use our service by proactively reaching out to them with an offer of an advance based on their payment processing history. The terms are straightforward, sellers get their funds quickly (often the next business day), and in return, they agree to make payments equal to a percentage of the payment volume we process for them up to a fixed amount.”

As of June 30th, Square had already racked up a net loss for the year of nearly $78 million. In 2014, the company lost $154 million. While the losses stem mainly from their payment processing operations, they had outstanding merchant cash advance receivables of $32 million as of mid-year which illustrates how much exposure they have with that product.

The three announcements ironically coincided with comments made by SoFi CEO Mike Cagney about the industry’s lack of ambition. “The problem with fintech is that it’s not ambitious enough in terms of its objectives. It’s not really transforming anything,” he’s quoted as saying in the San Francisco Business Times. Cagney went on to categorize Lending Club as just an electronic interface bolted onto a bank to originate loans for them. While his comments hold weight given that his lending company recently just raised $1 billion in a Series E round led by Softbank, it may be fair to say however that Wednesday proved there was anything but a lack of ambition in the space right now.

OnDeck (ONDK) Curiously Flips the Script

July 17, 2015

“The company is now reportedly losing tens of millions of dollars through defaults on its loans,” reads a release put out just hours ago by Robbins Arroyo LLP about OnDeck. Their announcement is a little late because OnDeck just announced a Q2 profit on July 15th.

After nearly eight straight years of losses, OnDeck issued a press release announcing that their Q2 earnings call on August 3rd would reveal GAAP net income of somewhere between $4 million and $5 million.

It’s a stark difference from the guidance issued in their Q1 earnings report which put projected Adjusted EBITDA for Q2 at between a loss of $3 million and a loss of $4 million. Projected GAAP losses were much worse.

2015 was supposed to be another year of carefully planned red ink for the business lender as they continued their unrelenting strategy of growth. So where did this profit come from? And were some of their business decisions in Q2 influenced by unhappy shareholders?

Unlike Lending Club who had some company insiders file notices with the SEC to announce they had sold stock, OnDeck did not experience a rush to the selling exits when the lockup period expired. No insider sales were reported.

I published my theories about the stock’s drop back on June 29th.

And now suddenly we have a profit, but the source of the cash is clearly identified in the release. OnDeck sold off a lot of their loans to institutional investors and booked the revenue.

“In the second quarter, 19% of the loans sold through Marketplace were loans originated prior to the second quarter that were previously designated as loans held for investment,” the release stated. That sale also allowed them to reduce their loan loss reserves, it said.

The downside is that the perceived risk of the loans themselves at least for now in the public’s mind has not changed. OnDeck is simply transferring the risk to someone else but they can only do that in the future so long as there are buyers. Therefore they need to consider creating an asset that they and their shareholders would be comfortable holding on to and plan for the economic doomsday where there are no buyers, which will inevitably come.

Compass Point analysts Michael Tarkan and Andrew Eskelsen were not impressed by the pre-announcement. In a note to clients, they wrote, “On the surface, results were stronger than expected due to significantly higher gain on sale revenue and lower expenses. However, if we exclude the one-time gains, core revenues came in well below our expectations, suggesting a meaningful deceleration in loan origination growth and/or another decline in yields.”

Notably, OnDeck’s sudden reliance on the OnDeck Marketplace to achieve profit coincides with a U.S. Treasury Department request for public comments on online marketplace lenders.

“Treasury seeks responses that will allow policymakers to study the various business models and products offered by online marketplace lenders, the potential for online marketplace lending to expand access to credit to historically underserved borrowers, and how the financial regulatory framework should evolve to support the safe growth of this industry.”

OnDeck experienced a surge in its stock price the morning following the Q2 forecast. It has since come down a little and closed at $13.45 on July 16th.

—

Note: I have never bought or sold OnDeck stock.

Strategic Funding Source Names Stephen Lerch Chief Financial Officer

March 10, 2015NEW YORK (March 10, 2015) – Strategic Funding Source, Inc., a New York City-based provider of financing options to small and midsize businesses (SMB), today announced that Stephen E. Lerch has joined the company as Executive Vice President and Chief Financial Officer.

In this role, Lerch will be responsible for all aspects of the company’s financial operations, including enhancing fiscal capabilities, identifying new investment opportunities and executing growth plans. He will report to Strategic Funding Source Chairman and CEO Andrew Reiser.

With more than 17 years in various C-suite roles with technology-based companies in both the public and private sectors, Lerch brings an extensive range of expertise in finance, revenue generation and operations management to Strategic Funding Source. Most notably, he is a veteran of the small business finance and marketing industry, having worked for more than seven years as CFO and COO of Rewards Network where he helped pioneer the early successful growth of the alternative lending marketplace. Prior to that, Lerch was a Partner at Coopers & Lybrand, now PwC. He is a graduate of the University of Notre Dame.

“We are thrilled to welcome Steve to the Strategic Funding Source team,” said Reiser. “With his immense financial, operational and industry specific experience, Steve will play a key role in advancing the way we do business and drive the company’s growth.”

“I am extremely pleased to be joining Andy and the talented management group at Strategic Funding Source,” Lerch commented. “With the best reputation in the industry, the premier underwriting and syndication platform and an excellent equity partner in Pine Brook Partners, Strategic Funding Source is extremely well-positioned to take advantage of the tremendous growth opportunity already underway in small business financing.”

About Strategic Funding Source, Inc.

Strategic Funding Source finances the future of small businesses utilizing advanced technology and human insight. Established in 2006, the company is headquartered in New York City and maintains regional offices in Virginia, Washington state, and Florida. The company has served thousands of small business clients across the U.S. and Australia, having financed over $800MM since inception. Visit www.sfscapital.com to learn more about Strategic Funding Source, its financing products and partnership opportunities.

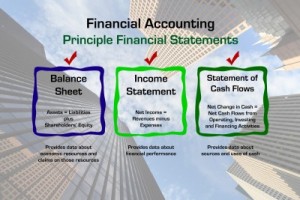

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.

I’ve hung around enough small business owners to know that 99% of their time is spent running the business, not maintaining a general ledger. I get that operational duties bring in the cash and pay the bills, and that the books are something that spawn into existence on April 15th just to satisfy the tax man. I know that feeling, but that routine hurts in the long run especially when it comes time to apply for financing.  Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.

Unfortunately, over the course of many years, advertising that basically anyone can get approved with no financial statements and less than stellar credit history has caused people to let their guard down. The attitude is often, “the lenders don’t seem to care, so why should I take this seriously?” This mindset couldn’t be more detrimental to your approval chances. The CEO of New Resource Bank in his interview with Nerdwallet said, “A lender will judge you based on how you fill out your documents.” The same applies in merchant lending. In my experience, I’d estimate that about 20%-30% of small business owners submitted documentation with at least half the pages missing. I’d receive only the odd numbered pages or I’d get the bank statements for the strong months but none for the bad months even if they were the most recent. Strangest of all were the applicants that sent in only the first page of each statement as if showing the deposit figures for the month were somehow supposed to be comprehensive enough to analyze cash flow. The more disorganized the paperwork, the less credibility the applicant had in the mind of those judging them.