Can’t Wait to Become a Bank? Buy One

March 15, 2021 Major fintech companies can’t wait to become chartered banks, and some don’t have the patience to wait for the paperwork to go through.

Major fintech companies can’t wait to become chartered banks, and some don’t have the patience to wait for the paperwork to go through.

Last week, SoFi bought California-based Golden Pacific Bank (GPB) for $22.3 million to speed up its mission to become a nationally chartered bank. SoFi paid for the cash purchase and will apply to take ownership of the bank’s OCC charter- swapping out their pending application to become a bank outright.

“By pursuing a national bank charter, we will be able to help even more people get their money right,” CEO Anthony Noto said. “We are thrilled to have found a partner in Golden Pacific Bank to both accelerate our pursuit to establish a national bank subsidiary, as well as begin to expand our offerings in SoFi’s financial products.”

SoFi, once an anti-bank fintech was preliminarily approved by the OCC for a charter earlier this year.

A year ago Varo started the buy/apply banking trend after receiving approval for an FDIC Bank Charter. LendingClub, a former Peer-to-Peer lender, soon after joined the club by picking up Radius Bank. Square just two weeks ago became a bank, announcing it received an industrial banking license.

Other lesser-known fintechs have been moving toward chartered banking as well. In February, Brex, an online banking fintech, began the process of opening a Utah Based industrial bank as well. Jiko, a small online banking and payments firm, bought Mid-Central National Bank in Minnesota.

There are other up-and-coming fintech banks, like Chime and even blockchain banking contenders, like Figure Technologies. Figure is a home equity lender that is currently applying for a banking charter without the normal FDIC-insured deposits but instead deposits over $250,000 that would act as uninsured high yield loans.

If Sofi’s plan works, the firm aims to contribute $750 million toward digital lending while maintaining GPB’s community banks’ business and branches. The deal should be completed before the end of 2021, and GPB will operate as a division of SoFi Bank.

Failing Main Street NY

December 21, 2020 During the election, we heard candidates on both sides to toss around the phrase “small businesses are the backbone of the American economy.” A staple of exhausted political rhetoric, made trite despite its truth because for many politicians it’s a talking point, not a platform. We must move from rhetoric to action. To do so, America’s political leaders need a real understanding of what small businesses need—and what they don’t.

During the election, we heard candidates on both sides to toss around the phrase “small businesses are the backbone of the American economy.” A staple of exhausted political rhetoric, made trite despite its truth because for many politicians it’s a talking point, not a platform. We must move from rhetoric to action. To do so, America’s political leaders need a real understanding of what small businesses need—and what they don’t.

The struggle between understanding and posturing is on display right now in Albany. While small business owners struggle to open their doors, the legislature passed a so-called “truth in lending for small business” bill that claims to provide more disclosure to business owners seeking financing. Led by Senator Kevin Thomas and Assemblyman Ken Zebrowski the bill is currently pending before Governor Cuomo. The legislators recently authored an op-ed that further demonstrates their failure to recognize that the innocuously named bill is rife with faults and lacks a competent grasp of small business issues. The critical blind spots in the bill’s design threatens billions of dollars in capital leaving New York—a failing small businesses owners can scarcely afford at such a difficult time.

Yet, rather than incentivizing finance providers to stay in New York, the legislature is focused on complex disclosures that lack real meaning or understanding to small business owners. Senator Thomas opined on the Senate floor “… the reason I introduced this bill is because people don’t use standard terminology.” Interestingly, this bill creates several new terms and metrics that would be required to be disclosed that have never been used before in finance. Terms like “double-dipping” and new confusing metrics that even the CFPB under President Obama labeled as “confusing and misleading” to consumers. This bill’s fatal flaw is that it has confused information volume with transparency, somethings a recent study proved would harm small business owners.

Even Senator Thomas acknowledged the legislation’s myriad of problems while still encouraging its passage. In his colloquy with Senator George Borrello on the Senate floor, right before he called New York small business owners “unsophisticated,” he mentioned how his bill had “many issues” that he “hoped” would be worked out before implementation. Hope is not a strategy and it won’t help small business owners obtain the financing they need to stay in businesses. Advancing legislation that would limit options for entrepreneurs working to stay in businesses during a pandemic that has crippled the New York economy represents a reprehensible failure of leadership.

Minority-owned businesses have faced a disproportionate economic impact from the pandemic. According to the Fed, Black-owned businesses have declined by 41% since February, compared to only 17% of white owned businesses. Further, the Paycheck Protection Program (PPP), the federal government’s signature relief program for small businesses, has left significant coverage gaps: these loans reached only 20% of eligible firms in states with the highest densities of minority-owned firms, and in counties with the densest minority-owned business activity, coverage rates were typically lower than 20%. Specific to New York, only 7% of firms in the Bronx and 11% in Queens received PPP loans. Moreover, less than 10% of minority-owned businesses have a traditional banking relationship—something that was initially required to have access to the PPP.

The lack of cogency and lazy approach to this legislation is a disservice to the hard-working entrepreneurs who continue to open their businesses while facing daily economic uncertainty. Governor Cuomo has worked tirelessly to continue to provide economic relief to both businesses and consumers—removing billions in financing for small businesses will only hinder this effort. New York can do better.

Steve Denis

Executive Director

Small Business Finance Association

Canada’s Top Lending Leaders of 2021

December 16, 2020 The Canadian Lenders Association released its 2021 Leaders in Lending awards. The association is the voice of Canada’s lending ecosystem and represents more than 100 companies in commercial and consumer lending.

The Canadian Lenders Association released its 2021 Leaders in Lending awards. The association is the voice of Canada’s lending ecosystem and represents more than 100 companies in commercial and consumer lending.

All CLA members are vetted and accredited based on their corporate standards

and values. Their role is to support the highest level of lending in Canada,

servicing a wide spectrum of business and consumer borrowers’ growth requirements.

See previous year’s leading lending companies

See previous year’s leading lending executives

2021 Award Winners:

Lending Woman of the Year

|

Tiffany Kaminsky | Co-Founder of Symend

Tiffany Kaminsky is the co-founder of Symend, a fintech that uses analytics and behavioural science to create individualized debt recovery programs. The startup, which has offices in Calgary, Toronto and Denver, received USD $52 million in funding earlier this year and plans to hire up to 200 more roles in 2021. |

|

Nicole Benson | CEO of Valeyo

Nicole Benson is the President & CEO of Valeyo, a business solutions provider to financial institutions in Canada. Nicole drives every facet of business forward, with a focus on growing, evolving, and innovating Valeyo’s suite of solutions to meet the changing needs of its clients and the financial services industry. |

|

Andrea Fiederer | CMO of goeasy

Andrea Fiederer is EVP & CMO of goeasy, a leader in non-prime financial services with over 2000 employees. Andrea is responsible for goeasy’s overall marketing and brand strategy for both the easyhome and easyfinancial business units. |

|

Elena Ionenko | Co-Founder of Turnkey Lender

Elena Ionenko is the Co-Founder of Turnkey Lender, a loan origination platform. Under Elena’s leadership, the company has entered 50+ local markets, raised over $3.5 million in venture capital and launched regional offices all over the globe. |

|

Minal Shankar | CEO of Easly

Minal is the CEO of Easly, a SR&ED financing firm. This year Minal has doubled Easly’s capital under management & customer base. Prior to leading Easly, Minal was an investment manager for the VC firm Northgate Capital and an associate in the Technology Investment Banking group at J.P. Morgan Chase. Minal holds an MBA from the NYU Stern School of Business. |

Fintech Innovator the Year

|

Flinks

Flinks is a data company that empowers businesses to connect their users with the financial services they want. |

|

REPAY

REPAY is a leading provider of vertically-integrated payment solutions. |

|

VoPay

VoPay seamlessly connects you to the banking ecosystem enabling anyone to offer efficient and simple bank account payment processing. |

|

Fundmore

FundMore.ai is an automated underwriting system that uses machine learning to streamline the Pre-Funding process for loans. |

|

Provenir

Provenir offers a suite of risk analytics tools for lenders to make adjudication faster and simpler. |

Executive of the Year

|

Jason Mullins | CEO of goeasy

Jason Mullins is the President & CEO of goeasy, a leader in non-prime financial services with over 2000 employees. Since joining goeasy in 2010, Jason has helped the company scale to $1 billion in market capitalization with compound earnings growth of 28%. Jason is a recipient of Canada’s Top 40 Under 40 Award. |

|

Wayne Pommen | CEO of PayBright

Wayne Pommen is the CEO and Founder of PayBright, a Canadian leader in the BNPL space. His firm has partnered with 7,000 domestic and international retailers, and has approved over $1 billion in consumer credit. This year PayBright was acquired by Affirm in a $340 million transaction. |

|

Lawrence Krimker | CEO of Simply Group

At just 33 years of age, Lawrence Krimker has built Simply Group into a category leader in home equipment financing. This year his firm acquired competitors Dealnet & SNAP Financial in transactions that totalled over $750 million and brought his firm to $1.45 billion in assets under management. |

|

Andrew Graham | CEO of Borrowell

Andrew Graham is the CEO and Co-Founder of Borrowell, Canada’s first fintech to provide free credit monitoring. This year Andrew launched Borrowell Boost to help the 53% of Canadians living paycheck to paycheck meet their bill payments. |

|

Maria Soklis | President of Cox Automotive

In the 6 years that Maria Soklis has led Cox Automotive Canada, the company has become a category leader in software and financing solutions for consumers and dealers across the country. Maria has also left her mark with initiatives that promote diverse and inclusive workplaces, and this year signed the BlackNorth Initiative CEO Pledge. |

Emerging Lending Platform of the Year

|

Moselle

Moselle is a digital platform that simplifies the importing workflow for small medium business owners. |

|

Moves

Moves is a financial services platform for independent “gig” workers. |

|

Vendor Lender

VendorLender is Canada’s first POS lender for dealers in the equipment finance space. |

|

Lendle

Lendle is Canada’s first interest free credit provider. |

|

goPeer

goPeer helps everyday Canadians to achieve financial freedom through Peer-to-Peer Lending |

Small Business Lending Platform of the Year

|

Merchant Growth

Merchant Growth is a leading Canadian financial technology company that specializes in small business financing. Over the past decade, Merchant Growth has supported Canadian businesses with hundreds of millions of dollars in growth financing. |

|

Loop

Launched this year, Loop builds credit & payment products specifically for online merchants. The company is operated by the LendingLoop team that popularized P2P lending in Canada. |

|

Thinking Capital

Thinking Capital is one of Canada’s best known fintech lenders to the small business sector. This year the firm has forged relationships with multiple Credit Unions and hit $1 billion in loans deployed. |

|

OnDeck

Since its launch in 2015, OnDeck Canada has |

|

Clearbanc

Canadian based Clearbanc is the world’s largest e-commerce funder. Their data-driven approach takes the bias out of decision making. Clearbanc has funded 8x more female founders than traditional VC. |

Consumer Lending Platform of the Year

|

Flexiti

Flexiti is a leader in point of sale financing for retailers and has been named one of Canada’s fastest growing companies two years straight. |

|

CHICC

CHICC is one of the country’s leading rental & homeimprovement financing companies. |

|

Marble Financial

Marble uses fintech to empower Canadians to improve their credit score, manage debt, and budget to achieve financial goals. |

|

PayBright

PayBright is one of Canada’s leading buy now, pay later providers. This year the firm was acquired by BNPL giant, Affirm for $340 million. |

|

goeasy

Canada’s leading alternative financial services provider servicing non-prime Canadians through its easyhome and easyfinancial divisions. |

Auto Lending Platform of the Year

|

GoTo Loans

GoTo Loans is a fintech lender focused on helping consumers access the equity from their vehicle and the leading provider in Canada for automotive repair loans. |

|

Auto Capital Canada

AutoCapital Canada is a national auto finance company that works with dealer partners to help clients finance the purchase of new and used vehicles. This year the firm acquired competitor Rifco. |

|

Carfinco

The Western Canada based lender is a leader in non-prime lending to the auto sector. |

|

Canada Drives

Canada Drives is a leader in fintech auto lending. This year the firm hit over 400 employees and 1 million transactions, servicing consumers across Canada, the US, and the UK. |

|

Clutch

Clutch aims to bring speed and convenience to used car sales by taking the experience completely online. The fintech raised a $7 million round this year from Real Ventures. |

Technology Lending Platform of the Year

|

BDC

Launched only five years ago, BDC’s Tech Group has become a leader in lending to Canadian technology entrepreneurs. |

|

TIMIA

TIMIA is a specialty finance company that provides growth capital to technology companies in exchange for payments based on monthly revenue. |

|

Flow Capital

Flow Capital Corp. is a diversified alternative asset investor, specializing in providing minimally dilutive capital to high-growth businesses. |

|

Venbridge

Venbridge is a Canadian finance company offering non-dilutive venture debt, SR&ED financing, and tax credit consulting services. |

|

SVB

SVB has lead the technology lending movement for 35 years. The firm opened their first Canadian office last year. |

Immigrating From Cuba With “Nothing in my pockets,” to a CEO Funding $12 Million a Month

December 15, 2020 “Work hard, don’t ask questions, and good things will happen to you,” Frank Ebanks described his keys to success in the MCA world. “Being Positive, working hard, and keeping my eyes open: If I hadn’t been looking for opportunities at 2 am in the morning on Craigslist, I would have never known about this industry, but it’s huge, it’s such a big industry.”

“Work hard, don’t ask questions, and good things will happen to you,” Frank Ebanks described his keys to success in the MCA world. “Being Positive, working hard, and keeping my eyes open: If I hadn’t been looking for opportunities at 2 am in the morning on Craigslist, I would have never known about this industry, but it’s huge, it’s such a big industry.”

Ebanks started what would become Spartan Capital shortly after seeing an ad calling for startup investors in an industry Ebanks had never heard of, called Merchant Cash Advance.

It was around 2016. Ebanks was up late in the NYU university library, putting himself through an MBA while working as a reactor operator at the Indian Point nuclear power plant in Westchester.

Despite the job security Ebanks enjoyed, he said he wasn’t happy with his career, wasn’t getting the satisfaction he wanted. He had already made it a long way— starting before the millennium as a Cuban immigrant, immigrating to the Dominican Republic in 1998 and then Florida in 2002 with empty pockets. Shortly after arriving, Ebanks enlisted.

“I spent some time in the army; I wanted to put in some time,” Ebanks said. “I said: ‘I’m a new immigrant, what’s the best thing that I could do to reward these opportunities?’ To serve in the army, give the country a couple years, and payback in advance for this opportunity that I knew I was going to have.”

Ebanks said he learned early on to take every opportunity seriously. He served for two years and then became an engineer and contractor for the army, working on the Patriot Missile defense system. He went through college at NJIT, graduating in 2009, and following in his father’s footsteps to become an electrical engineer.

After working with South Jerseys PSE&G, Ebanks took the opportunity to work full time shifts at the the nuclear power plant, and by 2016 he was pursuing an MBA and looking for ways to grow what he called “my empire.” Used to investing in small businesses already, discovering MCA fit right within his world.

“I’ve always been active, throughout my professional career I had businesses in real estate, I owned several businesses such as laundromats, a lot of retail cell phone stores and things like that,” Ebanks said. “So at one or two am in the morning, I’m working on how to build my empire. I was on Craigslist looking for opportunities, seeing what’s out there, and somebody wanted an investment, to partner up and start a company in a new industry.”

He took a meeting and learned a ton. Although he did not end up going into business with that person, he was hooked on the concept.

“I looked at that ad, and $10,000 later, we had a company,” Ebanks said.

He learned what he needed and ended up opening his own MCA business shortly after in New Jersey, finding he loved setting up syndicated MCA deals.

He learned what he needed and ended up opening his own MCA business shortly after in New Jersey, finding he loved setting up syndicated MCA deals.

“I did some research, opened an office in New Jersey, secured a manager to run the operation, and we started brokering deals and learning about syndication.”

He worked with SFS Capital, now called Kapitus. He fell in love with the immediate gratification feedback of making deals, seeing returns on account receivables, and watching renewals come in. The business grew, but things were not always a straight climb to success.

“There was a point where things were not going well and I had to start a new company, find new parters and investors with a funding direct-only focus, and moved into my basement- my wife was unhappy with that. I started hiring people, processors, underwriters, and ISO managers in my basement,” Ebanks said. “At one point, she said, ‘Okay, this is enough. Ten strangers are coming into my house every day, you’ve got to get an office,’ so we secured an office in New York. And that’s when things took off in 2017.”

At that point, Ebanks had shifted his business model from securing deals to funding them all his own, using capital he raised. Ebanks said that being a broker partnered with Kapitus was great, but he wanted to grow and run his business entirely. The best way to do that was through ISO management, Ebanks said. Ebanks let the direct sales team phase out and he hired ISO managers, learning the ISO business as he went.

“So fast forward now: We have over five ISO managers, and we’re funding about $12 million a month,” Ebanks said. “It’s been a phenomenal journey and the most rewarding thing I’ve ever done in my life; I’m not shy to share how exciting every day is to me, and how other than my family and my kids and God, this is the most important thing my life.”

For brokers looking to get started in the industry, Ebanks has this advice to share: Don’t settle.

“Don’t settle, look for growth, and invest your money,” Ebanks said. “I always invested everything I could, 95%, every penny on the business. It matters especially at the beginning, the more you invest, don’t let it sit.”

That investment should go toward your business, your staff, and hiring. Ebanks said the more you invest, the bigger the bag, the more your firm would grow, and your employees will grow with you. Helping employees will mean they will eventually leave, but in Ebanks’ experience treating employees right creates partners.

“Some of them now are partners, and the employee-employer relationship is always more partnership,” Ebanks said. “Some of them own their own companies now, and we help each other out. If they have a big deal, they say: ‘Frank do you want to take $50,000 out of this deal?’ I say yea I trust you. I’ve known you for years.”

Now that he’s on track to grow with recurring customers, seeing some merchants come back to renew twenty times since 2016, Ebanks sees a possible bright future for Spartan Capital: becoming a chartered online bank.

“It is an alternative lending space but to offer the best products to people,” Ebanks said. “I think at the end of the day, and we need all the resources we can get, the next chapter is to apply and secure an online bank charter, it’s the future of the fintech industry.

“Why do people like doing business with us versus a bank? Some of them can do business with banks, but they choose to use us because they have direct access to us after 6 pm, they could call us Saturday, they can call us on a Sunday,” Ebanks said. “A great relationship that they can never get from a bank. I want to bring what we do in MCA to the banking industry to serve people that want banking products, but I want to give them that MCA experience.”

LendingClub P2P Investors Will Be Able to Transfer Funds to Founder Savings Account

December 11, 2020 When Lending Club retires its peer-to-peer lending platform on December 31st, users will have the option to transfer their remaining funds to Radius Bank into something called a Founder Savings Account. The company acquired Radius Bank in February this year and has communicated that its efforts have been dedicated to this initiative.

When Lending Club retires its peer-to-peer lending platform on December 31st, users will have the option to transfer their remaining funds to Radius Bank into something called a Founder Savings Account. The company acquired Radius Bank in February this year and has communicated that its efforts have been dedicated to this initiative.

As part of this shift, peers that were part of their soon-to-be discontinued platfrom will be eligible for a “Founder” Savings account.

“We will let you know of the interest rate at launch,” Lending Club’s FAQ says on the matter. “You can expect that it will be a compelling rate, as an exclusive way to thank our investors for their dedication to our community.”

At present, a standard “high-yield” savings account at Radius Bank earns up to .25% APY.

The company acknowledes that not everyone will want to become a banking customer. “If you don’t choose to open a Founder Savings account, your Notes account cash position will continue to build until you transfer those funds to another financial institution.”

Bankrate awarded Radius with the title of “Best online bank of 2020.”

Oikocredit Expands Its Commitment to Mexican SMEs With Investment in Aspiria

December 4, 2020 Aspiria (www.aspiria.mx), a digital lender targeting underbanked small and medium enterprises (SMEs) in Mexico, has completed an important Series A funding round with participation from social impact investor and worldwide cooperative, Oikocredit.

Aspiria (www.aspiria.mx), a digital lender targeting underbanked small and medium enterprises (SMEs) in Mexico, has completed an important Series A funding round with participation from social impact investor and worldwide cooperative, Oikocredit.

The Series A closing also saw follow-on investments from Aspiria’s current shareholders. The proceeds from the capital round will strengthen Aspiria’s financial capability to support Mexican SMEs.

With its investment in Aspiria, Oikocredit continues its commitment to support SMEs in Latin America, as Oikocredit sees SMEs as playing an important role in areas such as job creation.

Aspiria began operations in 2015 and has lent thousands of loans throughout Mexico. The institution has leveraged digital technologies, data analytics and high-quality service to support the financial needs of Mexican SMEs.

Guillermo Hernandez, CEO and cofounder of Aspiria, commented: “At Aspiria we are very excited to have Oikocredit onboard. SMEs have faced big challenges due to the pandemic and are in need of great financial services. Oikocredit’s investment is an acknowledgement of the tremendous potential of the Mexican SME sector. We look forward to continuing to serve a multitude of SMEs and helping create thousands of jobs in the country”.

Rodrigo Villalta, Equity Officer at Oikocredit, said: “At Oikocredit, we are proud to become shareholders of an institution whose mission is to provide financial support to SMEs that have been typically excluded from the formal financial system”.

“Mexican SMEs are key contributors to employment generation and economic development. We are happy that we can contribute towards building stronger social impact in the country by supporting access to the formal financial system for Mexican SMEs.”

About Aspiria

Aspiria works to increase access to capital to small businesses. Through our platform and the use of statistical credit origination models, we make it fast and simple for the small business owners who have been shunned by the traditional banking system, to obtain financing to continue growing their business.

For more information see: www.aspiria.mx

About Oikocredit

Social impact investor and worldwide cooperative Oikocredit has 45 years of experience funding organisations active in financial inclusion, agriculture and renewable energy.

Oikocredit’s loans, equity investments and capacity building aim to enable people on low incomes in Africa, Asia and Latin America to improve their living standards sustainably. Oikocredit finances close to 689 partners, with total outstanding capital of € 856 million (September 2020).

For more information see: http://www.oikocredit.coop

Note for editors

For more information or to request an interview, please contact Leyda Mar Blanco, Marketing Manager, Aspiria, press@aspiria.mx

Libertad 1966, Col Americana, Americana, 44160 Guadalajara, Jal., Mexico

From Sales to Founder: Craig J. Lewis Talks Gig Wage’s $7.5 Million Funding Round

November 27, 2020 Coming to you from the heart of Dallas, Texas is a digital payroll startup, Gig Wage, that received a $7.5 million Series A funding round just last month. The founder, CEO, and writer of The Sport of Sales, Craig J. Lewis, talked about his goal to make it easier for 1099 gig workers to get paid.

Coming to you from the heart of Dallas, Texas is a digital payroll startup, Gig Wage, that received a $7.5 million Series A funding round just last month. The founder, CEO, and writer of The Sport of Sales, Craig J. Lewis, talked about his goal to make it easier for 1099 gig workers to get paid.

Lewis made $10 million in payroll tech sales before going on to lead a firm that has seen 30% month-to-month growth this year, during a pandemic no less.

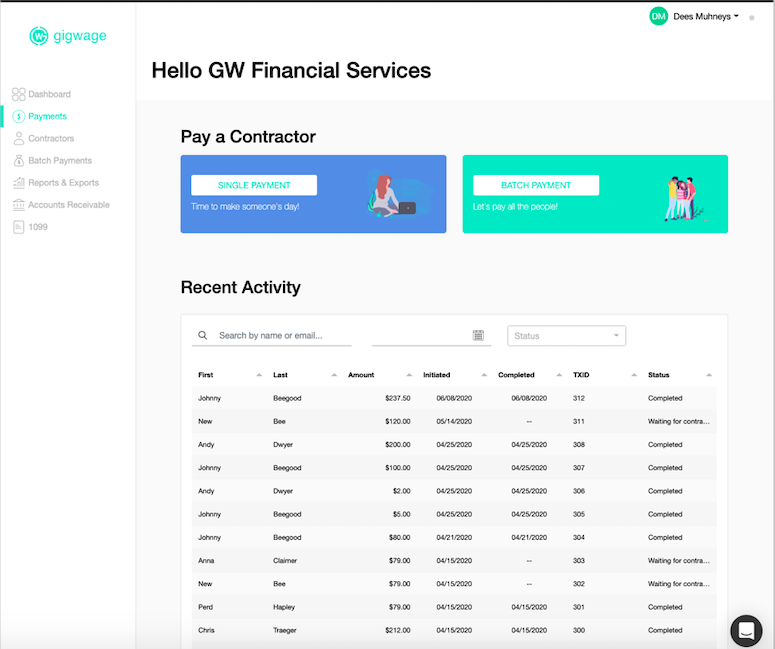

“We help businesses pay independent contractors, but because we’re so tech-centric, it’s evolved beyond just payroll,” Lewis said. “What we ended up building was financial infrastructure for the modern workforce. We help businesses get money from their customers to their contractors as fast and as flexibly as possible.”

The way Gig Wage does this, Lewis said, is by offering an online platform for the hybridization of payroll, payments, and banking from a single login. Businesses can manage their payroll needs for 1099 workers, then shift to payment needs quickly, through direct to debit, all major cards, bank transfers, and accounts receivables.

“One of the only- the only platform in the world actually that has embedded banking into payroll and payments, which is what kind of allows for this speed and flexibility that we offer,” Lewis said. “We’re like B to B to C: We help the businesses with technology and operational excellence, and because independent contractors are separate from the workplace, we provide tools for them.”

Lewis has years of experience in the payroll space- starting as a salesman for ADP small business payroll products back in 2008. Realizing he had a passion for payroll tech and getting customers the best services possible, Lewis went on to learn anything he could about the industry. Selling $10 million in software while moving across the country, Lewis landed in Silicon Valley, where he studied what it took to start a company.

“I was just awed how they thought about technology and products and company building,” Lewis said. “And I vowed to bring that to the payroll industry.”

Lews joined a startup, learned the Silicon Valley way of creating a company through an African American tech acceleration program. In 2014, Lewis founded Gig Wage to do something disruptive in the payroll space.

As Gig Wage attests, disruption is what the 1099 gig industry needs at the very least. Lewis believed the gig economy was going to keep growing when Gig Wage started. As he watched, the gig economy ballooned into a $2 trillion industry with an estimated 65-75 million person workforce. These workers suffer from an outdated payroll system, losing an estimated 2-20% of their income to flaws in the payments system Gig Wage found.

As Gig Wage attests, disruption is what the 1099 gig industry needs at the very least. Lewis believed the gig economy was going to keep growing when Gig Wage started. As he watched, the gig economy ballooned into a $2 trillion industry with an estimated 65-75 million person workforce. These workers suffer from an outdated payroll system, losing an estimated 2-20% of their income to flaws in the payments system Gig Wage found.

“With the maturation of Uber, Lyft, Postmates, Doordash, Grubhub, Upwork, all of these kinds of gig economy freelancer companies, we had great growth going into 2020,” Lewis said. “In Q1, we were set up to raise our series A, and then March happened, and the terms got pulled off the table.”

But when the dust settled after those first shutdown weeks, Gig Wage looked at the damage and found the skyrocketing unemployment rates and furloughs had only accelerated their growth as a company.

But when the dust settled after those first shutdown weeks, Gig Wage looked at the damage and found the skyrocketing unemployment rates and furloughs had only accelerated their growth as a company.

“The gig economy was right there waiting on the workforce to provide opportunities to earn, and we were positioned perfectly to help people compete for that talent and pay people in a modern way,” Lewis said. “The pandemic has been a huge growth accelerant for us, and we think those tailwinds will only continue.”

Those winds of success came during a time of protest. Amplified in the pandemic’s backdrop, the country was waking up to the unequal disenfranchisement black people faced. Only 1% of black founder entrepreneurs ever receive VC funding, and Lewis said he is proud to have raised a significant round, given that unfair stat.

“With so much controversy and negative energy around black people in general,” Lewis said. “I think putting this positive story out there and showing this black excellence, black tech, I think it’s super important, and it’s been something that I’ve embraced. We’ve been able to be a part of putting something extremely powerful and positive into the market.”

America is finally waking up to realize something Lewis said was obvious, that black people matter, even though it can be controversial to say so. He hopes his success can help others but affirms the funding round was no charity drive.

“This is a great opportunity for us to be clear about the fact that like hey, we’ve been working on this, we’ve built a good business and a good technology,” Lewis said. “This is a big business opportunity for our investors and us. It wasn’t charity, right: This isn’t like, oh he’s black, give him some money.”

The successful funding round shows confidence in the Gig Wage platform from Green Dot, which will allow Gig Wage to offer bank accounts and debit services to independent contractors. Green Dot is one of the only fintechs with a national banking license, Lewis said, and Gig Wage is joining the Banking-as-a-Service direction that the fintech industry is headed.

Beyond payroll, Lewis can’t wait to offer other financial products to businesses as the company grows.

“When you think about the gig economy, it’s important that people get paid fast and flexibly: You’ve got to have the cash to be able to do that,” Lewis said. “We see some unique opportunities to get involved in the lending space down the line as well as we continue to build out our technologies.”

Lufax, a Chinese Online Lending Marketplace, to IPO on NYSE Next Month

October 27, 2020 Lufax, an online lending marketplace and one of China’s largest fintech companies, plans on going public by the end of the month on the New York Stock Exchange. Lufax is one of the multiple Chinese fintech companies grappling for a public offering amidst increasing tension between U.S. and Chinese markets.

Lufax, an online lending marketplace and one of China’s largest fintech companies, plans on going public by the end of the month on the New York Stock Exchange. Lufax is one of the multiple Chinese fintech companies grappling for a public offering amidst increasing tension between U.S. and Chinese markets.

Offering an online shopping mall for financial products, Lufax connects borrowers to various lending products supplied by traditional and alternative investors alike. Lufax was one of the largest, if not the largest P2P lender in China just two years ago before a major crackdown on the P2P industry forced the company to revamp completely.

Lufax plans to issue 175 million shares that will be priced from $11.5 to $13.5 each, according to a prospectus with the U.S. Securities and Exchange Commission last week. This would net the company around $2.36 billion.

The IPO would give the company around a $30 billion in valuation, lower than the $39.4 billion valuation it received in 2019 from a major backer Ping An Insurance Group.

Lufax reported more than $1 billion of profit in the six months up to June 30th, according to the filing. Last year, the firm’s assets dropped by 6.1% after a 30% reduction in transaction volumes. This was a cut of nearly all P2P transactions, in compliance with regulation from the Chinese government.

After the P2P industry grew unchecked for a decade, fraud concerns bloomed into outrage as hundreds of platforms covering hundreds of billions of dollars defaulted. According to Mckinsey, from 2013 to 2015, fintech firms offering P2P products exploded from 800 to more than 2,500 companies. More than 1,000 of these firms began to default on their debt, ballooning to an outstanding loan value of $218 billion in 2018.

In response to protests, outrage, and stadiums of helpless borrowers trying to gain their funds back from Ponzi schemes, the Chinese government cracked down hard on fraudulent firms. According to Reuters, regulators placed every P2P firm on death row, stating in 2019 that the industry had two years to switch to “small loans.” The shutdowns have cost Chinese investors $115 billion, according to Guo Shuquing, China Banking Regulatory Commission.

Pivoting away from these shutdowns, Lufax and many firms like Alibaba funded Ant Group are switching to lending marketplaces. Lufax works with 50 lending providers that hold $53 billion in assets as of June. Lufax believes that there are trillions of dollars in the untapped alternative finance market in China.