Shopify’s Merchant Cash Advance Business Grows

July 31, 2018Today Shopify released its Q2 2018 earnings report, revealing that Shopify Capital issued $68.5 million in merchant cash advances in the second quarter of 2018, an increase of 84% compared to the $37.2 million issued in the second quarter of last year. Shopify Capital has advanced nearly $300 million to merchants since they launched in April 2016, $80 million of which was outstanding on June 30, 2018.

Founded in 2004 and headquartered in Ottawa, Canada, Shopify currently powers over 600,000 businesses in approximately 175 countries. The stock trades on the New York Stock Exchange and the Toronto Stock Exchange as SHOP.

Shopify’s Funding Automation Key to Its Growth

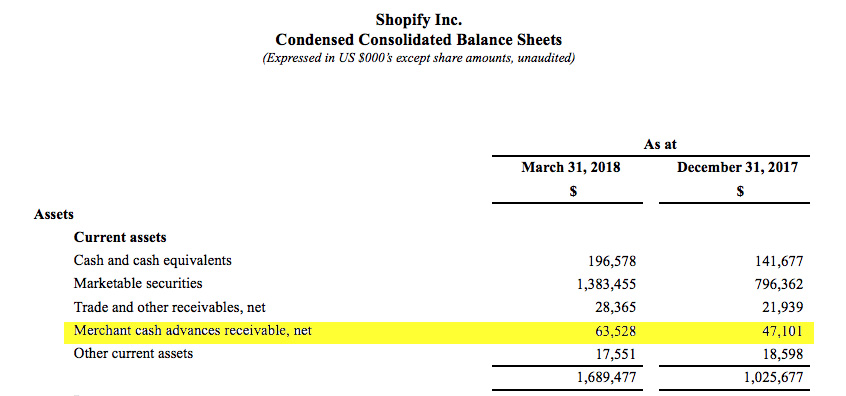

May 2, 2018 Canadian e-commerce company Shopify (NYSE:SHOP) has a business funding arm called Shopify Capital that issued $60.4 million in merchant cash advances in Q1 this year, according to the company’s earnings report yesterday.

Canadian e-commerce company Shopify (NYSE:SHOP) has a business funding arm called Shopify Capital that issued $60.4 million in merchant cash advances in Q1 this year, according to the company’s earnings report yesterday.

The funding operation offers an MCA product exclusively to merchants that are customers of Shopify. The company helps small business owners create online stores, with products ranging from web design to marketing and analytics. Currently, Shopify supports more than 600,000 small businesses worldwide.

Shopify Capital was launched in April 2016, but a company representative said it wasn’t until April 2017 that it started using algorithms 100 percent to automate offers of capital to merchants.

“What Shopify can see is a lot of patterns in a merchant’s [online] store,” a company spokesperson told AltFinanceDaily. “How engaged is that merchant? What has their GMV (Gross Merchant Volume) been? How spotty is their GMV? How often do they sell? There’s a bunch of different factors that help us predict GMV going forward. And as [our] algorithm gets better and smarter, we are able to get more granular in our offers.”

Many of Shopify Capital’s small business owner clients are new business owners who would not qualify for loans from banks, but need money to expand their businesses.

“Business owners typically spend copious hours putting an application together and funds typically take two to three weeks to receive,” a different Shopify spokesperson said. “Shopify Capital is designed to provide our merchants with timely access to Capital without putting them through additional financial stress…[And] merchants receive financing based on our predictive technology to determine what makes sense for their business in their trajectory.”

Shopify was founded in 2004 and is headquartered in Ottawa, Canada.

Shopify Capital Issued $60.4M in Merchant Cash Advances in Q1

May 1, 2018 Shopify Capital, Shopify’s small business funding arm, issued $60.4 million in merchant cash advances in Q1, according to the company’s earnings report, an increase of more than 300% year-over-year. The company has advanced $230 million to merchants since April 2016.

Shopify Capital, Shopify’s small business funding arm, issued $60.4 million in merchant cash advances in Q1, according to the company’s earnings report, an increase of more than 300% year-over-year. The company has advanced $230 million to merchants since April 2016.

On the company’s earnings call, Canaccord Genuity equity researcher David Hynes, inquired about the patterns of seasonal demand one could expect for the company’s merchant cash advances.

“So in terms of seasonality on Shopify Capital,” said Shopify COO Harley Finkelstein, “it’s important to note that the use of proceeds for Shopify Capital for most of our merchants tend to be in the realm of inventory or marketing spend, which we quite like, because that leads to more sales, which makes it easier for them to return the capital to us.

“Obviously, there’s the seasonality of capital reflecting the seasonality of retail in general, which is certainly more of a Q4 issue than it is a Q1 issue,” he added.

Canaccord’s Hynes also referred to Shopify’s product as a loan but was corrected by Finkelstein.

“Just keep in mind, these are not loans, these are cash advances, so I want to be very clear about that,” Finkelstein explained.

Shopify is a Canadian e-commerce company headquartered in Ottawa, Ontario. It is also the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems

Shopify Launches Merchant Cash Advance Program

April 27, 2016

Shopify (NYSE:SHOP), the online storefront software company that went public a year ago, announced today that it has formally launched a merchant cash advance product.

“For many merchants, securing capital is a frustrating and time-consuming process,” said Saad Atieque, Product Manager at Shopify. “With Shopify Capital, we’re giving entrepreneurs a simple, fast, and convenient way to secure financing to invest in their business. Similar to our payments and shipping solutions, Shopify Capital represents one more way Shopify can help entrepreneurs strengthen their business operations.”

The company’s release referred to it specifically as a merchant cash advance. “During the pilot program, merchants used Shopify Capital merchant cash advances to buy equipment and inventory, launch new products, hire more employees, and add new channels and products.”

Although Shopify is headquartered in Canada, the program will initially only be available to small businesses in the US.

The company closed yesterday at $31.47, nearly twice its $17 initial public offering.

Revenue Based Financing Continues to Spread at Global Pace

September 30, 2025 Earlier this month, Uber Eats joined the revenue-based financing movement by partnering with Pipe Capital.

Earlier this month, Uber Eats joined the revenue-based financing movement by partnering with Pipe Capital.

Karl Hebert, Vice President of Global Commerce and Financial Services at Uber, said of it, “We are happy to team up with Pipe to bring working capital to Uber Eats. Restaurants are our partners at Uber, and the backbone of our communities, yet many struggle with access to capital.”

It’s an unsurprising step considering rival DoorDash rolled out a merchant cash advance program nearly four years ago, though Uber arguably began experimenting with MCAs nearly ten years ago. And Uber is hardly doing it just to do it. Uber, for example, rolled out Uber Eats Financing, a revenue based financing product in Mexico through a partnership with R2 this past January, which went so well that they also rolled it out in Chile months later.

📢 Announcing a big milestone for R2 & @Uber!

Following a successful launch in Mexico, we’ve expanded our partnership with Uber Eats to Chile — bringing frictionless access to capital to thousands of merchants across the region. https://t.co/61WgP1ZtHy

— Roger Larach (@rogerlarach) April 30, 2025

In Chile with R2, the service is described as taking place entirely within the Uber Eats Manager App with a 5-minute application process and payments made automatically and deducted by a fixed percentage from sales made using the platform.

In the US with Pipe, it says that the Uber Eats App Manager will show capital offers from Pipe that are customized based on restaurant revenue, cash flow, and business performance.

Uber joins Amazon, Walmart, Shopify, Intuit, Stripe, DoorDash, PayPal, Square, GoDaddy, Wix, Squarespace and others in offering a revenue-based financing product.

Revenue-based financing as a product type is available in but not limited to the US, Canada, Mexico, Chile, UK, Germany, Ireland, Spain, South Africa, Nigeria, India, Hong Kong, Netherlands, Australia, Japan, Brazil, Singapore, and more.

The Great Concession, How the MCA Product Effectively Proved It Was Right All Along

September 26, 2025 There was no greater irony than the State of Texas banning ACH debits from sales-based financing providers at the same time that the State of Washington was celebrating the coming age of sales-based financing. In Texas, for example, the motivation for curbing sales-based financing was built on the premise that “this type of financing has raised significant concerns about predatory lending and that state attorneys general as well as the Federal Trade Commission have obtained high-profile judgments against such financing for predatory practices.” Meanwhile, in Washington, the motivation for the state holding the opposite opinion was that sales-based financing “increases access to capital for small businesses in Washington state, particularly those that have been historically underserved or underbanked.”

There was no greater irony than the State of Texas banning ACH debits from sales-based financing providers at the same time that the State of Washington was celebrating the coming age of sales-based financing. In Texas, for example, the motivation for curbing sales-based financing was built on the premise that “this type of financing has raised significant concerns about predatory lending and that state attorneys general as well as the Federal Trade Commission have obtained high-profile judgments against such financing for predatory practices.” Meanwhile, in Washington, the motivation for the state holding the opposite opinion was that sales-based financing “increases access to capital for small businesses in Washington state, particularly those that have been historically underserved or underbanked.”

How did these states reach the opposite conclusion?

There’s no caveat to how the Washington State program works. The State’s Department of Commerce partnered with Grow America and the operation is backed by a federal grant (SSBCI-21031-0048) to roll out and administer a revenue-based financing program as part of Washington’s State Small Business Credit Initiative. It’s sales-based financing or in this case revenue-based financing (which is the more common phrase these days). Grow America’s revenue-based financing program utters a very familiar phrase in its marketing.

“The months you generate more revenue, you pay a higher amount, when business is slower you pay less,” the company advertises.

This was at one time the signature calling card of a merchant cash advance, but now such features have been repackaged and rebranded into something similar but different, and everybody is doing them.

The Grow America program applies a 20% holdback on adjusted monthly revenue and requires a minimum monthly payment of $1,000 if the 20% holdback does not generate at least $1,000 for the month. Merchants can get approved for anywhere from $50,000 to $1 million. The product is marketed as having a 1.24 factor rate and an estimated 14.27% APR with a 3-year term. As industry participants are aware, increasing sales would translate into increasing payments, which means a rapidly paid off loan could potentially result in a final outcome APR in the triple digits, far and away from the “estimate.”

The irony is that the notable benefits of a similar product, merchant cash advances, which have no minimum monthly payments, no fixed term, and are not absolutely repayable, are eliminated when restructured in this way and presented as “revenue-based financing loans.” Revenue-based financing loans take the underlying structure of MCAs (payments tied to sales) and then strip away the benefits. However, when structured as loans, the argument often goes that they are likely to be cheaper, which may be true on average, but is not always true.

Indeed, Grow America leads specifically with price as for why its product, similar to its privately owned competitors, are the better option:

“There are a lot of online lenders offering revenue-based loans that promise instant approvals, but their terms are intentionally confusing, and the fees are high,” Grow America advertises. “Our lenders aren’t like that. They’re mission driven.”

In Texas, the author of the bill that banned debits from such financing providers “informed the [legislative] committee that commercial sales-based financing has become a popular financing option for small businesses desperate for credit and that, unlike traditional loans, this type of financing is repaid as a percentage of future sales or revenue.”

Indeed, it is very popular. The largest providers or brokers of such financing today whether structured as a purchase or loan, are household names like Amazon, Walmart, Shopify, Intuit, Stripe, DoorDash, PayPal, Square, GoDaddy, Wix, Squarespace and more. Some structure them as a purchase and call it a merchant cash advance and some structure it as a loan and call it revenue-based financing. In either case, payments are tied to the percentage of future sales or revenue.

In egregious cases of wrongdoing one way or another, such incidents have historically been a result of deceptive marketing or payments from a merchant exceeding the contracted amount. In New York, when transactions are structured as a purchase, courts generally look to make sure that the agreements have a reconciliation provision in the agreement, whether the agreement has a finite term, and whether there is any recourse should the merchant declare bankruptcy. Legally speaking, the products have become pretty well defined and understood in the court system.

Like Washington State, GoDaddy, which recently announced its new merchant cash advance program, markets its product in an almost identical fashion.

“If your sales go up, the MCA will be paid sooner; if the sales are slow, it’ll take longer,” GoDaddy says.

Same message.

Washington State requires merchants to make a minimum payment every month and a balloon payment if not fully repaid within 3 years. GoDaddy, by contrast, advertises no minimum payment amount, no set payment schedule, no penalties, and no late fees. One’s a loan, one’s a purchase.

While the best course of action is best left to the merchants, there appears to be a near-universal concession that the underlying nature of how merchant cash advance agreements were contemplated, payments tied to sales, made strong logical business sense all along. Washington State emphasizes this fact.

“We know that your business has its own needs and loans with fixed payment amounts may not be the best option for you,” they advertise. “The revenue-based financing fund offers loans with flexible payback terms so you can grow your business immediately and pay back your loan based on your varying revenue.”

Recent studies also now highlight the benefits of cash-flow-based underwriting.

In Sharpening the Focus: Using Cash-Flow Data to Underwrite Financially Constrained Businesses, “The paper finds that adding cash-flow information substantially increases the predictive signal of models that rely primarily on the business owners’ personal credit scores and firm characteristics.”

There’s also Square, the largest revenue-based financing provider in the US, that has explained why this system just works better. Square says that they can fund more businesses and have higher payment success rates than if they were to follow more conventional methods of underwriting and repayment.

“Square Loans addresses [the credit] gap by using near real-time business data to assess creditworthiness, evaluating metrics such as transaction volume and revenue patterns to offer short-term loans — with repayment on average in 8 months,” Square wrote in a White Paper. “This allows for a more accurate and timely understanding of a business’s capacity to borrow and repay. And loan repayments are higher during periods when business is stronger and reduced when sales are lower.”

What’s the sentiment these days on payments tied to sales revenue? The market has spoken.

The Largest Sales-Based Financing Providers

May 27, 2025Who are some of the largest sales-based financing providers in the US? The following companies are repaid as a percentage of sales or revenue, in which the payment amount may increase or decrease according to the volume of sales made or revenue received by the recipient:

| Sales-Based Financing Providers |

| Square |

| PayPal |

| Amazon (via Parafin) |

| Walmart (via Parafin) |

| Shopify |

| Intuit |

| Stripe |

| DoorDash (via Parafin) |

The State of Washington has also recently announced it will be offering sales-based financing through a Department of Commerce initiative.

Among those listed above, Square recently published a White Paper on the impact of its sales-based financing.

“Square Loans has opened credit to populations who traditionally have had less access to business loans. As of the third quarter of 2024, approximately 58% of Square Loan customers are women-owned businesses, compared to the industry average of 19%.38 And 15% of Square Loans go to Black/African-owned businesses compared to an industry average of 6.6%, while 14% of loans go to Hispanic/Latinx-owned businesses compared to the industry average of 11.3%.”

FundThrough Acquires Ampla, Strengthening its Digital-First Invoice Funding Solution

April 22, 2025HOUSTON and TORONTO – April 22, 2025 – FundThrough, the leading fintech invoice factoring platform for small and medium-sized businesses (SMBs), today announced its acquisition of Ampla, the leading provider of financial technology solutions for consumer brands offering working capital, business banking, corporate cards, and analytics. Ampla surpassed +$2B of loan originations and handled +$5T of transaction volume through its platform. This strategic acquisition strengthens FundThrough’s digital-first ecosystem, creating an unrivaled platform explicitly designed for small businesses that sell to larger companies and wait to get paid after invoicing.

Building on its successful acquisition of Bluevine’s factoring business in 2021, FundThrough again demonstrates its ability to identify and seamlessly integrate game-changing SMB technologies. Today, FundThrough’s expanding footprint now delivers crucial invoice factoring solutions across diverse B2B sectors, including retail, manufacturing, oil and gas, technology, professional services, and food supply and agriculture, with 85 percent of its funding helping American clients.

“Business owners have increasingly been forced to act like banks for their much larger customers who extend invoice payment terms beyond reasonable lengths. They need a seamless way to bridge the cash flow gap, and FundThrough provides a tech-enabled financial solution,” said Steven Uster, FundThrough’s CEO. “Now, Ampla’s technology significantly enhances FundThrough’s AI-powered model, enabling us to level the playing field further. With Ampla, we can scale faster, enhance our credit underwriting and monitoring processes, and help even more businesses solve their number one pain point, cash flow. I’m excited to work with Anthony, a proven entrepreneur with vast knowledge in this space.”

Ampla’s CEO, Anthony Santomo, will remain a strategic advisor to FundThrough and will be joined by his core team. “I’m excited about Ampla’s acquisition by FundThrough and the potential of the combined platform to support small businesses. This strategic move enhances commerce capabilities and provides operators with greater resources to succeed,” said Santomo.

Concurrently with the acquisition, FundThrough also raised $25M in equity capital led by existing investor Klister Credit Corp., an early, large investor in both Shopify and FundThrough. This strategic investment fuels aggressive expansion into key growth areas, including further acquisitions, investments in technology and AI, enhanced UX, and accelerated product innovation.

“Steven’s leadership has firmly established FundThrough as a bellwether in the fintech and specialty finance industry. FundThrough’s track record over the past years of uncertainty is impressive. FundThrough has stayed tightly focused on robustly serving the needs of small businesses forced to hold receivables from their much larger, better-capitalized customers,” said John Phillips, President of Klister. “The outlook for small business growth continues to be positive, and my increased investment reflects my confidence in the FundThrough team’s continuing focus on serving this important market through the best service and continual product innovation.”

“As small businesses navigate the evolving global tariffs, the best thing they can do is preserve their cash flow. FundThrough helps bridge the gap by providing peace of mind for business owners during these uncertain times,” concluded Uster.

FundThrough continues to earn recognition for its growth and technology, landing spots on the Deloitte Fast 500 and Globe & Mail’s Report on Business Top Growing Companies List.

About FundThrough

FundThrough is the leading fintech invoice factoring platform for small and medium-sized businesses (SMBs). Based in Houston and Toronto, FundThrough’s digital-first ecosystem leverages real-time financial data and predictive analytics, offering flexible, tailored financing solutions for growing businesses. Since its founding, the award-winning organization has funded over $2.7 billion of invoices. For more information, visit fundthrough.com.

FundThrough Media Contact

Nadia Milani

VP, Marketing

nmilani@fundthrough.com