Fintech Law Goes into Effect in Mexico

March 9, 2021 It will be a big year for fintech in Mexico, with at least 93 fintech firms in the process of obtaining a Financial Technology Institution (FTI) license.

It will be a big year for fintech in Mexico, with at least 93 fintech firms in the process of obtaining a Financial Technology Institution (FTI) license.

Lawyer Rene Arce Lozano, an advisor with the international Hogan Lovells law firm, wrote about the new “fintech law”; the first of its kind in Latin America. Many firms will see an authorization in the coming year from the National Banking and Securities Commission.

“Over the last few years,” Lozano wrote, “the fintech ecosystem in Mexico has evolved to become one of the most developed in Latin America.”

Mexico, home to 441 startups- the largest fintech hub in central America- passed the law in 2018 that went into effect this past year 2020, nurturing the creation of dozens of Mexican neo banks and electronic payments firms.

The new law sets regulations for payments and open banking and has stirred up excitement for fintech enterprise in the country as a whole. But according to Financial specialist Stefan Staschen, the law isn’t the cure-all.

“The law covers only two types of fintech companies,” Stashen wrote. “It does not provide regulatory guidance for other services, such as fintechs offering balance sheet lending, big tech companies launching financial services, investment services other than crowdfunding, or central bank digital currencies.”

The new law may be a great start, but it is the first step to broader regulatory approval to the diverse financial tech world. Staschen works at the CGAP– an international advocacy group based in Washington that aims to extend financial inclusion throughout the world.

2021: The Year of Uncertainty

January 7, 2021 For alternative lenders and funders, 2021 is starting out with a question mark and will lead (hopefully) to a resounding exclamation point of recovery.

For alternative lenders and funders, 2021 is starting out with a question mark and will lead (hopefully) to a resounding exclamation point of recovery.

Many industry participants waved goodbye to 2020 with relief, and are welcoming a bounce-back in 2021, despite some trepidation about potential bumps along the way and how long a full recovery will take. While things started to improve somewhat toward the latter half of 2020 after grinding to a halt earlier in the year, the pandemic is still raging, with economic growth highly dependent on the immunization trajectory. Then there’s the incoming Democratic administration and the possibility of new rule- making, along with January’s runoff elections in Georgia that could change the balance of power in the Senate, and thus impact the new president’s law- making abilities.

Beyond these macro-issues, the funding industry is also dealing with its own uncertainties. Small business lenders and funders have been hit particularly hard, with underwriting decidedly more difficult in this environment. Some industry players have been forced to find alternative revenue streams in order to ride things out. Not only that, but there are scores of small businesses still reeling from pandemic-induced shutdowns and lighter foot traffic, with some gloomy estimates about their ability to bounce back. Many alternative players are weighing diminished returns against a widely-held bullish outlook for the industry long-term. Many are simply hoping they can hunker down and stick it out long enough and to avoid additional carnage and consolidation that’s widely expected over the short-term.

Ultimately things will get better, but it’s unclear precisely when, says Scott Stewart, chief executive of the Innovative Lending Platform Association. “It’s going to be a bumpy ride for the next year to figure out who is going to be able to survive,” he says.

Here’s a deeper dive into how industry participants see 2021 shaping up in terms of the challenges, competition, M&A, regulation, changing business model, expansion opportunities and more.

SPECIFIC CHALLENGES FOR SMALL BUSINESS FINANCERS

Companies that focus on consumer financing haven’t struggled quite as much amid the pandemic as their small business brethren, and they could continue to see demand grow in 2021. Even amid high unemployment rates, many consumers still need loans for home repairs or as a stop-gap to pay necessary expenses, helping to mitigate the impact on firms that focus on personal loans.

Small business financers, however, got pummeled in 2020 and the situation remains precarious, especially given the prognosis for small companies broadly. Consider that 163,735 Yelp-listed businesses closed from the beginning of the pandemic through Aug. 31—at least 97,966 of them permanently. Further underscoring how dire the situation is for small businesses, 48 percent of owners feared not earning enough revenue in December to keep their businesses afloat, according to a recent poll by Alignable, an online referral network for small businesses. What’s more, 50 percent of retail establishments and 47 percent of B2B firms could close permanently, according to the poll of 9,204 small business owners.

A SHRINKING COMPETITIVE LANDSCAPE

For many lenders and funders, the latter part of 2020 proved more successful for originations, though business is still a far cry from before the pandemic. A number of players who suspended or reduced business operations for a period of time during the first wave of the pandemic have dipped their toes back in and are in the process of trying to adapt to the new normal. For some, though, the challenges may prove too great, industry observers say. Given that many brokers and funders that were on the fringe have been hurt by the pandemic, more shake- out can be expected, says Lou Pizzileo, a certified public accountant who advises and audits alternative finance companies for Grassi in Jericho. N.Y.

And, with fewer competitors, there will be more of a need for those who are left to pick up the slack, says Peter Renton, founder of Lend Academy. Beyond being a lifeline for many alternative financers, PPP loans helped open the eyes of many small businesses who hadn’t previously considered working with anyone but a bank. In the beginning, when it was so difficult for small businesses to get these funds, they looked beyond banks for options and some found their way to online providers. This could be a boon for the industry going forward since alternative providers are now on the radar screen of more small businesses, says Moshe Kazimirsky, vice president of strategic partnerships and business development at Become.

He predicts that larger, stronger players will gradually ease some of their lending and funding criteria early on in 2021, but no one is expecting a quick revival, with some predicting it could be well into 2022 before the industry is on truly stable footing. “I think it’s going to be a very slow recovery,” Kazimirsky says.

M&A

In 2020, the industry saw bellwethers like Kabbage and OnDeck get swallowed up, and with so many businesses pinched, there are likely to be more bargains ahead from M&A standpoint, Pizzileo says. “The damage from Covid is palpable; we just haven’t seen the real impact of it yet,” he says.

No matter what product you are providing, if you’re a smaller player who can’t find your way, you’re going to have a hard time staying in business,” says Stewart of the Innovative Lending Platform Association. “There will be some collateral damage going into next year,” he predicts.

In terms of likely buyers, Renton says he expects other fintechs to step in, and possibly even mid-size community banks snap up some alternative providers. If you can buy something for “a song” it’s compelling, he says. “I expect to see a few more offers that are too good to refuse,” he says.

CHANGING BUSINESS MODELS

Pizzileo, the CPA, predicts there will be ongoing opportunities in the year ahead for well-positioned, strong businesses with available capital. In some cases, however, this may require tinkering with their existing ways of doing business.

Before the crisis, some lenders applied the same or very similar lending model across industries. “That is going the way of the dinosaur. That’s not going to be a successful model going forward,” Renton says. Lenders will focus more on having a differentiated model for the businesses they serve. “I think the crisis created this necessity to treat each industry on its own merits and create a model that has some level of independence, he says.

The year ahead is also likely to be one in which e-commerce lending continues to thrive. According to the third quarter 2020 report from the U.S. Census Bureau, U.S. retail e-commerce stood at $209.5 billion, up 36.7% year over-year. E-commerce accounted for 14.3% of total retail sales in Q3. Because it’s such a high-growth area, and many businesses that didn’t have this vertical before are moving in this direction and more lenders are focusing on it and growing that part of their business, says Kazimirsky of Become.

It will also be interesting to watch how lenders and funders continue to reshape themselves. Sofi, for instance, is continuing to pursue its goal of receiving a national bank charter. Other lenders and funders may also seek to reinvent themselves as they attempt to stay afloat and compete more effectively.

“Monoline lenders that rely on a single product will have more difficulty supporting customers in the wake of Covid,” says Gina Taylor Cotter, senior vice president and general manager of global business financing at American Express, which purchased Kabbage in 2020. “Small businesses need multi-product solutions to not only access working capital, but also real-time insights to help them be more prudent with their cash flow and accept contactless payments safely to encourage more business,” she says.

CHANGES IN RISK MODELING

Another pandemic-driven change is that lenders have had to tweak their risk modeling. Everyone understands the economy is not in the greatest spot, but their challenge in 2021 will be developing a way to assess future losses in the absence of a baseline, says Rutger van Faassen, head of product and market strategy for the benchmarking and omnichannel research group at Informa Financial Intelligence.

Consumer behaviors have changed, for instance. So even though the pandemic will end, it’s too soon to say what the structural impacts on an industry will be and how that affects the desirability of lending to especially hard-hit businesses, such as restaurants, cruise lines and fitness centers. “Clearly the behavior that everyone is showing right now is because of the pandemic. The question is: how will people behave once the pandemic ends,” he says.

“In the meantime, a lot of lenders will have to do more in-the-moment decision-making, until we get to a point when we’re truly in a new normal, when they can start recalibrating models for the longer-term,” he says.

OPPORTUNITIES TO HELP SMALL BUSINESSES

One certainty in the year ahead is the need to help existing small businesses with their recovery, says Cotter of American Express. “Small businesses represent 99 percent of all jobs, two-thirds of new jobs and half of the non-farm GDP in America. Our country’s success depends on small businesses, and financial institutions have a great opportunity to meet their needs to recover and return to positions of growth in 2021,” she says.

How to make this happen is something many alternative financers will grapple with in 2021. Another opportunity may exist in providing funding solutions to new businesses or those that have pivoted as a result of the pandemic. Cotter points to the inaugural American Express Entrepreneurial Spirit Trendex, which found 76% of businesses have already pivoted their business this year and 73% expect to do it again next year. “New-business applications have reached record heights as entrepreneurs pivot and adapt, indicating a surge of new ventures that will require financial solutions to build their business,” Cotter says.

REGULATORY WATCH

Several regulatory issues hang in the balance in 2021, including state-based disclosure laws, expected rules on third-party data aggregation and demographic data collection, and the status of a special purpose charter for fintechs, says Ryan Metcalf, head of U.S. public policy, regulatory affairs and social impact at Funding Circle. With a new administration coming in, the regulatory environment could become more favorable for measures that stalled during Trump’s tenure.

Armen Meyer, vice president of LendingClub and an active member of the Marketplace Lending Association, says he’s hoping to see a bill pass in 2021 that requires more transparency for small business lending. He would also like to see more states follow the lead of California and Virginia and make the 36% interest rate standard of Congress’s Military Lending Act, which covers active- duty service members (including those on active Guard or active Reserve duty) and covered dependents, the law of the land. “We’re calling for this to be expanded to everybody,” he says.

CANADA

Meanwhile, our neighbors to the North have their own challenges and opportunities for the year ahead. The alternative financing industry in Canada originated out of the 2008 recession when banks restricted their credit box and wouldn’t lend to certain groups. While conditions are very different now, “this period of economic uncertainty is going to be an incredible fertile period of time for fintechs to come up with new and interesting and creative credit products just like they did entering the last financial crisis,” says Tal Schwartz, head of policy at the Canadian Lenders Association.

Open banking continues to be on the Canadian docket for 2021 and how the framework shapes up is of utmost interest to fintech lenders in Canada. Schwartz says he’s also hopeful that alternative players in Canada will have a role to play in subsequent government- initiated lending programs. He’s also expecting to see more growth in the e-commerce area, particularly when it comes to extending credit to e-commerce companies and in financing solutions at checkout for online shopping.

New Jersey Legalizes Recreational Marijuana

November 4, 2020One chill result from the 2020 election was the legalization of recreational marijuana in New Jersey for adult use. In a 2-1 victory, Option One on New Jersey ballots passed, paving the way for a regulated environment for recreational use, possession, and cultivation in the Garden State.

4:20 PM.

Time to legalize it. pic.twitter.com/157WC7qgof

— Governor Phil Murphy (@GovMurphy) October 28, 2020

Before the vote, Gov. Murphy showed support

We did it, New Jersey!

Public Question #1 to legalize adult-use marijuana passed overwhelmingly tonight, a huge step forward for racial and social justice and our economy. Thank you to @NJCAN2020 and all the advocates for standing on the right side of history.

— Phil Murphy (@PhilMurphyNJ) November 4, 2020

The amendment was billed as not only a chance to increase tax revenue but as civil rights reform. Advocates argued that prohibition laws disproportionately harmed minority communities.

The change was initially put before the legislature in 2017 but failed to pass by 2019. A bipartisan supermajority put the choice up to the public referendum. Appearing in Willingboro on Tuesday, long time advocate of legalization, Gov. Phil Murphy, spoke on voting day in last-minute support.

“I got to supporting it first and foremost due to social justice,” Murphy said. “We inherited when I became governor the largest white, nonwhite gap of persons incarcerated in America, and the biggest contributor to that was low-end drug offenses.”

New Jersey was one of four states with legalization on the ballot, and all succeeded, bringing adult use to Arizona, Montana, and South Dakota as well. After Tuesday, more than 111 million Americans- a third of the country live in a state where recreational marijuana is legal.

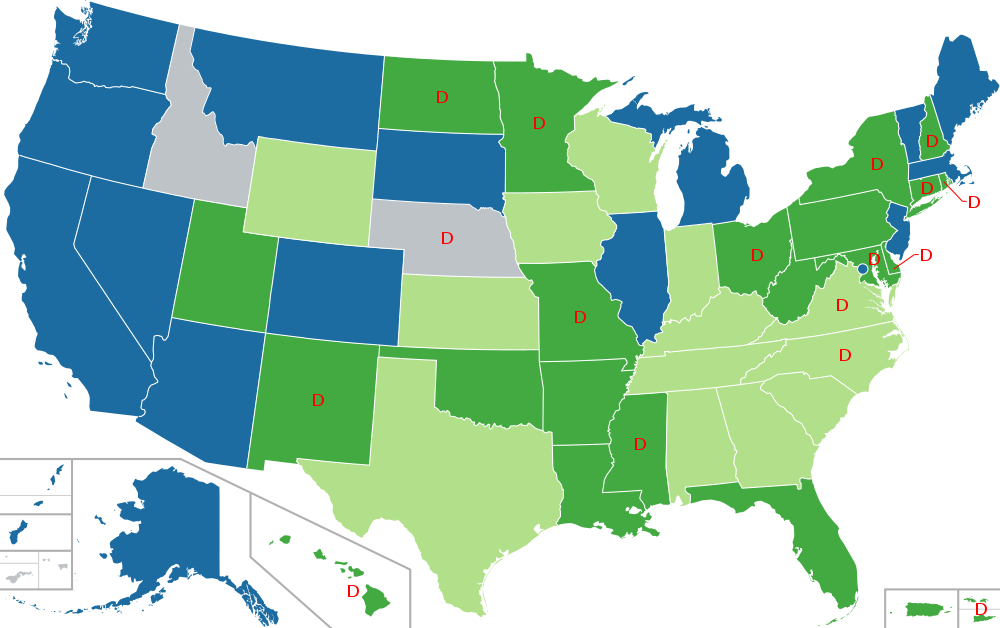

Image SourceKEY

Blue = Legal

Dark Green = Legal for medical use

Light Green = Legal for medical use – limited THC content

Grey = Prohibited for any use

D = Decriminalized

Cannabis legalization advocates, like Doctors For Cannabis Regulation (DFCR), saw the day as a significant victory for industry and social progress. Dr. David Nathan founded DFCR in 2015, where he serves as president of the board. Dr. Nathan stood up and spoke out against the prohibition of marijuana 11 years ago and said he was one of the first accredited mainstream physicians to do so.

“I’m not a medical cannabis physician, I’m a psychiatrist who sees how much damage cannabis prohibition does compared to the drug itself,” Dr. Nathan said. “I’ve really been given the platform to speak up, but at the same time, it was hard to get colleagues to speak up on an issue.”

After working for NJ United for Marijuana Reform, Dr. Nathan founded DFCR to create an organization to facilitate physicians who wanted to get involved at a national level. The success of Tuesday’s vote demonstrates how far legal cannabis advocation has come, from a resounding no to a majority yes.

“A lot of doctors who understood cannabis prohibition as a tragedy and a mistake were concerned about what their peers would think about them if they spoke out,” Dr. Nathan said. “Now we’ve got a group of highly respected physicians organized and advocating strongly, not just for legalization but much more importantly for effective regulation.”

Dr. Nathan sees the NJ amendment as a significant chance for improvement in public health. Despite legalization, it is unclear how the new law will go into effect. Per the amendment, the state will create a regulatory framework and tax the sale of marijuana at 6.625%, but implementation is up for debate.

Legislators still have to agree on how a new Cannabis Regulatory Commission will function. The state will also have to choose how decriminalization, possession limits, growing limits work, and forgiveness of past marijuana crimes.

All of which will be figured out and are necessary to the fair implementation of the passage of the amendment, Dr. Nathan said.

But those changes may come fast. NJ, like many states, is hurting during the COVID recession. Last month New Jersey officials approved a budget that is set to borrow $4.5 billion from the Federal Reserve to plug pandemic-sized holes in state spending.

Basing estimates on Colorado’s experience after legalizing cannabis in 2014, the state legislature predicts NJ could see tax revenues of up to $126 million a year from recreational sales.

“According to the Colorado Department of Revenue, retail cannabis sales, excluding medical cannabis, totaled $1.2 billion in calendar year 2018,” The report said. “Assuming New Jersey experiences similar per capita sales of recreational cannabis as Colorado, total retail cannabis sales for New Jersey could reach $1.9 billion, yielding sales tax revenues of up to $125.6 million annually at the current 6.625 percent sales tax rate.”

With such high revenues, some suspect New Jersey to lead the way for other northeastern states; income will spur jealous neighboring Pennsylvania and New York to legalization in competition.

“If this gives both Pennsylvania and New York a push, that would be great,” Dr. Nathan said. “I do think it’s going to have an impact, now that there will be a state right in the middle of the Mid Atlantic that is going to have regulated sales.”

But even with tristate legalization, the cannabis industry faces a problem with funding.

Most firms in cannabis supply chains- from growers to dispensaries- are small businesses that suffer from a lack of access to bank funding. Because marijuana is an illegal Section 1 drug like Heroin on a federal level, banks and venture capitalists have their hands tied when it comes to credit. But with Tuesday’s victories for legalization, federal regulation is closure to changing.

“I think that each state that adopts, sends a stronger message to the federal government,” Dr. Nathan said. “The voters in those states are giving resounding victories to the notion that cannabis should be de-scheduled not rescheduled, and then regulated.”

deBanked has been following the SAFE Banking Act since it passed in the House last year, a piece of legislation that hopes to address cannabis banking problems by allowing legal pot firms to open banking deposit accounts.

The law was bundled into the HEROES act with the rest of business aid projects, stuck between the GOP-controlled Senate and the blue House since the summer. Depending on the Senate’s layout when ballots are fully counted, financial institutions that have left pot companies de-banked may be-danked.

2020 and Beyond – A Look Ahead

March 3, 2020 With the doors to 2019 firmly closed, alternative financing industry executives are excited about the new decade and the prospects that lie ahead. There are new products to showcase, new competitors to contend with and new customers to pursue as alternative financing continues to gain traction.

With the doors to 2019 firmly closed, alternative financing industry executives are excited about the new decade and the prospects that lie ahead. There are new products to showcase, new competitors to contend with and new customers to pursue as alternative financing continues to gain traction.

Executives reading the tea leaves are overwhelming bullish on the alternative financing industry—and for good reasons. In 2019, merchant cash advances and daily payment small business loan products alone exceeded more than $20 billion a year in originations, AltFinanceDaily’s reporting shows.

Confidence in the industry is only slightly curtailed by certain regulatory, political competitive and economic unknowns lurking in the background—adding an element of intrigue to what could be an exciting new year.

Here, then, are a few things to look out for in 2020 and beyond.

Regulatory developments

There are a number of different items that could be on the regulatory agenda this year, both on the state and federal level. Major areas to watch include:

- Broker licensing. There’s a movement afoot to crack down on rogue brokers by instituting licensing requirements. New York, for example, has proposed legislation that would cover small business lenders, merchant cash advance companies, factors, and leasing companies for transactions under $500,000. California has a licensing law in place, but it only pertains to loans, says Steve Denis, executive director of the Small Business Finance Association. Many funders are generally in favor of broader licensing requirements, citing perceived benefits to brokers, funders, customers and the industry overall. The devil, of course, will be in the details.

- Interest rate caps. Congress is weighing legislation that would set a national interest rate cap of 36%, including fees, for most personal loans, in an effort to stamp out predatory lending practices. A fair number of states already have enacted interest rate caps for consumer loans, with California recently joining the pack, but thus far there has been no national standard. While it is too early to tell the bill’s fate, proponents say it will provide needed protections against gouging, while critics, such as Lend Academy’s Peter Renton, contend it will have the “opposite impact on the consumers it seeks to protect.”

- Loan information and rate disclosures. There continues to be ample debate around exactly what firms should be required to disclose to customers and what metrics are most appropriate for consumers and businesses to use when comparing offerings. This year could be the one in which multiple states move ahead with efforts to clamp down on disclosures so borrowers can more easily compare offerings, industry watchers say. Notably, a recent Federal Reserve study on non-bank small business finance providers indicates that the likelihood of approval and speed are more important than cost in motivating borrowers, though this may not defer policymakers from moving ahead with disclosure requirements.

“THIS WILL DRIVE COMMISSION DOWN FOR THE INDUSTRY”

If these types of requirements go forward, Jared Weitz, chief executive of United Capital generally expects to see commissions take a hit. “This will drive commission down for the industry, but some companies may not be as impacted, depending on their product mix, cost per lead and cost per acquisition and overall company structure,” he says.

- Madden aftermath. The FDIC and OCC recently proposed rules to counteract the negative effects of the 2015 Madden v. Midland Funding LLC case, which wreaked havoc in the consumer and business loan markets in New York, Connecticut, and Vermont. “These proposals would clarify that the loan continues to be ‘valid’ even after it is sold to a nonbank, meaning that the nonbank can collect the rates and fees as initially contracted by the bank,” says Catherine Brennan, partner in the Hanover, Maryland office of law firm Hudson Cook. With the comments due at the end of January, “2020 is going to be a very important year for bank and nonbank partnerships,” she says.

- Possible changes to the accredited investor definition. In December 2019, the Securities and Exchange Commission voted to propose amendments to the accredited investor definition. Some industry players see expanding the definition as a positive step, but are hesitant to crack open the champagne just yet since nothing’s been finalized. “I would like to see it broadened even further than they are proposed right now,” says Brett Crosby, co-founder and chief operating officer at PeerStreet, a platform for investing in real estate-backed loans. The proposals “are a step in the right direction, but I’m not sure they go far enough,” he says.

Precisely how various regulatory initiatives will play out in 2020 remains to be seen. Some states, for example, may decide to be more aggressive with respect to policy-making, while others might take more of a wait-and-see approach.

“I think states are still piecing together exactly what they want to accomplish. There are too many missing pieces to the puzzle,” says Chad Otar, founder and chief executive at Lending Valley Inc.

As different initiatives work their way through the legislative process, funders are hoping for consistency rather than a patchwork of metrics applied unevenly by different states. The latter could have significant repercussions for firms that do business in multiple states and could eventually cause some of them to pare back operations, industry watchers say.

“While we commend the state-level activity, we hope that there will be uniformity across the country when it comes to legislation to avoid confusion and create consistency” for borrowers, says Darren Schulman, president of 6th Avenue Capital.

Election uncertainty

The outcome of this year’s presidential election could have a profound effect on the regulatory climate for alternative lenders. Alternative financing and fintech charters could move higher on the docket if there’s a shift in the top brass (which, of course, could bring a new Treasury Secretary and/or CFPB head) or if the Senate flips to Democratic control.

If a White House changing of the guard does occur, the impact could be even more profound depending on which Democratic candidate secures the top spot. It’s all speculation now, but alternative financers will likely be sticking to the election polls like glue in an attempt to gain more clarity.

Election-year uncertainty also needs to be factored into underwriting risk. Some industries and companies may be more susceptible to this risk, and funders have to plan accordingly in their projections. It’s not a reason to make wholesale underwriting changes, but it’s something to be mindful of, says Heather Francis, chief executive of Elevate Funding in Gainesville, Florida.

“Any election year is going to be a little bit volatile in terms of how you operate your business,” she says.

Competition

The competitive landscape continues to shift for alternative lenders and funders, with technology giants such as PayPal, Amazon and Square now counted among the largest small business funders in the marketplace. This is a notable shift from several years ago when their footprint had not yet made a dent.

This growth is expected to continue driving competition in 2020. Larger companies with strong technology have a competitive advantage in making loans and cash advances because they already have the customer and information about the customer, says industry attorney Paul Rianda, who heads a law firm in Irvine, Calif.

It’s also harder for merchants to default because these companies are providing them payment processing services and paying them on a daily or monthly basis. This is in contrast to an MCA provider that’s using ACH to take payments out of the merchant’s bank account, which can be blocked by the merchant at any time. “Because of that lower risk factor, they’re able to give a better deal to merchants,” Rianda says.

Increased competition has been driving rates down, especially for merchants with strong credit, which means high-quality merchants are getting especially good deals—at much less expensive rates than a business credit card could offer, says Nathan Abadi, president of Excel Capital Management. “The prime market is expanding tremendously,” he says.

Certain funders are willing to go out two years now on first positions, he says, which was never done before.

Even for non-prime clients, funders are getting more creative in how they structure deals. For instance, funders are offering longer terms—12 to 15 months—on a second position or nine to 12 months on a third position, he says. “People would think you were out of your mind to do that a year ago,” he says.

Because there’s so much money funneling into the industry, competition is more fierce, but firms still have to be smart about how they do business, Abadi says.

Meanwhile, heightened competition means it’s a brokers market, says Weitz of United Capital. A lot of lenders and funders have similar rates and terms, so it comes down to which firms have the best relationship with brokers. “Brokers are going to send the deals to whoever is treating their files the best and giving them the best pricing,” he says.

Profitability, access to capital and business-related shifts

Executives are confident that despite increased competition from deep-pocket players, there’s enough business to go around. But for firms that want to excel in 2020, there’s work to be done.

Funders in 2020 should focus on profitability and access to capital—the most important factors for firms that want to grow, says David Goldin, principal at Lender Capital Partners and president and chief executive of Capify. This year could also be one in which funders more seriously consider consolidation. There hasn’t been a lot in the industry as of yet, but Goldin predicts it’s only a matter of time.

“A lot of MCA providers could benefit from economies of scale. I think the day is coming,” he says.

He also says 2020 should be a year when firms try new things to distinguish themselves. He contends there are too many copycats in the industry. Most firms acquire leads the same way and aren’t doing enough to differentiate. To stand out, funders should start specializing and become known for certain industries, “instead of trying to be all things to all businesses,” he says.

Some alternative financing companies might consider expanding their business models to become more of a one-stop shop—following in the footsteps of Intuit, Square and others that have shown the concept to be sound.

Sam Taussig, global head of policy at Kabbage, predicts that alternative funding platforms will increasingly shift toward providing more unified services so the customer doesn’t have to leave the environment to do banking and other types of financial transactions. It’s a direction Kabbage is going by expanding into payment processing as part of its new suite of cash-flow management solutions for small businesses.

“Customers have seen and experienced how seamless and simple and easy it is to work with some of the nontraditional funders,” he says. “Small businesses want holistic solutions—they prefer to work with one provider as opposed to multiple ones,” he says.

Open banking

This year could be a “pivotal” year for open banking in the U.S., says Taussig of Kabbage. “This issue will come to the forefront, and I think we will have more clarity about how customers can permission their data, to whom and when,” he says.

Open banking refers to the use of open APIs (application program interfaces) that enable third-party developers to build applications and services around a financial institution. The U.K. was a forerunner in implementing open banking, and the movement has been making inroads in other countries as well, which is helping U.S. regulators warm up to the idea. “Open banking is going to be a lively debate in Washington in 2020. It’ll be about finding the balance between policymakers and customers and banks,” Taussig says.

The funding environment

While there has been some chatter about a looming recession and there are various regulatory and competitive headwinds facing the industry, funding and lending executives are mostly optimistic for the year ahead.

“If December 2019 is an early indicator of 2020, we’re off to a good start. I think it’s going to be a great year for our industry,” says Abadi of Excel Capital.

Snapshot On Australia: Growth In The Making

August 30, 2019

The Australian alternative lending market continues to gain momentum, bolstered in part by increased awareness, heightened competition and growing dissatisfaction with the status quo.

Indeed, there’s been significant growth in the few years since AltFinanceDaily first wrote about the nascent alternative lending business down under. Notably, Australia’s alternative funding volume surpassed $1.14 billion in 2017, up 88 percent from $609.59 million in 2016, according to the latest data available from KPMG research. It’s the largest country in terms of total alternative finance market volume in the Asia Pacific region, excluding China, according to KPMG.

To be sure, the Australian market is still relatively small—at least compared with the U.S. Digging deeper, the largest share of market volume in 2017—the latest data available—came from balance sheet business lending, accounting for more than $574 million, according to KPMG. P2P marketplace consumer lending had the second largest market volume at $256 million. Invoice trading was the next largest segment of the Australian alternative finance market, accounting for $142.65 million, according to the KPMG report.

Its small size notwithstanding, what makes the Australian market particularly interesting is the potential promise it holds for the companies already established there and the opportunities it may offer to new entrants that find ways to successfully compete in the market.

Certainly alternative lending opportunities in Australia are growing, as awareness increases and the desire by consumers and businesses for favorable rates and faster service intensifies. The Australian alternative lending market is similar to Canada in that a small number of large banks dominate the market both in terms of consumer lending and small business lending. But, like in Canada, alternative lenders are gaining ground amid a changing customer mindset that values speed, favorable rates and a digital experience.

Equifax estimates that alternative finance volume in Australia is now growing at about 10 percent to 15 percent per year; that compares to a decline of approximately 20 percent for some major traditional lenders in terms of credit growth, says Moses Samaha, executive general manager for Equifax in Sydney. This presents an opportunity for alternative lenders to serve parts of the market the banks don’t want and those that are more attuned to a digital experience.

Even so, challenges persist. For instance, digital disruptors are still working on gaining brand awareness, and the market is only so big to be able to accommodate a certain number of alternative players. Time will time whether there will be consolidation among alternative lenders and more bank partnerships, which haven’t been so successful to date. “It doesn’t feel like they are as active as they were announced to be,” Samaha says.

At present, the Australian market consists of a few dozen alternative lenders pitted against four major banks. RateSetter, SocietyOne and Wisr are among the largest alternative players in the consumer lending space. On the small business side, Capify, GetCapital, Moula, OnDeck, Prospa and Spotcap are some of the leading companies. PayPal Working Capital also has a growing presence in the Australian small business lending market.

New lenders continue to eye the Australian market for entry, but it’s not an easy market to crack, according to industry participants. The market consists of mostly home-grown players and that’s not expected to change drastically. (Capify, OnDeck and Berlin-based Spotcap are notable exceptions. Another U.S. major player, Kabbage, previously provided its technology to Australia’s Kikka Capital, but that agreement is no longer in force.)

There can be a steep learning curve when it comes to outsiders doing business in Australia. What’s more, there’s no longer the first-to-market advantage that existed a decade or so ago. It’s also a relatively limited market in terms of size, which can be off-putting. Australia has a population of around 25 million, making it less populated than the state of California, with an estimated 39.9 million residents.

Still, for alternative players that are able to successfully navigate the challenges the Australian market presents, there’s ample opportunity to grab market share away from traditional players—similar to the pattern that’s emerged elsewhere around the globe.

Take consumer lending, for example. The unsecured consumer lending market in Australia sits at about $70 billion, with the large banks occupying maybe a 90 percent share of that, says Mathew Lu, chief operating officer of Wisr (previously known as DirectMoney Limited). Compared with other markets such as U.K. and the U.S., who went through a similar journey around a decade ago, “Australia is probably three or four years into that same journey of growth. It’s shifting and changing,” he says.

Alternative lenders have made strides in undercutting the large banks by offering generally lower rates and typically faster loan times. Unfavorable press related to bank lending practices has also benefited alternative lenders. Lu refers to these conditions as “a perfect storm” for growth.

Wisr, for instance, saw loan origination volume spike 409 percent in fiscal year 2018. The company secured $75 million in loan funding agreements last year and boasts more than 80,000 customers, according to a company presentation.

Marketplace lender, SocietyOne, which in March reached $600 million in loan originations, is another example of an alternative lender that has benefited from the momentum. The company— celebrating its 7th anniversary this summer—is hoping to reach $1 billion in loans by 2020, according to its website.

RateSetter—another major player in this space—has also experienced significant growth since launching in Australia in 2014, and is now funding over $20 million in loans each month, according to its website. In April, the company soared past $500 million in loans funded and in May it saw a record number of new investors register. The company has more than 15,000 registered investors by its own account.

One question for the future is whether the consumer alternative lending space in Australia will ultimately be too crowded amid a spate of new entrants. Wisr’s Lu says “there’s a big question mark” regarding how many alternative lenders the market can sustain. “Will there be a level of consolidation or amalgamation? These are questions ahead of us,” he says.

One question for the future is whether the consumer alternative lending space in Australia will ultimately be too crowded amid a spate of new entrants. Wisr’s Lu says “there’s a big question mark” regarding how many alternative lenders the market can sustain. “Will there be a level of consolidation or amalgamation? These are questions ahead of us,” he says.

For its part, alternative lending to small businesses is also a growing force within Australia. As a testament to the development of this market, in June 2018, a group of Australia’s leading online small business lenders released a Code of Lending Practice, a voluntary code designed to promote fair terms and customer protections. Currently, the Code only covers unsecured loans to small businesses. Signatories include Capify, GetCapital, Moula, OnDeck, Prospa and Spotcap.

Capify—an early entrant to Australia—has been pursuing businesses there since 2008. The company, which integrated its U.S. business in 2017 to Strategic Funding Source (now called Kapitus) is now operating only in Australia and the U.K. In Australia, it has executed more than 7,500 business financing transactions for Australian businesses and has more than 50 staff members in its Australian offices.

The company recently closed a deal with Goldman Sachs for a $95 million line of credit for growth in Australia and the U.K., which includes building out its broker program to increase distribution and technology investment.

David Goldin, the company’s chief executive, says Capify is hoping to grow its Australian business between 25 percent and 30 percent in 2019. The company is looking at M&A activity as well as organic growth.

Since Capify has been in the market, he has seen a number of new entrants—some more successful than others. One concern Goldin has is the lack of experience by some of these competitors. Many aren’t pricing the risk properly and not underwriting prudently to be able to weather a downturn, he says. They are so new, he questions whether they have the expertise to be able to survive a downturn given what he characterizes as pricing and underwriting missteps.

“You can’t go out 24 months on a 1.25 factor rate – that’s crazy,” he says, referring to some contracts he’s seen. “I’ve seen this movie in the U.S. before and it doesn’t end well.”

Meanwhile, competition has driven down prices and made moving quickly on potential leads more of a necessity. When leads come in today, if you’re not on the phone in 30 minutes, you could lose it to a competitor, he says.

Meanwhile, competition has driven down prices and made moving quickly on potential leads more of a necessity. When leads come in today, if you’re not on the phone in 30 minutes, you could lose it to a competitor, he says.

While the small business market is an enticing one for alternative lenders, raising awareness of their offerings continues to be a challenge.

“The small business market is fragmented and raising awareness is expensive,” says Beau Bertoli, co-founder and co-chief executive of Prospa, another prominent small business lender in Australia. “There hasn’t been much innovation in small business banking, but many Australians still don’t think of switching from banks and traditional lenders,” he says.

That said, more small businesses are turning to alternative lenders and these companies say they expect growth to increase over time. Recent research commissioned by OnDeck found that 22 percent of small and medium-sized businesses would consider an online lender, up from 11 percent in the past. This could be buoyed further by the introduction of Open Banking in Australia, which was set to be introduced in Australia in 2019, but this was pushed back to early 2020.

“We look forward to the introduction of Open Banking in Australia as it should allow lenders to use incremental data points to improve risk modeling, and increase competition in the SME lending space, ultimately providing SMEs with improved access to cashflow solutions to grow and run their businesses,” says Cameron Poolman, chief executive of OnDeck in Australia.

Bertoli of Prospa, which recently listed on the Australian Stock Exchange, says the Australian alternative lending market will also benefit from strong support from industry and government to increase competition and improve consumer and small business outcomes. The government recently established a $2 billion Australian Business Securitisation Fund, which is a huge win for small business, he says, that will ultimately make the finance available to small business owners more affordable by lowering the wholesale cost of funds for alternative lenders. “We expect this will boost credibility and consideration of alternative lenders among small business owners,” he says.

Declining property values is another factor helping alternative lending. “In November 2018 we saw the largest annual fall in property prices in Australia since the global financial crisis in 2009,” says Simon Keast, managing director of Spotcap Australia and New Zealand.

“As property prices decline, business owners find it more difficult to use their home as loan security and as such, turn to alternative lenders such as Spotcap that can provide them with unsecured loans for their business,” he says. What’s more, the SME Growth Index in March showed for the first time that business owners are almost as likely to turn to an alternative lender as they are to their main bank to fund growth, says.

“As property prices decline, business owners find it more difficult to use their home as loan security and as such, turn to alternative lenders such as Spotcap that can provide them with unsecured loans for their business,” he says. What’s more, the SME Growth Index in March showed for the first time that business owners are almost as likely to turn to an alternative lender as they are to their main bank to fund growth, says.

Overall, the market opportunity for alternative lending to small businesses is compelling, says Bertoli of Prospa. “We estimate the potential market for small business lending in Australia is more than $20 billion per annum and we’ve penetrated only about 2 percent of the market so far. There are 2.3 million small businesses in Australia, and they’re crying out for capital,” he says.

Keast of Spotcap says he expects to see more banks and non-financial enterprises looking to leverage the technology fintech lenders have built to provide swift and digital lending products to small businesses. He offers the example of a partnership Spotcap, a German-based company, has with an Austrian Bank to provide same-day finance to SMEs in Austria as an example of the types of partnerships the company could also seek in Australia. “We have already partnered with an Austrian Bank that is leveraging our lending platform to provide same-day finance to SMEs in Austria, and there is plenty of interest for similar partnerships on the ground here,” he says.

OnDeck, meanwhile, expects to see a shake-out within the alternative finance sector, which will result in a smaller number of bigger players, with the ability to scale and serve multiple customers with a variety of products, according to Poolman, the company’s chief executive.

For his part, Goldin of Capify is bullish on the Australian small business market, but he cautions others that it’s not a gold rush type of place where everyone who comes in can make money.

“The state of California has more opportunity than the entire continent of Australia,” he says.

Canada Fintech Week Launches in Toronto

August 12, 2019 This week sees the first ever Canada Fintech Week (CFW) in Toronto. Running from August 12th to the 15th, the four-day celebration of everything fintech in Canada features a slew of events and panels for those in the industry.

This week sees the first ever Canada Fintech Week (CFW) in Toronto. Running from August 12th to the 15th, the four-day celebration of everything fintech in Canada features a slew of events and panels for those in the industry.

Ranging from how to incorporate blockchain technology in Holocaust asset recovery to cybersecurity, to the future of open banking, CFW appears to cover a mix of topics and issues that are at the forefront of various corners of the scene.

CFW was launched by the Digital Finance Institute (DFI), a thinktank established to provide assistance to the digital finance ecosystem of Canada, with particular attention being paid to inclusion, responsible innovation, and the supporting of women in fintech. Having held the Annual National Fintech Canada Conference for the previous four years, DFI is combining the two events into one this year, with the fifth conference taking place on Wednesday.

In the lead up to CFW, DFI has released a list of its top 50 fintech companies in Canada that features the likes of Interac, OnDeck, and Lendesk; which accompanies its previous list of the top women in Canadian fintech. FundThrough, whose Director of Innovation spoke with AltFinanceDaily last month after appearing on this list, will be hosting a panel covering alternative finance on Thursday.

CFW is coming at a time when fintech in Canada appears to be on the up, with a recent report from PwC-CBInsights finding that the first six months of 2019 have seen totals funds raised by Canadian fintech firms almost doubling from $133 million in Q1-Q22018 to $251 million. As well as this, investments in seed-stage companies have risen too, with the portion of seed round investments made in the first six months of 2018 being 36% of total investments, while 2019 witnessed 49%.

AltFinanceDaily’s “Ice Edition”

December 14, 2018 AltFinanceDaily’s final issue of 2018 is in the mail. We’re calling it the ice edition because of how the cover’s colors came out. For November/December we cover the new legislation in California, what’s happening in New Jersey, and what may be still to come. In addition we tackle the concept of open banking, delve into Small Business Development Centers, and reflect back on the biggest moments of 2018. There’s more of course, but you’ll have to get your hands on the ice to see for yourself.

AltFinanceDaily’s final issue of 2018 is in the mail. We’re calling it the ice edition because of how the cover’s colors came out. For November/December we cover the new legislation in California, what’s happening in New Jersey, and what may be still to come. In addition we tackle the concept of open banking, delve into Small Business Development Centers, and reflect back on the biggest moments of 2018. There’s more of course, but you’ll have to get your hands on the ice to see for yourself.

If you’re not already subscribed, YOU CAN REGISTER TO GET ALL FUTURE ISSUES HERE FOR FREE.

And don’t forget, the deadline to become a sponsor of AltFinanceDaily CONNECT – Miami is Wednesday, Dec 20th. Email events@debanked.com to get signed up.

New Industry Group Established to Support Consumers’ Right to Access their Financial Data

January 19, 2017The Consumer Financial Data Rights (CFDR) group defends consumers’ access to their data and fuels new innovation in fintech

REDWOOD CITY, Calif., Jan. 19, 2017 /PRNewswire/ — The Consumer Financial Data Rights (CFDR), a new industry group formed by some of the most recognized companies in the financial sector, officially launched today in support of the consumers’ right to innovative products and services that improve their financial well-being and are powered by unfettered access to their financial data. As fintech companies increasingly collaborate with banks around the world to provide innovative solutions through open application program interfaces (APIs), this right ensures a consumer can continue to give permission to third party companies to use that individual’s data for managing their personal finances, obtaining loans, making payments, and providing investment advice in addition to many other applications.

The CFDR brings together organizations from across the fintech ecosystem and includes some of the most influential and innovative companies in the financial sector, including the following founding members: Affirm, Betterment, Digit, Envestnet | Yodlee, Kabbage, Personal Capital, Ripple, and Varo Money among many other companies.

Section 1033 of Dodd-Frank codified the consumers’ right to access their personal financial data through technology-powered third party platforms. Together with promoting consumer choice and access to these consumer-first financial health tools, the CFDR is also committed to improving dialogue throughout the financial industry, actively engaging the government and working with banks, fintech innovators, and third party platforms. The CFDR aims to be a resource for policymakers, including the Consumer Financial Protection Bureau, as they determine how to best assist consumers in leveraging their own financial data.

“Each consumer’s right to their own financial data is vital in helping to understand their finances and make the best saving and spending decisions,” said Max Levchin, Founder and CEO of Affirm. “As a company we’re committed to helping customers make the best financial decisions and improve their financial lives through technology and improved flexibility, and having a complete picture of a customer’s financial picture is essential to achieving this. As a founding member of the CFDR, we’re committed to ensuring that all consumers have access to data which makes their financial lives better.”

“Consumers and small business owners need to be able to view their entire financial picture to make decisions that are truly in their best interests,” said Rob Frohwein, Co-Founder of Kabbage. “The ability to freely access financial data empowers customers to take actions to improve their financial lives, whether it’s accessing capital to grow a business or better understanding their income streams. Access to financial data is not just vital for customers wanting to enjoy financial health, but it also allows companies to provide better user experiences. Kabbage is thrilled to join other companies also committed to democratizing access to financial data.”

CFDR’s first action will be the submission of a joint comment letter in response to an advanced notice of proposed rulemaking on Enhanced Cyber Risk Management Standards issued by the Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation. The submission will encourage the regulators to establish a risk hierarchy with regard to cybersecurity risk in the fintech industry and will note the importance of continuing to allow consumers to access secure tools that enable their financial well-being.

“Consumers have the right to access financial solutions that allow them to improve their financial well-being,” said Anil Arora, CEO of Envestnet | Yodlee. “The CFDR is committed to initiatives that enable fintech innovation in the United States, much of which has transpired globally including recent open API initiatives in Europe, the Open Banking standard in the UK, and the commitment by the Monetary Authority of Singapore to create an open API economy and promote the secure use of cloud environments. The consumers’ right to unfettered access to their financial data will help enable the continued growth of innovative financial technologies and ultimately help consumers improve their financial health.”

About Consumer Financial Data Rights (CFDR)

The Consumer Financial Data Rights (CFDR) is a new industry group formed by some of the most recognized companies in the financial sector, launched to support the consumers’ right to unfettered access to their financial data. Open data acess is critical to enabling innovative tools that can help consumers improve their financial lives. CFDR members seek to: drive financial innovation in a collaborative ecosystem by bridging the needs of consumers, banks, fintech innovators, and regulators; partner with banks to support unfettered access to consumer and small business data through a secure and open financial system; and promote consumer rights to access and share their financial data with third party companies that provide tools to enable better financial outcomes.

SOURCE Envestnet | Yodlee