Shopify Originates $153M in MCAs and Loans in Q2

July 29, 2020 Shopify had a monster 2nd quarter. The e-commerce giant generated $36M in profit on $714.3M in revenue. As part of that the company originated $153 million worth of loans and merchant cash advances, only slightly down from the $162.4M in Q1. Still that figure was up by 65% year-over-year (and was more than 2x the volume originated by OnDeck).

Shopify had a monster 2nd quarter. The e-commerce giant generated $36M in profit on $714.3M in revenue. As part of that the company originated $153 million worth of loans and merchant cash advances, only slightly down from the $162.4M in Q1. Still that figure was up by 65% year-over-year (and was more than 2x the volume originated by OnDeck).

The company has offered capital to its US merchants since 2016 and recently begun doing the same with its UK and Canadian merchants starting this past March and April respectively, the company revealed.

Shopify CFO Amy Shapero said that company had maintained loss ratios “in line with historical periods,” despite COVID. “Access to capital is even tougher in times like these, which makes it even more important to continue lowering this barrier by making it quick and easy so merchants can focus on growing their business,” Shapero stated.

Shopify Shows Strength in Q1 Results, Issues $162.4M in MCAs and Loans

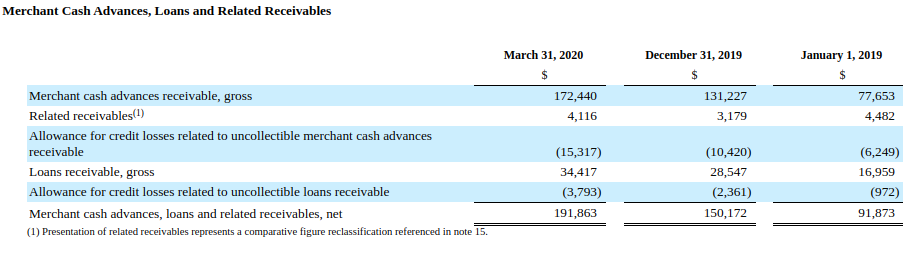

May 6, 2020eCommerce platform Shopify, 2nd only to Amazon in retail eCommerce sales, issued $162.4M in merchant cash advances and business loans in Q1, up from $115.9M in the previous quarter. The statistic pushed them past the $1 billion threshold of funds cumulatively issued since inception.

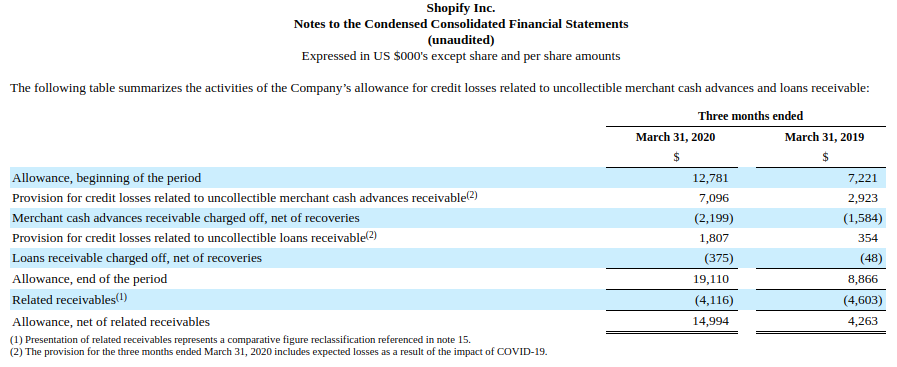

The company’s provision and allowance for loan losses ticked up from significantly from the same period the prior year but Shopify at that time was originating 50% less volume.

The company reported a GAAP net loss of $31.4M on $470M in revenue. Shopify also has approximately $2.36B in cash and cash equivalents on its balance sheet.

The company reported an increase of monthly recurring revenue, thanks to an increase in the number of merchants joining the platform, strong app growth, and Shopify Plus fee revenue growth.

Shares of Shopify (NYSE: Shop) jumped by more than 5% after the announcement.

Shopify Capital Originated $430 Million in Loans and MCAs in 2019

February 17, 2020 Shopify Capital, the e-commerce giant’s small business financing arm, originated $430 million in funding through loans and merchant cash advances in 2019. Shopify now has more than 1 million e-commerce merchants on its platform, the company says. Earlier in the year the company began rolling out funding to merchants that are not using its payment service.

Shopify Capital, the e-commerce giant’s small business financing arm, originated $430 million in funding through loans and merchant cash advances in 2019. Shopify now has more than 1 million e-commerce merchants on its platform, the company says. Earlier in the year the company began rolling out funding to merchants that are not using its payment service.

Though 2019 year-end reporting for the industry is still sparse, the company’s origination figures will likely cause Shopify to move up the rankings maintained by AltFinanceDaily.

PayPal, who AltFinanceDaily predicts will keep its #1 spot, did not disclose its annual origination figures in its already-reported Q4 earnings.

Shopify Capital Originated $141M Of Loans And MCAs In Q3, Says It’s a Meaningful Part Of The Shopify Business

October 29, 2019 Shopify Capital, Shopify’s small business funding division, originated $141 million in loans and merchant cash advances last quarter, an 85% increase over Q3 last year.

Shopify Capital, Shopify’s small business funding division, originated $141 million in loans and merchant cash advances last quarter, an 85% increase over Q3 last year.

The company has now cumulatively originated $768.9M since it began funding in April 2016.

On the earnings call, Shopify COO Harley Finkelstein commented on the company’s recent initiative to fund non-Shopify payment merchants by saying that “while it’s still early, we’re seeing strong adoption from those merchants.”

“We started Shopify Capital to help solve another playing field for entrepreneurs, access to capital to grow their businesses,” he explained. “This is especially true as merchants gear up for their busiest selling season of the year.”

When asked about how funding would play a role in the company’s long term expansion and retention plans, Finkelstein said the following:

[P]art of this is making sure that we have merchants in the entirety of their journey to success, certainly things like having additional cash for things like inventory and marketing are very important to them. And there’s not too many place to get that with capital. So we think we’re helping merchants by doing this. It also serves of course as a way to retain merchants because we’re not only now their e-commerce platform or the point sale provider or the payments provider, we’re also now in some cases playing the role of their capital provider.

So this is a meaningful part of our business, and it keeps growing, and it’s certainly something we’re very proud of. And in terms of managing the risk, it’s something we keep a close eye on. We do a ton of trade forecasting and ensuring that we look at the data to update our models as we see trends changing. That being said, it’s important to remember that most of the capital that we put out there is insured by our partner EDC.

So we think that we continue to grow the capital business at the same time manage the risk and so we’re not doing anything that is outside of that loss ratio and risk exposure comfort zone that we think we have right now.

Shopify CEO Tobi Lutke later added how their Capital division adds to their Gross Merchandise Value (GMV) because merchants use funds to build their businesses.”What happens is a lot more businesses, that otherwise would not have access to loans get them and therefore actually continue building their business.”

Shopify Issued $93M in MCAs and Loans in Q2, Has Begun Offering Funding to Non-Shopify Payment Customers

August 4, 2019 Shopify, a publicly traded e-commerce platform, is quickly growing its merchant cash advance and loan originations through its Shopify Capital brand. The company issued $93M in Q2, up 36% year-over-year and an increase from the prior quarter of $5.2M. Shopify’s loan product is only available in Arizona, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, North Carolina, South Carolina, Utah, Washington, Wisconsin, and Wyoming.

Shopify, a publicly traded e-commerce platform, is quickly growing its merchant cash advance and loan originations through its Shopify Capital brand. The company issued $93M in Q2, up 36% year-over-year and an increase from the prior quarter of $5.2M. Shopify’s loan product is only available in Arizona, Idaho, Illinois, Indiana, Iowa, Kansas, Louisiana, Maine, North Carolina, South Carolina, Utah, Washington, Wisconsin, and Wyoming.

The company also recently began offering funding to merchants who don’t use Shopify Payments but still use the Shopify platform.

On the quarterly earnings call, Shopify CFO Amy Shapero said in doing so “we still have significant visibility into their operations, we see their orders, we see the engagement with the platform. And so, we are very comfortable moving in that direction.” The move provides an opportunity to expand their eligible market by 10%, she added.

Furthermore, Shopify’s deals are performing well, the company claims. Shapero said “we’ve actually managed our loss ratio in a very, very tight range. In fact, it’s lower than the top of the range where we think we could go with this, which says the power of our algorithms are working.”

Shopify Capital has originated more than $180M in 2019 so far, indicating they may be surpass many competitors in the rankings this year. The company originated $277.1M in 2018.

Shopify Capital Issued $87.8M in Merchant Cash Advances in Q1

April 30, 2019Shopify’s small business funding division, Shopify Capital, issued $87.8 million in merchant cash advances in the first quarter of 2019, according to the company’s earnings report. The figure is a 45% increase over the same period last year. Overall, the company has funded more than $535 million in MCAs since inception.

Shopify is primarily an e-commerce platform, but they are quickly becoming a competitor to both Square and PayPal, both of whom also offer funding solutions.

Shopify is Quickly Climbing the Ranks of the Largest Small Business Funders

February 12, 2019Shopify originated $277 million in merchant cash advances in 2018, according to their quarterly earnings reports. That figure already places them among the largest small business funding providers nationwide.

Below is a look of how they stack up thus far:

| Company Name | 2018 Originations | 2017 | 2016 | 2015 | 2014 | |

| OnDeck | $2,484,000,000 | $2,114,663,000 | $2,400,000,000 | $1,900,000,000 | $1,200,000,000 | |

| Kabbage | $2,000,000,000 | $1,500,000,000 | $1,220,000,000 | $900,000,000 | $350,000,000 | |

| Square Capital | $1,600,000,000 | $1,177,000,000 | $798,000,000 | $400,000,000 | $100,000,000 | |

| Funding Circle (USA only) | $500,000,000 | |||||

| BlueVine | $500,000,000* | $200,000,000* | ||||

| National Funding | $427,000,000 | $350,000,000 | $293,000,000 | |||

| Kapitus | $393,000,000 | $375,000,000 | $375,000,000 | $280,000,000 | ||

| BFS Capital | $300,000,000 | $300,000,000 | ||||

| RapidFinance | $260,000,000 | $280,000,000 | $195,000,000 | |||

| Credibly | $180,000,000 | $150,000,000 | $95,000,000 | $55,000,000 | ||

| Shopify | $277,100,000 | $140,000,000 | ||||

| Forward Financing | $125,000,000 | |||||

| IOU Financial | $91,300,000 | $107,600,000 | $146,400,000 | $100,000,000 | ||

| Yalber | $65,000,000 |

*Asterisks signify that the figure is the editor’s estimate

Shopify Capital Issued $76.4M in Merchant Cash Advances in Q3

October 25, 2018Shopify Capital, Shopify’s funding arm, issued $76.4 million in merchant cash advances in the third quarter, the company revealed. That brings the total to $375 million advanced since April 2016.

Overall, the company reported Q3 revenue of $270.1 million and a net loss of $23.2 million.

The company operates an e-commerce platform for online stores and retail POS systems.