Qwave Fails to Acquire IOU Financial, But Becomes Major Shareholder

September 24, 2015 After some tense fanfare, Qwave Capital failed to acquire a controlling stake in IOU Financial but has succeeded in becoming a major shareholder. In a published statement, Qwave manager Serguei Kouzmine said, “As a significant shareholder in IOU, I plan to work constructively with the Board of Directors to ensure the company is focused on growing profitably and creating value for all IOU shareholders over the long term. I appreciate the support my offer has received and look forward to helping IOU realize its potential.”

After some tense fanfare, Qwave Capital failed to acquire a controlling stake in IOU Financial but has succeeded in becoming a major shareholder. In a published statement, Qwave manager Serguei Kouzmine said, “As a significant shareholder in IOU, I plan to work constructively with the Board of Directors to ensure the company is focused on growing profitably and creating value for all IOU shareholders over the long term. I appreciate the support my offer has received and look forward to helping IOU realize its potential.”

Nearly 15% of the company’s issued and outstanding shares were acquired under the offer.

Qwave stands to materially benefit in the long run especially since the timing coincides with IOU Financial hitting historic milestones.

“The Company’s loan originations for the months of July and August, totaled US$31.3 million, representing a year over year increase of 150% in comparison to the same period in 2014,” IOU announced.

They also funded more than $100 million in 2014 and if that volume is a metric that anyone is measuring then IOU is substantially undervalued.

If the takeover attempt accomplished anything, it may have stirred IOU from a slumber at just the right moment in alternative lending history. They’ll be a lender worth keeping an eye on.

IOU Financial is Playing Offense in 11th Hour

September 19, 2015 Perhaps jolted awake by corporate raiders attempting a hostile takeover, IOU Financial is making some bold moves and issuing some optimistic news. Yesterday on September 18th, IOU announced that they took home a profit for the months of July and August and in addition signed a letter of intent for a credit facility of up to $50 million. They also said that the board has received an offer to proceed with a private placement of up to $10 million in principal amount of convertible debentures, with committed subscriptions in excess of $7 million.

Perhaps jolted awake by corporate raiders attempting a hostile takeover, IOU Financial is making some bold moves and issuing some optimistic news. Yesterday on September 18th, IOU announced that they took home a profit for the months of July and August and in addition signed a letter of intent for a credit facility of up to $50 million. They also said that the board has received an offer to proceed with a private placement of up to $10 million in principal amount of convertible debentures, with committed subscriptions in excess of $7 million.

It should be noted that neither is guaranteed and a letter of intent is not a closed deal. The lender’s loan originations for the months of July and August, totaled US$31.3 million, representing a year over year increase of 150% in comparison to the same period in 2014.

IOU is fighting to stave off Qwave Capital, a VC firm that recently made a formal bid to buy a controlling stake for $17 Million CAD. IOU’s board has adamantly rejected the offer and has been urging share holders to turn it down.

The offer expires at 5pm EST on Tuesday, September 22nd.

“We continue to believe Qwave’s Offer provides IOU shareholders with excellent value, liquidity and opportunity,” said Serguei Kouzmine, a manager of Qwave Capital in a release dated September 17th. “The IOU board has failed to deliver an alternative offer, has repeatedly refused to act in the best interests of all shareholders, and has approved related-party transactions that put insiders first. We think IOU shareholders deserve better, and we’re asking them to tender their shares and partner with us to help IOU realize its full potential.”

Qwave Capital Steps Up Pressure to Acquire IOU Financial

September 2, 2015 The nuclear scientists in venture capital clothing have laid out their case to IOU Financial’s shareholders that they would be better served if they were running things. In a letter distributed on Monday by Qwave Capital, the firm trying to acquire IOU, they criticized the lender’s state of affairs.

The nuclear scientists in venture capital clothing have laid out their case to IOU Financial’s shareholders that they would be better served if they were running things. In a letter distributed on Monday by Qwave Capital, the firm trying to acquire IOU, they criticized the lender’s state of affairs.

In all, IOU continues to demonstrate that it cannot grow profitably and compete effectively within its current model. This is made worse by the fact that, because IOU does not have sufficient capital, conservative lenders are reluctant to provide IOU access to capital at competitive rates. In comparison, OnDeck, IOU’s major online lending competitor, had raised far more capital when at the same stage of development that IOU is at today. OnDeck can now attract the lower interest funds it requires to lend out to customers and support its profitable growth in the U.S. and Canada.

Qwave chastised IOU’s board members for decisions it didn’t feel aligned with the best interests of the company.

“IOU transactions have allowed Board members and insiders to maintain their dominant interest in IOU and purchase shares for below-market value,” they wrote.

And continued:

“For instance, IOU recently completed a private placement financing at $0.40 per share, a 20% discount to Qwave’s Offer and the private placement’s original $0.50 per share price. IOU completed the $0.40 per share offering even though Qwave’s offer was on the table and IOU had confirmed offers at $0.50 per share on its books. Parties related to IOU management subscribed to approximately 17% of the offering at the discounted offer price.”

Judging by the rest of the letter, IOU shareholders will certainly have a lot to consider. You can read a full copy of it here.

OnDeck vs. IOU Financial: Are one of these lenders mispriced?

August 12, 2015 Has OnDeck’s stock price dropped so much that it’s now a buying opportunity? You’ll probably want to read this before you decide.

Has OnDeck’s stock price dropped so much that it’s now a buying opportunity? You’ll probably want to read this before you decide.

OnDeck’s IPO market cap was $1.3 billion. They funded $1.2 billion worth of loans in 2014. OnDeck’s stock has since dropped though, bringing its market cap down to around $650 million. The company is often compared to Lending Club despite their business models being completely different. But since there has been seemingly no one else to make comparisons with, the two have become star crossed lovers in a new FinTech Lending category of the market.

Everyone seems to have ignored the fact that one of OnDeck’s direct competitors is also a public company and I don’t mean a subsidiary of a giant conglomerate for which no individual comparison would be logical, but a standalone entity that is a serious player.

Kennesaw, GA-based IOU Financial (formerly IOU Central) is actually a public company in Canada, even though its only operational activities are small business loans in the U.S. The company is not a fly-by-night me-too business lender, as they funded more than $100 million in 2014 and earned a spot on the AltFinanceDaily leaderboard for being one of the biggest in the industry.

OnDeck out-loaned IOU in 2014 at a ratio of 12 to 1, but here’s the kicker, OnDeck’s market cap is more than 34x the size of IOU. When converting to USD, IOU’s market cap is only slightly above $18 million.

$18 million…

That for a company that loaned $100 million last year. It’s no wonder that the perceived low market value has invited a hostile takeover bid from Russian venture capitalists. The tender offer of $15 million, presumably in Canadian dollars, would’ve acquired 55.9% of the company’s outstanding shares. The company is currently waiting for its shareholders to vote on the offer.

Meanwhile, another competitor, Kabbage, was recently valued at $875 million on loan volume last year of $400 million.

Ignoring all other factors that comprise a lender’s worth

- Kabbage was valued at more than twice its annual loan volume

- OnDeck’s IPO value was about equal to its annual loan volume, but their current market cap is almost half its annual loan volume

- IOU Financial’s current market cap is less than 20% its annual loan volume.

On these stats alone, IOU Financial seems to be incredibly undervalued, especially for a company whose spokesperson is celebrity investor and TV personality Kevin O’Leary.

OnDeck touts OnDeck marketplace as a way to sell off loans and generate income but IOU also regularly sells off its loan receivables while retaining the servicing rights just like OnDeck does.

Kabbage out-loaned IOU last year by a ratio of only 4 to 1, yet is valued almost 50x higher than IOU.

Every company has strengths, weaknesses, and reasons why they stand apart from their peers even if they look very much like them. However, given the mind blowing disparity in valuations for lenders that compete for the same customer with similar products, there surely has to be a buying or selling opportunity in here somewhere.

I think the Russian nuclear scientists are on to something…

BHG Financial Had a Strong Second Quarter

August 22, 2025 BHG Financial had loan originations of $1.5B in the 2nd quarter of 2025, up from 1.2B YoY. The company is 49% owned by Pinnacle Bank.

BHG Financial had loan originations of $1.5B in the 2nd quarter of 2025, up from 1.2B YoY. The company is 49% owned by Pinnacle Bank.

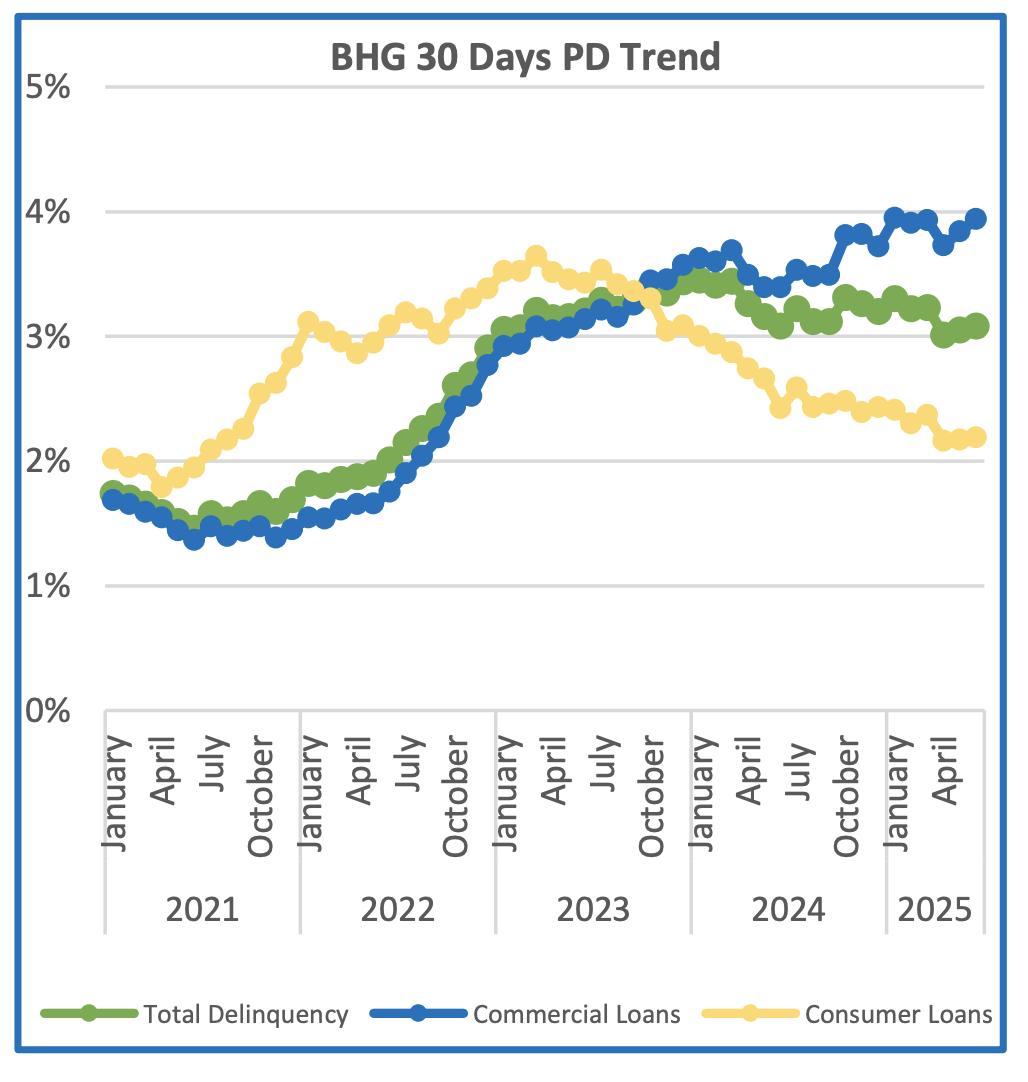

The company’s trending 30-day commercial past-due rate has been hovering at around 4% since the same time last year while past-due rates on their consumer loans have been in a consistent decline since Summer 2023.

During the Q2 earnings call, Pinnacle CFO Harold Carpenter, said that both production and credit growth have been good this year.

“I think credit has really been the bigger surprise for the year,” said Carpenter, “and we feel like that it looks like it’s pivoted and hopefully, it will continue to pivot.”

BHG primarily serves as a full-service commercial loan provider to healthcare providers and other skilled professionals for business purposes but also makes consumer loans for various purposes.

Dedicated Financial GBC Celebrates 10 Years of Significance by raising over $64,000 for Nonprofit Organizations

January 22, 2025 Shoreview MN – On January 10th, 2025, Dedicated Financial GBC proudly hosted its first-ever gala, celebrating 10 years of existence and significance. Held at the JW Marriott in Bloomington, the evening was spectacular. A glamorous red-carpet experience welcomed guests, complete with professional photos and video interviews led by the night’s host, Eric Perkins. Behind them stood a stunning backdrop displaying the logos of the many nonprofit organizations that Dedicated has worked with throughout the past decade.

Shoreview MN – On January 10th, 2025, Dedicated Financial GBC proudly hosted its first-ever gala, celebrating 10 years of existence and significance. Held at the JW Marriott in Bloomington, the evening was spectacular. A glamorous red-carpet experience welcomed guests, complete with professional photos and video interviews led by the night’s host, Eric Perkins. Behind them stood a stunning backdrop displaying the logos of the many nonprofit organizations that Dedicated has worked with throughout the past decade.

The evening celebrated the heart of Dedicated’s mission: that businesses have the greatest opportunity to change the world and Dedicated is taking steps to prove that. The night began with a 90-minute cocktail hour to connect directly with the nonprofits at their table. Throughout the night, nonprofits shared from the stage about their mission and inspired guests toward action. Next, a borrower that Dedicated collected from during a truly devastating tragedy in her life shared a touching testimony. Acclaimed musical guest Jason Gray delivered an unforgettable, soul-stirring performance, and Amanda Brinkman took to the stage to inspire guests with her powerful message about pursuing purpose and following one’s unique journey.

The night also honored those who made an enduring impact by working with Dedicated. Awards were presented to outstanding team members, and a lifetime achievement award bestowed upon the CEO’s longtime mentor and the Senior Advisor to Dedicated, Dr. John Reik—a heartfelt tribute to the guidance and wisdom that shaped the company’s journey.

Closing the event, Dedicated’s CEO expressed deep gratitude to everyone who poured love, care, and time into the company over the past 10 years. In a moving moment, guests were invited to donate to the cause that resonated most with them. Representatives from each nonprofit met with guests and told firsthand stories of how their missions change lives.

It is incredibly unique to see a company mark a milestone like this—not by focusing solely on its achievements but by raising funds and awareness for causes that truly matter. In just one night, Dedicated and their guests raised $64,000 to support 14 nonprofit organizations. Over the past decade, Dedicated has contributed to these nonprofits through various drives, campaigns, and volunteer efforts, making a significant difference in many lives.

Looking forward to the next 10 years, Dedicated remains steadfast in their commitment to inspire businesses in becoming purpose-driven and putting people over profits.

BriteCap Financial Ramps Up Team, Ready For Growth

December 20, 2024 The stream of announcements coming out of BriteCap Financial garnered notice. It started with news of a $150M credit facility back in August, followed by announcements of a new CEO, CFO, CCO, VPs, and more. The new CEO, Richard Henderson, whose CV includes previous roles at CAN Capital, Marlin Capital Solutions, and Direct Capital, told AltFinanceDaily that the company wanted to have the right team in place to carefully grow the business. BriteCap, which is part of the North Mill family of companies, offers attractive term loans to small businesses.

The stream of announcements coming out of BriteCap Financial garnered notice. It started with news of a $150M credit facility back in August, followed by announcements of a new CEO, CFO, CCO, VPs, and more. The new CEO, Richard Henderson, whose CV includes previous roles at CAN Capital, Marlin Capital Solutions, and Direct Capital, told AltFinanceDaily that the company wanted to have the right team in place to carefully grow the business. BriteCap, which is part of the North Mill family of companies, offers attractive term loans to small businesses.

As part of the plan, the company is looking to add not just new brokers but the right brokers, especially given the upstream programs they offer to merchants. “We’re being very selective on who we onboard,” said Henderson. “We’re trying to make sure that we’ll use that to get to scale, but also to build powerful relationships with those brokers where it’s a true partnership.”

BriteCap has developed an online checkout system to streamline the funding process. It can be configured to work with however the broker is used to working. They’ve focused a lot on the mobile experience so that a merchant need not even be in front of a computer to go through it.

One notable advantage to BriteCap is precisely that affiliation with the North Mill family because it opens up the possibility of not just working capital as a solution but also equipment finance. According to Henderson, the potential crossover between the products works well especially when the deals have been originated in the right context. That context includes the best practices and professionalism that equipment finance brokers typically operate within.

Among the C-suite executives to recently join BriteCap are Pushkar Choudhuri as Chief Financial Officer and David Lafferty as Chief Credit Officer. The timing of everything aligns with the firm’s economic sentiments. Henderson said that he believes optimism is higher now and growing.

“…generally speaking, we’ve seen demand picking up and we have a pretty bullish view on the economy moving forward,” he said. “I think we’re entering into a very good time in our space.”

The Long Running Mysterious Fraud in the Small Business Finance Industry and How to Defend Yourself

May 1, 2024The submitted deals are real. The merchants are real. Everything checks out until suddenly it doesn’t. The merchants block the payments and find out they’ve been scammed.The funders find out they’ve also been scammed. But it’s too late because the money is gone and the fraudsters disappear without a trace.

deBanked reviewed hundreds of court documents, emails, and websites in preparation for this story and spoke with multiple people familiar with the matter, though only one would agree to go on record. Here’s the story of how the scam works and what you need to know to defend yourself.

It was a textbook merchant interview call. The business owner answered the questions succinctly and convincingly. He knew his stuff and sounded confident, like somebody who wanted to just finish the process and get the underwriter to issue a final approval on his funding application. His accent said little about where he was from. It sounded like it could be Mid-Atlantic or perhaps lower New England, just a regular business owner on Main Street USA.

“It sounded a little nasal, right?” said Alex Shvarts, CEO of FundKite, after playing the recording for me to judge.

The tone of the voice did actually sound unusual after thinking about it. Something was off about the call and that was the only tell. For the person on the other end of the phone wasn’t who they claimed to be. It would later be debated if they had used voice changing technology, one of many layers of obfuscation that had been put in place to cover up what is quickly becoming the scheme of the decade.

FundKite had signed up a new broker and promptly received two deals from them. On this particular one the paperwork attached to the application was real. This was a real business and these were their real documents. But the real owner of the business had no idea that any of it had been used to apply for funding with FundKite.

In a typical identity theft scenario, a scammer gets a lender to send the loan proceeds to a bank account that is controlled by the scammer, keeping the victim completely in the dark that their identity is being used for the fraud until much later when a default occurs. But in this case the scammer intended to have a funding company send money to the victim’s actual bank account. It’s a twist that understandably makes it very difficult for the funding company to later believe that the merchant’s identity had been stolen since they were the ones receiving the proceeds. But once the business has been funded, the scammer executes the next step in the scheme, convincing the business owner to send the money to them. If that sounds like a whole lot more work to make this heist successful, then you have no idea how many layers of deceit are in play and the scale at which it’s operating.

It started sometime around 2019 (maybe even earlier) and is still happening to this day across the industry. The scammer uses stolen identities to incorporate businesses, followed by using those entities to open up bank accounts for them. One account is used to impersonate being a lender and another to impersonate being a broker. They first get to work by being the fake lender and register a domain name that closely resembles and could be mistaken for a real lender they’re trying to impersonate. According to records obtained by AltFinanceDaily, domain names challenged via UDRP and seized as part of an ongoing investigation into the fraud reveal that the scammers also use stolen identities to register the domains, making the real buyers untraceable.

It started sometime around 2019 (maybe even earlier) and is still happening to this day across the industry. The scammer uses stolen identities to incorporate businesses, followed by using those entities to open up bank accounts for them. One account is used to impersonate being a lender and another to impersonate being a broker. They first get to work by being the fake lender and register a domain name that closely resembles and could be mistaken for a real lender they’re trying to impersonate. According to records obtained by AltFinanceDaily, domain names challenged via UDRP and seized as part of an ongoing investigation into the fraud reveal that the scammers also use stolen identities to register the domains, making the real buyers untraceable.

The objective of having these fake domains in the first place is to contact existing real borrowers of the real lender and to pass themselves off as the real lender. It’s a classic phishing scheme.

There’s various theories as to how this is done, but there’s a possibility that public records are sufficient for the scammer to accomplish this step. A reverse UCC search can reveal the names of a lender’s customers and the time in which they received a loan. From there, big data or cursory internet searches are enough to obtain the contact info of those borrowers. This type of list building is nothing new and fairly common in the data business.

The scammers then email the borrowers from the fake domain, purporting to work for their real lender, and give them the great news that positive repayment history has afforded them the reward of being able to refinance their loan at a lower rate.

It is generally good practice to check the domain name of a sender, even though that itself is not foolproof, but an incorrect one, especially one that resolves to a “404 Error Not Found” page, should be a sufficient indicator that these emails are coming from an impostor, yet business owners still fall for it, perhaps because they recognize the name and find the offer consistent with their expectations.

In one case that AltFinanceDaily reviewed, the opportunity was presented to refinance a double digit APR loan down to as low as 4% with the same lender. When the victim was asked during a deposition if that number had struck him as suspiciously low, he said it did not, especially considering his belief that he had “excellent payment history” and that he felt like it made sense to get a break after all the stresses of covid.

In one case that AltFinanceDaily reviewed, the opportunity was presented to refinance a double digit APR loan down to as low as 4% with the same lender. When the victim was asked during a deposition if that number had struck him as suspiciously low, he said it did not, especially considering his belief that he had “excellent payment history” and that he felt like it made sense to get a break after all the stresses of covid.

The scammers generally communicate with perfect English over email but will also do phone calls. They use Google voice numbers in the area code that match up with the real lender. AltFinanceDaily called an older one that had been used and nobody picked up. They might use the name of a real employee at the lender or create a fake one, going so far as to generate a paper trail online that shows the name of that person working for the lender.

Once on the hook, they ask the victim to submit lengthy documentation over email so that the refinance can be reviewed. These are typically documents like tax returns, bank statements, a copy of a driver’s license, A/R and/or A/P schedules, etc. After that the scammer moves on to the next phase, using the phished documents to apply for loans or merchant cash advances. This is where the scammer’s fake broker entity comes in.

These fake brokers tend to pass a background check because they rely on stolen identities that are clean, the business entities they’ve created under them are real and match up, there’s a tax ID, there’s a bank account in their name, and there’s no sketchy stuff about them on the internet. They even have a website, again registered with the fake identity, that often looks like or is an outright exact copy of another broker’s website. Even a diligent funding company can be duped despite a background check. Once the fake broker is signed up with a funder, the phished merchant data is submitted but with the scammer’s phone number and email address. Oftentimes the deal amounts are large. AltFinanceDaily reviewed several cases related to this scheme that ranged in size from $200,000 to $600,000.

Since all the merchant information is legit, the merchants tend to get approved. The scammers are also adept at pretending to be the merchants in an interview phone call with an underwriter, like the one I listened to previously. They can even guide the merchant through a funder-mandated bank verification under the illusion that it’s all related to their current lender for the refinance. If any questions arise about the mention of another financial company name, it’s explained away as an affiliate partner or related vendor that they use.

Once the scammer is confident the funds are coming, they tell the merchant the refinance has been approved and that there is a narrow window to complete the final steps. As part of this they send a lengthy legalese-filled digital contract with an e-sign for the fake refinance that looks exactly like their real lender’s, again reinforcing how legitimate the whole thing feels.

Once the scammer is confident the funds are coming, they tell the merchant the refinance has been approved and that there is a narrow window to complete the final steps. As part of this they send a lengthy legalese-filled digital contract with an e-sign for the fake refinance that looks exactly like their real lender’s, again reinforcing how legitimate the whole thing feels.

Once complete, they’re told that a large wire will be arriving in their account, which will actually be from the funding company they don’t know about. In a normal refinance, a lender might withhold a portion of the new loan to apply to the outstanding balance, but in these cases the victims are told that they have to receive the full amount of the funds from their lender first and then wire the outstanding balance of the loan straight back to the lender. The merchant nets the difference if there is any left over. This round-trip transaction is communicated as being their way of managing their accounting, an excuse that again seems to come across as plausible to those that think they’re dealing with their trusted lender the whole time.

In the earlier iterations of the scheme, the name on file for the bank account to wire the funds to would look almost identical to their lender’s name. When the victim sends the wire to pay off their outstanding loan, they are completely unaware that they have just wired funds to a scammer and that the entire thing had been a very elaborate ruse. It’s not until days later when their account starts getting debited by a funding company they have never heard of as part of an agreement they had never entered into do they become alerted that something is amiss. By then it’s too late. Doubly too late if the funder has also wired the fake broker a commission for putting the whole deal together in the first place.

Although the scheme can yield several hundred thousand dollars at a time, it ultimately results in the loss of their fraudulently opened bank accounts as the funders respond with an investigation that can include litigation and/or a report to law enforcement. That means the scammers have to open new accounts under new stolen identities. That’s easier said than done, which is perhaps why last year they apparently improvised on this step. They don’t need to open bank accounts for the fake lenders anymore.

Instead, according to at least three examples reviewed by AltFinanceDaily, they’re more recently asking the victims to wire the funds to the general deposit account of a cryptocurrency exchange. If this sounds like it would be too obvious, consider that it has worked. The wire forms, which look identical to the earlier versions, are only different in that they contain a different account name to send the funds to. The lender’s logo can still be found on the top.

In one case, AltFinanceDaily was able to obtain records that allowed for the funds to be traced. The scammer had the exchange convert the wired funds into Ether, to which the Ether apparently moved between three crypto exchanges before disappearing into a generic holding address of an offshore exchange with millions of transactions. Another dead end.

In one case, AltFinanceDaily was able to obtain records that allowed for the funds to be traced. The scammer had the exchange convert the wired funds into Ether, to which the Ether apparently moved between three crypto exchanges before disappearing into a generic holding address of an offshore exchange with millions of transactions. Another dead end.

AltFinanceDaily emailed one of the two exchanges it reviewed related to this scheme to ask about their customer KYC procedures but received no response. The other was not contacted to avoid tipping them off to a possible active investigation. The exchanges both have deposit accounts at US banks, both of which are known for their fintech relationships. Typically, crypto exchanges that take on US customers do rely on some level of KYC. It appears based on limited evidence so far that the crypto accounts opened up by the scammers are done under the stolen identities of the merchants so that everything matches when a wire comes in. This is where it gets murky because the scammers may ask the merchants to take selfies of themselves, ones that could include holding up their ID in their hand or holding a piece of paper with a specific written message on it as proof that it’s them. That a merchant might jump through these hoops on the belief that it’s all to secure a purported refinance with their existing lender requires some suspension of disbelief, though many online finance companies these days are requiring varying levels of customer identity verification.

The outcome, in any case, is that millions of dollars have been purportedly stolen over the course of several years. The scam has been directed at all sorts of funders, from the A paper players to the Z paper players. The merchants, as the original dupes that make this possible because they fall for a basic phishing scheme, are also left to pick up the pieces. The scammers may have even scammed another high profile scammer, at least according to documents reviewed by AltFinanceDaily. There’s a brazen fearlessness to it all.

A main connecting link has been funders that will do large deals, hundreds of thousands of dollars in a single transaction. But that might be changing. Industry chatter more so than hard evidence suggests the web of intended targets might be growing and that thanks to innovations with AI and crypto, the scammers may attempt to use artificial identities for the brokers rather than real ones. A lot of the steps involving bank accounts and stolen identities are no longer as necessary, which means if you’re a funding or lending company and you’re reading this, you may be vulnerable.

Sources familiar with the matter say that it’s good practice to remind your customers about possible phishing risks and to keep them informed about what methods of communication you will use throughout the life of the relationship. This includes whether or not you might employ phone calls, emails, texts, or snail mail communications, and the precise sender information they should expect. This might limit the likelihood of your own customers from getting phished but there’s tactics you can use to prevent becoming the victim funding company as well.

According to Alex Shvarts, a good start is only conducting a merchant interview on phone numbers assigned to the business. “If it’s a cell phone we have to have a cell phone bill that verifies the owner’s information,” he says. Also, if the customer has a website, avoid communicating with them over a free email address like Outlook or Gmail or Proton Mail and instead direct all communications to an address on their company domain name, one you’ve confirmed is really theirs and not a boilerplate setup by the scammers to deceive you again. Other possible steps are to use live ID verification or a common tool like CLEAR, he suggests. Shvarts wouldn’t disclose some of the proprietary methods they’ve come up with so as not to tip off a scammer reading this.

When it comes to the broker, do proper due diligence. It’s been said that a fake broker may test the waters with a small deal first before submitting the large fraudulent one to generate a level of confidence that everything is on the up and up.

When it comes to the broker, do proper due diligence. It’s been said that a fake broker may test the waters with a small deal first before submitting the large fraudulent one to generate a level of confidence that everything is on the up and up.

According to documents reviewed by AltFinanceDaily, the scammers typically rely on a relatively bare bones website for their fake broker shop, a collection of borrowed templates and verbiage from other companies out there. It’s a rabbit hole that can lead one down many wrong directions, especially in an era when similar bare bone lead gen sites litter the internet by the thousands. Consider doing a FaceTime or Zoom call with the broker so that you can see if their face matches the identity that’s been provided!

The scammers have used different domain name registrars and hosting services. They may push for a weekly or monthly payment option so as to create lead time between when the victim wires the funds to them and when the first debit hits from the funder they’ve targeted for it. They seem to prey on merchants that have an outstanding business loan rather than an MCA because it makes the low in-house interest rate refinance all the more plausible. So if you see debits in an applicant’s bank account from any one of the more commonly known online business lenders, you should be thinking about this story and ways to make sure you are speaking with the actual business owner. Do they know who you are? Have they been offered a refinance? Do they even know who their broker is?

“When you first identify the fraud, notify law enforcement including the FBI,” one source familiar with the matter said.