Hundreds of Brokers Registered for AltFinanceDaily CONNECT MIAMI

January 9, 2024 MIAMI BEACH – Hundreds of small business finance brokers are registered for this year’s AltFinanceDaily CONNECT MIAMI. Taking place on Thursday, January 11 at the Miami Beach Convention Center, the event’s modified format includes the first-ever Broker Battle™ with a $5,000 grand prize to the winning broker, on top of an all-kosher food experience. That’s in addition to a featured presentation from David Goldin, the first-of-its-kind Broker Brilliance education session, tech demos, networking, and cocktails. Bitty Advance is the Title Sponsor.

MIAMI BEACH – Hundreds of small business finance brokers are registered for this year’s AltFinanceDaily CONNECT MIAMI. Taking place on Thursday, January 11 at the Miami Beach Convention Center, the event’s modified format includes the first-ever Broker Battle™ with a $5,000 grand prize to the winning broker, on top of an all-kosher food experience. That’s in addition to a featured presentation from David Goldin, the first-of-its-kind Broker Brilliance education session, tech demos, networking, and cocktails. Bitty Advance is the Title Sponsor.

“This is our sixth event in Miami,” said conference founder and AltFinanceDaily President Sean Murray. “I think kicking off a new year is as good a time as ever to reinvent yourself and change things up. I’m really excited for this show and I think 2024 is going to be a truly unique year.”

Registration opens at 1pm on Thursday and the event culminates with the Broker Battle at 5:10pm. That will lead right into the cocktail networking reception.

About AltFinanceDaily CONNECT Miami

AltFinanceDaily CONNECT events are operated by Foinse, LLC. Foinse, LLC is an events company based in Brooklyn, NY. To learn more visit: http://www.debankedmiami.com. For inquiries, email events@debanked.com.

Attend AltFinanceDaily CONNECT MIAMI for Broker Brilliance

November 20, 2023Before the Broker Battle at AltFinanceDaily CONNECT MIAMI, come join the Broker Brilliance session!

- Enjoy a preview of the official SBFA broker certification led by the Executive Director of the SBFA and a Partner of top law firm Hudson Cook, LLP.

- Learn about pending legislation and regulations that could impact your career forever.

- Find out what licenses are required for brokers and broker shops so that you stay compliant.

- Hear about the extraordinary opportunity that comes with joining the official Broker Council.

- Don’t just sell for today, make sure you’re set up for longevity!

BUT, in order to experience all of it you MUST be registered for AltFinanceDaily CONNECT MIAMI. Join the industry on January 11th!

New Domain Name Gold Rush Sets Up Possible Battle for Future of SMB Finance

April 25, 2022 If you could have businessloan.com or businessloans.com as your website, would you jump on the opportunity to get it?

If you could have businessloan.com or businessloans.com as your website, would you jump on the opportunity to get it?

It’s evident that the market for keyword-based domains has evolved over time. Couldn’t get the .com? You could’ve tried to get the less coveted .net or .org. Don’t like those? Today, you can get the .business, .deals, .financial, .loan, .loans, or hundreds of other customized tlds. With so many to choose from, most experts in the field would advise that if you don’t own the .com version, to not even bother getting cute with customizations for your brand or keyword because customers will just get confused.

But recently, another domain name market has quietly been gaining steam. It’s for something called a .eth, an Ethereum blockchain-based crypto address shortener by the Ethereum Name Service. It’s not necessarily something one could use to build a website with, at least not yet. Originally envisioned as a way to condense long impossible-to-remember crypto wallet addresses into memorable words, users have started to buy up a bunch of keywords that may be familiar to AltFinanceDaily readers. Just to name a few:

- businessloan.eth

- businessloans.eth

- smbloans.eth

- merchantcashadvance.eth

- ach.eth

- syndication.eth

- lending.eth

- ppploan.eth

- underwriting.eth

- brokers.eth

- loanbroker.eth

- mca.eth

- factoring.eth

- funding.eth

- backdoored.eth

At face-value, this might appear to be a vanity crypto play, one in which one could send crypto to your-name-here.eth instead of trying to type out a long address like: 0x64233eAa064ef0d54ff1A963933D0D2d46ab5829. But an ENS domain name holds much more potential than just that. It’s moving towards becoming the backbone of one’s identity in the upcoming era of the web called web 3.0 (web3 for short). Instead of having to remember passwords for hundreds of websites, identity can be validated through one’s digital wallet. Such a concept is not theoretical. It’s already being used.

Take seanmurray.eth for example. You could send eth, bitcoin, litecoin, or dogecoin to it, but at the same time it’s connected to an email address and a url (this one). Plus it’s linked to an NFT avatar (broker #7 from The Broker NFT collection) which is in that wallet. I can use it to do an e-commerce online checkout in 5 seconds without ever needing to enter any payment information even if I’ve never visited the site before. It’s faster than PayPal and with less steps involved. I can connect it to my twitter account, OpenSea, or use it to vote in an official poll without ever having to create an account on something. The wallet is the identity verification. The .eth name, therefore, has the potential to become the defining baseline of who or what one is on the internet. Not theoretically. It’s already happening.

Take seanmurray.eth for example. You could send eth, bitcoin, litecoin, or dogecoin to it, but at the same time it’s connected to an email address and a url (this one). Plus it’s linked to an NFT avatar (broker #7 from The Broker NFT collection) which is in that wallet. I can use it to do an e-commerce online checkout in 5 seconds without ever needing to enter any payment information even if I’ve never visited the site before. It’s faster than PayPal and with less steps involved. I can connect it to my twitter account, OpenSea, or use it to vote in an official poll without ever having to create an account on something. The wallet is the identity verification. The .eth name, therefore, has the potential to become the defining baseline of who or what one is on the internet. Not theoretically. It’s already happening.

Crypto is already starting to creep into the small business finance industry. In August, a funding company announced that it would begin offering commissions and fundings in crypto because of the speed potential. Far from being a gimmick, brokers started to choose crypto payments over ACH or a wire because of how fast it would be. There’s also no chargeback risk with crypto.

Currently, the owner of mca.eth has listed the domain for sale on OpenSea at a price of 20 eth (approximately $60,000). That’s less than what MerchantCashInAdvance.com sold for in 2011. Perhaps the value of an Ethereum Name Service domain holds less promise than a website that ranked well on Google in 2011. But then again, being well ranked on Google is not as important as it used to be. It’s impossible to say what, if any impact web3 will have on the small business finance industry long term, but for now there are those out there quietly buying up names like ach and funding and syndication on the chance that they will become something.

Mortgage Brokers: pick a side

March 5, 2021 United Wholesale Mortgage (UWM) and Rocket Mortgage are still going at it, this week heating up to a new boiling point.

United Wholesale Mortgage (UWM) and Rocket Mortgage are still going at it, this week heating up to a new boiling point.

UWM announced on Facebook Live Thursday that it would not partner with brokers who work with Rocket Mortgage or Fairway Independent Mortgage Corp. CEO Mat Ishbia gave brokers until March 15th to sign a loyalty document to pledge their allegiance to the UWM team.

“If you work with them, can’t work with UWM anymore, effective immediately,” Ishbia said. “I can’t stop you, but I’m not going to help you, help the people that are hurting the broker channel, and that’s what’s going on right now.”

After competing Superbowl ads, it looked like the competitors were peacefully building broker networks, but now brokers have to pick a side. Rocket Pro TPO VP Austin Niemiec told the Housing Wire that UWM is attempting to manipulate the broker market.

“What UWM is attempting to do is really manipulate the market and have brokers swear allegiance to one company and literally give them financial penalties if they don’t listen to them,” Niemic said. “That harms their ability to compete, and it harms the consumer. Make no mistake about it, this was a move to benefit one company and one company alone, UWM.”

The feud comes after the stock price of Rocket Companies, Rocket Mortgage’s parent company, spiked in price. Founder Dan Gilbert briefly placed number 16 in Bloomberg’s Billionaire Index.

Loan Brokers Attack Online Direct Lending in Super Bowl Commercial Duel

February 2, 2020

The battle is on between lenders and brokers in the mortgage space as middlemen try to out-compete push-button loan technology.

Quicken Loans ran a Super Bowl Commercial that featured Game of Thrones Actor Jason Momoa aka Khal Drogo and its Rocket Mortgage product. The theme, that of being super comfortable in your home, is a complete 180 from the controversial route the company took during a previous year’s Super Bowl that prompted a negative response from regulators and viewers. Even if you’re not in the market for a mortgage, Momoa revealing “his true self” is pretty humorous.

But not everyone is a fan of what online direct lenders are selling. FindAMortgageBroker.com criticized “playing with rockets” when it comes to mortgages and advocated working with an independent local mortgage broker instead. Why work with a broker they say? Because brokers work with various lenders instead of just one. The company goes as far as saying that brokers are faster, easier, and more affordable and they sign off with the hashtag, #brokersarebetter.

Check it out…

The Broker: How Andy Savarese Changes Collars and Closes Deals

October 12, 2018 Title:

Title:

I’m the Managing Partner at JustiFi Capital, a brokerage in Farmingdale, Long Island. I started it September 2017 with my cousin, who’s the owner and my best friend. We do mostly MCA, but also some term loans.

His schedule:

I have a part-time/full-time job in the mornings. I work in sanitation for the town of Oyster Bay on Long Island. I typically wake up at around 3:37 a.m. I get into my yard at 4:15 a.m. and I go right into my route. My job is task completion. So the faster you work, the faster you get to go home. You get paid the same. I was fortunate to get on a fast truck, so I’m usually done between 7:45 a.m. and 9:30 a.m.

I go home, I take a quick shower, and I change my outfit. I go from blue collar to white collar. I get into the office around 10:30 a.m. and I start doing more of a mental hustle compared to a physical hustle.

At around 12:45 p.m., I take my lunch and I go to the gym for about 45 minutes. I get back to the office and I keep up the closing, the pitching, the selling, the prospecting. At around 5:30 p.m., I leave the office, I pick up my son from daycare, and since my wife works evenings, I take care of him at night until around 7:30 p.m., and get him ready for bed. The second he hits his crib, I hit my bed and I call it a day.

His background in the business:

About three years ago, I was driving oil trucks after sanitation, and my cousin, who is also my best friend, gave me a call. He knew I was breaking my butt all day. He had a friend that was starting his own ISO. So I did that for a year and I learned the industry. It didn’t really work out there, so I convinced my cousin to open up our own shop, which is JustiFi.

His process:

At JustiFi, we’ve been growing. We’re just grinding it out and things are going really well. We have four brokers and we keep it tight. We keep it small so that everybody is inundated with files and everybody’s making money and everybody’s happy. We don’t have any processors or chasers. We do it all on our own. We’re working the deal from beginning to end. My cousin has devised a pretty strategic marketing plan that inundates us with leads all day. I disperse them and I follow up with my guys and see how I can help. I overlook all of the closings and make sure that everything than can get worked is getting worked.

His biggest challenge as a broker:

A lot of people will say getting good leads and keeping your brokers happy. What I found is the most challenging part of being a broker in this industry is keeping a really level head and keeping your emotions out of the game. It’s a very tumultuous industry. One day, you could have 12 deals in the funding chute, the next day, your pipe could be dry. You could have a deal you think is going close and something happens on the funding call and it gets derailed. The point is that you’ve got to stay positive, you’ve got to stay confident, and you’ve got to roll with the punches. If not, you’re going to lose it and you’re going to get eaten alive. Because it’s a battlefield out there. You’ve got to keep your composure, no matter what the size of the deal. You’ve got to just keep pushing through. Because if not, you’re not going to make it.

His largest deal funded:

$250,000. And I made $38,000.

His advice for brokers:

When I go to close a good sized deal, or a tough deal, I don’t like to come off as a salesman. I’ll never do that. I’m going to come off as an advisor. I’m going to come off as a partner with you where I’m going to explain the ins and outs of the deal. I’m going to explain how it benefits you. I’ll never put on pressure or talk slang. I’m going to be a professional. You’ve got to kind of put yourself in [the merchant’s] shoes and you’ve got to see that it really makes sense for them. Because when it makes sense to you and it makes sense to them, you’re going to close the deal and you’re going to move forward.

But there are always deals that will never close, deals that you can’t sell. So you can’t be too hard on yourself. You’ve got to stay positive. You can’t beat yourself up if you don’t sell something. You’ve got to just do your best, stay neutral, and just talk to clients how you want to be talked to.

What he does to pump himself up for a deal:

If I know my day is bringing a big deal that I have to sell and I’m a little uneasy about it, I have an advantage. I’m on the back of a garbage truck all morning and I focus on what’s in store for me that day. If I have a big deal, I recite in my head [from the truck] how I’m going to report to my client. So when I get into the office, I dial up and I already know how the conversation is going to go. I have my rebuttals in my head, I have the direction, I have everything ready to go so that when I get on the call, I’m fully prepared.

Will you quit your morning job?

No. When my pension kicks in, I’ll leave. But I told myself the day I started this and the day I started seeing the return, “I’m never leaving sanitation. I won’t.” I made that promise to myself. There’s been days when I’ll have a five figure commission day and the next morning it’ll be pouring rain out, and I’ll say to myself, “Man, I just want to take the day off.” But no, I made a promise. I go in.

Why?

It keeps me grounded, it’s a stress relief. It’s what I am. It’s what I do.

Nest Planner: The Story Of A Startup MCA Broker

March 4, 2018AltFinanceDaily interviewed Anthony Frisone, the founder of Nest Planner, a young ISO on Long Island, on how he got his start.

What were you doing before becoming an MCA broker?

I was doing real estate and then I got sick. I was having a hard time walking. And you can’t sell real estate when you can’t walk. I was bedridden for a long time [before I got better.] I was in a bad place, mentally and physically, and a friend of mine just said to me “you should try this out.” I knew nothing about it. So I went to his office and I actually grabbed a AltFinanceDaily magazine off of one of the desks in his office.

What’s the greatest challenge of being an MCA broker?

Being sick was easier than starting out in this business. It was rough. The first three or four months was an uphill battle. It was brutal. We did zero. No business at all. But I didn’t give up. We just kept dialing the phone. I couldn’t even get funders to send deals to. I was calling quite a few of them. And they were like “Who are you sending deals to now?” And I said, “No one. I’m brand new in the business.” And they were basically like “Come back to me when you have something under your belt.”

I had a whole list of people I was calling and I called up a place called Cardinal Equity, which came from the AltFinanceDaily website or magazine. The owner answered the phone and we were just talking, for a half hour, maybe an hour. I remember it was late at night and right before Thanksgiving, and he said “Call me next week and I’ll send you the application.” I was like “Oh wow, thanks.” [..] Finally he sent it to me and I sent it back to him. And he let me send him deals.

What about getting deals made?

Getting deals was a whole different story because I didn’t have anyone to tell me “Don’t take $5,000 a month accounts.” We were surrounded by no one that knew the business. So it made it even harder by not knowing what I was doing. But I had no choice. So I just came in everyday and worked. And something, little by little, started panning out.

After Cardinal Equity, I didn’t get another funder until after I took the AltFinanceDaily “Merchant Cash Advance Basics” [online course] in January 2017. It was eye opening for me. Everything started making sense. I was able to have a conversation with funders and actually understand them. I started sending over my MCA Basics Certificate of Completion to every funder I could think of, and within a month’s time, I had over 30 different funders waiting for me to send them deals. However, [at the time] I had no merchants to send them.

After Cardinal Equity, I didn’t get another funder until after I took the AltFinanceDaily “Merchant Cash Advance Basics” [online course] in January 2017. It was eye opening for me. Everything started making sense. I was able to have a conversation with funders and actually understand them. I started sending over my MCA Basics Certificate of Completion to every funder I could think of, and within a month’s time, I had over 30 different funders waiting for me to send them deals. However, [at the time] I had no merchants to send them.

So where have you found your best leads?

We tried out so many different places and spent so much money. But we had no one to guide us in the right direction. So we would look online and probably at AltFinanceDaily also. We called up a bunch of different places. None of them were fantastic, but none of them were terrible. So we knew it was a numbers game and we had to stay on the phone. So there was no set place. I bought a little bit from everywhere and a little bit worked from everywhere.

When did you start making money?

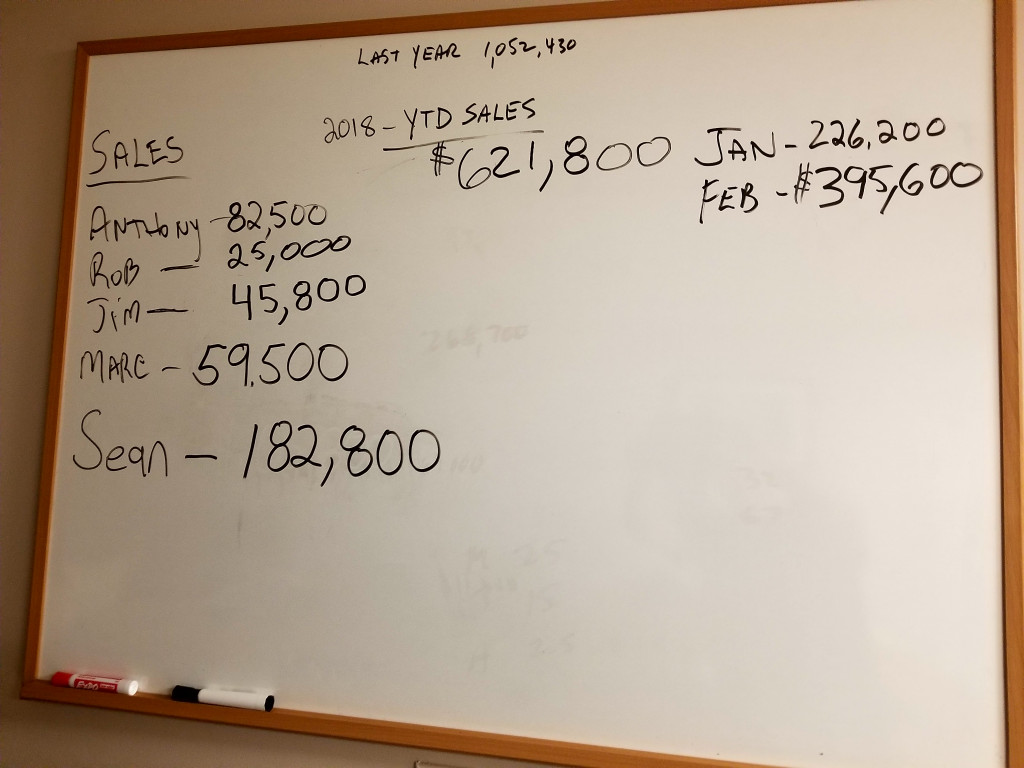

I started the business, called Nest Planner, in October 2016 all by myself. Just me and a desk and a laptop. And I didn’t start making money until March 2017. From October to March was a long 5 months. And in March I made close to $10,000 in advances. But by the end of last year, we hit the $1 million mark in advances. It’s not a lot, but it’s something that showed that we’re doing something right. And this year, it’s just February, and we have over $600,000 in [advances]. That’s huge for us and it’s just from us not giving up and pounding the phones.

How many people work for you?

Six.

How do you personally define success as a broker?

I guess the obvious part is the funds. If you make sales or close deals, it does feel good to make money. I have a wife and two kids and not taking home a paycheck is brutal. But what’s nice, also, is to see the people we hire make money. It’s nice to see them go home with a check.

How many applications do you typically send out?

So far, for January and February of this year, five of us sent in just under a 100 applications. And we funded 20 of them so far.

What resources do you wish you had that could have helped you made more deals in the beginning?

A CRM. I just had paper leads everywhere. We would just write it up on a piece of paper. No CRM and it’s rough. But it costs money. So we weren’t able to do it.

Apart from approving your applications, what do you look for in a funder?

Someone I could trust. Someone that returns calls. At the very beginning, it was hard. couldn’t get the time of day [from funders]. No one would call me back, except for Cardinal Equity. Now they’re actually calling me.

Want to become a better closer in this industry? Join your peers for training and networking at Broker Fair on May 14 in Brooklyn, NY! You can register here.

CFC on the Front Lines of the MCA Regulation Battle

November 6, 2017

As the US Senate attempts to reach a bipartisan agreement on relaxing some of the rules in the Dodd Frank legislation of 2010 that would treat banks more favorably, the MCA industry is having to fend off legislation and regulation of its own at the state and federal levels that could position funders in a similarly crippling position.

MCA regulation has been thrust into the spotlight for a number of reasons, not the least of which has been the Consumer Financial Production Bureau (CFPB). The CFPB is moving forward with the Dodd-Frank Section 1071 rulemaking process for data collection regarding small business lending, a sector of the market for which they do not have jurisdiction, sources say.

Front and center in the policy discussions has been the Commercial Finance Coalition (CFC), a merchant cash advance trade association that is coming up on its two-year anniversary in December. While federal policymakers appear to be listening, state legislatures have been a more difficult nut to crack.

The CFC’s Influence

In its short two-year history, the CFC has been one of the most vocal if not the most influential trade organization lobbying on behalf of the MCA industry, having attended 70 congressional meetings and having led advocacy efforts for the industry in the halls of Albany, Sacramento, Illinois and Washington, D.C.

Dan Gans, executive director of the CFC, has been the voice of the MCA industry on Capitol Hill and has been invited to testify in key congressional hearings. “For whatever reason, the CFC has really become the voice and has taken an active part in the so far successful advocacy efforts to educate and mitigate potential harm to our members’ ability to deploy capital to small businesses that need access,” Gans told AltFinanceDaily.

Most recently the CFC participated in a fly-in, one of two such events this year, to Washington, D.C. in which the association’s counsel Katherine Fisher of Hudson Cook, LLP testified.

In her testimony Fisher said: “The MCA and commercial lending spaces are sufficiently regulated by existing federal and state laws and regulations. Both MCA companies and commercial lenders must comply with laws and regulations affecting nearly every aspect of their transactions, from marketing and underwriting through servicing and collection.”

She went on to explain: “Even if they comply with every applicable law and regulation, small business financers must also be wary of the Federal Trade Commission’s powerful authority to prevent unfair or deceptive acts or practices.”

Fisher told AltFinanceDaily she received a “positive” response to her testimony from funders but has not heard anything from lawmakers.

Gans said Fisher did a fantastic job in articulating the needs and status of the industry.

“She presented a very good case as to why the industry is currently adequately regulated. We don’t feel there is a need for federal regulation. In some cases, less regulation would allow our members to deploy more capital and help more small businesses,” Gans said.

The sweet spot for MCAs, Gans explained, are transactions under $100,000 and probably in the $24,000 – $40,000 range. He said the industry does a fantastic job of being able to deploy financial resources to small businesses in a timely manner that neither banks nor SBA lenders can match. He’s not suggesting MCA is for everybody but for some businesses it’s an essential product that can help. There have been many success stories.

“Competition is all over the place. But that’s great for the merchant. The more options that merchants have, the more we can enforce best practices and more competitive rates. And the more we can keep the government from impeding people from getting into this space, the better off small businesses are going to be,” said Gans.

Setting the Record Straight

The CFC was formed with the mindset that the organization, which is currently comprised of CEOs of small- and medium-sized funders, would take a proactive rather than a reactive approach to industry regulation. In its two-year history the CFC has tasked itself not only with educating policymakers on the role of MCA funders for small businesses but also with undoing the misinformation and misconception surrounding the anatomy of an MCA.

“Unfortunately, because MCA uses the term cash advance in its product name, uninformed people will often confuse MCA as some form of payday lending. And so that has been one of our biggest challenges, educating members of congress and committees that there is absolutely no correlation between MCA products and what their views of consumer payday loans is,” said Gans, adding that the CFC has had to communicate that MCA is a version of factoring has been around for more than 1,000 years.

A common thread that the CFC has been able to weave with lawmakers has been the diverse geographical representation of both the trade group and the House and Senate.

“Most venture capital is deployed in a few spots – New York, California and Texas – and it’s a cliff to get to those three states. So, one nice thing that I take pride in is my members are looking all around the country regardless of the geographic location. That helps us with policymakers, most of whom are not from the New York City metropolitan area or Silicon Valley. It’s nice being able to look at them in the eye and tell them we care just as much about your district as you do,” he said.

The Road Ahead

The CFC has an ambitious long-term agenda, one that includes raising their profile in the industry and participating in events.

“I think one of the ambitions we have is to have an organization where funders and brokers can be at the same table and work though some of the issues impacting the industry and try to make sure people are doing things in the right and best way.”

The trade group is planning to partner up with AltFinanceDaily for Broker Fair 2018 and they’re looking to bolster membership.

“The industry has had a lot of free riders that are benefiting from our advocacy efforts but not supporting it. So, from my perspective, if you’re in this industry, particularly in the MCA space, we’d like to expand membership. If we grow our membership, we can do more things, engage more states and expand our lobbying team,” said Gans. “The more members we have, the more we can do to advance the ball and protect the interests of the industry.”

The CFC will need all the help it can muster given the fight ahead to fend off regulation particularly in Washington, Albany and Sacramento. “I think we could see some harmful regulations and potentially legislation over time. Some of those bad ideas that emanate in states have a tendency to percolate into Washington. If at some point there is a less business-friendly administration in the future, we could see all those ideas get some traction at the federal level,” Gans warned.