Top Lawmakers Request Information About Online Small Business Lending

November 16, 2015 In the past two weeks, four ranking members of Congress have sent letters to the Treasury Department, SBA, SEC and CFPB requesting information about alternative small business lending. On November 3, Senators Jeff Merkley (D-OR), Sherrod Brown (D-OH) and Jeanne Shaheen (D-NH) sent a letter to the Treasury Department and the SBA requesting information about the impact of marketplace lending on small businesses. The Senators serve, respectively, as the ranking member of the Senate Subcommittee on Financial Institutions and Consumer Protection, the ranking member of the Senate Banking Committee, and the ranking member of the Senate Small Business Committee.

In the past two weeks, four ranking members of Congress have sent letters to the Treasury Department, SBA, SEC and CFPB requesting information about alternative small business lending. On November 3, Senators Jeff Merkley (D-OR), Sherrod Brown (D-OH) and Jeanne Shaheen (D-NH) sent a letter to the Treasury Department and the SBA requesting information about the impact of marketplace lending on small businesses. The Senators serve, respectively, as the ranking member of the Senate Subcommittee on Financial Institutions and Consumer Protection, the ranking member of the Senate Banking Committee, and the ranking member of the Senate Small Business Committee.

In their letter, the Senators cited concerns of some observers about the regulatory framework governing the space:

Observers have questioned what the appropriate role of federal regulators should be in supervising non-bank companies providing small business capital. Government agencies such as the federal financial regulators, Small Business Administration (SBA), or the Federal Trade Commission may have a role to play, as well as state regulators. However, it is possible that ‘the current online marketplace for small business loans falls between the cracks for Federal regulators.’ As we saw during the crisis, financial markets that fall between the cracks may result in predatory lending, consumer abuse, or systemic issues.

And last Thursday, Nydia Velazquez (D-NY), ranking member on the House Committee on Small Business, sent a letter to the SEC and CFPB inquiring about small business lending marketplaces. Rep. Velazquez cited a 2011 GAO report discussing early developments in P2P lending. Rep. Velazquez noted that in the report the GAO had proposed two approaches for federal regulation of online lending: one SEC-centered and the other CFPB-centered. Rep. Velazquez requested the agencies to provide her with more information concerning their regulation of online lending marketplaces for small business borrowers.

The lawmakers also posed a number of specific questions to the agencies, such as:

- What are the most significant risks in the market?

- What authority exists for federal agencies to supervise and examine companies offering online small business loans?

- What impact is the market having on community banks?

- How do online business lenders fit in the broader financial regulatory framework?

- What disclosures are required in small business lending?

- What resources have your agencies devoted to the regulation of the online lending marketplaces?

- Do you believe that your agencies possess the necessary legal authorities to protect small business borrowers and retail investors as it relates to the online lending marketplace?

And most interesting:

8. What statutory changes, additional legal authorities, and resources are necessary to support your agencies’ role in the regulation of online lending as it relates to small business loans and extensions of credit?

The recent congressional interest is likely a result of the RFI issued by the Treasury Department regarding marketplace lending. It seems Capitol Hill is also interested in learning more about the topic and, specifically, how alternative small business finance products are currently being regulated.

Treasury Official Discusses Responses to RFI, Offers Mixed Review of Alternative Small Business Lending

November 3, 2015 Antonio Weiss, Counselor to the Secretary of the US Treasury, recently spoke at the Information Management Network Conference on Marketplace Lenders. In his prepared remarks, Mr. Weiss discussed the comments Treasury had received in response to its Request for Information about marketplace lenders. Mr. Weiss highlighted a number of themes about alternative small business finance that he believed had emerged from the responses.

Antonio Weiss, Counselor to the Secretary of the US Treasury, recently spoke at the Information Management Network Conference on Marketplace Lenders. In his prepared remarks, Mr. Weiss discussed the comments Treasury had received in response to its Request for Information about marketplace lenders. Mr. Weiss highlighted a number of themes about alternative small business finance that he believed had emerged from the responses.

First, Mr. Weiss stated that alternative small business lenders have the potential to increase lending to a historically underserved market.

Structural challenges in the small business lending market often make it difficult for business owners to obtain affordable credit. While larger businesses typically rely on banks for 30 percent of their financing, small businesses receive fully 90 percent of financing from banks. However, small business lending has high fixed costs for banks– it costs about the same to underwrite a $5 million dollar loan as a $200,000 loan. And we know that many small business owners are unable to access the credit they need to grow their businesses. Marketplace lending has the potential to unlock access to the capital markets for these borrowers.

Second, he stated that many responses to the RFI had cautioned that the new underwriting models used by market entrants were still untested. Mr. Weiss stated that many commenters had “noted that new underwriting models have yet to be tested through a full credit cycle” and therefore it was too soon to tell if these alternatives were better than traditional models at predicting future performance.

Third, Mr. Weiss noted that many commenters had argued that protections provided to consumers should be extended to small business borrowers. “[M]any commenters highlighted the need to establish a level playing field. All borrowers—businesses as well as consumers—should have the same protections. Small businesses are run by people. Those people receive protection as individual consumers, but when they are called ‘small businesses’ they get no protection,” he stated.

Mr. Weiss also highlighted calls for increased disclosure requirements. “…[C]ommenters almost universally agreed on the need for, and benefits of, greater transparency. To my mind, this means clear, simple terms that borrowers and investors can understand. For small businesses, transparency requires standardized all-in pricing metrics, so that a business understands a loan’s true cost and can make like-to-like comparisons across different loan products,” he stated.

In closing, Mr. Weiss noted that while Treasury will continue to monitor developments in the marketplace it is not a regulator in the space. Instead, Mr. Weiss stated that Treasury would work to inform those state and federal agencies that do have regulatory authority about developments in the market so that they could take any necessary actions.

Blurring Small Business: A Troubling Narrative is Gaining Steam

October 30, 2015Almost 18 months ago at LendIt’s 2014 conference, Brendan Carroll, a partner and co-founder of Victory Park Capital said that in regards to business lending, “the government doesn’t have the same scrutiny on this sector as it does in the consumer space.”

This double standard is the crux of American capitalism. In business you can win or lose, be smart or foolish, risk it all or play it safe. Government regulations don’t let the average consumer be subjected to the same stakes. They are viewed to be at a natural disadvantage against businesses and thus there are laws to protect them, and perhaps rightly so.

Since entrepreneurship is a choice, businesses and the people that own businesses are held to a higher standard of acceptable risk taking. In the free market, the pursuit of profit holds the system together.

This economic worldview is part of the reason why entrepreneurial TV shows such as Shark Tank are so popular. In the Tank, contestants can just as easily walk away with a terrible deal as they can a good one. And when bad deals get made, and they do, I’ve yet to see regulators descend on the set to fine or arrest Daymond John, Kevin O’Leary, or Barbara Corcoran.

But Shark Tank features entrepreneurs on a remote stage detached from their daily environment, giving it the look and feel of a game show. If you want to see cold hard dealmaking with mom-and-pop shops on an up close and personal level, just watch CNBC’s The Profit. On the show, small business expert Marcus Lemonis does not sugarcoat what he is. “I’m not a bank. I’m not a consultant. And I’m not the fairy godmother,” he bluntly told one small business owner. It doesn’t matter if it’s a family owned store or a full fledged corporation, Lemonis is looking to make a deal and make some money. When it comes to business, he is well… all business.

Just as the CFPB hasn’t shut down Shark Tank, (which one has to wonder if they’ll be subject to Reg B of Dodd Frank’s Section 1071) none of Lemonis’ deals have been scrutinized by a Federal Reserve study, nor has the Treasury Department issued an RFI to better understand why entrepreneurs go on the show in the first place.

It’s no wonder then at LendIt 2014, Carroll also said that there wasn’t the same sort of moral hurdle when it came to institutional capital investing in business lenders as opposed to consumer lenders.

Moral was a telling word choice because the morality of certain commercial transactions have recently come under fire by groups claiming to represent small businesses. The premise of their argument is that commercial entities are no more sophisticated than consumers, that a corporation and the average joe are equal in their ability to take risks and make decisions for themselves.

Their evidence is that sometimes in business-to-business transactions, particularly in lending, one side accepts terms that would be considered far outside the norm for consumers, terms that violate a moral threshold. One has to wonder where a loan with an infinity percent interest rate ranks on this morality scale, a deal that’s actually been made and accepted several times on a TV show. Referred to as a “Kevin deal” since they are Kevin O’Leary’s favorite, the borrower is obligated to pay a perpetual royalty on top of repaying the loan itself. In simple terms, it’s a loan that can never be paid off.

In the case of Wicked Good Cupcakes, a business that appeared on Shark Tank in 2012, a mother-daughter team struck a deal that would cost them 45 cents per cupcake in perpetuity to Kevin O’Leary. Many fans criticized them for it and yet the two have said that they have no regrets.

In the case of Wicked Good Cupcakes, a business that appeared on Shark Tank in 2012, a mother-daughter team struck a deal that would cost them 45 cents per cupcake in perpetuity to Kevin O’Leary. Many fans criticized them for it and yet the two have said that they have no regrets.

The fact that Wicked Good Cupcakes decided what made sense for them and was happy about it, damages the storyline that businesses need to be saved from their own decisions. But there’s another problem, government entities themselves may be inadvertently effectuating this false narrative by inferring incorrect conclusions from their own research.

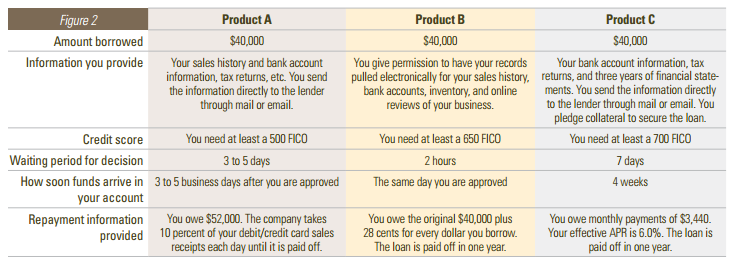

Nowhere is this more evident than in a report recently published by the Federal Reserve Bank of Cleveland that analyzed small businesses and their understanding of “alternative lending.” The report shared the results of two focus groups that had been shown terms for three hypothetical products that supposedly represented actual products in the real world.

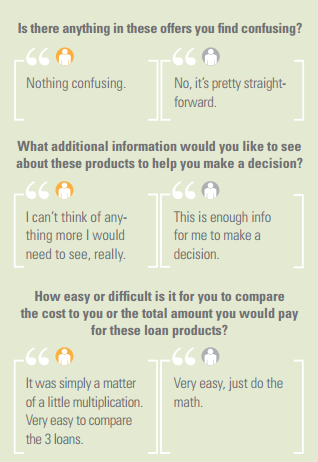

Unsurprisingly, the report concedes “when comparing the products, participants initially reported the three were easy to compare and that they had all the information to make a borrowing decision.” But the researchers pressed on until they got an answer that fit their expectations, that small businesses are confused when it comes to money and finance.

In a hypothetical scenario where a commercial entity sold $52,000 of future receivables for $40,000 today, it stated that the “lender” would withhold 10% of each debit/credit card transaction until satisfied. Participants were then asked to guess the interest rate on this loan if they paid it back in one year. That caused a lot of folks to scratch their heads and that’s because it was a trick question.

The question itself introduced conflicting facts and lacked crucial variables to make an intelligent guess. Nevermind that respondents prior to that question said that there was “nothing confusing” about the products presented as is. The original feedback should’ve been enough. Below are some of the responses offered before they were deliberately tricked.

- “Nothing Confusing.”

- “No, it’s pretty straight-forward.”

- “I can’t think of anything more I would need to see, really.”

- “This is enough info for me to make a decision.”

The researchers concluded however that the answers to their trick question suggested there were “significant gaps in their understanding of the repayment repercussions of some online credit products and the true costs of borrowing.”

And while it might be true that they semi-admit to what they did when they wrote, “using only this information, calculating a true effective interest rate would not have been possible without making some assumptions,” the headline that spread thereafter was that small business owners are confused by alternative lenders.

And while it might be true that they semi-admit to what they did when they wrote, “using only this information, calculating a true effective interest rate would not have been possible without making some assumptions,” the headline that spread thereafter was that small business owners are confused by alternative lenders.

But even if that was the case, at what point does confusion become unfair in a purely commercial transaction? And what would be an appropriate remedy?

We’ve been down this road before where federal regulators have set mandatory disclosures in order to bring transparency to a lending environment believed to be obscure. And just recently on September 17th, 2015, the House Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access pressed community bankers on the impact of such measures dictated by Dodd-Frank.

Congressman Trent Kelly asked if all the added new pages to loan agreements make it easier for their borrowers to understand. “Do they understand what they’re signing?” he asked.

B. Doyle Mitchell Jr., the CEO of Industrial Bank that was speaking on behalf of the Independent Community Bankers of America responded that they do not. “It is not any more clear,” he answered. “In fact it is even more cumbersome for them now.”

If anything, the Federal Reserve study offered compelling evidence that small businesses are happy with the way alternative lenders are currently disclosing their terms. It is only when government researchers tricked them that they became confused. That should say it all.

One consequence of entrepreneurship is that businesses are not created equal in their ability to assess financial transactions and no amount of disclosures or intervention can save them. There must be losers in order for there to be winners.

Case in point, there are lenders out there doing deals so lopsided that they actually turn to each other and say, “I can’t believe she took that.” Such is the case of RuffleButts, a children’s fashion line that appeared on Shark Tank in 2013.

“When they wake up, they’ll realize they messed up,” said Mark Cuban in reference to the deal Lori Greiner proposed and closed. An article on BusinessInsider.com covered the episode and unabashedly concluded, “Shark Tank isn’t a charity. The investors are putting in their own money, so they have every incentive to push to get the best deal possible for themselves.”

Shark Tank has risen in popularity because it is a reflection of a culture that believes dealmaking, both good and bad, is inherent to the endeavor of entrepreneurship. When a bad deal is made, regulators don’t come on the show to urge a do-over.

But what’s dealmaking got to do with the local pizza joint seeking $20,000 that doesn’t have the time to mess around on TV shows? Unlike lenders who refer to their transactions as loans or units, merchant cash advance companies and the agents who negotiate the transactions appropriately refer to their agreements as deals. How else would one label an agreement in which a commercial entity sells future receivables for a mutually agreed upon price?

But what’s dealmaking got to do with the local pizza joint seeking $20,000 that doesn’t have the time to mess around on TV shows? Unlike lenders who refer to their transactions as loans or units, merchant cash advance companies and the agents who negotiate the transactions appropriately refer to their agreements as deals. How else would one label an agreement in which a commercial entity sells future receivables for a mutually agreed upon price?

And if the Federal Reserve study indicated anything, it’s that business owners feel there’s nothing confusing about these deals.

So it would seem that everything as Americans know it, watch it and understand it, is business as usual.

Even Brendan Ross, the president of Direct Lending Investments, was quoted by the BanklessTimes as saying, “I want to emphasize there’s absolutely nothing novel about lending money to businesses. This isn’t some phenomenon we are rediscovering. There isn’t going to be increased regulation because this isn’t new.”

Perhaps the only thing that could be considered new is that loan sizes have gotten smaller and the types of products small businesses can access has diversified. Along the way, some of these new startups have decided to offer products in line with a self-professed moral code, which is to deliberately lend money at a loss and lash out at lenders who seek profit.

There’s a term for lending startups that don’t make money. They’re called “failed startups.” By casting small businesses as being no different from unsophisticated consumers, it’s quite possible that shows like Shark Tank and The Profit would become illegal in the process. Disclosures meant to help make things more transparent could actually make things less clear and more cumbersome, just as they have in the past.

I don’t think anybody is in favor of small business failure or an environment where confusion prevails, including the guys making infinity percent interest loans like Kevin O’Leary. But if the goal is to increase transparency, it should be in a way that businesses on both sides are content with.

The Federal Reserve study showed the system is working well as is and that prescribing mandatory changes to fit some universal standard would only serve to usher in an era of confusion that everyone is trying to avoid. Lenders can always do better to serve their clients, but the free market must prevail. As Mitchell, Industrial Bank’s CEO said when he testified in front of the Small Business Committee, “the problem with Dodd-Frank is you cannot outlaw and you cannot regulate a corporation’s motivation to drive profit at all costs so while it has a lot of great intentions in over a thousand pages, it has not helped us serve our customers any better.”

The Industry’s First Small Business Financing Report Revealed

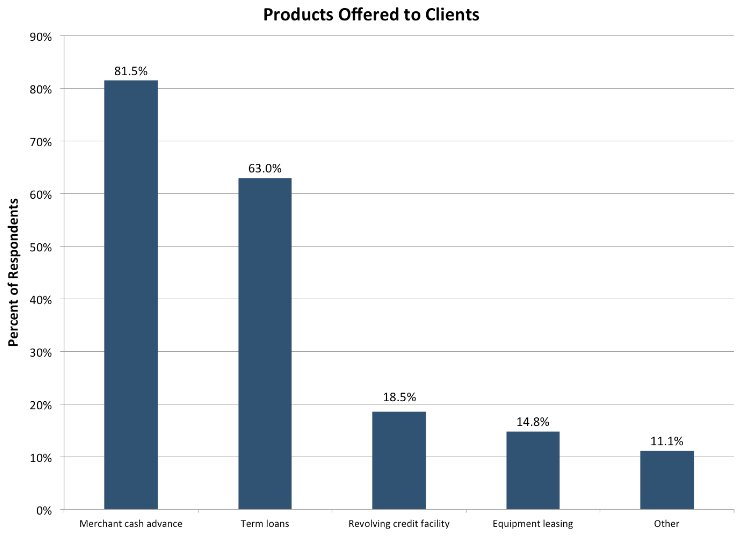

October 25, 2015AltFinanceDaily teamed up with Bryant Park Capital, an investment bank providing M&A and corporate finance advisory services to emerging growth and middle market public and private companies, to conduct the industry’s first comprehensive report.

Our initial findings are drawn from a survey of twenty-seven C-level participants, whose companies primarily offer merchant cash advances and small business loans. Combined, the participants represent more than $1.9 billion in annual origination volume. The survey was sent to over one-hundred eligible respondents, with participation open to all of them equally and included both direct funders and brokers.

- Thirteen respondents reported being on pace to originate $50 million or more in 2015.

- Seven respondents reported being on pace to originate $100 million or more in 2015.

Analyzing the origination volume of participants over a three-year period, the industry was determined to have a:

Compound Annual Growth Rate of 56%.

THE INDUSTRY HAS A DIVERSIFIED PRODUCT MIX

Respondents revealed a diversified product mix beyond merchant cash advance. Five participants actually reported originating no merchant cash advances at all and instead offered term loans or other products.

THE INDUSTRY CEOS HAVE A CONFIDENCE INDEX OF 83.7

Based on responses from CEO/participants asked to give their confidence level in the continued success of the small business lending/MCA industry over the next 12 months on a scale of 0–100, with 100 being the highest.

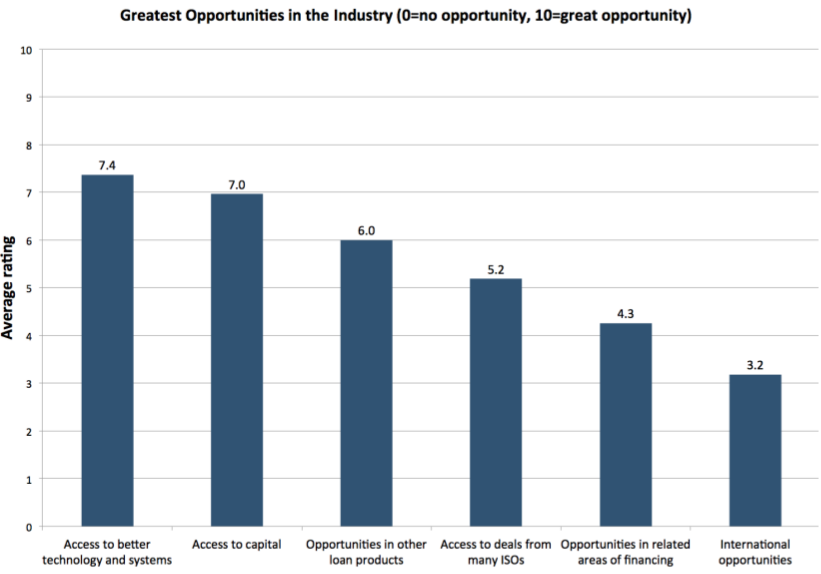

ACCESS TO BETTER TECHNOLOGY AND SYSTEMS IS THE GREATEST OPPORTUNITY IN THE INDUSTRY

Based on responses from participants asked to score the importance of opportunities on a scale of 0–10, with 10 being the highest.

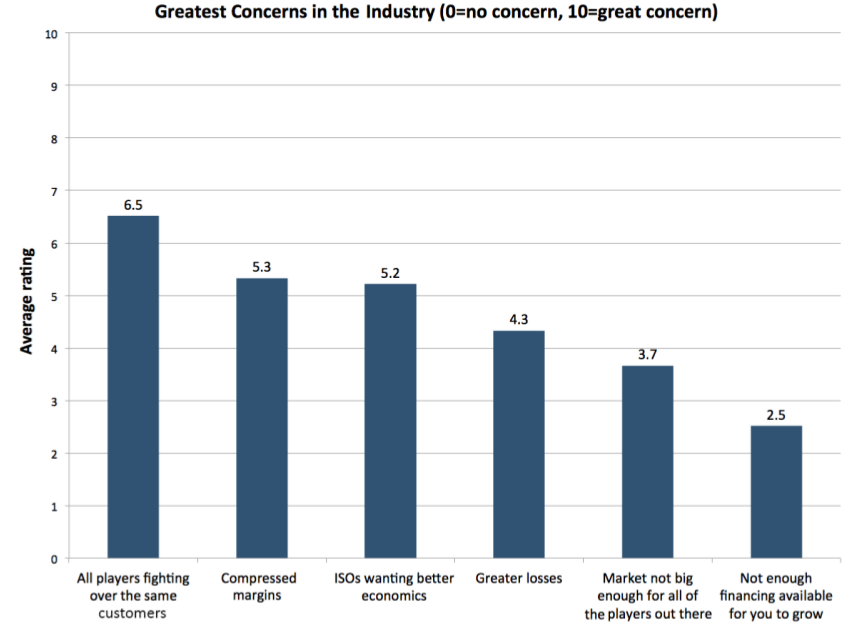

ALL PLAYERS FIGHTING OVER THE SAME CUSTOMERS IS THE GREATEST CONCERN IN THE INDUSTRY

Based on responses from participants asked to score their concerns on a scale of 0–10, with 10 being the highest.

The identities of participants and their individual responses are confidential. Participants were asked a total of 27 questions and had the ability to waive a response to any question, including the disclosure of their identity to the surveyors themselves.

Survey participants are eligible to receive the full anonymized report. Industry players who complete the full survey will automatically receive a full copy of this report. If you are not part of an operating company in the industry and you would like to obtain a copy of the report or participate in the survey, please contact Bryant Park Capital or AltFinanceDaily.

DOWNLOAD THE PDF VERSION

Lenders Subject to Section 1071 of Dodd-Frank May Find Silver Lining in CFPB’s Roll Out of New HMDA Rules

October 23, 2015 Last week, the CFPB finalized its update to the reporting requirements of the Home Mortgage Disclosure Act (HMDA) regulations. Under the new rules, the CFPB expects that the number of non-depository institutions that will be required to report may increase by as much as 40 percent. This will lead to a sizable increase in the total number of records reported.

Last week, the CFPB finalized its update to the reporting requirements of the Home Mortgage Disclosure Act (HMDA) regulations. Under the new rules, the CFPB expects that the number of non-depository institutions that will be required to report may increase by as much as 40 percent. This will lead to a sizable increase in the total number of records reported.

Given the breadth of the new rules and the additional compliance efforts they will require, the CFPB has set January 1, 2018 as the effective date of the new regulations. Given that the Bureau could have chosen January 1, 2017 as the effective date, the longer lead time is welcome news for many in the mortgage industry.

The longer lead time may also be positive news for small business lenders that will be subject to the new Small Business Data Collection rule required by the Dodd-Frank act. Section 1071 of the act requires the CFPB to issue implementing regulations. The Bureau has yet to begin its work on the new rule but some small business lenders have already voiced concerns about the costs of other regulations implemented pursuant to Dodd-Frank. They argue that these costs have already begun to restrict access to small business credit.

A well-timed roll out of the new data collection rule could reduce some of these costs. Having adequate time to develop and implement regulatory compliance procedures in a cost-effective manner will lessen the financial impact to small business lenders. This in turn will allow lenders to minimize the new rule’s impact on credit availability to small businesses.

Once the Small Business Data Collection rule is finalized, small business lenders should be given a sufficient period to adjust to the new requirements, just as the CPFB has done for mortgage lenders with the new HMDA rules. HMDA was enacted in 1975 and lenders have been subject its reporting rules for decades. Yet the increased reporting requirements of the revised rules more than justify a two year lead period.

A similar lead period is just as, if not more important for the small business lenders that will be subject to the new data collection rule. The Dodd-Frank act was enacted just five years ago and requires reporting about small business lending that has never been required before. Lenders will need adequate time to develop the new systems required to meet their reporting obligations.

The CFPB’s conscientious roll out of the HMDA revisions is a rare regulatory silver lining. Let’s hope small business lenders get one too.

Leads vs. Data: Do You Know What You’re Buying?

October 11, 2015 One important aspect of being a broker is your ability to generate qualified leads. At the core of a broker’s business, he/she is really just a lead generator for their network of funders, functioning as a way to improve their funder’s profitability through the acquisition of new clientele.

One important aspect of being a broker is your ability to generate qualified leads. At the core of a broker’s business, he/she is really just a lead generator for their network of funders, functioning as a way to improve their funder’s profitability through the acquisition of new clientele.

While I once questioned if brokers truly knew what they were selling when it came to the merchant cash advance product, my next question is in relation to the purchase of what vendors refer to as “Leads.” I want to know, do you (as a broker) know what you’re buying?

While it’s apparent that you can produce qualified leads internally, can you truly produce the same externally? With the various companies that pop up (seemingly overnight) without domain names, without professionally designed websites or with just the use of a Gmail/Yahoo Email Address, can you truly trust the claims that most of them make in terms of their ability to sell you qualified leads? Maybe so, maybe not, but I believe if we begin with the proper connotation of a “lead” vs. a “data record”, then it might help to truly determine what you’re purchasing from these external sources.

WHAT IS DATA?

Data is business intelligence, which is either generic or specialized information on a business or a group of businesses that are within a sales professional’s generic target market. It would be up to the sales professional to take this data, turn it into a sales pipeline (leads), convert a percentage of those pipeline listings into application submissions, and a portion of those applications into funded deals. Data can come in the form of generic listings such as those from the Yellow Pages or specialized listings such as those from court houses, financing requests and UCC records.

So for example, a UCC record is a data record, not a lead. You would buy let’s say 2,000 UCC records and after running through them via a predictive dialer internally, you might filter off 130 interested prospects which creates your sales pipeline, which is what you would now call “leads.” Then through following up on those 130 interested prospects, you might convert let’s say 20 – 30 of them into application submissions and fund 6 – 9 of them.

WHAT IS A LEAD?

A lead is an actual interested prospect in the services/products that you specifically have to offer. This means they have seen your specific ad or marketing piece, and have specifically expressed interest in what you have to offer. These can only be generated in-house through:

- Running through Data Records as explained above.

- Using other forms of direct marketing such as mailers, email marketing and through directly contracted referral sources who resell your product/company.

- Using indirect marketing options such as banner ads, radio ads, TV ads, print ads, billboard ads, SEO related concepts, and Pay-Per-Click, where the prospect will see or hear the ad and respond to you directly through filling out a form, giving you a call, shooting you an email, etc.

I firmly do not believe you can purchase Leads externally, I believe they can only be generated in-house using direct or in-direct marketing procedures listed above.

HOW TO ADDRESS LEAD GENERATION COMPANIES?

HOW TO ADDRESS LEAD GENERATION COMPANIES?

So when a company comes to you selling “leads,” you should ask them are they selling “leads” or are they selling “data” records? Because they can only be selling YOU leads if they have specifically marketed your specific company and products to said generic target market, and generated interested parties to your specific company and products.

So what about companies that generate what they deem to be “leads” for the “service” that you offer in a generic fashion? For example, people that sell insurance would see people selling insurance Leads, people that sell equipment leasing will see people selling equipment leasing leads, and of course people that sell merchant cash advance will see people selling merchant cash advance leads.

I am still of the belief that these are not leads, but data records, it’s just a different type of data record similar to that of a UCC. A UCC is a more specialized type of data record that tells you more in-depth information on the current situation of the prospect in particular, such as the fact that they took out a cash advance on XYZ date with XYZ funder. This is more specialization than let’s just say a basic Yellow Pages listing, which just has the company’s name, address and telephone number. But both the UCC record and the Yellow Pages listing are still data records.

The “product specific leads” that are sold are usually just a listing of individuals who filled out various online forms requesting some type of particular product, service or financing vehicle. In my opinion, these are not leads, but still data records that will list only the generic information on the company and the date/time they requested more information “generically” on the product or service in particular.

You (as the broker) still have to call these leads and sell them on your company, your product, your pricing, your platform, etc. This means similar to UCC records, if you get 2,000 of these records, you might only convert 130 to interested prospects, which would now be the official “leads.” Then of course from there through following up on those 130 interested prospects, you might convert let’s say 20 – 30 of them into application submissions and fund 6 – 9 of them.

HOPEFULLY NO ONE IS OFFENDED

HOPEFULLY NO ONE IS OFFENDED

This article might offend some individuals who are in the “Lead Generation” business, but I explicitly want to state that my intention is not to cause distress. I firmly believe that the vast majority of the time, when one is purchasing “leads” from an external source, they are indeed only purchasing data records. As a result, such disclosure should be made and such pricing structures modified.

The purpose of this article is so that brokers can know what they are purchasing ahead of time, to make sure that the price they’re paying fits their ROI analysis.

The last thing any vendor would want (in my opinion) is to have a bunch of angry online reviews from brokers who paid $3.00 a piece for your 2,000 “leads,” that only converted to 130 truly interested parties, and then only produced 20 – 30 completed application submissions.

CFPB to Begin Work on Small Business Loan Data Collection Rule After Completion of HMDA Revisions; Plans ECOA Examinations Within the Next Year

September 30, 2015CFPB Director Richard Cordray testified yesterday before the House Financial Services Committee. During the session, Director Cordray was asked when the Bureau plans to begin work on its implementation of the Small Business Loan Data Collection Rule of section 1071 of the Dodd-Frank Act. Noting the recent calls for implementation of the rule by members of Congress and a number of community groups, Mr. Cordray stated that the Bureau plans to begin work on the rule following the completion of its overhaul of the Home Mortgage Disclosure Act rules. He stated he expected the Bureau to finish the revisions to the HMDA regulations by the end of the year.

Mr. Cordray also noted that the CFPB plans to begin examinations of financial institutions regarding their compliance with the Equal Credit Opportunity Act as it relates to small business lending. “We have a little window of authority [over small business lending] under the Equal Credit Opportunity Act and we have indicated that we will begin examinations of institutions on their small business lending within the next year,” he said. ECOA is one of the few statutes applicable to small business lenders that is enforced by the CFPB.

The Director’s statement follows the Bureau’s recent ECOA enforcement action against Hudson City Savings Bank for alleged redlining in its consumer lending operations in New Jersey, New York, Connecticut, and Pennsylvania. Given the Bureau’s recent and controversial use of the disparate impact theory, it will be interesting to see if the Bureau expands the use of the theory when it begins its examination of institutions regarding their small business lending operations.

Dodd-Frank and More Paperwork Make Lending Harder

September 19, 2015 It’s not just alternative lenders that have concerns about Dodd-Frank, Section 1071 and the CFPB. Several community bankers recently testified in front of The House Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access to explain just how detrimental regulations have been to their lending operations.

It’s not just alternative lenders that have concerns about Dodd-Frank, Section 1071 and the CFPB. Several community bankers recently testified in front of The House Committee on Small Business Subcommittee on Economic Growth, Tax and Capital Access to explain just how detrimental regulations have been to their lending operations.

While the discussion encompassed all types of lending including consumer mortgages, B. Doyle Mitchell Jr, the CEO of Industrial Bank said that, “Dodd-Frank was intended for maybe 50 to 100 institutions. It was not intended for mainstream institutions, minority banks around the country.” Mitchell was speaking on behalf of the Independent Community Bankers of America (ICBA).

While repeatedly making the case about how important community banks were to local communities, he explained that Dodd-Frank had not helped them achieve their goals. “It has only increased our costs,” he testified.

Mitchell also expressed a feeling of perpetual anxiety over the loans they make, worrying that a regulator will not like them.

Dixies FCU CEO Scott Eagerton, who was there speaking on behalf of the National Association of Federal Credit Unions (NAFCU) said, “I really feel like we’re getting away from helping people and making sure that we make the loans that Washington agrees with and I think that needs to change.”

While alternative lenders were not on the agenda, the subject of government mandated transparency and its intent to help make things easier for borrowers is both timely and relevant. Referencing some of the new disclosures required in loan documents by Dodd-Frank and/or the CFPB, Congressman Trent Kelly asked if all the added pages to loan agreements make it easier for their customers to understand.

“Do they understand what they’re signing?” he asked.

Mitchell responded that they do not. “It is not any more clear,” he answered. “In fact it is even more cumbersome for them now.”

Regulators should pay special attention to this especially in light of a Federal Reserve study that came to the same conclusion. In Alternative lending: through the eyes of “Mom & Pop” Small-Business Owners, small business owners were asked if they understood financing terms offered by typical online lenders. The feedback was overwhelmingly positive that they did. But when asked a trick question about annual percentage rates, most got confused. While some advocacy groups interpreted this to mean that small business owners are confused by online lenders, it actually offers pretty compelling evidence to the contrary. A future standard of government mandated transparency as it relates to annual percentage rates would only serve to make it harder for small businesses to understand contracts, not easier.

Both Eagerton and Mitchell made the case that increased compliance costs undermined the ability of community banks to grow the economy. “You cannot expect a trillion dollar institution to focus on hundred thousand dollar loans,” Mitchell said. And Subcommittee Chairman Tom Rice said, “the burdens created by Dodd-Frank are causing many small financial institutions to merge with larger entities or shut their doors completely, resulting in far fewer options where there were already not many options to choose from.”

Both Eagerton and Mitchell made the case that increased compliance costs undermined the ability of community banks to grow the economy. “You cannot expect a trillion dollar institution to focus on hundred thousand dollar loans,” Mitchell said. And Subcommittee Chairman Tom Rice said, “the burdens created by Dodd-Frank are causing many small financial institutions to merge with larger entities or shut their doors completely, resulting in far fewer options where there were already not many options to choose from.”

Eagerton argued that,”lawmakers and regulators readily agree that credit unions did not participate in the reckless activities that led to the financial crisis, so they shouldn’t be caught in the crosshairs of regulations aimed at those entities that did. Unfortunately, that has not been the case thus far. Accordingly, finding ways to cut-down on burdensome and unnecessary regulatory compliance costs is a chief priority of NAFCU members.”

But Congressman Donald Payne, Jr wondered why the ICBA was objecting to Section 1071 of Dodd-Frank, the part that grants the CFPB authority to collect certain pieces of data from financial institutions. Regulation B of Section 1071, for those that aren’t aware, was intended to study gender, racial and ethnic discrimination in small business lending.

Payne likened the law to The Home Mortgage Disclosure Act (HMDA), pronounced HUM-DUH, in which raw data is disclosed to the public but no penalties are specifically imposed if the data leans one way or another.

Mitchell responded to that by saying HMDA was a good example of something that was already very burdensome and another reason why Section 1071 was a bad idea. “While there is a clear need to outlaw discrimination at any level, I don’t think [this law is] necessary for community institutions,” he said. He pointed out that his bank could suffer reputational damage in the community by disclosing the gender and racial statistics of their business loans to the public at large.

While he did not expand on what he meant by reputational risk, one could fill in the blank that he meant the context that such data would lack. For example, if 75% of Hispanic-owned businesses were declined for business loans while only 25% of African-American-owned businesses were declined for business loans, one might infer from that raw data that there is potential discrimination taking place. Since small business loans are less FICO driven than consumer lending and focused more on the story of the business and the projected financial future, it is impossible to infer anything from raw data as it relates to discrimination.

“Simply put, Dodd-Frank needs to be streamlined,” said Marshall Lux, Cambridge, MA, John F. Kennedy School of Government, Harvard University.

And “the problem with Dodd-Frank,” Mitchell voiced, “is you cannot outlaw and you cannot regulate a corporation’s motivation to drive profit at all costs so while it had a lot of great intentions in over a thousand pages it has not helped us serve our customers any better.”

You can watch the full hearing below: