Marketplace Lending Investors: Enjoy Redlining While it Lasts

March 9, 2016 For investors, geographic discrimination in marketplace lending is not only a possibility, it’s a privilege and a joy

For investors, geographic discrimination in marketplace lending is not only a possibility, it’s a privilege and a joy

Two years ago, LendingMemo’s Simon Cunningham openly boasted about his exclusion of Florida borrowers from his marketplace lending strategy. In, The Joy of Redlining: Why I Never Lend Money to Florida, Cunningham wrote “folks from Florida are less likely, in a statistically significant way, to pay back their p2p loans. So I have never loaned a dollar to people in Florida, and have gone on to earn a higher net return on my peer to peer investment than 90% of p2p lenders.”

And he could openly say that because so long as the lenders are the ones making the loans, it’s within his right to buy pieces of the ones he wants in a secondary market. If Lending Club themselves were to underwrite that way however, well then they could potentially be accused of discriminatory redlining.

Lending Club used to offer rather precise geographic data to investors such as the actual city of the borrower, but that has since changed to only include the first 3 digits of the zip code. Racial and gender identity are obviously not disclosed.

NSR Invest, a marketplace lending investment-advisory firm, told the WSJ that about about 16% of people who buy loans from online marketplaces use a borrower’s state to make lending decisions. Some investors however are simply ignoring states like Vermont, New York and Connecticut because of a peculiar court ruling with jurisdiction over those three states.

Investors might not be able to redline forever, its foretold. According to the WSJ, the CFPB is reviewing this practice. “The agency said it aims to ensure that companies aren’t incorporating potentially discriminatory factors into marketing or underwriting.” Jo Ann Barefoot, a former advisor to the CFPB, said that “it may be unclear whether the investors in marketplace loans would have liability,” adding that the practice is in the regulatory gray space.

—

Full disclosure: I currently exclude borrowers from 11 states in my marketplace lending strategy, including Florida.

SEC Says You Can Crowdfund Startups This Summer

February 23, 2016Now you can own a piece of a startup doing the next-big-thing or invest seed money in an idea that looks promising starting May this year.

Last week, the SEC released an investor bulletin on crowdfunding for retail investors and said that “Starting May 16, 2016, companies can use crowdfunding to offer and sell securities to the investing public.”

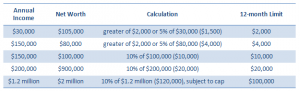

In October last year, the regulator adopted rules permitting companies to offer securities and raise a maximum of a million dollars a year through crowdfunding platforms. Individual investors with annual income or net worth less than $100,000 can invest no more than $2,000 but less than 5 percent of their annual income and not more than 10 percent for investors with income and net worth of over $100,000 in a twelve-month period.

Investors are allowed to invest in these ventures strictly through an online platform including mobile app of a broker-dealer or a funding portal registered with the SEC and a member of FINRA.

This is a major step in recognizing crowdfunding as a legitimate means of raising capital, which thus far has been typically used to solicit charitable donations or raise funds for artistic projects like movies, music and social projects.

The SEC warned investors of the risks involved with such investments like limited disclosure, illiquidity, opacity in valuation and capitalization that is associated with private companies. Investors are also prohibited from reselling their stake for the first year unless it’s a transfer to the company, an accredited investor or a family member.

A Loan Bazaar Where You Can Literally Buy Loans for Pennies – FOLIOfn

February 22, 2016 Welcome to the true marketplace where you can trade debt on any level you like

Welcome to the true marketplace where you can trade debt on any level you like

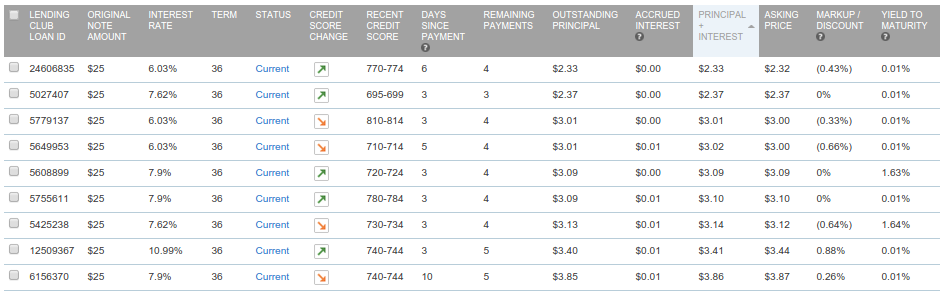

You haven’t experienced marketplace lending until you’ve entered the world of FOLIOfn. Operating as a secondary market for Lending Club and Prosper investors, the platform offers more than just liquidity for holders of 3-5 year consumer debt-backed notes. It’s a sort of anything-goes bazaar for loans, the kind of place where you can bet on a borrower making their last and final loan payment after having made 35 straight monthly payments with no problems.

For the price of 82 cents, an investor could literally buy the remaining 83 cent principal balance (their last payment) on a $25 3-year note.

Why invest in a borrower with no proven track record anyway? On FOLIOfn, you don’t have to. You can buy a note from someone else after the borrower has made their first few payments.

And what if you just want bigger? You can get that. Some investors are offering much larger loan pieces. You can even buy whole loans from them. Would you buy the entire remaining principal of a $6,000 loan paying 21% APR if you knew the buyer had already made all their payments in the first year on time? Somebody will make you that deal, but you’ll have to pay more than the outstanding principal balance to get it.

FOLIOfn has a bet for everyone. You can buy notes for example where the borrower’s FICO score has dropped by more than 200 points but is still surprisingly current on their loan. A drop by that much likely indicates that the borrower is delinquent on their other forms of credit, so you might want to get a discount on buying it. And yet, many investors list such loans at a premium, which could indicate that scarcity is a prevailing force.

The effects of scarcity are certainly evident on FOLIOfn, considering how many loans are up for sale on the platform in which no payments have been made yet because the loans are newly issued. With these, a different kind of loan speculator could hope to book a quick 5% gain in just 1 month by reselling a highly prized note to someone who seeks it. Do this over and over 12x a year and well… you could make a killing.

Millions of dollars worth of loans and loan pieces are being marketed at any one time. At the time this was written, there were more than 300,000 trades offered. Of course, they’re all ASKs. There’s no BIDs on FOLIOfn, which limits the efficiency of the marketplace and creates information asymmetry. Hence, a lot of the proposed trades are terrible and investors on industry forums are at times not shy about expressing their hope that a sucker buys them.

And just like one might expect at a bazaar, you don’t always know exactly what you’re going to get. Last year on the Lend Academy forum for example, investors pointed out that you could inadvertently buy notes that had already paid off. What was happening was that a note was being sold from one investor to another before Lending Club could process that the note had been paid off in full. If the investor paid a premium for it, they would immediately lose the premium and forfeit the future interest, causing a loss. The buyer would likewise take home a free premium.

Consider this conundrum. The note selling for 82 cents has a remaining principal balance of 83 cents that is coming due in less than a month, a bet that supposedly promises 1 cent profit (before the 1% Lending Club fee) if it works out. According to the borrower’s payment schedule however, they’re apparently only supposed to make one last payment of 76 cents, 7 cents less than the remaining principal officially stated on the account. If that’s correct, then a buyer’s best outcome is a loss of 6 cents (7 cents after the 1% Lending Club fee) and a worst case loss of 82 cents. It’s not uncommon for investors to notice and complain about these weird discrepancies (sometimes chalked up as rounding errors), but that’s the nature of the market. Confusing information is part of the trade.

To FOLIOfn’s credit, there is one cardinal rule, CAVEAT EMPTOR. The following is prominently displayed on top of the platform:

Notes are highly risky and only limited information is available about them. They are suitable only for investors whose investment objective is speculation. You could lose most or all of the money you invest in them. Folio Investing has no role in the original issuance of the Notes and is not responsible for and does not approve, endorse, review, recommend or guarantee the Notes or the accuracy, reliability, or completeness of any data or information about the Notes. See the Important Disclosures page for additional important information.

In the FOLIOfn loan bazaar, the numbers don’t always add up and the borrowers and traders are anonymous. Welcome to lending’s real marketplace, where it’s really hard to know much of anything.

Luckily, beginners only need bring pennies to start trading.

—

There’s actually something called The Penny Note Strategy (AKA The Toilet Note Strategy). You can read about it on Peter Renton’s blog.

Industry Trade Group Coming of Age: The SBFA is Becoming More Political

February 1, 2016By hiring an executive director, the Small Business Finance Association hopes to achieve at least two goals – taking a step toward becoming a full-service trade group and providing a public voice for the alternative finance industry.

Stephen Denis, formerly deputy staff director of the U.S. House Committee on Small Business, went to work in the new role in mid-December, setting up shop with his cell phone and laptop in a Washington, DC, area coffee emporium. He’s the SBFA’s first full-time employee.

Hiring Denis, who also has association experience, represents “the next evolution” of the trade group, according to David Goldin, SBFA president and Capify’s founder, president and CEO.

The SBFA, which got its start in 2008 as the North American Merchant Advance Association, changed its name last year because members have added small-business loans to the their merchant cash advance offerings. Although the trade group’s not exactly new, it has plenty of room to grow and its leadership and members seem open to change.

The SBFA, which got its start in 2008 as the North American Merchant Advance Association, changed its name last year because members have added small-business loans to the their merchant cash advance offerings. Although the trade group’s not exactly new, it has plenty of room to grow and its leadership and members seem open to change.

“The goal is to start from scratch and take a look at everything the association is doing,” Denis told AltFinanceDaily, “and to really build this out to a robust group that represents the interests of small businesses.”

Denis appears optimistic about pursuing that goal. He’s a native of the Boston area and a Harvard University graduate whose first job out of school was as an aide to Republican Sen. John E. Sununu of New Hampshire. After three years in that position, he took a job for two years with a UK-based trade association, traveling frequently to London to inform the group of Congressional action in the United States.

From there, Denis went on to become director of government affairs and economic development for the Cincinnati Business Committee, a regional association that included Fortune 500 companies among its members. After two years in that role, Denis joined the staff of Rep. Steve Chabot, R-Ohio, moving back to Washington and serving as the congressman’s deputy chief of staff during a five-year stint that ended when he joined the SBFA.

While working for Chabot, Denis also became deputy staff director of the House Committee for Small Business, the No. 2 position there, and he has held that job for the last three years. The committee’s tasks include learning as much as they can about small business, including financing, and using the information to advise members of the House on policy initiatives.

The experience Denis has amassed in government should serve the association well because his duties include briefing federal legislators and regulators on how the alternative-finance business works. With Denis as spokesperson, the industry can speak to government with a single voice, Goldin asserted.

“We are going to be aggressive in our outreach to legislators and regulators as well as be active reaching out to local, state governments,” Denis said. The SBFA will “work with other trade groups and small business groups to promote our mission to ensure small businesses have alternative finance options available to them.”

Until now, too many players from the alternative finance industry have been vying for lawmakers’ attention, Goldin said. To make matters worse, some of those seeking to influence government in hearings on Capitol Hill are brokers instead of lenders and thus may not have a perfect understanding of risk and other aspects of the business, he maintained.

“We’re hearing that there are people trying to be the voice of small-business finance that either don’t have a lot of years of experience or they’re not telling the whole story,” Goldin said. “We want to make sure the industry’s represented properly.”

Denis can draw attention away from the “noise” created by unqualified voices and focus on information that Congress needs to make reasonable decisions about the alternative finance business, Goldin maintained.

Besides getting the word out in Washington, the SBFA hopes to convey its message to the general public on “the benefits of alternative financing,” Goldin said. At the same time the group can help make small business owners aware of the finance options, Denis added.

Asked whether hiring Denis marks the beginning of an effort to lobby members of Congress for legislation the association deems favorable to the industry, Goldin said only that additional announcements will be forthcoming.

Asked whether hiring Denis marks the beginning of an effort to lobby members of Congress for legislation the association deems favorable to the industry, Goldin said only that additional announcements will be forthcoming.

Meanwhile, updated “best practices” guidelines might be in the offing to help industry players navigate the business ethically and efficiently, Goldin said. A set of six best practices the association released in 2011 included clear disclosure of fees, clear disclosure of recourse, sensitivity to a merchants’ cash flow, making sure advances aren’t presented as loans and paying off outstanding balances on previous advances.

Addressing other possible steps in the association’s growth, Goldin said the group doesn’t plan to publish an industry trade magazine or newsletter. However, a trade show or conference might make sense, he noted.

Denis said he and the board had not discussed the possibility of a test, credential or accreditation to certify the expertise of qualified members of the industry. However, associations often establish and monitor such standards, so it would be reasonable for the SBFA to do so, he added.

The association might establish a Washington office, Goldin said. “We’ll look to Steve for his thoughts and guidance on that,” he observed. Denis seems amenable to the idea. “Down the road, we would love to open an office and hire more people,” he said.

In Goldin’s view, all of those moves might help the rest of the world comprehend the industry. Understanding the industry requires taking into account the cost of dealing with risk and business operations, he said.

Placing a $20,000 merchant cash advance, for example, requires a customer-acquisition effort that costs about $3,000 and a write-off of losses and overhead of about $4,000, Goldin said. That’s a total of $27,000 even without the cost of capital, he maintained.

“Most people don’t understand the economics of our business,” Goldin continued. The majority of placements are for less than $25,000, he said, characterizing them as “almost a loss leader when you factor in the acquisition costs.”

While spreading that type of information on the industry’s inner workings, Denis will also conduct the day-to-day for the not-for-profit’s affairs. The association’s board of directors will continue to set policy and objectives.

Members elect the board members to two-year terms. Current board members are Goldin; Jeremy Brown of Rapid Advance, who’s also serving as the group’s vice president; John D’Amico, GRP Funding; Stephen Sheinbaum, Bizfi; and John Snead, Merchants Capital Access.

Member companies include Bizfi, BFS Capital, Capify, Credibly, Elevate Funding, Fora Financial, GRP Funding, Merchant Capital Source, Merchants Capital Access (MCA), Nextwave Funding, NLYH Group LLC, North American Bancard, Principis Capital, Rapid Advance, Strategic Funding Source and Swift Capital.

Companies pay $3,000 in monthly dues, which Denis characterizes as inexpensive for a DC-based trade association.

Membership could spread to other types of businesses, Denis said. “I’d like to expand the tent to other industries,” he noted. “The association is trying to represent the interests of small business and make sure they have every finance option available to them.”

But a key purpose of the trade association is to provide a forum for members to come together as an industry, Denis said. “We’re thinking big,” he admitted. “We hope that all members of the marketplace will want to become a part of it.”

Getting a California Lender’s License

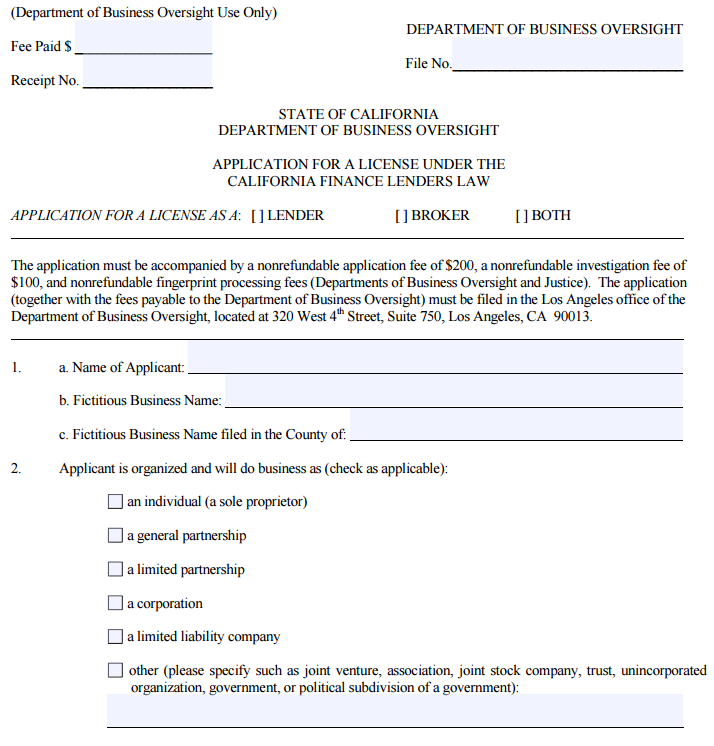

December 17, 2015Given the fact there have been a number of successful lawsuits against cash advance companies in California, many cash advance companies have decided to take a different route and get a lending license to provide loans to merchants in the state. If done correctly, this can allow companies to provide loans to merchants in California at roughly the same profit margins one could expect from a cash advance. Below I will discuss the process for obtaining a California lender’s license and some tips for making that process less painful.

To start, go to the California Department of Business Oversight and get the form titled “Application for a License Under the California Finance Lenders Law.” The application is long and detailed but don’t let that scare you. Most of the information you provide is really more related to letting the State know about your company and the main people that will be responsible for managing the lending operations. As you complete the form, one thing you do need to do is make sure you are very careful and meticulous as any small mistake will cause the application to be rejected making the process much longer.

To start, go to the California Department of Business Oversight and get the form titled “Application for a License Under the California Finance Lenders Law.” The application is long and detailed but don’t let that scare you. Most of the information you provide is really more related to letting the State know about your company and the main people that will be responsible for managing the lending operations. As you complete the form, one thing you do need to do is make sure you are very careful and meticulous as any small mistake will cause the application to be rejected making the process much longer.

The first part of the application requests basic information about your company and its officers. In filling out this and other parts of the application, it is essential to respond to all the questions. If you fail to miss just one response the application will be rejected. To that end, even if a question does not apply to you I find it better to respond “N/A” or “not applicable” rather than just leaving a blank. By doing that you force yourself to fill in every blank and therefore reduce the chances for missing a response resulting in a rejection of your application.

Also, you need to be very precise in your responses. I have experienced a situation where the examiner rejected an application because the name of the company was incorrectly spelled on the application. The name of the company was submitted on the application with “Inc” instead of the complete “Inc.” at the end of the company’s name. The examiners are very good at what they do and very thorough. You need to make sure the packet you submit is perfect and also that there are no inconsistencies in the document.

Another important point to remember is that the application requires you to name the person that will be responsible for running the location where the lending is occurring. The main requirement is that the person running the location must be physically present at the location. As a result, you could not manage a California office remotely from New York for instance. In another twist, if your principal location is out of state, you will need to get the license and fill out the main application for that out of state address. For the California location, you will need to fill out the short form application in addition to the main application and submit the short form application as part of the packet to allow the license to apply to the location in the state of California.

There are a number of exhibits you also have to provide as part of the process. Some of them are simple like a balance sheet for the company. It is acceptable that the company is new and has little in the way of assets. You just have to make sure you attach a balance sheet and that it is prepared in compliance with generally accepted accounting principles. I have seen times when the balance sheet was rejected because there was no line items for liabilities for instance, even though the company was new and therefore had none. It is probably wise to engage your accountant to make sure you submit a balance sheet that complies with those guidelines.

You also have to get a surety bond in the amount of $25,000. There are readily available bonding companies that specialize in providing these bonds. In addition, you need some other exhibits like a statement of good standing for your company, authorization for financial disclosure, social security number (on a separate exhibit), organizational chart and a few other documents. As with the rest of the application the key is to make sure you include everything they are asking for exactly as requested.

The most involved exhibit is the “Statement of Identity and Questionnaire.” That exhibit has to be filled out for each owner, officer and manager listed on the application. It requests detailed information going back 10 years for each person for items like residence address and work history.

In addition, there are a series of questions on topics such as whether the person has been involved in lawsuits, had any licenses revoked or declared bankruptcy. Fingerprints are also taken as part of the process. This part of the application is trying to vet the various people working for the company to make sure they are suitable to be in the lending business.

Once you have all the documents prepared, you need to put them together in a packet to send off to the Department of Business Oversight to be reviewed. Again, I cannot overemphasize how important it is to completely and accurately answer the questions and put the packet together. You need to make sure things are in the proper order and complete. Triple check the application for errors and to make sure that packet is presented in the best manner possible. You also need to determine the amount of fees to submit with the application. Then, send the package by overnight delivery to make sure you have proof of delivery.

So what happens next? Well there is usually a bit of a wait. Typically it takes 3 months or more to get a reply. If you have done your homework, you might get lucky and successfully get your license on the first try. If there are any deficiencies, you will get a response letter from the State detailing the items that need to be corrected in the application and a time frame in which you have to respond or the application is abandoned.

On the first go round, you are usually given at least 2 months so you should have plenty of time. Digest the things they want and provide the required information. The deficiency letters are very detailed so it should be easy to make the requested changes. Resubmit the requested items and wait for the next response. It could be in the form of another deficiency letter but it could be an approval of the license. Just keep on trying until you are finally successful.

That’s it, you are finally a licensed lender in California! But that is where the fun begins. You are subject to many laws in California and audits by the State. To get the right to operate as a licensed lender, you need to make sure you prepare your application correctly. Once you have done that, you need to get all your loan documents drafted in compliance with California law. Make sure you have adequate experience and professional help to take on those tasks.

National Security Could Prove to be Alternative Lending’s Achilles Heel

December 11, 2015 While alternative lenders debate disclosure policies, stacking, and the cost of bad merchants, there’s a new regulatory threat taking root that no one seems to be able to slow down, national security. Ever since it was revealed that one of the two terrorists in the San Bernardino attack received a $28,500 loan from the Prosper Marketplace, government officials and the public at large are pointing fingers at online lenders.

While alternative lenders debate disclosure policies, stacking, and the cost of bad merchants, there’s a new regulatory threat taking root that no one seems to be able to slow down, national security. Ever since it was revealed that one of the two terrorists in the San Bernardino attack received a $28,500 loan from the Prosper Marketplace, government officials and the public at large are pointing fingers at online lenders.

House Financial Services Chair Jeb Hensarling said on Thursday that, “clearly the financing link to terrorism is a critical one.” As quoted by Politico, “everything’s on the table,” he said when asked about further scrutiny of online lenders.

His sentiment echoes other responses, some of which are clearly emotionally charged and accusatory. LendAcademy’s Peter Renton for example wrote, “I have had to answer such ridiculous questions as, is P2P lending going to become the new way for terrorists to get funding?”

With so much misinformation now floating around out there about online lenders, conspiracy theorists are even claiming that it would be impossible for someone earning $53,000 a year (As Syed Farook did) to get an unsecured loan for $28,000, the implication being that there is something more sinister going on. Of course those that work in the alternative lending industry, including myself personally as someone who invests on the Prosper Marketplace, know that’s not true.

But before the experts can be called on to answer the questions, those motivated to protect this country at all costs (with noble intentions) are rallying around swift and immediate consequences for online lenders such as Prosper.

“The issue may end up being whether marketplace lenders are too easy of a source of cash to finance terrorist attacks,” said Guggenheim Partners analyst Jaret Seiberg in a research letter.

In an article published by The Street, writer Ross Kenneth Urken basically likened Prosper Marketplace to Silk Road where bitcoins were used to buy drugs, weapons, and killers for hire.

Breitbart News, a right-wing news website, led in with an even bigger headline, San Bernardino: Has Islamic State Hijacked Consumer Loans?. It quickly sums up the story by insinuating that online lenders will become the funding tool of choice for ISIS. “The San Bernardino terrorists, Syed Rizwan Farook and his wife Tashfeen Malik, funded their killing spree with a debt consolidation loan, raising questions about whether terrorists might use popular consumer loans to fund their activities,” Breitbart wrote.

And the International Business Times argued that Utah industrial banks are aiding terrorism. “Meanwhile, industrial banks in Utah are taking full advantage of the lack of regulation in the peer-to-peer lending market while they still can, aiding potential terrorists along the way,” author Erin Banco concluded.

According to the WSJ, the House Financial Services Committee will examine whether new legislation is needed in online lending. They’ve also made inquiries to the Treasury Department about existing online lending regulations. Treasury Counselor Antonio Weiss’s previous remarks hinted that the Treasury up until recently was concerned about discriminatory lending practices more than anything else, but stressed that they were not a regulator in this area. Terror financing was not something they even addressed.

According to many sources, lawmakers are drafting up legislation on terrorism financing and expect to have something ready early next year. As for how that will impact online lenders is unknown. Right now, everyone’s still trying to figure out what just happened. Hopefully whatever is ultimately done is done intelligently.

Merchant Cash Advance is The Real Square IPO Story

November 22, 2015 Square’s debut on the New York Stock Exchange is being talked about as one of the more consequential IPOs of 2015. As a mobile payments company famous for both losing money and its founding by Jack Dorsey, Twitter’s CEO, the $2.9 billion valuation pales in comparison to its rival First Data that went public just a month before. First Data, which was founded in 1971, is worth five times more than Square with a market cap of $14.7 billion to Square’s $2.9 billion. But it’s Square that everyone’s talking about and not necessarily in a positive way. Cast as the poster child for runaway private market valuations in Fintech, Square’s Series E round just a year before had supposedly increased its worth to $6 billion.

Square’s debut on the New York Stock Exchange is being talked about as one of the more consequential IPOs of 2015. As a mobile payments company famous for both losing money and its founding by Jack Dorsey, Twitter’s CEO, the $2.9 billion valuation pales in comparison to its rival First Data that went public just a month before. First Data, which was founded in 1971, is worth five times more than Square with a market cap of $14.7 billion to Square’s $2.9 billion. But it’s Square that everyone’s talking about and not necessarily in a positive way. Cast as the poster child for runaway private market valuations in Fintech, Square’s Series E round just a year before had supposedly increased its worth to $6 billion.

Robert Greifeld, the CEO of Nasdaq, had warned people just weeks earlier about the validity of private market valuations. “A unicorn valuation in private markets could be from just two people,” he said. “Whereas public markets could be 200,000 people.”

And while Square’s IPO was relatively well-received, closing at 45% above its offered price, there’s an entire story beyond payments hidden in the company’s financial statements under the label of “software and data products.” That’s code for merchant cash advance, the working capital product they offer to customers that currently makes up 4% of the company’s revenue.

“Since Square Capital is not a loan, there is no interest rate,” states the company’s FAQ. That echoes what dozens of other merchant cash advance companies have been saying for a decade. “You sell a specific amount of your future receivables to Square, and in return you get a lump sum for the sale,” marketing materials explain.

Lenders that don’t approve of this receivable purchase model are lobbying politically against it, some of whom are well-known. Lending Club for example, is a signatory to the Responsible Business Lending Coalition’s Small Business Borrowers Bill of Rights (SBBOR), committing themselves to things like transparency and the disclosure of APRs even for non-loan products.

But disclosing an APR on a receivable purchase merchant cash advance transaction is not only impossible since there is no time variable, but would violate the spirit of the contract even if estimates were used to fill in the blanks. Nonetheless, Fundera CEO Jared Hecht, whose marketplace platform has also signed the SBBOR told Forbes in September that “small business owners have been sold by pushy salespeople, hiding terms, disguising rates and manipulating customers into taking products that aren’t good for them.”

But disclosing an APR on a receivable purchase merchant cash advance transaction is not only impossible since there is no time variable, but would violate the spirit of the contract even if estimates were used to fill in the blanks. Nonetheless, Fundera CEO Jared Hecht, whose marketplace platform has also signed the SBBOR told Forbes in September that “small business owners have been sold by pushy salespeople, hiding terms, disguising rates and manipulating customers into taking products that aren’t good for them.”

Ironically, Fundera’s own merchant cash advance partners have not made any such pledge to disclose APRs. No one’s commitment is verified anyway. “Neither Small Business Majority nor any other coalition member independently verifies that any of these signatory companies or entities in fact abide by the SBBOR,” the group’s website states. This isn’t to say that their intent is misguided, there’s just very little substance to it below the surface.

For example, while the coalition has made some subtle and not so subtle digs about merchant cash advances over fairness and transparency, it’s the lending model used by some of the SBBOR’s signatories that is being challenged by the courts right now. Because of Madden v. Midland, Lending Club’s practice of using a chartered bank to originate loans could potentially be in jeopardy. The ruling was just appealed to the U.S. Supreme Court. At the heart of the issue is the ability to usurp state usury caps through the National Bank Act. For a company that has pledged to offer non-abusive products, it’s ironic that their model relies on preemption of state interest rate caps all the while reassuring their shareholders that there’s no risk because of their Choice of Law fallback provision. In truth, Lending Club uses a state chartered bank and not a nationally chartered bank and thus would be somewhat shielded in an unfavorable Supreme Court ruling.

Those concerned in years past that receivable purchase merchant cash advances were full of regulatory uncertainty had shifted towards the model that Lending Club uses since it was perceived to have more nationally recognized legitimacy. However, with that model seriously challenged, old school merchant cash advances are once again looking pretty good. That’s probably why publicly traded Enova International Inc. (NYSE:ENVA) bought The Business Backer this past summer. And it’s why Square skated through their IPO without much resistance to their merchant cash advance activities.

The story of Square was either that it was overvalued, that CEO Jack Dorsey couldn’t handle running two companies, that they were losing money, or that their deal with Starbucks was a mistake. Meanwhile Square has processed $300 million worth of merchant cash advances, a product that doesn’t disclose an APR since it’s not a loan. “Nearly 90% of sellers who have been offered a second Square Capital advance cho[se] to accept a repeat advance,” their S-1 stated.

“If our Square Capital program shifts from an MCA model to a loan model, state and federal rules concerning lending could become applicable,” it adds. And right now partly due to Madden v. Midland, the loan model looks pretty shaky. Square proved many things when they went public on November 19th and one was that merchant cash advances are just the opposite of what critics have argued in the past.

Battery Ventures’ general partner Roger Lee told Business Insider, “the [Square Capital] product itself will have unique advantages in the market, and it’s a big market.”

Lending Club Narrowly Avoids Major Transparency Flop

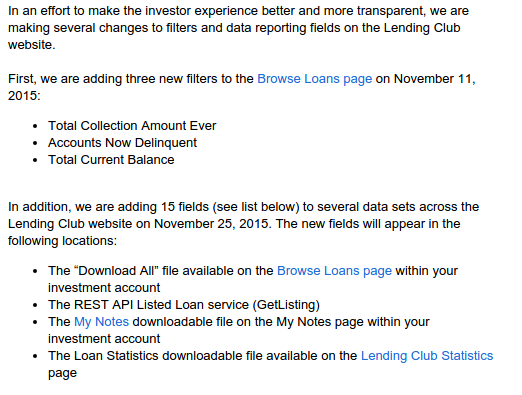

November 18, 2015After many months of Lending Club warning that they would be REMOVING borrower credit data from note listings, they have completely reversed course and ADDED fifteen new credit attributes. On Peter Renton’s LendAcademy forum, one member speculated that this move was made to compete with Prosper for the attention of institutional investors. If true, that would be entirely misguided.

Almost exactly one year ago, Lending Club announced that they were cutting the amount of data points available to investors from 100 to 56. Renton, a marketplace lending evangelist and founder of the LendIt conference, gave it a negative spin in his blog:

It is pretty obvious by now that I don’t like these changes. For quite some time now Lending Club has been reducing the amount of transparency for investors. Now, some changes I completely understood such as removing the Q&A with borrowers and even the removal of loan descriptions. But removing data that investors have been using to make investment decisions is a step too far in my opinion.

I think Lending Club need to ask themselves if they are a true marketplace connecting borrowers and investors in a transparent fashion or whether they are more of a loan origination platform that makes products available to investors. They are certainly moving more towards the latter, I think, and that is a shame for everyone.

The move was seen by many as a way to stop investors from trying to reverse engineer their models and beat their grading system for above average yields. While understanding that perspective, it is mind boggling that they had planned to remove more data points and make the loans on the platform even less transparent. And here’s why…

Lending Club is a key signatory to the Small Business Borrower’s Bill of Rights, a group of political activists that claim innovative small business lending can only achieve its potential “if it is built on transparency, fairness, and putting the rights of borrowers at the center of the lending process.” With transparency being a focal point of their agenda there, one might find their attempts to reduce disclosure and eradicate transparency a bit hypocritical.

Lending Club is a key signatory to the Small Business Borrower’s Bill of Rights, a group of political activists that claim innovative small business lending can only achieve its potential “if it is built on transparency, fairness, and putting the rights of borrowers at the center of the lending process.” With transparency being a focal point of their agenda there, one might find their attempts to reduce disclosure and eradicate transparency a bit hypocritical.

Investors on Renton’s forum who had for months anticipated Lending Club to remove more data points, also viewed it negatively. “I’d have to think hard on whether to continue investing in LC notes without those credit fields — it would be very much like gambling rather than investing,” wrote Fred back on July 8th.

A similarly named user, Fred93, communicated that these data points were all investors had to go off. “We can’t shake a borrower’s hand, feel the firmness of his grip, the sweatiness of his palm. We can’t look a borrower in the eye. We live or die by a handful of numbers, which we hope mean something, on the average,” he wrote.

Clearly some investors weren’t thrilled with the proposed changes. All the while, Lending Club’s co-signatories had been promoting the transparency pledge through speeches, TV appearances, public relation events, and press releases. To be fair, The Small Business Borrowers Bill of Rights is aimed at transparency between business borrowers and sources offering business financing. Lending Club’s planned removal of data was targeted at investors in their consumer notes. It sounds different enough until you consider that 72% of Lending Club’s loans originated in 2014 were funded by investors vastly less sophisticated than the commercial businesses they have pledged to protect. That’s because that money came from consumers, many of whom are unaccredited and went through no screening process. Instead, these investors are presented with a prospectus as if they were buying a stock or bond and stuck with the risk whether they understand it all or not.

These consumers who are legally presumed to be unsophisticated are the very same people that Lending Club planned to reduce disclosures to, all the while heavily promoting to them that they roll over their retirement savings onto their platform. That logic is the very definition of insanity. Obfuscating the reasoning behind certain scoring grades to these investing consumers would be nothing short of unconscionable and would reasonably invalidate any pledge they’ve made towards transparency in other areas.

Lending Club has for now avoided a major flop by reversing course after having added 15 new pieces of data for investors.

While some investors speculated the move had to do with pressure from Lending Club’s institutional investor base. The more likely reason is increasing scrutiny from federal regulators. Less than two weeks ago for example, the FDIC warned banks about marketplace lending and advised them to perform their own underwriting on the loans they buy and not to rely on originator scoring models. A summary of their letter specifically said:

Some institutions are relying on lead or originating institutions and nonbank third parties to perform risk management functions when purchasing: loans and loan participations, including out-of territory loans; loans to industries or loan types unfamiliar to the bank; leveraged loans; unsecured loans; or loans underwritten using proprietary models.

Institutions should underwrite and administer loan and loan participation purchases as if the loans were originated by the purchasing institution. This includes understanding the loan type, the obligor’s market and industry, and the credit models relied on to make credit decisions.

Before purchasing a loan or participation or entering into a third-party arrangement to purchase or participate in loans, financial institutions should:

– ensure that loan policies address such purchases,

– understand the terms and limitations of agreements,

– perform appropriate due diligence, and

– obtain necessary board or committee approvals.

These guidelines conflict with Lending Club’s long sought after goal of getting investors to trust their A-G scoring grades. The banking regulator is advising banks to basically disregard them. “The institution should perform a sufficient level of analysis to determine whether the loans or participations purchased are consistent with the board’s risk appetite and comply with loan policy guidelines prior to committing funds, and on an ongoing basis,” the more complete memo reads. “This assessment and determination should not be contracted out to a third party.”

A law firm with specialized knowledge of the industry, criticized the FDIC’s move when they wrote on their website, “Ironically, given the Treasury Department’s recent request for information, which supported marketplace lending and focused in part on how the federal government could be supportive of the innovations in marketplace lending, we now have a federal banking agency that is creating roadblocks to having banks participate in this dynamic and rapidly growing space.”

Asking banks not to rely on marketplace scoring models alone hardly seems like a roadblock, especially when the models are tucked away in algorithmic obscurity, have hardly been around for very long, and would decide the fate of depositor money. And if this directive indeed contributed to Lending Club’s transparency reversal, then it couldn’t have been any more well-timed.

Asking banks not to rely on marketplace scoring models alone hardly seems like a roadblock, especially when the models are tucked away in algorithmic obscurity, have hardly been around for very long, and would decide the fate of depositor money. And if this directive indeed contributed to Lending Club’s transparency reversal, then it couldn’t have been any more well-timed.

Whether or not the added data points will make any difference to the performance of investment portfolios is irrelevant. If unaccredited investors and/or depositor money are the source of marketplace loan funding, then Lending Club has a responsibility to disclose as much as possible, no matter how little value they believe certain pieces of information are worth. The 15 additional points are a welcome announcement. The question going forward should be, what else can they disclose?

As a company that pledged so strongly to protect corporations from transparency issues in the developing commercial finance market, they should be trying twice as hard to protect the unsophisticated consumers that invest in the loans they approve and make available for investing. Some of these consumers are prodded into putting their retirement funds on the platform and we all know some people will irresponsibly place their entire retirement portfolio in it. The “Number of credit union trades” a borrower has might not unlock the secret to better investing performance but if it’s something Lending Club knows, the investing public deserves to know it too, if only in the name of transparency which they have so committed themselves to uphold…