Again? Wells Fargo Fined $100 Million for Creating Fake Accounts

September 8, 2016The CFPB fines Wells Fargo, again — this time for opening unauthorized deposit and credit card accounts.

The agency fined the bank $100 million after employees opened “more than two million deposit and credit card accounts” unbeknownst to borrowers, racking up fees and charges, the CFPB said in a statement. Wells Fargo is also required to pay $2.5 million in customer refunds.

According to an internal analysis conducted by the bank, employees opened 1.5 million deposit accounts and 565,000 credit card accounts, issued debit cards and enrolled customers to online banking without consent, for bonuses and meeting sales goals.

“Wells Fargo employees secretly opened unauthorized accounts to hit sales targets and receive bonuses,” said CFPB Director Richard Cordray. “Because of the severity of these violations, Wells Fargo is paying the largest penalty the CFPB has ever imposed. Today’s action should serve notice to the entire industry that financial incentive programs, if not monitored carefully, carry serious risks that can have serious legal consequences.”

This is strike two for Wells Fargo from the CFPB which alleged that the bank indulged in illegal student loan practices by charging consumers illegal fees, not reporting credit score information accurately and a failure to provide adequate disclosures for payment information. The bank agreed to settle the case for $4 million.

Alleged Illegal Student Loan Practices Cost Wells Fargo $4 Million

August 23, 2016Without admitting or denying any of the CFPB’s findings, Wells Fargo has consented to a $3.6 million fine over alleged unfair penalties imposed on certain student borrowers. They must pay another $410,000 to cover consumer injuries.

The South Dakota-based Education Financial Services is a division of Wells Fargo that lends to approximately 1.3 million consumers in all 50 states.

“If a borrower made a payment that was not enough to cover the total amount due for all loans in an account, the bank divided that payment across the loans in a way that maximized late fees rather than satisfying payments for some of the loans,” CFPB said in a statement.

The bank also misled borrowers on partial payments, charged certain consumers late fees for payments made on the last day of the grace period and also failed to correct inaccurate information on credit reports of borrowers.

Reuters quoted a Wells Fargo spokesperson saying that the settlement revolves around procedures that were retired or improved many years ago and impacts a small number of customers.

The bureau also required the bank to provide consumers with disclosures explaining how the bank applies and allocates payments and correct inaccurate information on borrower credit reports.

California Finance Lenders Law Licensing Compliance for Merchant Cash Advance Financiers

August 2, 2016 Since the Richard B. Clark v. AdvanceMe Inc. class action case settlement was brought to the awareness of the Merchant Cash Advance (“MCA”) industry, many MCAs applied and obtained a California Finance Lenders Law License from the Department of Business Oversight. (“DBO”)

Since the Richard B. Clark v. AdvanceMe Inc. class action case settlement was brought to the awareness of the Merchant Cash Advance (“MCA”) industry, many MCAs applied and obtained a California Finance Lenders Law License from the Department of Business Oversight. (“DBO”)

After your company obtains a California Finance Lenders Law license, it will then need to comply with the California Finance Lenders Law. (“CFLL”)

CFLL does not contain specific financial code sections and regulations to regulate MCAs. However, CFLL regulates consumer and commercial loans. So, MCAs licensed under the CFLL will need to comply with the code sections and regulations that apply to commercial loans, assuming that MCAs provide advances that are each “bona fide” $5,000 or more in principal amount and for commercial purposes.

The MCA contract you use when making advances in other states is likely not in compliance with CFLL. CFLL regulation includes without limitation, (either directly or by incorporation of other California and federal laws) the rates and charges, marketing and advertising, disclosures, contractual provisions, electronic transactions, collections, credit applications, default and repossession, brokers and finders, and general operations of main and branch offices.

The CFLL license application requires the MCA company’s principal (corporate officer or LLC manager) to acknowledge on behalf of the MCA company, that it read the contents of and is familiar with the CFLL, and that it agrees to comply with the CFLL.

Lack of compliance can be brought to the attention of DBO’s enforcement officials as a result of either, a customer or competitor complaint, a DBO audit, through the Annual Report that must be filed by CFLL licensees by March 15 of each year, or by other means.

It is important to not only obtain the CFLL license, but to also comply with the CFLL to keep the license. DBO publishes online enforcement actions, such as Desist and Refrain Orders and Accusations. A CFLL licensee has a right to request an administrative hearing to defend itself and present its case. Unfortunately, although the legality of this practice by DBO is questionable, DBO publishes online none-final (and also final) administrative enforcement actions such as Desist and Refrain Orders (“D&Rs”) and Accusations. (publishing of final administrative orders is specifically authorized by the Financial Code but not none-final orders) Potential customers and competitors who review none-final D&Rs, are under the mistaken belief that the D&R is a final order, and may therefore refuse to conduct business with the licensee.

MCAs who are either CFLL licensees or potential licensees should familiarize themselves with CFLL law to avoid administrative enforcement actions, court actions, loss of business, and other adverse repercussions.

FIRE DRILL IN ILLINOIS: BUSINESS FUNDING COMPANIES TARGETED IN REPRESSIVE BILL

June 30, 2016* Update 6/30 AM: Sen. Jacqueline Collins, D-Chicago is expected to introduce a revised bill today.

** Update 6/30 PM: Reintroduction of the bill has been delayed while they wait for comments from additional parties

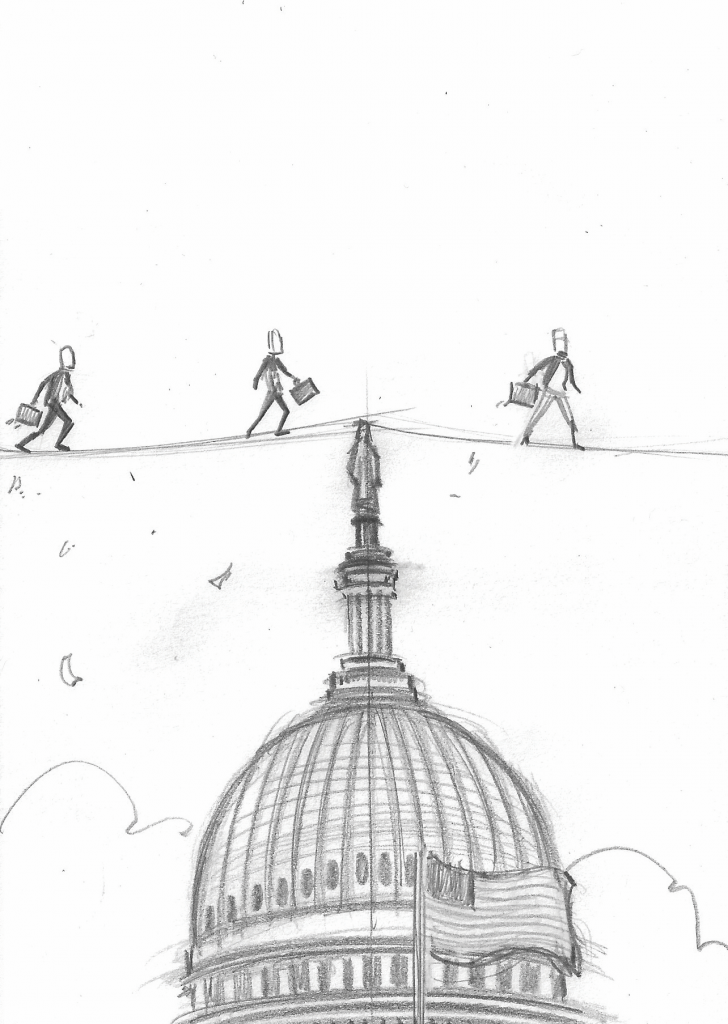

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Bankers and non-bank commercial lenders – two groups that often disagree – are united in their opposition to financial regulation proposed in Illinois. Both contend that if the state’s Senate Bill 2865 becomes law it could choke the life out of small-business lending in the Land of Lincoln and might set a precedent for a nightmarish 50-state patchwork of rules and regulations.

Foes say the measure was created to promote disclosure and regulate underwriting. They don’t argue with the need for transparency when it comes to stating loan terms, but they maintain that a provision of the bill that would cap loan payments at 50 percent of net profits would disrupt the market needlessly.

Opponents also regard the bill as an encroachment on free trade. “The government shouldn’t be picking winners or losers – the market should be,” said Steve Denis, executive director of the Small Business Finance Association, a trade group for alternative funders.

The states or the federal government may need to protect merchants from a few predatory lenders, but most lenders operate reputably and have a vested interest in helping clients succeed so they can pay back their obligations and become repeat customers, several members of the industry maintained.

“The ability to pay is really a non-issue,” noted Matt Patterson, CEO of Expansion Capital Group and an organizer of the Commercial Finance Coalition, another industry trade group. “I don’t make any money if a borrower doesn’t pay me back, so I don’t make loans where I think there is an inability to pay.”

Outsiders may find interest rates high for alternative loans, but companies providing the capital face high risk and have a short risk horizon, said Scott Talbott, senior vice president of government affairs for the Electronic Transactions Association, whose members include purveyors and recipients of alternative financing. Several other sources said the risks justify the rates.

Besides, a consensus seems to exist among industry leaders that most merchants – unlike many consumers – have the sophistication to make their own decisions on borrowing. Business owners are accustomed to dealing with large amounts of money, and they understand the need to keep investing in their enterprises, sources agreed.

In fact, no one has complained of any small-business lending problems in Illinois to state regulators, said Bryan Schneider, secretary of the Illinois Department of Financial and Professional Regulation and a member of Gov. Bruce Rauner’s cabinet.

Regulators should not indulge in creating solutions in search of problems, Sec. Schneider cautioned. “When you’re a hammer, the world looks like a nail,” he said, suggesting that regulators sometimes base their actions on anecdotal isolated incidents instead of reserving action to correct widespread problems.

But the proposed legislation could itself cause problems by placing entrepreneurs at risk, according to Rob Karr, president and CEO of the Illinois Retail Merchants Association, which has 400 members operating 20,000 stores. “It would stifle potential access to capital for small businesses,” he warned.

Quantifying the resulting damage would present a monumental task, but a shortage of capital would clearly burden merchants who need to bridge cash-flow problems, Karr said. Shortfalls can result, for example, when clothing stores need to buy apparel for the coming season or hardware stores place orders in the summer for snow blowers they’ll need in six to eight months, he said.

Restaurant owners and other merchants who rely on expensive equipment also need access to capital when there’s a breakdown or a need to expand to meet competition or take advantage of a market opportunity, Karr observed.

Capital for those purposes could dry up because just about anyone providing non-bank loans to small merchants could find themselves subject to the proposed legislation, including factoring companies, merchant cash advance companies, alternative lenders and non-bank commercial lenders, said the CFC’s Patterson.

Banks and credit unions are exempt, the bill says, but a page or two later it includes provisions written so broadly that it actually includes those institutions, said Ben Jackson, vice president of government relations at the Illinois Bankers Association.

Trade groups representing all of those financial institutions – including banks and non-banks – have joined small-business associations in working against passage SB 2865. “The most important thing is to make sure we’re coordinating with the other groups out there,” the SBFA’s Denis contended. “Actually, Illinois was good practice for the industry in how we’re going to go about dealing with attempts at regulation.”

Patterson of the CFC agreed that associations should coordinate their responses to proposed legislation. “We’ve tried to gather all the affected players in the space and have dialogue with them,” he maintained.

Even though that various associations reacting to the bill generally agreed on principles, their competing messages at first created a cacophony of proposals, according to some. “There was a lot of noise, and I think we’ll all learn from that,” Denis said. “The industry has to learn to speak with one voice to legislators.”

Citing the complexity of dealing with 50 states, 435 members of Congress and 100 senators, Denis said everyone with an interest in small-business lending must work together. “If we don’t, we lose,” he warned.

Many of the groups came together for the first time as they converged upon the Illinois capital of Springfield last month when the state’s Senate Committee on Financial Institutions convened a hearing on the bill. The committee allowed testimony at the hearing from three groups representing opponents. The groups huddled and chose Denis, Jackson and Martha Dreiling, OnDeck Capital Inc. vice president and head of operations.

City of Chicago Treasurer Kurt Summers was the only witness who testified in favor of the bill, according to Jackson. The idea of regulating non-bank commercial lenders in much the same way Illinois oversees lending to individuals arose in Summers’ office, said an aide to Illinois Sen. Jacqueline Collins, D-Chicago. Sen. Collins serves as chairperson of the Financial Institutions Committee and introduced to the bill in the senate.

Sen. Collins declined to be interviewed for this article, and Treasurer Summers and other officials in his of office did not respond to interview requests. However, published reports said Drew Beres, general counsel for Summers, has maintained that transparency, not underwriting, is the main goal. Talbott has met with Sen. Collins and said she’s interested primarily in transparency.

Support for the bill isn’t limited to the Chicago treasurer’s office. Some non-profit lending groups and think tanks back the proposed legislation, opponents agreed. The bill appeals to progressives attempting to shield the public from unsavory lending practices, they maintained.

Politicians may view their support of the bill as a way of burnishing their progressive credentials and establishing themselves as consumer advocates, said opponents of the legislation who requested anonymity. “It’s an important constituency,” one noted. “No one is against small business.”

After listening to testimony at the hearing, committee members voted to move the bill out of committee for further progress through the senate, Jackson said. Eight on the committee voted to move the bill forward, while two voted “present” and one was absent. But most of the senators on the committee said the legislation needs revision through amendments before it could become law, according to Jackson.

The legislative session was scheduled to end May 31. If the bill didn’t pass by then it could come up for consideration in a summer session if the General Assembly chooses to have one, Jackson said. If it does not pass during the summer, it could come to a vote during a two-week “veto session” in the fall or in an early January 2017 “lame duck session.” Unpassed legislation dies at that point and would have to be reintroduced in the regular session that begins later in January 2017, he noted.

Although time is becoming short for the proposed legislation, it’s a high-profile measure that could prompt action, particularly if amendments weaken the rule for underwriting, Jackson said. The Illinois General Assembly sometimes passes important legislation during lame duck sessions, he said, noting that a temporary increase in the state sales tax was enacted that way.

Whatever fate awaits SB 2865, some in the alternative funding business have suspected that the bill came about through an effort by banks to push non-banks out of the market. But cooperation among groups opposed to the proposed legislation appears to lay that notion to rest, according to several sources.

“I don’t get that impression,” Denis said of the allegation that bankers are colluding against alternative commercial lenders. “I think this shows banks and our industry can get together and share the same mission.”

Talbott of the ETA also counted himself among the disbelievers when it comes to conspiracy theories against alternative lenders. “I’d say that’s a misreading of the law and not the case,” he said. “Traditional banks oppose this because it would effectively reduce their options in the same space.”

The interests of banks and non-banks are beginning to coincide as the two sectors intertwine by forming coalitions, noted Jackson of the state bankers’ association. A number of sources cited mergers and partnerships that are occurring among the two types of institutions.

In one example, J.P. Morgan Chase & Co. is using OnDeck’s online technology to help make loans to small businesses. Meanwhile, in another example, SunTrust Banks Inc. has established an online lending division called LightStream.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

At the same time, alternative funders who got their start with merchant cash advances and later added loans are contemplating what their world would be like if they turned their enterprises into businesses that more closely resembled banks.

And however the industries structure themselves, the need for small-business funding remains acute. Banks, non-banks and merchants agree that the Great Recession that began in 2007 and the regulation it spawned have discouraged banks from lending to small-businesses. The alternative small-business finance industry arose to fill the vacuum, sources said.

That demand draws attention and could lead to bouts of regulation. Although industry leaders say they’re not aware of legislation similar to Illinois SB 2865 pending in other states, they note that New York state legislators discussed small-business lending in April during a subject matter hearing. They also point out that California regulates commercial lending.

Many dread the potential for unintended results as a crazy quilt of regulation spreads across the nation with each state devising its own inconsistent or even conflicting standards. Keeping up with activity in 50 states – not to mention a few territories or protectorates – seems likely to prove daunting.

But mechanisms have been developed to ease the burden of tracking so many legislative and regulatory bodies. The CFC, for instance, employs a government relations team to monitor the states, Patterson said. The ETA combines software and people in the field to deal with the monitoring challenge.

And regulation at the state level can make sense because officials there live “close to the ground,” and thus have a better feel for how rules affect state residents than federal regulators could develop, Sec. Schneider said.

Easier accessibility can also keep make regulators more responsive than federal regulators, according to Sec. Schneider. “It’s easier to get ahold of me than (Director) Richard Cordray at the Consumer Financial Protection Bureau,” he said.

Also, state regulators don’t want to take a provincial view of commerce, Sec. Schneider noted. “As wonderful as Illinois is, we want to do business nationwide,” he joked.

State regulators should do a better job of coordinating among themselves, Sec. Schneider conceded, adding that they are making the attempt. Efforts are underway through the Conference of State Bank Supervisors, a trade association for officials, he said.

At the moment, state legislatures and federal regulators have small-business lending “squarely on their agenda,” the ETA’s Talbott observed. The U.S. Congress isn’t paying close attention to the industry right now because they’re preoccupied with the elections and the presidential nominating conventions, he said.

The goal in Illinois and elsewhere remains to encourage legislators to adopt a “go-slow approach” that affords enough time to understand how the industry operates and what proposed laws or regulations would do to change that, said Talbott.

At any rate, the industry should unite in a proactive effort to explain the business to legislators, according to Denis. “We need to work with them so that they understand how we fund small businesses,” he said. “That’s the way we can all win.”

Transparent Pricing Creates a Level Playing Field, says Kabbage’s Kathryn Petralia

June 7, 2016 Loan matchmaking site Lending Tree has joined the Innovative Lending Platform Association (ILPA) to participate in developing a universal small business lending disclosure system to raise transparency with lenders. It will work closely with the association over a 90-day “national engagement period” to create and implement the SMART Box (Straightforward Metrics Around Rate and Total Cost).

Loan matchmaking site Lending Tree has joined the Innovative Lending Platform Association (ILPA) to participate in developing a universal small business lending disclosure system to raise transparency with lenders. It will work closely with the association over a 90-day “national engagement period” to create and implement the SMART Box (Straightforward Metrics Around Rate and Total Cost).

AltFinanceDaily spoke to Kathryn Petralia, cofounder of Kabbage Loans, which is spearheading the association with OnDeck and CAN Capital. Below are the edited excerpts from the interview:

Tell us about how the ILPA came about?

We (OnDeck, CAN Capital and Kabbage) represent the largest non bank lenders. We have collectively lent $12 billion through the course of our businesses and so we thought it will be great for us to make a statement through ILPA. We came from a perspective that there are a lot of different products for small businesses on the market like merchant cash advance, equipment financing, invoice factoring and lines of credit. All of these serve different needs and are ambiguously priced. So we wanted to find some methodology which is transparent to borrowers so they can know the exact price and total cost of borrowing.

We want to keep it open and hope that everyone participates in the disclosure methodology so borrowers can have a clear understanding of the fees they are paying.

What is SMART Box. How does it work?

Different loan products have different fees — some have maintenance fees, some have broker fees, usage fees and so on and they are all structured very differently. It can get very confusing and so we came up with all the products to understand what disclosures would be necessary to know the total cost of borrowing. We’re working with OnDeck and CAN Capital to gather comments and disclose a series of methodologies that will create the ‘Straightforward Metrics Around Rate’ and Total Cost or SMART Box. Those who want to participate will have to disclose it on loan agreements to their customers.

What about disclosures by companies? Would you say the industry needs more regulation on that front?

Kabbage and other companies in the industry are all regulated and go through FDIC audits. We all follow KYC, CIP, FFIEC guidelines that refer to lenders. We all follow these regulations and I would argue vociferously that we are regulated businesses already. All companies are very different and there are a bunch of things happening — states like California, Illinois and New York and CFPB are all taking interest in small business lending and it’s a positive that they recognize the partnership between banks and tech companies. On the general lending side, we have Dodd-Frank and Madden vs Midland which look at lending issues. Some of the regulation is around how loans are sold and some of it is around how they are limited. And on the small business lending side, there is push for more transparency which is the reason we launched ILPA. We wanted to set the standard for what that would look like. And having it done comprehensively is beneficial for us as it gives us a level playing field.

On the consumer lending side, there is transparency but it’s still lacking a comprehensive system that encapsulates the total cost of borrowing. APR is a great metric but the total cost of borrowing must be included.

Give us a snapshot of what the industry looks like to you

All businesses serve different markets, are different in the way they fund their loans and operate in different geographies, so it’s hard to say but in general those who have done a good job at incorporating data and tech and streamlined operative process will have an advantage and will make it through economic turbulence.

What’s your short-term prediction?

Companies that are not well capitalized will have a tough time raising capital in 2016 and we have already been approached by a number of businesses that are looking to sell or find a partnership because they aren’t well capitalized.

Tell us what’s happening at Kabbage?

We have two businesses – the direct lending business which we are trying to grow and the second is the platform business where we have seen sustained growth, with existing partnerships with ING in Europe, Santander in the UK and Scotia Bank in Canada. More partnerships are in the offing – both domestically and in Latin America.

Here’s Why The DOJ Wants to Keep an Eye on Online Lenders

May 26, 2016

Online lending has been getting a lot of attention, but not necessarily all good.

The U.S. Justice Department is among the latest authorities to be concerned about online lending, while it’s going through a rather choppy ride.

Assistant Attorney General at the DOJ, Leslie Caldwell voiced the regulator’s concern that the loans made online were backed by investors and are without “traditional” safeguards of deposits that banks rely on. Although alternative lending is still a small part of the lending industry, DOJ wants to keep an watchful eye to avoid another mortgage crisis-like situation.

“I’m not saying … that we’ve uncovered a massive fraud, but just that there’s a potential for things to go awry, like when underperforming loans were being sold in residential mortgage-backed securities,” Caldwell told Reuters.

And while the DOJ questions Lending Club, New York’s financial regulator is said to have sent letters to 28 online lenders seeking information on loans made in the state.

The New York Department of Financial Services first subpoenaed Lending Club on May 17th, seeking information about fees and interest on loans made to New Yorkers. Bloomberg reported that the regulator has sent letters to 28 firms including Funding Circle and Avant asking for similar disclosures. The full contents of those letters have not been made public yet, but Reuters seemed to characterize them as being perhaps more aggressive than the inquiry in California six months ago.

Most lenders, the NYDFS will likely learn, are relying on preemption granted under the National Bank Act or Federal Deposit Insurance Act. Chartered banks covered under these laws are typically the entities in question making the actual loans. The “online lenders” buy the loans from the banks and service them. But absent that structure, it is possible that New York could model future regulation on California’s system, where lenders must go through a vetting process and be licensed.

Online lenders dependent on chartered banks to enjoy preemption have slightly less reason to be worried after the US Solicitor General recently filed a response to the US Supreme Court’s request, that argued the Second Circuit’s ruling in Madden v Midland, a case that challenged preemption, was simply incorrect.

Lending Club Faces Pressure to Redeem An Entire Industry

May 15, 2016

In the wee early morning hours of May 3rd, I finally wrapped up the latest AltFinanceDaily story and hit the publish button. Then as I made my way off to bed, I started to second guess the headline. Titled, Is The Marketplace Lending Apocalypse Upon Us?, I fretted over whether or not it was overly sensational.

Apocalypse. Apocalypse. Apocalypse, I repeated over and over in my head.

As I tossed and turned for an hour, I worried that thousands of readers would think AltFinanceDaily was crossing over into tabloid territory. I decided to leave it up anyway, certain enough at least that the clouds forming over the horizon signaled the arrival of a dark storm.

Less than a week later, Lending Club’s famous CEO would resign in disgrace in a scandal that also brought down several other employees. The company would delay its quarterly earnings report and the stock would drop by more than 50% over the course of just a few days. Closely related companies like OnDeck would be dragged down by the news, Wall Street banks would announce suspensions of securitizations, and community banks would halt the purchases of Lending Club loans. Blackstone Group would end its planned foray into online lending and banks like Wells Fargo, smelling blood in the water, would strike at the heart of some marketplace lenders by announcing a new technology-enabled product.

Reporters from all types of media outlets would contact me to ask what I thought of it all and I spoke from my gut in some of them.

Little details would trickle out, such as a whistle-blower submission to the SEC last July over Lending Club’s disclosure practices and another board member’s stake in a little known company named Cirrix Capital would be called into question. The non-stop fearmongering headlines from the media definitely didn’t help.

Lending Club’s complete silence after Monday morning’s announcement only made it worse. Those who buy notes on their platform never received a single communication about it, a fact that might be entirely related to quiet period rules surrounding the release of quarterly earnings. For some platform users, that continued silence fed into even the most rational investors’ worst fears.

On the LendAcademy forum for example, some users argued that Lending Club could be facing bankruptcy before the end of the year. Many who were more calm but still concerned, indeed said they were refraining from purchasing new notes until they got further guidance just to be safe. Others ventured off into complete paranoia while rational minds tried to reel them back to reality. As someone who has a significant Lending Club portfolio, I found myself shifting back and forth between those roles.

Everything is fine. Or is it?! No, everything should be fine. BUT WHAT IF IT’S NOT?!!

On Monday, In what will be a semi-post-apocalyptic world, Lending Club will have a lotta ‘splainin to do. New CEO Scott Sanborn will be tasked with restoring order to the world of marketplace lending. His predecessor, Renaud Laplanche, was the face of peer-to-peer finance. He was an icon. As the four-time keynote speaker of LendIt, Laplanche’s persona assured a skeptical public that disruption in lending was true Silicon Valley innovation, not Wall Street engineering. This lending marketplace could not possibly be risky, one might have supposed, because it looked so charmingly French. The intellectual in the red vest with a degree from école des Hautes Etudes Commerciales de Paris did not look and sound like Dick Fuld from New York City. And yet Lending Club’s offense that led to Laplanche’s departure, opened it up to comparison to the shoddy mortgage origination market in the early 2000s that led to Lehman Brothers’ collapse and the Great Recession.

This week, Scott Sanborn will have to make a most convincing argument to restore belief in the movement. Regulators, legislators, investors, and borrowers alike, have pegged at least some of their perceptions surrounding fintech to Lending Club. What happens this week may very well decide the future of online lending altogether. For Sanborn, those are some very big shoes to fill, or in Lending Club’s case, it will all depend on how good he looks in his red vest.

Autres temps, autres mœurs

Godspeed.

Online Lending APR ‘SMART Box’ To Apply To Loans, Not Merchant Cash Advances

May 5, 2016

OnDeck, Kabbage and CAN Capital have launched an initiative to make online loan shopping easier. Dubbed the SMART (Straightforward Metrics Around Rate and Total Cost) Box, these lenders plan to present small businesses “with a chart of standardized pricing comparison tools and explanations, including various total dollar cost and annual percentage rate metrics that enable a comprehensive pricing comparison of loans of equivalent duration.”

The Box, clearly meant to increase transparency, was explained in an ironically confusing way, particularly where it said it would include annual percentage rate metrics. An Annual Percentage Rate (APR) is indeed a representation of several metrics and thus it wasn’t clear if the Box would just include some of these individual metrics and conveniently leave out the APR itself.

OnDeck CEO Noah Breslow for example told Forbes only six months ago that annual terms don’t make sense. “The APR overstates the actual cost of the loan to the borrower,” he said. He was not alone in thinking that way. Several studies have concluded too that merchants don’t always even know what APR represents. Lendio for example, found that two-thirds of small businesses selected the total dollar cost of a loan as the easiest to understand. Only 17.4% said the APR was the easiest.

And there’s another thing, the fact that CAN doesn’t just do loans, they also do a significant amount of merchant cash advances. What role could an APR have there? While the Box’s final system won’t be decided until after the conclusion of a 90-day national engagement period that begins next month, one can only imagine that it might have a Schumer Boxer feel to it.

Via: NerdWallet

The syntactic ambiguity in the announcement however was unintentional. A spokesperson for the group (Known as the Innovative Lending Platform Association) said that the SMART Box will indeed include Annual Percentage Rates.

But that’s where loans are concerned…

When AltFinanceDaily asked about merchant cash advances, Daniel Gorfine, vice president and associate general counsel of OnDeck; Parris Sanz, Chief Legal Officer of CAN Capital and Azba Habib, assistant general counsel of Kabbage, submitted the following joint response:

“As part of the SMART Box initiative, we are interested in engaging with providers of MCA products. Based on consistent assumptions about a small business’s future sales volumes and its ability to deliver the contracted amount of receivables within the period of time estimated during underwriting, the SMART Box could apply to MCA products.”

So long as SMART Box disclosure is voluntary, an MCA company could perhaps employ their own version of it. It just might come sans APR given the product’s history with state regulations. The Association is emphatic however that this concept could be used by MCA companies and others in the small business financing space. After all, the initiative is rooted in transparency for the small business owner, they say.

In September, the Association “will encourage those interested in promoting the responsible development of the small business lending industry to voluntarily adopt or support the model disclosure.”

Given the level of influence these companies have on the industry, the voluntary nature of the SMART Box has the potential to spark an industry-wide box revolution. MCA companies however would need to structure transparent disclosure around their contractual frameworks. But even that could be a good thing. One commercial financing broker for example, posted a redacted service fee agreement to the DailyFunder forum earlier this week that purported to show another broker trying to charge a merchant a 26% premium (26% of the funding amount) for their work. Despite this unusually high cost, the charge itself was hard to find, hidden among fine print on an otherwise benign looking page. Naturally, others in the industry did not respond kindly to it. Even other brokers referred to it as “outrageous,” “nonsense,” or “bs.”

Their reactions make clear that there is a desire for transparency even among the group most often blamed for the lack thereof. Some of the industry’s forward thinkers have told AltFinanceDaily that a system like a SMART Box is the future of the industry whether one agrees with it or not. And if not for the sake of small businesses and regulators, then for the sake of being able to compete fairly against companies that may be relying on truly hidden fees.

SMART Box. All aboard the transparency train?