Industry Representatives to Testify at California Hearing

April 18, 2018

Several people will be testifying in front of the Senate Committee on Banking and Financial Institutions in California today. Among them are Joe Looney, COO & GC at RapidAdvance, who will be speaking on behalf of the Small Business Finance Association, and Katherine Fisher, Partner at Hudson Cook LLP, who will be speaking on behalf of the Commercial Finance Coalition.

At issue is SB 1235, a bill that would require providers of commercial financing to provide disclosures about the cost of that financing to the recipients of the financing.

Industry analysts believe the bill could have implications not just for small business lending but also for factoring and merchant cash advance.

Update: Full video of the hearing below

I Got Funded, Again

March 1, 2018 One year after I received a 12-month loan from Square on fixed monthly ACH, I logged onto my dashboard to renew. I was pre-approved to do it all over again, the screen indicated, but the monthly ACH payment option had disappeared. In its place, Square offered to withhold a fixed percentage of my credit card sales going forward until the balance was paid in full.

One year after I received a 12-month loan from Square on fixed monthly ACH, I logged onto my dashboard to renew. I was pre-approved to do it all over again, the screen indicated, but the monthly ACH payment option had disappeared. In its place, Square offered to withhold a fixed percentage of my credit card sales going forward until the balance was paid in full.

Known as a “split,” diverting a percentage of the card payment proceeds to a financial company is straight out of the merchant cash advance playbook. Square, however, structures their transactions as loans. That means that regardless of how my sales ebb and flow, I must pay off my balance in full in 18 months.

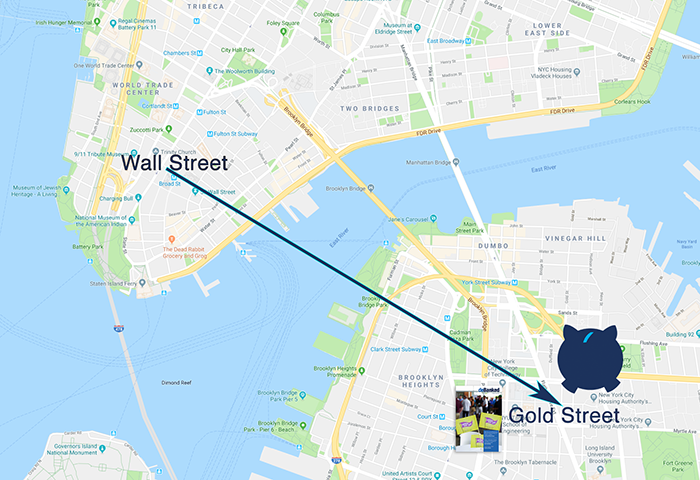

I was okay with that. I had to be. It was that time of year when working capital is very important, the holidays. Not to mention, AltFinanceDaily was in the process of moving, again. If you recall in December of 2016, we moved to a slightly larger office in the same building on Wall Street. In December of 2017, however, we moved from Manhattan to Brooklyn, a process that was a little more involved.

But this loan had no monthly payment, just a 15.75% split. Others may refer to this as the holdback, withhold, or specified percentage. Square’s application process this time around was slightly more rigorous than a year ago, a few more buttons, a couple more disclosures, and even a notice that a review could take between 1-3 days. I was still approved the same day, however, and had funds the next. There were no hidden fees or closing costs.

Six days after being funded, I ran a charge, Square took their split, and I netted the different minus the interchange fees. I noticed, but in a way I didn’t. I didn’t have to worry about how much the monthly payment would be and when. The loan was being repaid all by itself. That was how I processed it psychologically anyway, as I imagine many other small business owners have as well.

And the feeling of relief from impending monthly payments is not entirely mental. Seven weeks later, I was already 17% paid off. That’s real progress, especially with a 65-week window remaining to pay off in full.

Had the same transaction been structured as a merchant cash advance, the timeframe would’ve been unlimited. But hey, I guess sometimes you can’t have it all. It was a 1.10 factor rate, decent by industry standards, certainly not the most expensive, but not the least expensive either. It was fast, it was helpful, and best of all, it was free from the burden of fixed monthly payments.

I got funded again and loved it. What are you still waiting for?

Editors Note: AltFinanceDaily did not collaborate with Square in the writing of this editorial. Square did not even contact us after I published my first experience with their product one year ago. It is unclear if they are even aware that I wrote anything at all. Square is not an advertiser nor have they sponsored any of our events. I did not attempt to interview them for this write-up or tip them off that I would be writing anything. To my knowledge, we did not receive any special benefit or pricing. AltFinanceDaily chose Square for funding in part to avoid the conflict of writing a review about a paying advertiser or sponsor.

Minority-Owned Businesses Present Opportunities for Online Lenders

February 27, 2018

Research consistently shows that minority-owned businesses have a harder time accessing capital than other businesses. Online financing has the potential to change this.

Most of the online funding process is based on objective factors such as your business type and revenue. When you apply for funds online, it’s harder to discern things like the color of your skin or your ethnicity—factors which research shows can sometimes play into the face-to-face lending process, even though it’s illegal and immoral. What’s more, applying for funds online eliminates the stigma that keeps many minority-owned businesses from walking into a bank to apply for a loan, according to industry participants.

“Many minorities are hesitant to go into a bank,” says Louis Green, interim president of The National Minority Supplier Development Council, which provides business development opportunities for certified minority-owned businesses. He says the growth of online lending platforms will potentially open more doors for minority-owned businesses to get much-needed capital to operate and expand.

“The beauty of things on the Internet is that it has the ability to take away discriminatory issues,” says Green, who is also the chief executive of Supplier Success LLC, a Detroit-based business that offers online business financing solutions.

Certainly, minority-owned small businesses are a large and growing market. There were 8 million minority-owned firms in the U.S. as of 2012, according to U.S. Census Bureau data. Minority-owned firms represented 28.8% of all U.S. firms in 2012.

Historically, however, minority-owned businesses have had trouble getting access to credit for a host of reasons, and recent research suggests the problems persist.

A report published in November by the Federal Reserve Banks of Cleveland and Atlanta examines the results of an annual survey of small business owners. The report found that while many minority small businesses were profitable, a significant majority faced financial challenges, experienced funding gaps and relied on personal finances.

A report published in November by the Federal Reserve Banks of Cleveland and Atlanta examines the results of an annual survey of small business owners. The report found that while many minority small businesses were profitable, a significant majority faced financial challenges, experienced funding gaps and relied on personal finances.

Some of the trouble obtaining financing may have discriminatory underpinnings. For instance, a recent working paper by researchers at Utah State University, Brigham Young University and Rutgers University, among others, suggests that minorities were more highly scrutinized for loans than other applicants. For instance, African American “mystery shoppers” underwent a higher level of scrutiny and received a lower level of assistance than their less-creditworthy Caucasian counterparts, according to the study.

Also, African American testers were asked significantly more often about their marital status and their spouse’s employment. This “marks another and even illegal differential experience for these minority entrepreneurial consumers compared with the Caucasian shoppers,” the study finds.

To be sure, other factors are also likely to blame. For instance, the average credit score of a minority small-business owner is 707, which is 15 points lower than the overall average for small-business owners in the U.S., according to a 2016 study by credit bureau Experian.

Even so, the bias issue remains a stark possibility in at least some cases. A 2010 report by the Minority Business Development Agency (MBDA) offers data to show that minority-owned firms are less likely to receive bank loans than non-minority-owned firms. Among all minority firms, 7.2 percent received a business loan from a bank compared with 12.0 percent of non-minority firms, according to the report. High sales minority-owned firms were more likely to receive bank loans with 23.3 percent receiving this source of startup capital. By contrast, 29.2 percent of high sales non-minority firms received bank loans, the data shows.

To be sure, it’s very difficult to prove discrimination when a bank loan is denied. A few years ago, a mortgage banker who asked not to be named, says he suspected discrimination when an Asian couple he worked with was denied a small bank loan. While he didn’t have rock solid proof, he felt the bank’s stated reasoning for turning down the loan was unjustified and he tried going to bat for the couple. His efforts were rebuffed, however, and the loan was denied.

Based on the size of the loan and the couple’s finances, the banker says the loan would have easily been approved by an online provider that was looking only at objective factors. “They see the numbers they’ve been given and calculate risk and make decisions based purely on numbers,” he says.

Indeed, this is where online lending has already shown significant potential. Alicia Robb, a research fellow at the Atlanta Federal Reserve who co-authored the November report by the Cleveland and Atlanta Federal Reserves, says when controlling for credit score and other business-related factors, the data shows that minority businesses have a better shot at getting loans approved online than they do at a large or small bank.

Industry participants say the online funding process can be a boon for minority business owners because it strips subjective reasoning out of the decision-making process. Instead of presenting themselves, applicants are presenting what their business looks like financially, and funders are making highly automated decisions based on the information provided.

“Humans make terrible decisions. The more you can eliminate human bias in the process the better,” says Kathryn Petralia, co-founder and president of Kabbage. She says 95 percent of the online lender’s customers have an entirely automated experience, which includes validating their identity using digital processes. “We never see a picture of them or know anything about their ethnicity or demography,” she says.

Even funders who do ask for photo identification say that doesn’t happen until after applicants have been approved. And even then, it’s just to “make sure that the person you are funding is actually the person you are funding and no one is trying to defraud you,” says Isaac D. Stern, chief executive of Yellowstone Capital LLC, a MCA funder in Jersey City, N.J. “Online financing is colorblind. It doesn’t matter if [you’re] white or Hispanic or black,” he says.

Even funders who do ask for photo identification say that doesn’t happen until after applicants have been approved. And even then, it’s just to “make sure that the person you are funding is actually the person you are funding and no one is trying to defraud you,” says Isaac D. Stern, chief executive of Yellowstone Capital LLC, a MCA funder in Jersey City, N.J. “Online financing is colorblind. It doesn’t matter if [you’re] white or Hispanic or black,” he says.

Dean Sioukas, chief executive of Magilla Loans, an online search engine that matches prospective borrowers and lenders, has hope that the anonymity of the online funding process could eventually make the off-line process more equitable for all applicants. After accepting a number of solid proposals from viable lending opportunities—without knowing any personal information about the applicant—his hope is that whatever biases a loan officer may previously have had will dissipate, he says. Funding decisions should only be made on objective criteria, he says. “The rest has no place in the process.”

While in theory online lending should improve access to funds for minority-owned businesses, several industry observers say barriers remain.

One major challenge is getting the news out to minority business owners, many of whom don’t know about the online funding opportunities that exist, says Lyneir Richardson, executive director of The Center for Urban Entrepreneurship and Economic Development, a research and practitioner-oriented center at Rutgers Business School in Newark, N.J.

He suggests online lenders and funders need to do a better job of connecting with minority-owned businesses and explaining what they have to offer. He works with about 300 entrepreneurs, 70 percent of whom are minority-owned businesses. He’s held this position for 10 years, but says he’s never been approached by an online lending company to market its services, speak at one of his events, provide funding advice to business owners or in any other capacity.

“There is an opportunity for online small business lenders to market and make known, particularly to minority business owners, that they have viable, market rate lending products that can help them grow,” he says.

“There is an opportunity for online small business lenders to market and make known, particularly to minority business owners, that they have viable, market rate lending products that can help them grow,” he says.

One caveat is that rates online are often higher than traditional bank loans, so there is a trade-off for minority-owned businesses, says Brett Barkley, a senior research analyst in the community development department at the Federal Reserve Bank of Cleveland, who co-authored the November report.

Other research from the Federal Reserve shows that satisfaction levels were lowest at nonbank online lenders for both minority- and nonminority-owned firms compared with borrower satisfaction levels at small banks and large banks, he says. The satisfaction levels seem to be related to higher interest rates and “lack of transparency,” he adds. While the study doesn’t define the latter term, the findings could “point to confusion regarding the actual terms of the loan,” Barkley says.

Some online firms have taken steps to make pricing more transparent by using the SMART Box disclosure agreement, a comparison tool developed by the online lending industry to help small businesses more fully understand their financing options. There are currently three different versions of the SMART Box disclosure –for term loans, lines of credit, and merchant cash advances.

This “is a really important metric,” says Petralia of Kabbage, which offers the tool to customers.

Green, the interim president of NMSDC, says that helping its 12,000 minority-owned business members gain access to capital is a major goal for the organization. While online financing is still a largely “untapped resource” for minority businesses, it makes borrowing money easier and more appealing. “It holds great promise for minority-owned businesses, but I think the reality hasn’t met that promise yet,” he says.

Was Section 1071 of Dodd-Frank a Massive Mistake?

August 23, 2017Did Congress make a huge mistake by thinking small business loans were easily commoditized?

Pursuant to Section 1071 of Dodd-Frank, the CFPB is planning to collect data from companies engaged in small business finance in order to potentially screen for discrimination against women and minorities. Before deciding how exactly they’re going to do that, they’ve asked the public for comment, and the public… isn’t showing the law much love. Below are some excerpts of the nearly 300 responses already submitted.

We can tell all the stories we want, and hold all the hearings imaginable, and there is still no way to disguise the fact that implementing a HMDA-like reporting requirement will add cost, complexity, and rigidity to our amazingly customized lending

– Alan Gay

A loan priced properly for the risk may be acceptable for one institution and not acceptable to another. For example a client requests funds to open their second doughnut shop in town. One bank declines the loan because they do not specialize in food service business per lending policy and the banks appetite for risk. Another bank would consider the loan, however after reviewing the current competition decides that the market is saturated and the loan is too risky based on the three competitors within five miles. The third bank is willing to loan the money based on the cash flow of the owner and her husband, but will not take into account the expected cash flow from the business, and will require the collateral to include the primary residence of the client. The fourth bank is an SBA lender and proposes the client use the SBA program to mitigate the risk for the bank. The fifth bank declines the loan due to cash flows. They will not consider the revenues from the new location, because it is considered a start-up business. As I understand it the CFPB will collect the data from all five banks to determine “Fair Lending” similar to the consumer lending program. I find this problematic on many levels: I believe in the scenario presented all the lenders were fair. The data is redundant and will not show the result of credit search on the commercial loan request or accurate results.

– Doug Mitchell

Creating additional documentation and regulation only makes those in Congress and the CFPB feel better without truly adding benefit to our community and it’s businesses.

– Joseph Williams

COLLECTING AND AGGREGATING THIS INFORMATION WOULD BE A BURDEN THAT WOULD REQUIRE ADDITIONAL STAFF AND NOT CHANGE OUR HISTORY AND BUSINESS MANDATE OF SERVING OUR SMALL TOWN BUSINESSES.

– Dee Baertsch

As a community banker in rural Ohio I strongly urge the repeal of Section 1071 of the Dodd-Frank Act. The addition of another report will be counterproductive to lending to small businesses.

– Chuck Dixon

Commercial lending is a completely different animal from consumer lending, and has so many different aspects to consider. While a consumer loan is typically viewed from and ability and intent to pay by reviewing a consumer credit score and debt to income calculation, a commercial loan is viewed from not only current earnings but also projected earnings, the economic conditions surrounding the specific business/industry, competitiveness in the market, and the speed of obsolescence of the business’ products and services. It is so much more than pulling a credit report and getting the last two pay stubs.

– Brian Smith

The Race and Sex questions should be eliminated from all loans.

– David Ludwig

Our bank in particular will be unduly burdened by small business lending data collection.

– Casey D. Lewis, CRCM, First Bank & Trust

This new requirement will place a large burden on our small bank and staff as more time will be spent on data collection and reporting rather than giving the value added service to our actual customers. It also may increase the cost of credit to our borrowers in order to offset the increased compliance cost to comply.

– Anita Drentlaw

These regulation proposed by the CFPB will only act to hamper and restrict our ability to continue meet the credit need of our communities and will not provide any meaningful benefit to anyone.

– Jim Goetz

Adding new requirements to collect and report data related to these loans much like HMDA diverts time of our limited staff away from serving our customer needs and expends resources that do not help our community.

– James Milroy

The last thing I need is to spend even more of my time collecting data similar to the HMDA data we collect on other loans. It is a timely, costly and inefficient use of our resources which could be better utilized for spending more time with potential and current customers and lowering their interest rates. Very few businesses are the same which would lead to misrepresentation and baseless fair lending complaints.

– Daniel Mueller

By making our jobs harder, you are making it harder for small businesses to thrive.

– Joy Blum

I have seen first hand the negative effects of the HMDA collection and reporting to our bank. The increased work for our small bank has driven up our costs and is making it harder for us to compete. In addition to the negative impact on our bank mortgage customers pay a cost and as more and more community banks decide they can no longer provide these services the community will be left with fewer options.

– Jeff Southcott

Stop all the paper work to get a commercial loan. Enough is Enough!

– Jeff Spitzack

We are a small $65 Million dollar bank with limited personnel now being asked to police another segment of our customer base. We do not have the resources to carry out more regulatory burden.

– Girard J. Hoel, Chairman, The Miners National Bank of Eveleth

Commercial lending cannot be “commoditized” in the way that consumer lending can, nor can it be subject to simplified, rigid analysis which may generate baseless fair lending complaints.

– Steve Worrell

We are so heavily burdened with keeping up with all the changing regulations and requirements, it would be very burdensome for not only our bank, but many other community banks. There has to be a way to ensure the end results that you are looking to achieve without making it so hard on Community Banks. We feel that we have to really analyze if it is cost prohibitive to actually make the loan – and how does that help the small businesses?

– Margi Fleming

We would never decline a profit making loan because of the race or sex of the applicant. You would be appalled to know how little attention borrowers pay to the dozens of pages of disclosures required by regulation. Over disclosure is no disclosure.

– Douglas Krogh

Community banks simply do not have numbers on our side, either in manpower or funding, to seamlessly and efficiently absorb the vast and sweeping regulatory changes.

– Cheryl Hiller, 1st National Bank of Scotia

The new data collection will add additional staff at our institution. This salary will be passed on in the form of origination fees or increased rates to our small business customers. This is not fair to them, but with the increased regulatory demands by the CFPB on small business lending if this is adopted will increase their borrowing cost.

– Russell Laffitte

The burden of data collection and reporting would in effect end up costing our customers more to get a loan.

– Shannon Fuller

This tracking will be onerous on a small bank that stays competitive by maintaining a small staff like ours

– Jim Legare

Section 1071 will have a chilling effect on lenders’ ability to price for risk. This, in addition to the expense of data collection and reporting, may impact community banks’ ability to provide affordable commercial lending products and curb access to small business credit, an engine of local economic growth and job creation.

– Freeman Park

Please make every effort to prevent the added burden to small business lending and community bank processes by repealing Section 1071 of the Dodd Frank Act.

– Julie Goll

All Companies Can Now Submit Draft IPO Registrations Confidentially

June 29, 2017 There’s a reason the public never got to view BFS Capital’s September 2015 IPO registration documents. Thanks to the JOBS Act, “an emerging growth company may confidentially submit to the Commission a draft registration statement for confidential, non-public review by the Commission staff prior to public filing.” They can then choose to abandon the offering altogether without having to suffer the fate of their financial statements being made public, which is what BFS Capital did. But if they ultimately had chosen to move forward, their documents would’ve been shared in the public domain.

There’s a reason the public never got to view BFS Capital’s September 2015 IPO registration documents. Thanks to the JOBS Act, “an emerging growth company may confidentially submit to the Commission a draft registration statement for confidential, non-public review by the Commission staff prior to public filing.” They can then choose to abandon the offering altogether without having to suffer the fate of their financial statements being made public, which is what BFS Capital did. But if they ultimately had chosen to move forward, their documents would’ve been shared in the public domain.

A new decision handed down by the SEC is now expanding that privilege beyond “emerging growth companies” to all companies. That means that any company can submit draft documents confidentially. It will take effect on July 10th.

“This is an important step in our efforts to foster capital formation, provide investment opportunities, and protect investors,” said Director of the Division of Corporation Finance, Bill Hinman. “This process makes it easier for more companies to enter and participate in our public company disclosure-based system.”

The only reason BFS Capital’s confidential filing is known, is because the company broadcasted that they had filed accordingly in a press release.

“By expanding a popular JOBS Act benefit to all companies, we hope that the next American success story will look to our public markets when they need access to affordable capital,” said Chairman Jay Clayton. “We are striving for efficiency in our processes to encourage more companies to consider going public, which can result in more choices for investors, job creation, and a stronger U.S. economy.”

It is possible that other companies in the industry have filed draft registration statements, got discouraging feedback from the SEC and then decided to withdraw without any of their competitors being the wiser.

New York State Assembly Proposes Online Lending Task Force

June 5, 2017On June 2nd, the New York Assembly drafted its answer to the recent joint-committee hearing on online lending. It’s called Bill A8260, an ACT to establish a task force on online lending institutions. As it’s proposed now, the task force would include individuals from the online lending community, the small business community, the financial services industry, and the consumer protection community that would be appointed by the Assembly, Senate and Governor.

The task force would be required to present a report on the following by April 15, 2018:

(a) an analysis of data received by the department of financial services on the prevalence of these institutions in the state, specifically, how many online lenders are lending to consumers and small businesses in this state;

(b) an analysis of data received by the attorney general and division of consumer affairs regarding the number of complaints, actions and investigations related to online lending institutions;

(c) an examination of the online lending industry and the key participants therein, and an investigation and understanding of the differences in small business and consumer borrowers, lenders and markets, such as the history, business models and practices of online lending institutions including identification of interest rates charged by online lenders;

(d) an examination of how consumers are utilizing online consumer credit to manage existing debt, potentially reduce borrowing costs or access needed funds;

(e) an examination of the existing small business credit gap and small business’ use of credit and credit needs;

(f) identification of alternatives for consumers and small businesses who are unable to access traditional financing and whether new technologies can enhance access to credit;

(g) an examination of whether existing federal and state laws already provide appropriate police powers and regulation of small business and consumer lending by online lending institutions;

(h) an evaluation of the impact of any contemplated or proposed law or regulation on the small business credit gap, including a quantitative analysis of the amount of increased or decreased credit available to small businesses as a result of such law or regulation, including the extent to which access to credit would be affected under the state’s current usury laws;

(i) an analysis of the potential interaction of federal law with any contemplated or proposed state regulation;

(j) an exploration of options for multi-state collaboration to harmonize the laws and regulations of various states related to small business and consumer lending across state borders;

(k) an assessment of best practices for small business and consumer loan disclosures, including current online lending industry efforts to advanced standardized and clear information for borrowers;

(l) an assessment of whether consumer loans and small business loans are treated differently by online lending institutions and if any level of oversight should take such differences into consideration;

(m) an identification of what consumer protections exist to protect consumers in this state from predatory practices of online lending institutions; and

(n) a determination of what new measures, if any, are needed to ensure consumers are protected from deceptive or predatory lending without unduly restricting access to credit.

Once the report is delivered, the task force would be disbanded. The bill is currently in committee.

Commercial Finance Coalition Continues to Engage

June 1, 2017

A sign of a mature industry? The Commercial Finance Coalition is becoming a major liaison between the merchant cash advance industry and Washington. Just as peer-to-peer lenders and electronic payment companies have their own trade associations, the CFC is regularly engaging with legislators to offer their input where needed. And that requires a concerted effort, as evidenced by the group’s most recent trip that included meetings with 26 Members of Congress and senior staff. Those are typically separate individual meetings so you can imagine the amount of time and preparation involved.

“The Commercial Finance Coalition (CFC) conducted our third Washington, DC legislative fly-in last week,” Dan Gans, the CFC’s executive director, said to AltFinanceDaily. “Fifteen members of the organization attended as well as a few prospective members. The CFC continues to establish itself as the premier trade group in the MCA and alternative small business finance space.”

The CFC also gets involved at the state level and played a role in preventing harmful legislation in New York a few months back. Most importantly, their mission is to simply tell their story.

“Studies show that traditional banks cannot meet the overwhelming demand for small business capital in the United States and we be believe that CFC members help thousands of entrepreneurs grow and sustain their businesses,” Gans explained. “We believe it is critical to educate policy makers in Washington and in state capitals like Albany and Sacramento about the vital role our industry plays in helping small businesses achieve success.”

The CFC is not the only trade association in the industry, but they have made political engagement a focal point of their mission since they were founded 18 months ago.

Gans elaborated on this. “Since its establishment in January of 2016, the CFC has been educating Members of Congress and state legislators about MCA and non-bank small business finance. We give our members a needed voice with elected officials and regulators. I would encourage anyone in the MCA space that is not a CFC member to inquire about membership. The industry is facing many threats and it is important that groups like the CFC stand in the gap to educate government leaders about the thousands of jobs advances from our members create across the country.”

To inquire about CFC membership, they advise to please contact Mary Donohue at mdonohue@polariswdc.com or call (202) 368-9758.

Full disclosure: I have accompanied the CFC on their DC fly-ins and the engagement is every bit as real and consequential as it sounds.

Old Woes Continue to Hang Over Lending Club

May 26, 2017 Former Lending Club CEO Renaud Laplanche at LendIt in 2016

Former Lending Club CEO Renaud Laplanche at LendIt in 2016A class action lawsuit filed against Lending Club last year isn’t going away. On Thursday, United States District Judge William Alsup denied parts of Lending Club’s motion to dismiss, meaning that the securities fraud case will continue to move forward.

The complaint touched on several issues related to former CEO Renaud Laplanche’s departure, including a conflict of interest he had with a related company named Cirrix, misreported loan volume figures, and manipulated loan data.

In one area of the decision, the judge held that allegations relating to internal controls were adequately pled in that the registration statement represented that disclosure controls and procedures were effective at a reasonable level, when in fact the company represented eighteen months later that internal controls actually suffered from various material weaknesses.

“Reasonable investors would have found it important to know of CEO Laplanche’s prior efforts to drive his company’s performance with artificially initiated loans, and even more importantly, that LendingClub’s internal controls could not effectively curb the artifice,” the judge wrote.

The case # is 3:16-cv-02627-WHA in the Northern District of California. The lead plaintiff is the Water and Power Employees’ Retirement, Disability and Death Plan of the City of Los Angeles.

Lending Club’s stock was down 62% from its IPO price as of Thursday’s close but was up almost 9% on the year, according to the AltFinanceDaily Tracker.