Bet On the Iowa Caucus and Political Primaries With Bitcoins

January 31, 2016 I’m often asked if bitcoin still has a future or if it’s dead. As someone who has mined bitcoins, made purchases with them, sold advertising space with them, traded them, and contributed to political campaigns with them, I feel pretty confident that bitcoins are here to stay. While the system isn’t as anonymous as some people believe, bitcoin fills a void that many people the world over have long sought, a way to move money outside the banking system, and all without a replacement form of centralized control. It is the only way to truly de-bank.

I’m often asked if bitcoin still has a future or if it’s dead. As someone who has mined bitcoins, made purchases with them, sold advertising space with them, traded them, and contributed to political campaigns with them, I feel pretty confident that bitcoins are here to stay. While the system isn’t as anonymous as some people believe, bitcoin fills a void that many people the world over have long sought, a way to move money outside the banking system, and all without a replacement form of centralized control. It is the only way to truly de-bank.

The value is volatile but there are several markets where such volatility is the cost of doing business. Would you rather your bitcoins be worth 5% less when you receive them as payment or would you rather get nothing of what you are owed because the traditional banking system is preventing the transaction?

Enter one black market, betting on US elections, a practice that is largely illegal. And if people could bet on it they would, according to odds maker Jimmy Vaccaro at the South Point Casino in Las Vegas. He told CNN that opening up betting on elections would be the biggest thing they’d ever booked. “It would make the Super Bowl look like a high school football game,” he reportedly said.

But you can still bet on elections if you really want to, according to Market Watch’s Brett Arends. In the name of journalism, Arends successfully bet $1 on the Iowa Caucus… using bitcoins. He bet on Rand Paul with 40 to 1 odds. If he wins, he’ll collect those winnings in bitcoins.

And nobody can stop him.

As an independent system controlled by nobody, there are no bank accounts to freeze, ACH processors to shut down or physical dollars to confiscate. And despite the critics that claim bitcoins have to be converted to a “real” currency at some point in order to realize the value, that’s not necessarily true. You can live your life on bitcoin.

For one bookmaker (and you should view it as a reference only), the odds of a Ted Cruz win in the Iowa caucus is 2.6 to 1. Marco Rubio is paying 10.5 to 1. On the Democrat side, Bernie Sanders is paying 2.92 to 1.

Market Watch’s Arends argues that such activity might not be gambling at all since the IRS ruled bitcoin to be property, not a currency. In his simplistic view, they might as well be digital jelly beans. “When I wagered $1 worth of bitcoins on Sen. Paul last week, in the eyes of the law I wasn’t actually betting real money. I was just betting jelly beans,” he wrote.

You can of course buy cool stuff with those jelly beans.

It’s quite gray indeed, but if the interest in political gambling truly dwarfs the Super Bowl, then a totally bank-less decentralized system opens up all kinds of doors, the kind that don’t want to be closed.

In non-bank finance, a topic I often write about, all roads inevitably lead back to banks, no matter how much the system is disrupted. The truly de-banked use bitcoins and with that, the possibilities with it are endless.

Would you bet on Bernie Sanders with 2.92 to 1 odds? You’re not supposed to be able to do it, but in a bankless world, you could.

A Recession Could Turn Marketplace Lending Into The Hunger Games

January 13, 2016 When you don’t have the upper hand, one strategy is to partner up with opponents whose skills complement yours in order to compete with everyone else. But partnerships, while essential to self-preservation in an ultra competitive environment, are fleeting on the road to victory. When the field starts to narrow, it’s only a matter of time before truces are cancelled. The enemy of your enemy is your friend until they eventually become your enemy as well. Katniss Everdeen was not a lender last I checked, but her story is not so different.

When you don’t have the upper hand, one strategy is to partner up with opponents whose skills complement yours in order to compete with everyone else. But partnerships, while essential to self-preservation in an ultra competitive environment, are fleeting on the road to victory. When the field starts to narrow, it’s only a matter of time before truces are cancelled. The enemy of your enemy is your friend until they eventually become your enemy as well. Katniss Everdeen was not a lender last I checked, but her story is not so different.

Just last year, OnDeck partnered up with Chase while Fundation partnered up with Regions bank. Dozens of other “lenders” have partnered up in a different way with WebBank, Bank of Internet and Celtic Bank. Marketplace lending platforms that serve as centralized matchmakers have partnered up with hundreds of lenders and merchant cash advance companies. And Wells Fargo has had an arrangement with CAN Capital for what seems like forever.

Bank of America however, has vowed to fight on alone. According to the Wall Street Journal, BoA CEO Brian Moynihan “has no plans to partner with online or alternative lenders in part because of potential dings to its reputation.” Is that decision at their own peril?

While 2015 became the year of alternative lenders gushing about partnerships with banks (and that supposedly being the plan all along), Broadmoor Consulting Managing Principal Todd Baker relegated these alleged disruptors to a lesser status he refers to as “enablers.” Baker posits that OnDeck’s future for example, “may be brighter as a technology provider to banks than as a freestanding finance company subject to the vagaries of economic, credit, liquidity and regulatory cycles.” While perhaps not intentional, he seems to suggest that overtaking banks through technological innovation was unlikely and that alternative lenders are destined to a life of impotence, one that merely “enables” the competitors they were never going to beat.

Somewhere out there in the arena, Baker’s best friend Mike Cagney of SoFi is gearing up to win the 2016 Hunger Games. By openly admitting that banks like Wells Fargo and First Republic are the enemy, Cagney exhibits the ferocity one would expect of a tribute from District 2. SoFi has made nearly $7 billion in loans and wants their borrowers to leave their banks.

Behind the scenes, the Head Gamemaker is threatening to shower the arena with regulations and rising interest rates. While the alternative lending contestants partner up to ensure survival at least until the later rounds, there is potential trouble brewing in and around Panem, another recession. To hear most companies tell it, they would welcome a recession because they believe their models are built to withstand boom and bust cycles. Indeed, the atmosphere at Money2020 was exactly that, that it would be really convenient if the weak could hurry up and die already.

We should however consider that the consequences of a recession may go one step further and tip the scales of lending in a way that the “enablers” almost unwittingly become the new masters few now believe they’re destined to be. The Royal Bank of Scotland chief credit officer for example has already gone on record and told the public to sell bloody everything and prepare for the impending end of the world. 2016 will be a “cataclysmic year,” Andrew Roberts said. Fortune and Forbes have run less harrowing stories in recent days but warned that China, declining oil prices, and market signals indicate a recession could happen this year or the next. Reuters says we’re just facing a little thing called a “profit recession.” But whether these issues are false flags or indications of something more, an environment where credit once again becomes frozen in the traditional banking system could mean a suspension of partnerships between banks and alternative lenders. For alternative lenders that rely entirely on traditional banks for capital to begin with, the end for them will be swift and painful.

For those that don’t, let’s just say there’s a certain long-term advantage to being open for business when everyone else is closed. The merchant cash advance industry for example, which operated in an abyss between 1998 and 2008, suddenly awoke like a sleeping dragon during the Great Recession. In what is now a $7 billion/year industry or a $20 billion/year industry depending on how you define a merchant cash advance, the concept is now widely accepted as an alternative to traditional financing, even if at times criticized.

Foundation Capital’s Charles Moldow believes that “marketplace lending” will be a trillion dollar industry by 2025. “Consumers are fed up,” writes Moldow in his white paper. “Banks are no longer part of their communities. Rates are high for borrowers and not even keeping up with inflation for depositors. During the Great Recession of 2008-2009, when consumers and small businesses needed access to credit more than ever, many banks stopped offering loans and lines of credit.”

71% of Millenials would rather go to their dentist than listen to what banks are saying, according to Viacom’s Scratch. 33% believe they won’t need a bank at all in 5 years.

The presumption is often that banks will prevail in the lending tug-of-war anyway because they are more or less tasked by the federal government to be the arbiters of all lending activity. An economy where consumers and businesses regularly conducted their finances outside the purview of the banking system would be a nightmare scenario for a government that relies on the ability to monitor and control everything. Ergo alternative lenders should partner up with these banks, “enable them” and surrender to a future of impotence in which their only purpose is to serve their masters until perhaps one day the banks replace them with something else.

With alternative lenders still operating unfettered for now, today’s developing regulatory pressure would in all likelihood be traded for support in a recession, even if that support came in the form of willful ignorance.

If Millenials would already rather get a root canal than talk to their bank, then it’s probably not a good time for banks to become even less friendly, as would happen in a recession. The timing of one in the near future is almost to be expected considering how long it’s been since the last one, but the next one could be one of those transformative moments in history in which the world actually comes out looking a little bit different. Make no mistake, today’s alternative lenders are disruptive, they’ve just been playing the game rather safely. Partner up, work together, “enable” if they must, whatever it takes to ensure their survival into the later rounds. From student loans to consumer loans to business loans, 2016’s tributes are a force to be reckoned with.

There was only supposed to be one victor of the 74th hunger games, the banks. And there was always one until one year there were two. They surprisingly weren’t there to serve and enable their master either. The system that always was, was irreversibly disrupted.

The next recession could produce a similar outcome. Partnering with banks now seems like a great idea, but absent an actual merger or acquisition, they should be considered temporary alliances. You know what that means…

To the marketplace lenders and the technologies that power them, happy 2016! And may the odds be ever in your favor.

Alternative Business Funding’s Decade Club

October 22, 2015 The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

The working capital business is a very different animal now than it was a decade or so ago when many of today’s established players were just starting out.

“At that time, the industry was a bunch of cowboys. It was an opportunistic industry of very small players,” says Andy Reiser, chairman and chief executive of Strategic Funding Source Inc., a New York-based alternative funder that’s been in business since 2006. “The industry has gone from this cottage industry to a professionally managed industry.”

Indeed, the alternative funding industry for small businesses has grown by leaps and bounds over the past decade. To put it in perspective, more than $11 billion out of a total $150 billion in profits is at risk to leave the banking system over the next five plus years to marketplace lenders, according to a March research report by Goldman Sachs. The proliferation of non-bank funders has taken such a huge toll on traditional lenders that in his annual letter to shareholders, J.P. Morgan Chase & Co. chief executive officer Jamie Dimon warned that “Silicon Valley is coming” and that online lenders in particular “are very good at reducing the ‘pain points’ in that they can make loans in minutes, which might take banks weeks.”

The burgeoning growth of alternative providers is certainly driving banks to rethink how they do business. But increased competition is also having a profound effect on more seasoned alternative funders as well. One of the latest threats to their livelihood is from fintech companies, like Lendio and Fundera,for example, that are using technology to drive efficiency and gaining market share with small businesses in the process.

“Established lenders who want to effectively compete against the new entrants will need to automate as much decisioning as possible, diversify acquisition sources and ensure sufficient growth capital as a means to capture as much market share as possible over the next 12 to 18 months,” says Kim Anderson, chief executive of Longitude Partners, a Tampa-based strategy consulting firm for specialty finance firms.

Of course, there is truth to the adage that age breeds wisdom. Established players understand the market, have a proven track record and have years of data to back up their underwriting decisions. At the same time, however, experience isn’t the only factor that can ensure a company will continue to thrive over the long haul.

WORKING TOWARD THE FUTURE

Indeed, established players have a strong understanding of what they are up against—that they can’t afford to live in the glory of the past if they want to survive far into the future.

“With every business you have to reinvent yourself all the time. That’s what a successful business is about,” says Reiser of Strategic Funding. “You see so many businesses over the years that didn’t reinvent themselves, and that’s why they’re not around.”

Strategic Funding has gone through a number of changes since Reiser, a former investment banker, founded it with six employees. The company, which has grown to around 165 employees, now has regional offices in Virginia, Washington and Florida and has funded roughly $1 billion in loans and cash advances for small to mid-sized businesses since its inception.

One of the ways Strategic Funding has tried to distinguish itself is through its Colonial Funding Network, which was launched in early 2009. CFN is Strategic Funding’s secure servicing platform which enables other companies who provide merchant cash advances, business loans and factoring to “white label” Strategic Funding’s technology and reporting systems to operate their businesses.

“When you’re in a commodity-driven business, you have to find something to differentiate yourself,” Reiser says.

FINDING WAYS TO BE DIFFERENT

That’s exactly what Stephen Sheinbaum, founder of Bizfi (formerly Merchant Cash and Capital) in New York, has tried to do over the years. When the company was founded in 2005, it was solely a funding business. But over the years, it has grown to around 170 employees and has become multi-faceted, adding a greater amount of technology and a direct sales force. Since inception, the Bizfi family of companies has originated more than $1.2 billion in funding to about 24,000 business owners.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Earlier this year, the company launched Bizfi, a connected online marketplace designed specifically to help small businesses compare funding options from different sources of capital and get funded within days. Current lenders on the platform include Fundation, OnDeck, Funding Circle, CAN Capital, SBA lender SmartBiz, as well as financing from Bizfi itself. Financing options on the platform include short-term funding, equipment financing, A/R financing, SBA loans and medium term loans.

Sheinbaum credits newer entrants for continually coming up with new technology that’s better and faster and keeping more established funders on their toes.

“If you don’t adapt, you die,” he says. “Change is the one constant that you face as a business owner.”

David Goldin, chief executive of Capify, a New York-based funder, has a similar outlook, noting that the moment his company comes out with a new idea, it has to come up with another one. “If you’re not constantly innovating you’re in trouble,” he says. “It’s a 24/7 global job.”

Capify, which was known as AmeriMerchant until July, was founded by Goldin in 2002 as a credit card processing ISO. In 2003, the company began focusing all of its efforts on merchant cash advances. Four years later, the company made its first international foray by opening an office in Toronto. The company continued to expand its international presence by opening up offices in the United Kingdom and Australia in 2008. The company now has more than 200 employees globally and hopes to be around 300 or more in the next 12 months, Goldin says. The company has funded about $500 million in business loans and MCAs to date, adjusted for currency rates.

THE CULTURE OF CHANGE

Five or six years ago, Capify’s main competitors were other MCA companies. Now the competition primarily comes from fintech players, and to keep pace Capify has made certain changes in the way it operates. From a human resources standpoint, for instance, Capify switched from business casual attire to casual dress in the office. The company has also been doing more employee-bonding events to make sure morale remains high as new people join the ranks. “We’ve been in hyper-growth mode,” he says.

CAN Capital in New York, another player in the alternative small business finance space with many years of experience under its belt, has also grown significantly (and changed its name several times) since its inception in 1998. The company which began with a handful of employees now has about 450 and has offices in NYC, Georgia, Salt Lake City and Costa Rica. For the first 13 years, the company focused mostly on MCA. Now its business loan product accounts for a larger chunk of its origination dollars.

This year, the company reached the significant milestone of providing small businesses with access to more than $5 billion of working capital, more than any other company in the space. To date, CAN Capital has facilitated the funding of more than 160,000 small businesses in more than 540 unique industries.

Throughout its metamorphosis to what it is today, the company has put into place more formalized processes and procedures. At the same time, the company has tried very hard to maintain its entrepreneurial spirit, says Daniel DeMeo, chief executive of CAN Capital.

One of the challenges established companies face as they grow is to not become so rule-driven that they lose their ability to be flexible. After all, you still need to take calculated risk in order to realize your full potential, he explains. “It’s about accepting failure and stretching and testing enough that there are more wins than there are losses,” says DeMeo who joined the company in March 2010.

ADVICE FOR NEWCOMERS

As the industry continues to grow and new alternative funders enter the marketplace, experience provides a comfort level for many established players.

“The benefit we have that newcomers don’t have is 10 years of data and an understanding of what works and what doesn’t work,” says Reiser of Strategic Funding. With the benefit of experience, Reiser says his company is in a better position to make smarter underwriting decisions. “There are many industries we funded years back that we wouldn’t touch today for a variety of reasons,” he says.

Experienced players like to see themselves as role models for new entrants and say newcomers can learn a lot from their collective experiences, both good and bad. Noting the power of hindsight, Reiser of Strategic Funding strongly advises newcomers to look at what made others in the business successful and internalize these best practices.

One of the dangers he sees is with new companies who think their technology is the key to long-term survival. “Technology alone won’t do it because that too will become a commodity in time,” he says.

Over the years Strategic Funding has learned that as important as technology is, the human touch is also a crucial element in the underwriting process. For example, the last but critical step of the underwriting process at Strategic Funding is a recorded funding call. All of the data may point to the idea that a particular would-be borrower should be financed. But on the call, Strategic Funding’s underwriting team may get a bad vibe and therefore decide not to go forward.

“We look at the data as a tool to help us make decisions. But it’s not the absolute answer,” Reiser says. “We are a combination of human insight and technology. I think in business you need human insight.”

Seasoned alternative funding companies also say that newbies need to implement strong underwritingcontrols that will enable them to weather both up and down markets.

The vast majority of newcomers have never experienced a downturn like the 2008 Financial Crisis, which is where seasoned alternative financing companies say they have a leg up. Until you’ve lived through down cycles, you’re not as focused as protecting against the next one, notes Sheinbaum of Bizfi. “Every 10 years or 15 years or so, there seems to be a systemic crisis. It passes. You just have to be ready for it,” he says.

Goldin of Capify believes that many of today’s start-ups don’t understand underwriting and are throwing money at every business that comes their way instead of taking a more cautious approach. As a funder that has lived through a down market cycle, he’s more circumspect about long-term risk.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

One of the biggest problems he sees is funders who write paper that goes two or three years out. His company is only willing to go out a maximum of 15 months for its loan product, which he believes is s a more prudent approach. He questions what will happen when the economy turns south—as it eventually will—and funders are stuck with long dated receivables. “You’re done. You’re dead. You can’t save those boats. They are too far out to sea,” Goldin says.

Having a solid capital base is also a key to long-term success, according to veteran funders. Many of the upstarts don’t have an established track record and need to raise equity capital just to stay afloat—an obstacle many long-time funders have already overcome.

Goldin of Capify believes that over time consolidation will swallow up many of the newbies who don’t have a good handle on their business. Hethinks these companies will eventually be shuttered by margin compression and defaults. “It can’t last like this forever,” he says.

In the meantime, competition for small business customers continues to be fierce, which in turn helps keep seasoned players focused on being at the top of their game. Getting too comfortable or complacent isn’t the answer, notes DeMeo of CAN Capital. Instead, established funders should seek to better understand the competition and hopefully surpass it. “Competition should make you stronger if you react to it properly,” he says.

Alternative Funding: Over The Top Down Under

September 2, 2015 San Francisco had its gold rush, Oklahoma had its land rush and now Australia is experiencing a rush of alternative funding. After a slow start a few years ago, foreign and domestic companies have been flocking to the market down under in the last 18 months.

San Francisco had its gold rush, Oklahoma had its land rush and now Australia is experiencing a rush of alternative funding. After a slow start a few years ago, foreign and domestic companies have been flocking to the market down under in the last 18 months.

As many as 20 new alt-funders are doing business in Australia, but that number could swell to a hundred, said Beau Bertoli, joint CEO of Prospa, a Sydney-based alternative funder. “The market in Australia has been very ripe for alternative finance,” Bertoli, said. “We see an opportunity for the alternative finance segment to be more dominant in Australia than it is in America.”

Recent entrants to the embryotic Australian market include Spotcap, a Berlin-based company partly funded by Germany’s Rocket Internet; Australia’s Kikka Capital, which gets tech backing from U.S.-based Kabbage; America’s Ondeck, which is working with MYOB, a software company; Moula, which began offering funding this year but considers itself ahead of the curve because it formed two years ago; and PayPal, the giant American payments company.

The new entrants are joining ‘pioneers’ that have been around a few years, like Prospa, which has been working for three years with New York-based Strategic Funding Source, and Capify (formerly AUSvance until it was consolidated into the international brand Capify), which came to market in 2008 with merchant cash advances and started offering small-business loans in 2012.

Some don’t take the newcomers that seriously. “There are small players I’ve never heard of,” said John de Bree, managing director of Capify’s Sydney-based office, in a reference to local Australian funders. “The big ones like OnDeck and Kabbage don’t have the local experience.”

But many players view the influx as a good sign. “I think it’s an endorsement of the market,” Bertoli said. “There’s more publicity and more credibility for what we’re doing here in terms of alternative finance.” It’s like the merchant who gets more business when a competing store opens across the street.

Besides, the market remains far from crowded. “I’m not concerned about the arrival of OnDeck and Kabbage because it really does validate our model,” maintained Aris Allegos, who serves as Moula CEO and cofounded the company with Andrew Watt.

The market’s relatively small size – at least compared to the U.S. – doesn’t seem to bother players accustomed to the heavily populated U.S., a development some observers didn’t expect. “I’m very surprised,” de Bree said of the American interest in Australia. “The American market’s 15 times the size of ours.”

Others see nothing but potential in Australia. “This is a market that will evolve over time, and we think the opportunity is enormous,” said Lachlan Heussler, managing director of Spotcap Australia.

Some view the Australian rush to alternative finance not so much as a solitary phenomenon but instead as part of a worldwide explosion of interest in the segment, driven by banks’ reluctance to provide loans since the financial crisis, de Bree said.

Viewed independently or in a larger context, the flurry of activity in Australia is new. “The boom is probably only getting started,” Bertoli maintained in a reference to the Australian market. “Right now, it’s about getting the foundation of the market established.”

To get the business underway in Australia, alternative funders are alerting small-business owners and the media to the fact that alternative funding is becoming available and teaching them how it works, de Bree said. “Half of our job is educating the market,” noted Heussler.

New players are building the track record they need to bring down the cost of funds, according to Allegos. “Our base rate is 2 percent or 3 percent higher than yours,” he said, adding that the cost of funds is more challenging than gearing up the tech side of the business.

Although the alternative-lending business started later in Australia than in the United States and lags behind America in in exposure, it’s maturing rapidly, said de Bree. Aussie funders are benefitting from the lessons their counterparts have learned in the U.S., he said.

But the exchange of information flows both ways. Kabbage, for example, chose to enter the Australian market with a local partner, Kikka. Kabbage learned from its earlier foray into the United Kingdom that it makes sense to work with colleagues who understand the local regulatory system and culture, said Pete Steger, head of business development for Atlanta-based Kabbage.

But the exchange of information flows both ways. Kabbage, for example, chose to enter the Australian market with a local partner, Kikka. Kabbage learned from its earlier foray into the United Kingdom that it makes sense to work with colleagues who understand the local regulatory system and culture, said Pete Steger, head of business development for Atlanta-based Kabbage.

Such differences mean that risk-assessment platforms that work in the United States or Europe require localization before they can perform effectively in Australia, sources said.

Sydney-based Prospa, for example, got its start three years ago and has been working ever since with New York-based Strategic Funding Source to localize the SFS American risk-assessment platform for Australia, said Bertoli, who shares the company CEO title with Greg Moshal.

Moula, which has headquarters in Melbourne, sees so many differences among markets that it decided to build its own local platform from scratch, according to Allegos.

One key difference between the two markets is that Australia does not have positive credit reporting. “We have nothing that even comes close to a FICO score,” said Allegos. The only credit reporting centers on negative events, he said.

Without credit scores from credit bureaus, funders base their assessments of credit worthiness largely on transaction history. “It’s cash-flow analytics,” said Allegos. “It’s no different from the analysis you’re doing in your part of the world, but it becomes more significant” in the absence of positive credit reporting, he said.

Australia lacks credit scores at least partly because the country’s four main banks control most of the financial sector and choose not to release credit information, sources said. The banks have warded off attacks from all over the world because the regulatory environment supports them and because their management understands how to communicate with and sell to Australian customers, sources said.

The big banks – Commonwealth Bank, Westpac, Australia and New Zealand Banking Group, and National Australia Bank – set their own rules and have kept money tight by requiring secured loans and long waiting periods, Bertoli said. It’s difficult for merchants who don’t fit into a “particular box” to procure funding, he maintained. “It’s almost like an oligarchy,” Allegos said of the banks’ grip on the financial system.

Eventually, the banks may form partnerships with alternative lenders, but that day won’t come soon, in Allegos’ estimation. It could be 12 months or more away, he said.

Even as the financial system evolves, deep-seated differences will remain between Australia and the U.S. Most Americans and Australians speak English and share many views and values, but the cultures of the two countries differ greatly in ways that affect marketing, Bertoli said. “In your face” advertising that can work well with “loud, confident” Americans can offend the more “laid-back” Australian consumers and business owners, he said.

Australians have become tech-savvy and comfortable with online banking, but they guard their privacy and often hesitate to reveal their banking information to a funding company, Allegos said. The entrance of OnDeck and Kabbage should help familiarize potential customers with the practice of sharing data, he predicted.

Cost structures for businesses differ in Australia from the U.S., Bertoli noted. Australian companies pay higher rent and have to pay minimum wages set much higher than in the United States, he said. Published reports set the Australian minimum wage at $13.66 U.S. dollars. The higher costs down under can take a toll on cash flow. “Take an American scorecard and apply it to Australia?” Bertoli asked rhetorically. “You just can’t.”

Distribution’s not the same for commercial enterprises in the two countries, Bertoli maintained. Despite having about the same geographic area as America’s 48 contiguous states, Australia has a population of 23 million, compared with America’s 322 million.

Distribution’s not the same for commercial enterprises in the two countries, Bertoli maintained. Despite having about the same geographic area as America’s 48 contiguous states, Australia has a population of 23 million, compared with America’s 322 million.

No matter how many people are involved, changing their habits takes time. Australian merchants prefer fixed-term loans or lines of credits instead of merchant cash advances, Bertoli said. In many cases Australian merchants simply aren’t as familiar as Americans are with advances, Allegos said.

Besides, the four big banks in Australia tend to solicit merchants for credit and debit card transactions without the help of the independent sales organizations and sales agents. In the U.S., ISOs and agents play an important role in explaining and promoting advances to merchants, Bertoli said. Advances make sense for merchants because advances adjust to cash flow, and they help funders control risk, but just haven’t caught on in Australia, Bertoli said. Australians resist advances if too many fees are attached, said Allegos.

Pledging a portion of daily card receipts might seem too frequent, too, he said. Besides, advances are limited to merchants who accept debit and credit cards, while any business could conceivably choose to take out a loan, said de Bree.

Advances have to compete with inventory factoring, which has become a massive business in Australia, according to Heussler. The business can become intrusive because funders may have to examine balance sheets and talk to customers, he said.

Australia’s reluctance to turn to advances, leaves most alternative funders promoting loans and lines of credit. Prospa, for example, uses some brokers to that end but also relies on online connections, direct contact with customers, and referrals from companies that buy and sell with small and medium-sized businesses.

“Anyone that touches a small business is a potential partner,” said Heussler, including finance brokers, accountants, lawyers and even credit unions, which have the distribution but not the product.

Moula finds that most of its business comes from well-established companies and that loans average just over $27,000 in U.S. currency and they offer loans of up to more than $77,000 U.S. The company offers straight-line, six- to 12-month amortizing loans.

Using a model that differs from what’s common in the U.S., Moula charges 1 percent every two weeks, collects payments every two weeks and charges no additional fees, Allegos said. A $10,000 (Australian) loan for six months would accrue $714 (Australian) in interest, he noted.

Spotcap Australia offers a three-month unsecured line of credit and doesn’t charge customers for setting it up, Heussler said. If the business owner decided to draw down, it turns into a six-month amortizing business loan for up to $100,000 Australian. Rates vary according to risk, starting at half a percent per month but averaging 1.5% per month.

Spotcap Australia offers a three-month unsecured line of credit and doesn’t charge customers for setting it up, Heussler said. If the business owner decided to draw down, it turns into a six-month amortizing business loan for up to $100,000 Australian. Rates vary according to risk, starting at half a percent per month but averaging 1.5% per month.

If companies have all of the necessary information at hand, they can complete an application in 10 minutes, Allegos said. Moula has to research some applications offline if the company’s structure deviates too greatly from the usual examples – much the same as in the U.S., he maintained. The latter requires strong customer-service departments, he said.

Kikka uses a platform based on the Kabbage model, which gives 95 percent of customers a 100-percent automated experience, Steger said. “It goes to show the power of our automation, our algorithms and our platform,” he maintained.

Spotcap prefers to deal with businesses that have been operating for at least six months, Heusler said. The funder examines records for Australia’s value-added tax and other financials, and it likes to connect with the merchant’s bank account. Spotcap can usually gain access to the account information through cloud-based accounting systems and thus doesn’t require most companies to download a lot of financial documents, he noted.

Despite the differences between the two countries, banking regulations bear similarities in Australia and the United States, sources said. In both nations the government tries harder to protect consumers than businesses because they assume business owners are more financially savvy. For consumers, regulators scrutinize length of term and pricing, sources said, and on the commercial side the government is concerned about money laundering and privacy.

Regulation of commercial funding will probably intensify, however, to ward off predatory lending, Bertoli said. Government will consult with businesses before imposing rules, he said. A couple of alternative business funders aren’t transparent with their pricing and they charge several fees – that sort of behavior will encourage regulation, Allegos said.

“I know they’re watching us – and watching us very closely,” he added.

In general, however, the Australian government supports alternative finance, Bertoli said, because they want there to be options other than the four big banks and wants small business to have access to capital. Small businesses account for 46 percent of economic activity in Australia and employ 70 percent of the workforce, he noted, saying that “if small businesses are doing badly, the economy is doing badly.”

Hence the need, many in the industry would say, for more alternative funding options in Australia.

Do Bank Statements Matter in Lending? Business Lenders and Consumer Lenders Disagree

July 16, 2015Bank statements. Those in consumer lending argue they’re all but irrelevant because FICO and credit reports do the job of predicting risk just fine, but over in today’s small business lending environment, there’s an entirely different sentiment; Reveal your recent banking history or be declined.

After having bought nearly $60,000 worth of consumer notes on Lending Club and Prosper combined, there’s something I’ve seen a lot of, bounced ACHs.

Lending Club doesn’t reveal borrower bank data to their investors. Sure, anyone can see the credit report, the income level, zip code, and job title, but the borrower could have negative $10,000 in the bank and be living off overdraft protection on day 1 and an investor would never know it.

Lending Club doesn’t reveal borrower bank data to their investors. Sure, anyone can see the credit report, the income level, zip code, and job title, but the borrower could have negative $10,000 in the bank and be living off overdraft protection on day 1 and an investor would never know it.

For all the fanfare surrounding online marketplace consumer lending, access to borrower banking history is oddly absent.

“Welcome to consumer lending, where the rules are different because the game is too,” replied a user to my comment on a peer-to-peer lending forum.

Veteran consumer lenders assumed I was a lost newbie who knew nothing about lending. “I have a feeling if you ask to crawl someone’s bank account, they’ll just go elsewhere,” one user said. “Seems that’d only work on subprime borrowers who have limited bargaining power.”

“I’m assuming you may be new to lending,” he continued. “Making a loan based on deposit balances is rarely a good idea.”

My initial question to them was that without bank statements, how could they ascertain if a borrower’s finances were actually in order at least at the time the loan was issued? It’s really easy to access someone’s banking history for the last 90 days by using common tools like Yodlee or Microbilt, I argued.

Some people sympathized with my logic but others believed requesting bank data would be suicide in today’s competitive environment. And still more wondered if there might be consumer protection laws that prevented lenders from seeing a loan applicant’s banking records (which sounded ridiculous).

A Credit Card Issuer’s Take

Those questions led me to interview an underwriting manager at one of the nation’s largest credit card issuers who would only speak on the condition of total anonymity, including the bank’s name. There, he oversees a department of people that manually assess credit card applicants. There is no algorithmic approval process. In his department, humans underwrite each application, conduct phone interviews with the prospective borrowers, and request additional documents if they feel it’s warranted.

Requesting bank statements is a regular part of the job, explained the manager. “We require proof of income for any line over 25k,” he added. “It’s the main thing we ask for along with proof of address.”

Requesting these documents keeps them compliant with the Bank Secrecy Act, he explained, but the bank statements in particular are their first choice in verifying somebody’s income, even more than pay stubs. And their underwriters aren’t oblivious zombies, he noted. If an applicant has no money in the bank, they’ll decline it.

Requesting these documents keeps them compliant with the Bank Secrecy Act, he explained, but the bank statements in particular are their first choice in verifying somebody’s income, even more than pay stubs. And their underwriters aren’t oblivious zombies, he noted. If an applicant has no money in the bank, they’ll decline it.

“The Adverse Action reason [for that] would be ‘sufficiently obligated’,” he stated. “That’s when their bank account shows they can not take on any additional financial obligations.”

The manager shared however that he believed there is a very strong correlation between what’s on the credit report and what to expect in the bank statements. Generally speaking, good credit will show a healthy banking situation, he explained. They’re rarely taken by surprise. Overall, the credit reports and phone interviews are enough for them to feel comfortable and the bank statements are really just there to check off a compliance box.

Meanwhile, those that speculated requesting bank data would be a death knell competitively might want to talk to Kabbage’s sister company, Karrot. Karrot already crawls bank accounts as part of their consumer loan application program and competes with Lending Club, Prosper, and Avant. Considering Kabbage has funded more than half a billion dollars worth of business loans using this very methodology, it’s safe to say that applicants aren’t flocking to competitors in droves over the perceived injustice or inconvenience of filling out three additional fields on a web application to share their transaction history.

Bounced Payments

Kabbage CEO Rob Frohwein offered these comments last year about their underwriting, “A critical aspect of consumer lending is determining the appropriate amount of a payment to collect so that an account doesn’t become overdrawn. Our intelligence accurately predicts how much of a payment to request via ACH so consumers avoid the cost and headache associated with non-sufficient funds.”

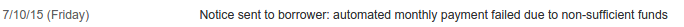

I thought about those statements when I noticed that thirty-six of my Lending Club notes carried a Grace Period status the other day. These are borrowers whose payments just recently bounced. Some are only three or four months into a five-year loan. Worse, there are those that are saying they have no money whatsoever to make a payment. How can this be when they just practically got approved?

To the consumer crowd it’s business as usual. “If you got their bank account, you still wouldn’t be able to predict who will default. You can’t predict defaults on any individual borrower,” argued one veteran on a forum.

But it’s not all about the lender’s tolerance for risk. ACH rejects can have consequences that affect a lender’s ability to debit accounts in the future.

“Ultimately, regulatory thresholds set by NACHA will continue to become more and more critical of returns,” said Moe Abusaad of ACH Processing Co, an ACH processor based in Plano, TX. “I think it’s safe to say that there is a positive correlation in considering statements as a component of the underwriting process to the rate of returns incurred,” he added.

And while it’s true that bank data can’t make predictions perfectly on its own, nobody in small business lending or merchant cash advance would consider an approval without it.

Bank Statements or Bust

“There is no substitute for banking information when reviewing a client for approval,” said Andrew Hernandez, a co-founder of Central Diligence Group, a risk management firm that allows business lenders and merchant cash advance companies to outsource their underwriting.

“Money moves fast through these businesses and every business is unique, so a lot more variables come into play than just having to account for the timely monthly payments of credit cards, cars, and mortgages as you find in the consumer world,” he added. “A FICO score along with other information presented in a credit report provide a detailed, historical snapshot of a client’s creditworthiness in consumer lending, and while these are great complementary tools for us to use in our underwriting process, I believe that banking data paints us a picture of its own which is absolutely essential in assessing the risk of a B2B transaction in our space.”

Those underwriting business loan deals have reported seeing applicants with open personal loans from Lending Club, which shows that the exact same borrowers are being underwritten in two different ways.

But Julio Izaguirre, another co-founder of Central Diligence Group added that, “banking transactions are essential in gauging the cash flow of the business by looking at recent and up-to-date bank volume, but it is even more important with businesses that lack historical data and cannot provide financials or other documentation to show and prove their track record.”

Translation: A lack of credit history and formal financial statements can be overcome thanks to in-depth analysis of bank account data.

“When our underwriters look at a bank statement you can get a better understanding of the business cash flow, operational cost and how the owner manages his business,” said Heather Francis, CEO of Gainesville, FL-based Elevate Funding. “The credit score is like a person’s blood pressure reading,” she continued. “It indicates there may be an issue but until lab work is pulled and analyzed you don’t know what that issue is. The bank statement is that lab work and it can tell you more about the issues behind the scenes than a credit score can.”

Greg DeMinco, a Managing Partner of Americas Business Capital based in Cherry Hill, NJ would probably agree. “FICO isn’t everything,” he shared. “Bank statements can tell a great story especially if there is upward momentum month after month, and more importantly a high ratio of deposits to requests for the advance.”

Meanwhile, the manager of the credit card issuer was surprised to hear about the high value placed on bank statements in business lending. I offered him the example of an applicant with good credit that was consistently negative in the bank because of a reliance on overdraft protection as a way to make sure all the bills were being paid. “That’s the craziest thing I ever heard,” he commented.

But over in the peer-to-peer lending forum it didn’t sound so crazy at all. “Plenty of Americans are ‘broke’, in the sense that they have negative net worth, yet they’ll continue servicing their debts for… a long time… no matter what it takes,” shared one user.

The argument seems to come full circle, that business lending and consumer lending are just different.

But to Isaac Stern, the CEO of New York-based Yellowstone Capital, the bank statements are not just about financial health. “We are literally underwriting against fraud,” said Stern, who said his office regularly receives applications with doctored statements. “Logging in [to the banks] and verifying those statements are probably the most important part of the process,” he noted.

His logic goes that a consumer that is paid a salary has a predictable stream of income and so that information along with a credit report might be enough for a consumer lender, but business revenue is less predictable and can vary practically day-to-day.

“You can’t just look at a FICO score and say, ‘this is a good a business’,” Stern explained. “The story is in the bank statements.”

Legal Brief: Madden v. Midland Funding

June 11, 2015Madden v. Midland Funding, 2015 U.S. App. LEXIS 8483 (2nd Cir. May 22, 2015).

This is an interesting case for the alternative lending industry that deals with the interplay between the National Banking Act and New York State’s usury laws.

This is an interesting case for the alternative lending industry that deals with the interplay between the National Banking Act and New York State’s usury laws.

The plaintiff borrower opened a credit card account with a national bank, Bank of America (“BoA”). BoA sold the account to another national bank, FIA. FIA subsequently sent a change of terms notice stating that, going forward, the plaintiff’s account agreement would be governed by the law of Delaware, FIA’s home state. FIA later charged off the account and sold it to a third-party debt purchasing company, Midland. FIA did not retain any interest in the account after selling it to Midland and Midland was not a national bank.

Midland attempted to collect on the account and sent the plaintiff a demand letter indicating that there was a 27% interest rate on the account. Plaintiff sued Midland, alleging violations of the Fair Debt Collection Practices Act and New York’s criminal usury laws. New York law limits effective interest rates to 25 percent per year. The parties agreed that FIA had assigned plaintiff’s account to Midland and that the plaintiff had received FIA’s change in terms notice. Based on the agreement, the trial court held that the plaintiff’s state law usury claims were invalid because they were preempted by the National Bank Act.

The National Bank Act supersedes all state usury laws and allows national banks to charge interest at the rate allowed by the law of the bank’s home state. Midland argued that, as FIA’s assignee, it was permitted to charge the plaintiff interest at a rate permitted under Delaware law. FIA was incorporated in Delaware and Delaware permits interest rates that would be usurious under New York law.

On appeal, The Second Circuit Court of Appeals noted that some non-national banks, such as subsidiaries and agents of national banks, might enjoy the same usury-protection benefit as a national bank. However, third-party debt buyers, such as Midland, are not subsidiaries or agents of national banks. Midland was not acting for BoA or FIA when it attempted to collect from the plaintiff. Midland was acting for itself as the sole owner of the debt. For this reason, the Second Circuit held that Midland could not rely upon National Bank Act preemption of New York State’s usury laws.

ACH is the Annoying Little Thing We Can’t Live Without

January 19, 2015 A few months ago I paid an invoice via ACH. The vendor was used to getting paid by check and didn’t accept credit cards. When I mentioned the funds would be paid overnight, they got excited but were suspicious. Would there be a fee to receive the money like a Fed wire might? “Nonsense,” I told them.

A few months ago I paid an invoice via ACH. The vendor was used to getting paid by check and didn’t accept credit cards. When I mentioned the funds would be paid overnight, they got excited but were suspicious. Would there be a fee to receive the money like a Fed wire might? “Nonsense,” I told them.

When the banks opened the next morning, they didn’t see it. The funds had been withdrawn from my account and I double checked that the account and routing number matched their voided check. They took no comfort in that verification of course because they didn’t see the money on “their side.” That put the burden on me to convince them nothing had gone wrong or that I wasn’t lying. “It should be there,” I told them. “Who knows, depending on your bank it might not post until tomorrow.”

Let’s spend all day researching this payment

Putting the blame on the recipient’s bank or the ACH system as an imperfect fluid thing that comes with no guaranteed delivery schedule only heightened their levels of suspicion.

If you’ve been in this situation before particularly when funding a merchant who claims the funds are not there, there is only so much you can say or do to pacify them.

“Can you give me some kind of confirmation number?” they ask. Ahh, the mythical confirmation number.

So you call your bank, get some kind of number and pass it along to them which their bank does nothing with because they have no record of any incoming payment.

At the vendor’s behest, I went back and forth between my bank and their bank to try and locate these funds. The quest to find the missing deposit took up the first six hours of my day. Honestly I wasn’t worried about it. I was pretty sure it would show up eventually, but the vendor was freaking out.

With the work day almost over, the receiving bank finally logged a pending deposit in the vendor’s account.

It was good enough for them. They finally believed me. Phew.

You got the money, right?

How do I know my vendor actually got the money? Well because they told me they did…

Good enough perhaps, but a few years ago I helped a merchant get financing that claimed they did not receive their funds even though I was pretty sure they did. I went through the whole shebang, ACH system this, your bank that, confirmation number this, let me double check that, etc.

Three days later they claimed they still had not gotten it. It turns out they had but they knew without direct access to their bank account, we couldn’t confirm it, at least not in time to try and reverse the transaction successfully. Did we screw up somewhere? Was the routing number right? It’s a horrible feeling to believe you didn’t deliver what you promised you would to a merchant.

Three days later they claimed they still had not gotten it. It turns out they had but they knew without direct access to their bank account, we couldn’t confirm it, at least not in time to try and reverse the transaction successfully. Did we screw up somewhere? Was the routing number right? It’s a horrible feeling to believe you didn’t deliver what you promised you would to a merchant.

After more than a week we had figured out he not only received the cash, but had moved the money out of the account and bailed.

Once the money goes into the ACH system, you really don’t know anything. Some alternative lenders can confirm clients received deposits by requesting the client’s username and password to log into their bank account. This is a terribly flawed system.

Out there in the regular world I couldn’t have asked my vendor for the credentials to their online banking. Oh you didn’t get the ACH? Give me the password to your bank accounts, I’ll go have a good look.

You call this efficient?

In 2015 I can send money and have no idea if the other person got it. Somehow this is standard. It’s like e-mail in a way. I know I sent it but until they tell me they received it, who really knows.

There are obviously options to transfer money instantly but it comes at a great cost. And someone still has to tell me it got to the other side. I can’t confirm it myself.

In the age of the Internet, it’s amazing how inefficient payments are. We refer to modern payment processors as disruptive services, but it’s same problem with a different twist. Somebody pays you by credit card and the payment processor flags the sale, causing you to have to send documentation to their risk department to review. If rejected, the funds are held for six months and quite possibly your merchant account terminated. The customer won’t know all this though. All they knew is that their card was charged.

Intermediaries make transaction processing easy but they also make it really hard. The alternative lending industry spends entirely too much time managing payments.

The ACH debit was successful… or was it? Let’s wait 3 days to find out if it gets reversed before we really know for sure.

Did they get the money? Let me call them to confirm. Oh they didn’t pick up. I’ll write them an email asking them to confirm that they got my ACH.

They said they sent the money but I don’t see anything. Can you send me a confirmation number?

I sent you that email on thursday, you didn’t get it?

We’re used to a system where the only thing you can confirm is that something was sent and so we spend countless hours and money trying to figure out if they were received.

Meanwhile, in the future…err present day

One of the most remarkable features about the Bitcoin system is that I can confirm that the money I sent was received by the other person. Everyone else in the world can confirm it too. The dollar/bitcoin balance of all bitcoin addresses are public and anyone can create a near infinite number of bitcoin addresses.

One of the most remarkable features about the Bitcoin system is that I can confirm that the money I sent was received by the other person. Everyone else in the world can confirm it too. The dollar/bitcoin balance of all bitcoin addresses are public and anyone can create a near infinite number of bitcoin addresses.

I joked before that in order to truly see with my own eyes that a vendor did not receive my ACH was to request the credentials to their online banking and log in. But all they need to do is generate a one-time use bitcoin address for the transaction and when I send funds, both they and I will see it deposited there, instantly.

Money sent, they got it instantly, I see it there, end of story.

Recently, .01 BTC was sent to this bitcoin address of mine: 19kzD1RkC8MjazfCkCJkfx7369ULCyPsg1

Check it out here: http://bitref.com/19kzD1RkC8MjazfCkCJkfx7369ULCyPsg1

or here: https://blockchain.info/address/19kzD1RkC8MjazfCkCJkfx7369ULCyPsg1

If you needed to pay me, I would click a “generate address” button on my computer, you send bitcoins to it, and there will be no doubt that they were received because you can view the balance of it yourself. I can keep the funds in that address or move them to another one. Even if moved, the paper trail that they were there remains. There is no uncertainty or research required.

So who confirms the transactions? Not the Automated Clearing House thank God. Bitcoin miners and nodes do. You can read about my experience as a miner here.

At present, the standard bitcoin network transaction fee is .0001 BTC, the equivalent of 2 cents. Transactions are also irreversible! No chargebacks!

You can send me a thousand dollars or a million dollars instantly for the price of 2 cents and view the balance in my receiving address as proof that I got it. Thousands of people do this every day.

Bitcoin’s adoption has been slow, it’s history volatile, and its reputation murky, but I pray everyday that a decentralized technology like this will last in the mainstream. The bureaucracy, inefficiency, and lack of transparency in other forms of payments are a drag on commerce.

If you’ve ever spent longer than a minute trying to figure out if money made it from point A to point B, you need to start learning about the Bitcoin system. If you’ve ever spent more than 2 cents sending money, you need to start learning about the Bitcoin system. And if you’ve ever had a payment processor give you a hard time about a transaction, you need to start learning about the Bitcoin system.

You might be happy with ACHs for now but we were all happy with telegrams once. That’s about the level of sophistication the mainstream payments industry has now. I can’t wait until this era is over.

My Satoshi Monday

December 3, 2014Call me brave, batshit crazy, or AltFinanceDaily in the modern era. Earlier this week I wound up at the Bitcoin Center in NYC, a place I didn’t really believe existed. They supposedly host events downtown by Wall Street every Monday and Thursday nights with free alcohol and food.

I don’t believe it, I thought. I called the place ahead of time, twice, half expecting the second attempt to reveal the number was actually out of service. Nevermind the fact that the first time I called, an enthusiastic gentleman was eager to have me stop by.

These bitcoin events start at 7pm. I got there 10 minutes early just to scope the situation out, that way I could escape before anyone knew I was there. Can’t take any chances with these bitcoin people.

But it looked safe. Well, safe enough. The Bitcoin Center is a giant open room on the first floor of 40 Broad Street. The lighting is dark and the floors are pure cement. It could easily double as a handball court or a trading floor, which it kind of is.

And so I kicked off a Satoshi Monday with a crowd that looked like they were doing unix programming in the 1980s. I was glad I dressed casual. We may have been physically near Wall Street but mentally it was light years away. I half expected Richard Stallman, the legendary icon of the free software movement to pop in and start handing out bitcoins, digitally of course, through some kind of cool free software.

And so I kicked off a Satoshi Monday with a crowd that looked like they were doing unix programming in the 1980s. I was glad I dressed casual. We may have been physically near Wall Street but mentally it was light years away. I half expected Richard Stallman, the legendary icon of the free software movement to pop in and start handing out bitcoins, digitally of course, through some kind of cool free software.

I’ve seen mainstream bitcoin enthusiasts at payments conferences around the country, you know, banker types, but the Bitcoin Center keeps it real. Within 15 minutes of my arrival, I had already had conversations that involved taking down the Federal Reserve, the Koch Brothers, and overthrowing the government. I learned that bankers were poisoning nature and that nature was gearing up for revenge. A war was brewing and you didn’t want to be on the wrong side. “You don’t want to f*ck with nature!” someone screamed.

I had no idea what any of it had to do with bitcoin but the crowd wasn’t all like that. Thank God.

Others gave me the inside scoop on Gems, a company that wants to be the “Bitcoin of social networks”. One fellow bought XGEMS early and if I was smart I should try to pick some up too. Maybe another time…

Cryptocurrencies and cryptoassets of all kinds were uttered. Of course each one seemed to be in presale, was only being offered for a low rate today, or was only open to a select few and for a limited amount of time. If you didn’t get in now, it was too late. The more seemingly elusive they were, the more people wanted to buy them, regardless of whatever they were.

Just as I was beginning to question My Journey to Bitcoin, shit got real. “You selling?” a guy asked me. I assumed he meant drugs. But when he saw how paralyzed I had become, he started to laugh. “I’m talking about bitcoin dude,” you have any to sell?

He wouldn’t be the first to ask me that night. In fact there’s a sizable group of folks that attend just to trade bitcoin. There was even an opening bell and an honorary guest bell-ringer guy to kick off trading.

The Bitcoin Center isn’t an exchange though. Any deals made and arranged are between you and another party. Online exchange prices affect the price on the floor but deals made on the floor don’t affect online exchange prices. On Satoshi Mondays, bitcoin goes for cash money.

The Bitcoin Center isn’t an exchange though. Any deals made and arranged are between you and another party. Online exchange prices affect the price on the floor but deals made on the floor don’t affect online exchange prices. On Satoshi Mondays, bitcoin goes for cash money.

I thought it was dumb at first so I asked the next guy that was looking to trade, “Why would I buy bitcoin from random people like you in person when I could just do it online?” I should’ve seen it coming. “Must be easy for people like you who have a bank account,” he responded.

I let that one sink in. Just the day before I had blogged that 25 million Americans are unbanked, meaning they don’t have bank accounts or even access to banking products. This fellow was one of them. He lived off cash but wasn’t letting that stop him from shopping online. He gave you cash, you gave him bitcoins. He stayed unbanked but not cut off from the Internet connected world.

I wanted to ask him why he chose that route over a prepaid debit card, but cards are not a cure-all. Other attendees told me that they buy products overseas and that they were either being charged a huge percentage on top to cover the card processing fees or that merchants had stopped accepting cards altogether. Sure they could make an international wire transfer but even that was a headache for merchants looking to conduct an automated business online.

Bitcoin was said to be simpler for all involved, something I believe because I purchased a new monitor using bitcoins on Overstock.com just last week. It was actually faster and easier than using a credit card. Seriously. I also saved Overstock on the processing fees. See what a good citizen a bitcoin buyer can be?

Bitcoin was said to be simpler for all involved, something I believe because I purchased a new monitor using bitcoins on Overstock.com just last week. It was actually faster and easier than using a credit card. Seriously. I also saved Overstock on the processing fees. See what a good citizen a bitcoin buyer can be?

An in-person bitcoin exchange also prevents the parties from having to pay an online exchange fee, not to mention that you can gain an edge through negotiating. The liquidity of cash on the spot can create some serious arbitrage opportunities.

People threw down thousands of dollars to buy bitcoins which were then transferred via a mobile app. I probably had enough to do some trading but I didn’t need the cash.

When the free pizza arrived, the crowd turned into a mob. The underbanked it seemed were also underfed and a life of living bitcoin to bitcoin meant this might be the only meal they had for some time. I pushed their weaker counterparts, the unbanked, out of the way to get a hot slice and they pushed me right back.

“Bank account lover!” they shouted. It was a harsh indictment, but they knew. As AltFinanceDaily as I was, they knew that ultimately I was banked.

Damn.

Some people left right after they ate. Those that remained began to tell me about their digital mining operations, a necessary component of the Blockchain technology that cryptocurrencies like bitcoin are built off of. Bitcoins don’t just magically appear. Computers on the Internet perform wildly difficult mathematical calculations in order to facilitate the creation and transfer of bitcoins. This design is partially why nobody can beat the Bitcoin system.

One guy told me that he had his basement completely redone so that he could turn it into a mining center. Most mining is done with specialized computer hardware that can perform nothing other than mining. You can actually buy such machines at the Bitcoin Center. If your mining is productive for the system, the system will reward you with bitcoins. The processing power required to solve the complex mathematics makes the odds of being rewarded very low. As time goes on, the system’s equations get more and more difficult to crack.

One guy told me that he had his basement completely redone so that he could turn it into a mining center. Most mining is done with specialized computer hardware that can perform nothing other than mining. You can actually buy such machines at the Bitcoin Center. If your mining is productive for the system, the system will reward you with bitcoins. The processing power required to solve the complex mathematics makes the odds of being rewarded very low. As time goes on, the system’s equations get more and more difficult to crack.

Some miners are backed by billion dollar investment funds and have a serious advantage in the mathematics arms race. But for those that just casually dabbled in mining, they seemed to be getting a little something from doing it, even if it was small.

Some miners are backed by billion dollar investment funds and have a serious advantage in the mathematics arms race. But for those that just casually dabbled in mining, they seemed to be getting a little something from doing it, even if it was small.

Admittedly one guy talked me into buying mining equipment, something miniscule and inexpensive, a novelty almost. It of course packs so little power that its contribution to the Bitcoin system will be insignificant and will likely yield nothing. I didn’t buy it from him though, I bought it on Amazon. Not taking any chances with the bitcoin weirdos.

I used a prepaid debit card to buy an Amazon gift card which I then used to buy a bitcoin mining machine, or something. I swear I’m not crazy. The moment I clicked buy though, something happened to me. My beard got a little more scraggly, the designer label on my pants faded away, all my past presidential votes magically got switched to Ron Paul, and I finally understood that nature was coming to kill us all.

Well, that’s almost what happened.

The Bitcoin Center might bring out the the industry’s worst stereotypes but between the lines, there’s something there. The unbanked, the merchants/consumers dealing with the costly nightmares of credit card processing, and the freeing feeling of operating outside the traditional banking system. I get it.

And they got me because I was one of the last people to leave that night. Before I knew it, Satoshi Monday almost became Satoshi Tuesday. “Party’s over buddy,” said one of the important Bitcoin Center people. I was ready to go. I really was. I had absorbed a lot. But I had just one more question for him.

“You selling?”

—–

Want to just try it out? Buy just $1 worth of bitcoin on Coinbase. You have nothing to lose by learning.