Alternative Funders Bid Adieu to 2016, Show Renewed Optimism for 2017

December 12, 2016

After getting pummeled in 2016, many alternative funders have licked their wounds and are flexing their muscles to go another round in 2017.

“The industry didn’t implode or go away after some fairly negative headlines earlier in the year,” says Bill Ullman, chief commercial officer of Orchard Platform, a New York-based provider of technology and data to the online lending industry. “While there were definitely some industry and company-specific challenges in the first half of the year, I believe the online lending industry as a whole is wiser and stronger as a result,” he says.

Certainly, 2016 saw a slowdown in the rapid rate of growth of online lenders. The year began with slight upticks in delinquency rates at some of the larger consumer originators. This was followed by the highly publicized Lending Club scandal over questionable lending practices and the ouster of its CEO. Consumers got spooked as share prices of industry bellwethers tumbled and institutional investors such as VCs, private equity firms and hedge funds curbed their enthusiasm. Originations slowed and job cuts at several prominent firms followed.

Despite the turmoil, most players managed to stay afloat, with limited exceptions, and brighter times seemed on the horizon toward the end of 2016. Institutional investors began to dip their toes back into the market with a handful of publicly announced capital-raising ventures. Loan volumes also began to tick up, giving rise to renewed optimism for 2017.

Notably, in the year ahead, market watchers say they anticipate modest growth, a shift in business models, consolidation, possible regulation and additional consumer-focused initiatives, among other things.

MARKETPLACE LENDERS REDEFINING THEMSELVES

Several industry participants expect to see marketplace lenders continue to refocus after a particularly rough 2016. Some had gone into other businesses, geographies and products that they thought would be profitable but didn’t turn out as expected. They got overextended and began getting back to their core in 2016. Others realized, the hard way, that having only one source of funding was a recipe for disaster.

“Business models are going to evolve quite substantially,” says Sam Graziano, chief executive officer and co-founder of Fundation Group, a New York-based company that makes online business loans through banks and other partners.

For instance, he predicts that marketplace lenders will move toward using their balance sheet or some kind of permanent capital to fund their loan originations. “I think that there will be a lot fewer pure play marketplace lenders,” he says.

Indeed, some marketplace lenders are starting to take note that it’s a bad idea to rely on a single source of financing and are shifting course. Some companies have set up 1940-Act funds for an ongoing capital source. Others have considered taking assets on balance sheet or securitizing assets.

“The trend will accelerate in 2017 as platforms and investors realize that it’s absolutely necessary for long-term viability,” says Glenn Goldman, chief executive of Credibly, an online lender that caters to small-and medium-sized businesses and is based in Troy, Michigan and New York.

BJ Lackland, chief executive of Lighter Capital, a Seattle-based alternative lender that provides revenue-based start-up funding for tech companies, believes that more online lenders will start to specialize in 2017. This will allow them to better understand and serve their customers, and it means they won’t have to rely so heavily on speed and volume—a combination that can lead to shady deals. “I don’t think that the big generalist online lenders will go away, just like payday lending is not going to go away. There’s still going to be a need, therefore there will be providers. But I think we’ll see the rise of online lending 2.0,” he says.

Despite the hiccups in 2016, Peter Renton, an avid P2P investor who founded Lend Academy to teach others about the sector, says he is expecting to see steady and predictable growth patterns from the major players in 2017. It won’t be the triple-digit growth of years past, but he predicts investors will set aside their concerns from 2016 and re-enter the market with renewed vigor. “I think 2017 we’ll go back to seeing more sustainable growth,” he says.

THE CONSOLIDATION EQUATION

Ron Suber, president of Prosper Marketplace, a privately held online lender in San Francisco, says victory will go to the platforms that were able to pivot in 2016 and make hard decisions about their businesses.

Prosper, for example, had a challenging year and has now started to refocus on hiring and growth in core areas. This rebound comes after the company said in May that it was trimming about a third of its workforce, and in October it closed down its secondary market for retail investors. Suber says business started to pick up again after a low point in July. “Business has grown in each of the subsequent months, so we are back to focused growth and quality loan production,” he says.

Not long after he said this, Prosper’s CEO, Aaron Vermut, stepped down. His father, Stephan Vermut, also relinquished his executive chairman post, a sign that attempts to recover have come at a cost.

Other platforms, meanwhile, that haven’t made necessary adjustments are likely to find that they don’t have enough equity and debt capital to support themselves, industry watchers say. This could lead to more firms consolidating or going out of business.

The industry has already seen some evidence of trouble brewing. For instance, online marketplace lender Vouch, a three-year-old company, said in June that it was permanently shuttering operations. In October, CircleBack Lending, a marketplace lending platform, disclosed that they were no longer originating loans and would transfer existing loans to another company if they couldn’t promptly find funding. And just before this story went to print, Peerform announced that they had been acquired by Versara Lending, a sign that consolidation in the industry has come.

The industry has already seen some evidence of trouble brewing. For instance, online marketplace lender Vouch, a three-year-old company, said in June that it was permanently shuttering operations. In October, CircleBack Lending, a marketplace lending platform, disclosed that they were no longer originating loans and would transfer existing loans to another company if they couldn’t promptly find funding. And just before this story went to print, Peerform announced that they had been acquired by Versara Lending, a sign that consolidation in the industry has come.

“I think you will see the real start of consolidation in the space in 2017,” says Stephen Sheinbaum, founder of New York-based Bizfi, an online marketplace. While some deals will be able to breathe life into troubled companies, others will merge to produce stronger, more nimble industry players, he says. “With good operations, one plus one should at least equal three because of the benefits of the economies of scale,” he says.

Market participants will also be paying close attention in 2017 to new online lending entrants such as Goldman Sachs’ with its lending platform Marcus. Ullman of Orchard Platform says he also expects to see more partnerships and licensing deals. “For smaller, regional and community banks and credit unions—organizations that tend not to have large IT or development budgets—these kinds of arrangements can make a lot of sense,” he says.

A BLEAKER MCA OUTLOOK

Meanwhile, MCA funders are ripe for a pullback, industry participants say. MCA companies are now a dime a dozen, according to industry veteran Chad Otar, managing partner of Excel Capital Management in New York, who believes new entrants won’t be able to make as much money as they think they will.

Paul A. Rianda, whose Irvine, California-based law firm focuses on MCA companies, likens the situation to the Internet boom and subsequent bust. “There’s a lot of money flying around and fin-tech is the hot thing this time around. Sooner or later it always ends.”

In particular, Rianda is concerned about rising levels of stacking in the industry. According to TransUnion data, stacked loans are four times more likely to be the result of fraudulent activity. Moreover, a 2015 study of fintech lenders found that stacked loans represented $39 million of $497 million in charge-offs.

Although Rianda does not see the situation having far-reaching implications as say the Internet bubble or the mortgage crisis, he does predict a gradual drop off in business among MCA players and a wave of consolidation for these companies.

“I do not believe that the current state of some MCA companies taking stacked positions where there are multiple cash advances on a single merchant is sustainable. Sooner or later the losses will catch up with them,” he says.

Rianda also predicts that the decrease of outside funding to related industries could have a spillover effect on MCA companies, causing some to cut back operations or go out of business. “Some companies have already seen decreased funding in the lending space and subsequent lay off of employees that likely will also occur in the merchant cash advance industry,” he says.

THE REGULATORY QUESTION MARK

One major unknown for the broader funding industry is what regulation will come down the pike and from which entity. The Office of the Comptroller of the Currency that regulates and supervises banks has raised the issue of fintech companies possibly getting a limited purpose charter for non-banks. The OCC also recently announced plans to set up a dedicated “fintech innovation office” early in 2017, with branches in New York, San Francisco and Washington.

There’s also a question of the CFPB’s future role in the alternative funding space. Some industry participants expect the regulator to continue bringing enforcement actions against companies. In September, for instance, it ordered San Francisco-based LendUp to pay $3.63 million for failing to deliver the promised benefits of its loan products. Ullman of Orchard Platform says he expects the agency to continue to play a role in the future of online lending, particularly for lenders targeting sub-prime borrowers.

Meanwhile, some states like California and New York are focusing more efforts on reining in online small business lenders, and it remains to be seen where this trend takes us in 2017.

MORE CONSUMER-FOCUSED INITIATIVES ON HORIZON

As the question of increased regulation looms, some industry watchers expect to see more industry led consumer-focused initiatives, an effort which gained momentum in 2016. A prime example of this is the agreement between OnDeck Capital Inc., Kabbage Inc. and CAN Capital Inc. on a new disclosure box that will display a small-business loan’s pricing in terms of total cost of capital, annual percentage rates, average monthly payment and other metrics. The initiative marked the first collaborative effort of the Innovative Lending Platform Association, a trade group the three firms formed to increase the transparency of the online lending process for small business owners.

Katherine C. Fisher, a partner with Hudson Cook LLP, a law firm based in Hanover, Maryland, that focuses on alternative funding, predicts that more financers will focus on transparency in 2017 for competitive and anticipated regulatory reasons. Particularly with MCA, many merchants don’t understand what it means, yet they are still interested in the product, resulting in a great deal of confusion. Clearing this up will benefit merchants and the providers themselves, Fisher notes. “It can be a competitive advantage to do a better job explaining what the product is,” she says.

CAPITAL-RAISING WILL CONTINUE TO POSE CHALLENGES

CAPITAL-RAISING WILL CONTINUE TO POSE CHALLENGES

Although there have been notable examples of funders getting the financing they need to operate and expand, it’s decidedly harder than it once was. Renton of Lend Academy says that some institutional investors will remain hesitant to fund the industry, given its recent troubles. “It’s a valuation story. While valuations were increasing, it was relatively easy to get funding,” he says. However, industry bellwethers Lending Club and OnDeck are both down dramatically from their highs and concerns about their long-term viability remain.

“Until you get sustained increases in the valuation of those two companies, I think it’s going to be hard for others to raise money,” Renton says.

Several years ago, alternative funders were new to the game and gained a lot of traction, but it remains to be seen whether they can continue to grow profits amid greater competition and the high cost of obtaining capital to fund receivables, according to William Keenan, chief executive of Pango Financial LLC, an alternative funding company for entrepreneurs and small businesses in Wilmington, Delaware.

These companies continue to need investors or retained earnings and for some companies this is going to be increasingly difficult. “How they sustain growth going forward could be a challenge,” he says. Even so, Renton remains bullish on the industry—P2P players especially. “The industry’s confidence has been shaken. There have been a lot of challenges this year. I think many people in the industry are going to be glad to put 2016 to bed and will look with renewed optimism on 2017,” he says.

Prior to this story going to print, small business lender Dealstruck was reportedly not funding new loans and CAN Capital announced that three of the company’s most senior executives had stepped down.

Merchant Cash Advance Misinformation Abounds – What’s A Broker To Think?

October 10, 2016

Last week, at least two panelists at the major commercial loan broker conference critiqued merchant cash advances, even going so far as to assign an arbitrary cost to them. Craig McGrain, President of factoring company Durham Funding, said they cost about 75%. Bob Coleman, owner of The Coleman Report, an SBA loan journal, said that merchant cash advance contracts should stipulate that prices are basically equivalent to 100% APR. Neither accurately describes a merchant cash advance if for no other reason than because a merchant cash advance is merely a methodology or a mechanism, not a price. The term itself is derived from the process of making a merchant an advance on their future projected sales. With hundreds of companies employing that concept, some are able to do it at a low cost and others at a high cost.

And it’s obviously the high cost ones to which their disdain was directed. But even then, when MCAs are properly structured as a purchase of future sales, there is no calculable APR because there is no assigned time frame, predetermined payments, or interest rate. This doesn’t mean an MCA product can’t be expensive, because surely they can be, but assigning randomly high percentages to scare people only compounds the misinformation that has persisted for years.

On a panel I participated in with Bob Coleman, Coleman said that these purchases were really just loans. The New York Supreme Court, however, repeatedly disagrees with him. In Platinum Rapid Funding Group Ltd v. VIP Limousine Services, Inc. and Charles Cotton, the court affirmed a purchase of future receivables for an upfront payment, adding that the request for the Court to convert the Agreement to a loan and assign an interest rate to it would require unwarranted speculation, and would contradict the explicit terms of the sale of future receivables in accordance with the Merchant Agreement.

In Merchant Cash & Capital, LLC v G&E Asian Am. Enter., Inc., the court reached the same conclusion.

With regard to McGrain of Durham Funding, he said that 70%-80% of companies that apply for his company’s factoring services have already used an MCA. This kind of competitive pressure is probably a leading reason why a factor would mischaracterize MCAs. In fact, the factoring industry has felt so threatened by MCAs, that two years ago the International Factoring Association voted to ban all MCA companies from their organization.

This isn’t to suggest that factoring is an inferior product and that MCA is the newer better thing. On the contrary, factoring is an excellent loan alternative and to McGrain’s credit he said that he believed the free market would work everything out. To facilitate that, more MCA brokers need to be educated on factoring and SBA lending. And in return commercial finance brokers need to understand the true nuts and bolts of MCA. That process gets sullied when misinformation abounds. Merchants will get the best help when the brokers fully understand all of the market’s options.

My panel with SBA lending expert Bob Coleman and equipment leasing veteran Kit Menkin at the NACLB conference last week highlighted some differences of opinions across these closely related industries but also demonstrated areas in which we all agree. Small businesses have different needs and it’s up to the brokers to prescribe the most appropriate solution. Whether it’s short-term or long-term, cheap or expensive, proactive or reactive, there’s capital out there. Hopefully the kind of cooperative engagement the NACLB conference provided this year will continue to be fostered for years to come.

Dear Funders: Don’t Dial ‘M’ for Marketing

October 7, 2016

Imagine you own a small donut shop in Arizona and receive an email saying, “Hello, I have heard your chocolate donuts are amazing and the most popular item. I work for XX, and we provide small business loans, do reach out to us if you’re looking to take it a step further.”

Versus

Getting yet another envelope in a deluge of mails with a bank-check-like promotional ad for a preposterous amount that startles you for a hot second before it ends up in the paper shredder.

One of these methods is free, personalized and subtle. And no points for guessing which one.

Gone should be the days where funders indiscriminately send out email blasts or cold call merchants offering working capital. But are they?

A year ago, a Wall Street Journal article said,

“A big reason online lenders make heavy use of mail, they said, is that it is still more effective than other types of direct marketing. Across all industries, the overall response rate for direct-mail overtures is 3.7%, compared with 0.1% for both email and social-media marketing campaigns, according to a recent report from the Direct Marketing Association, an industry group.”

Mintel Comperemedia, a database which tracks advertising data highlighted the use of technology as being the paramount shift in marketing for the financial services industry. But is the transition from analog to digital underway?

For some companies, it is. New York-based SOS Capital does not have a sales team and does all of its marketing on social media. The company sends no direct mailers, limits email blasts and instead scouts for small businesses on Facebook, LinkedIn and Yelp.

With more small businesses ramping up their social media presence, discovering leads has not only become easier but also cheaper. “Small business presence on Facebook is growing every day and finding them there can save you a lot of money,” said David Obstfeld, CEO and co-founder of SOS Capital. “Facebook is not explored by most funders but we have had great success.” The company spent $6,500 marketing to SMBs on Facebook and had 120 conversions over a period of two months.

How does that compare with the conventional methods of direct mail campaigns, email blasts and phone calls?

According to Justin Benton, sales director at leads generation firm, Lenders Marketing, it could cost about $100,000 to send out a million emails to active, verified accounts and as much as a dollar for a nice direct mail, including printing and postage.

“Even though it’s cost prohibitive for some folks and some others think that it’s past its prime, direct mail still wins,” said Benton who urges his clients to consider social media marketing which he says can be “virtually free.”

Discovering companies on sites like LinkedIn and Yelp can offer insights into the business and target customers better. “Calling a lead once and saying the words, ‘business loans’ or ‘working capital loans’ does not work, you need to understand the business,” Benton added.

Digital marketing can also help one keep better track of leads and reinvest in the ones that work. “It’s important to have a leads scoring system,” Benton said. The opposite of that, to him, looks like “Making a gumbo from scratch but you have no idea how you did it and cannot recreate it.”

Competition among financial companies will eventually force them to get more creative with their marketing tactics. Like Partners Funding for example, an MCA funder that markets to ISOs, uses incentives as baits. “If the ISOs fund three deals over $50,000, we reward them with extra points or give them marketing dollars,” said Michael Jenssen, ISO sales manager at Partners Funding, which sticks to marketing through email blasts, calls and exhibiting at trade shows.

Ultimately, the road to a lasting relationship with clients is paved with effective marketing. And the line between pushing call to action and being pesky is quite fine. “Funders have been using the same marketing campaigns and it’s making the clients sick,” said Obstfeld. “There are only so many mailers one can receive. They have to be creative about marketing to people without annoying them.”

For Obstfeld, the value in pursuing businesses through channels like Facebook is having more control over deals and interacting with the merchants directly, without any interference from ISOs. “It’s not just about saving money but the control over the deal. When there is no ISO involved, there is no stacking involved.”

The transition to moving all marketing online might be slow but inevitable. Until then, using bank check imagery to promote big pre-approvals will be more than just gags.

IT’S A BROKER’S WORLD

August 31, 2016

From east to west, small businesses are getting funded. But how they’re found and who they work with depends on where they are. In the US, where brokers tend to have a love/hate relationship with the funding companies they work with, they are no doubt a driving force in the market. In other countries, they might not even exist, are just starting to bloom or they add balance to a mature market. Is the world built for brokers? AltFinanceDaily traveled far and wide to find the answers.

Down under in Australia where American-based merchant cash advance and lending companies have expanded, the ISO (which stands for Independent Sales Office and is synonymous with broker) model has not really followed. David Goldin, CEO of Capify, an international company headquartered in New York, told AltFinanceDaily that there’s very few ISOs in Australia.

He believes that’s because there’s next to no payment processing ISO market there, a foundation that was a major precursor in the US towards the development of ISOs reselling merchant cash advances and business loans.

He believes that’s because there’s next to no payment processing ISO market there, a foundation that was a major precursor in the US towards the development of ISOs reselling merchant cash advances and business loans.

Luke Schmille, President of CapRock Services, echoed same. The Dallas-based company founded Sprout Funding in Australia earlier this summer as part of a joint venture with Sydney-based family office Huntwick Holdings. “Direct marketing is the primary method [of acquiring deal flow],” he said. “The credit card processing space is controlled by several large banks, so you don’t see ISO efforts in the acquiring space either.”

Big bank dominance was only one reason why another country’s emerging alternative small business funding market developed slowly. In Hong Kong, non-bank alternatives like merchant cash advances faced legal uncertainty for a long time. For example, Global Merchant Funding (GMF), once the only merchant cash advance company in the Chinese special administrative region, had been relentlessly pursued for years by the Secretary for Justice for conducting business as a money lender without a license. GMF fought it. And won.

In May of this year, the legality of merchant cash advances ultimately prevailed after the highest court ruled the agreements were not loans. Emboldened, several companies have stepped up their marketing of the product. But whether they’re doing daily debit loans or split-processing merchant cash advances (both of which exist there), marketing tends to be directed at merchants, not a middle market of brokers.

Gabriel Chung of Hong Kong-based Advanced Express Capital said that there are a handful of large brokers typically comprised of former bankers, but the rest of the broker market is highly fragmented, mostly made up of individual freelancers.

Gabriel Chung of Hong Kong-based Advanced Express Capital said that there are a handful of large brokers typically comprised of former bankers, but the rest of the broker market is highly fragmented, mostly made up of individual freelancers.

Adrian Cook, the Founder and CEO of Hong Kong-based Asia Capital Advance, agreed that marketing is usually aimed at merchants directly but that it’s changing. “Since the market is still very new and MCA is only beginning to gain popularity, brokers on the market are only starting to recognize MCA,” he said. “There is a lot of room for the brokerage market to grow.”

In the UK, where Capify also operates, CEO David Goldin explained that the UK doesn’t have a lot of credit card processing ISOs so there wasn’t a major migration from that business to MCA like there was in the US. But that doesn’t mean there is no middleman market at all.

Paul Mildenstein, executive director of London-based Liberis, said that brokers are an important channel, but not as dominant as they are in the US. “Our brokers are usually members of the NACFB, an organisation in the UK that actively supports and provides operating principles to the furtherance of the commercial finance broker community,” he wrote. The National Association of Commercial Finance Brokers claims to have 1600 members, one among them is Liberis.

Paul Mildenstein, executive director of London-based Liberis, said that brokers are an important channel, but not as dominant as they are in the US. “Our brokers are usually members of the NACFB, an organisation in the UK that actively supports and provides operating principles to the furtherance of the commercial finance broker community,” he wrote. The National Association of Commercial Finance Brokers claims to have 1600 members, one among them is Liberis.

“Many clients want the support of an experienced professional who can discuss the financial options available to them in their specific circumstances,” said Liberis’ CEO, Rob Straathof. “Given relatively low awareness of the Business Cash Advance product in the UK, this means that brokers have a key role to play in educating potential customers on when this is the right option for them,” he added.

Straathof stressed a robust criteria for the brokers they work with and explained that brokers are their eyes and ears in the market. “The relationships we have with them are not transactional, but transformational for our business,” he said.

The NACFB was also praised by Alexander Littner, Managing Director of Chelmsford, Essex-based Boost Capital. The company, which is actually a subsidiary of Coral Springs, FL-based BFS Capital in the US, sees a balance between their use of brokers and their efforts to acquire customers directly.

“As the alternative finance market is still relatively new here in the UK these brokers are important for this independent advice, and to help educate the market and establish trust,” Littner said. “At Boost Capital we work very closely with brokers across the UK, they are a critical part of our growth and fundamental to our ongoing success.”

In the US, brokers play such a dominant role in customer acquisition that some MCA funding companies rely on them to source the entirety of their business. Back in February, Jordan Feinstein of NY-based Nulook Capital told AltFinanceDaily, “We decided that the best way to grow is to build relationships to avoid the overhead, compliance, training and manpower that a sales team would require.” Nulook markets its broker-only approach as a strength.

Others take a more blended approach, like Justin Bakes, CEO of Forward Financing, for example. “While our priority is to self originate, it is essential to create and maintain partnerships in this business,” he said earlier this year.

Notably, no such guiding authority like the UK’s NACFB exists for brokers in the US so it’s not easy to track exactly how many there are or how they operate, but their role in the industry cannot be understated. AltFinanceDaily actually labeled 2015 The Year Of The Broker, when it published an article in its March/April 2015 issue that tried to capture the essence of the industry at the time. Tom McGovern, who was then a VP at Cypress Associates LLC, said of brokers, “They’re like the missionaries of the industry going out to untapped areas of the market.”

But preaching the gospel of alternative funding exists at different stages across the world. And Goldin, whose company Capify operates in four countries including the US, thinks that many middlemen here at home may not ultimately survive. In an interview, he predicted that the stronger ones over time will be acquired by funding companies and that direct marketing will only increase. “I think more and more companies are going to start building their own internal sales forces,” he said.

Other brokers are not convinced that acquisition costs will lead to the death of their businesses, especially if they’ve already found ways to reduce overhead costs. Several brokers have discreetly mentioned running operations from Costa Rica, Nicaragua or elsewhere as a way to keep things profitable. Still more, like Excel Capital Management based in Manhattan, have found that offering a suite of products allows them to monetize more customers. Chad Otar, a managing partner for Excel, said that they recently brokered a $4.9 million SBA loan. MCA is just one of their options these days. “As long as there’s small businesses, there’s always going to be opportunity,” he said.

In the US, the brokers have certainly seized it, but that’s because most funding companies offer big bucks and quick payment to those that are capable of sourcing customers. In other countries, compensation for services rendered might be the responsibility of the broker to arrange with the merchant since it may not be customary for funding providers to pay commissions. That would mean more work and more risk for the broker.

In the US, the brokers have certainly seized it, but that’s because most funding companies offer big bucks and quick payment to those that are capable of sourcing customers. In other countries, compensation for services rendered might be the responsibility of the broker to arrange with the merchant since it may not be customary for funding providers to pay commissions. That would mean more work and more risk for the broker.

Ironically, some brokers in the US will tap into both sides, earning a commission from the funder and charging a fee to the merchant for services rendered. And if the broker has payment processing roots, they can go a step further and earn merchant account residuals as well.

Brokers can’t exist without funding companies willing to support their endeavors, of course. While their prevalence around the world varies, most of the funding companies AltFinanceDaily spoke to, appear eager to nurture the middleman’s role, so long as they act responsibly.

“Brokers in the UK are incredibly important as independent advisors to small businesses on the various sources of finance to suit their needs,” said Littner.

And as long as those customers, wherever they may be, are getting the value they want from a broker, that role, so long as it can continue to be done profitably, will likely have a place in the world for the foreseeable future.

Calling Timeout On Financial Regulations, A Pump For Trump?

August 10, 2016

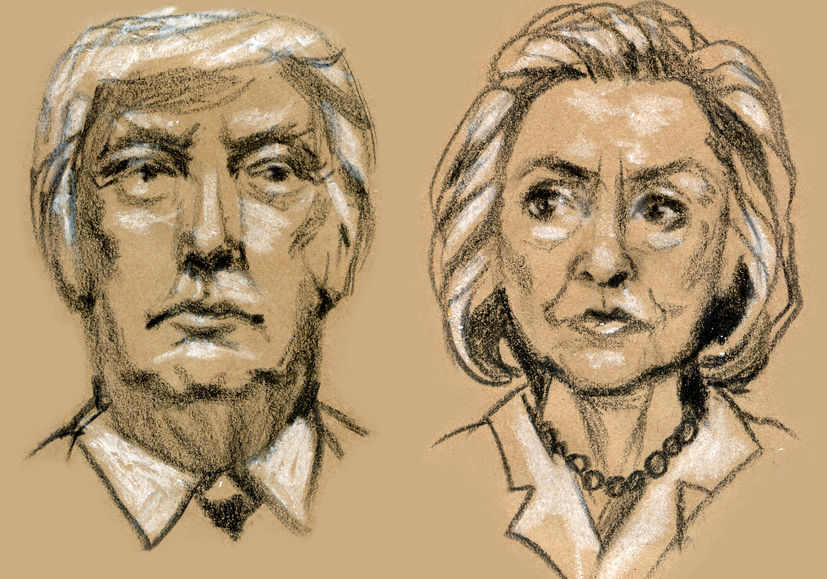

Only 24% of small business owners say that Hillary Clinton is the presidential candidate that has their best interest at heart, according to a survey conducted by Capify, a business financing company based in New York. 53% selected Donald Trump.

And whatever your opinions about Trump, his proposed moratorium on new financial regulations could entice both small businesses and alternative financial companies to consider a Trump presidency.

“Under my plan, no American company will pay more than 15% of their business income in taxes,” Trump said in Detroit on August 8th.

A report published by the National Federation of Independent Business (NFIB) last month found that 20% of business owners ranked taxes as the single most important problem facing their business. Only 2% reported that financing was their top business problem.

Message received? It appears not

In states like Illinois, some legislators are focusing their efforts on finding ways to make it harder for small businesses to obtain financing, convinced that questionable lending practices are the source of their problems, not taxes. But in a call with Bryan Schneider, secretary of the Illinois Department of Financial and Professional Regulation, he told AltFinanceDaily that no one has complained of any small-business lending problems in Illinois to state regulators.

Regulators should not indulge in creating solutions in search of problems, Sec. Schneider cautioned. “When you’re a hammer, the world looks like a nail,” he said, suggesting that regulators sometimes base their actions on anecdotal isolated incidents instead of reserving action to correct widespread problems.

And that’s why a moratorium on financial regulations (albeit on the federal level) might also resonate with small businesses. Lawmakers don’t appear to be addressing their grievances and ironically, passing new laws that make it harder to obtain financing could potentially even exacerbate the problems they’re already vocalizing.

Small businesses seemed to have become aware of the government-as-obstructionist role however since 22% of them surveyed in the NFIB study, said that government requirements and red tape were the single most important problem they faced, more than anything else.

The Finance Side

A timeout is not a sure-fire way to woo Wall Street however, since a moratorium on federal regulations could actually serve as a hindrance for some financial companies hoping to reach some legal framework consensus down the road. Last year, Bizfi founder Stephen Sheinbaum, said that a 50-state patchwork of laws would make operating companies like his more challenging. “Personally, I’d be glad to see it on the federal level, we won’t have to deal with 50 individual states, which is more unruly,” Sheinbaum said in regards to potential regulation.

But a timeout on making any moves might indeed be in order anyway, given the questions that are being asked by some federal legislators. Last month during a hearing, Rep. David Scott asked what made business loans different from consumer loans. Parris Sanz, the Chief Legal Officer of CAN Capital, who was there testifying on behalf of the Electronic Transactions Association (ETA), gave his answer.

But there is a fear, just by those questions, that some legislators are still having trouble understanding the fundamentals. And that may be why a dozen trade associations and lobbying groups have formed in the last year to provide educational resources about alternative financing.

In states like Illinois, Scott Talbott, SVP of government affairs for the ETA, said they are encouraging legislators to adopt a “go-slow approach” that affords enough time to understand how the industry operates and what proposed laws or regulations would do to change that.

Keep it Simple?

With Trump, despite all his quirks, it’s possible that his ideas about a moratorium, could be a deciding factor in how small business owners and those employed by alternative financial companies vote. Lower taxes, timeout on regulations, has the potential to resonate far and wide.

60% of small business owners think that the outcome of the presidential election will have a severe impact on small businesses, according to the Capify survey. 29% said it possibly will have a severe impact. With taxes and government red tape at the top of their list of grievances, there might just be a pump for trump on both sides of the alternative finance aisle.

As Credit Tightens, Borrowers and Investors Retreat Alike

July 5, 2016 America’s bond market is drying up.

America’s bond market is drying up.

The value of bonds packaged with personal, corporate and real-estate loans fell by $98 billion, a 37 percent decline from the first half of 2015 making it tough for businesses to refinance their debt.

Lenders have for long relied on securitization for capital but as the credit market tightens, companies will be forced to diversify and soon.

There are currently more than $10 trillion in outstanding securities backed by personal, business and other loans, according to the Securities Industry and Financial Markets Association, the Wall Street Journal said.

And it’s not just investors who are retreating. A recent study found that small businesses are hesitant to borrow and rely on personal resources to meet their business’ capital needs. Demand from businesses with revenues of less than $5 million shrunk 15 percent from Q1 2016 to Q2 2016, from 38 percent to 32 percent.

The survey also noted that a third of business owners that responded transferred personal assets like savings and personal credit cards to their business accounts in the last quarter.

“Business borrowing habits suggest owners may not see a need for an immediate infusion of capital,” said Dr. Craig R. Everett, assistant professor of finance and director of the Pepperdine Private Capital Markets Project. “However, these findings suggest business owners are still feeling the lasting impact of the recent recession and remain skittish about the future, as reflected in an abundance of caution when it comes to the economic environment.”

Business owners are being tightfisted with borrowing, instead using earnings and profits for capital expenditure.

“There are far fewer small businesses taking a loan, as they don’t see opportunity for expansion,” said Holly Wade, director of research and policy analysis at NFIB, a small business trade association. “Some are uncertain about the future so they don’t want to take out a loan and in some instances, owners have a more difficult time finding desired loans.”

As Mortgage Applications Slow Down, is it Smarter to Rent?

June 1, 2016It turns out those who rent might be smarter, after all. Applications for refinancing mortgages and new home purchases fell 4 percent from the previous week, according to Mortgage Bankers Association.

As home prices rise and the anticipation around Fed raising rates builds, it will only lead to loans getting more expensive. As such, refinance applications decreased 4 percent, seasonally adjusted, and purchase applications decreased 5 percent and applications for government loans fell 6 percent. The average loan size on refinances also dropped for three straight weeks.

“House prices have breached the peak levels of 2006, raising concerns about the long-term sustainability of current price levels,” Sean Becketti, chief economist at Freddie Mac, wrote in a report on the housing market.

This doesn’t bode well for lenders like SoFi which is trying to make a big headway into mortgage refinancing. “While we launched our mortgage business focused on larger ‘jumbo’ loans, the certainty and efficiency offered by Fannie Mae will enable us to serve more members by expanding geographically and into smaller loan amounts,” Michael Tannenbaum, VP of Mortgage at SoFi said when the lender became a Fannie Mae seller.

Online Lending APR ‘SMART Box’ To Apply To Loans, Not Merchant Cash Advances

May 5, 2016

OnDeck, Kabbage and CAN Capital have launched an initiative to make online loan shopping easier. Dubbed the SMART (Straightforward Metrics Around Rate and Total Cost) Box, these lenders plan to present small businesses “with a chart of standardized pricing comparison tools and explanations, including various total dollar cost and annual percentage rate metrics that enable a comprehensive pricing comparison of loans of equivalent duration.”

The Box, clearly meant to increase transparency, was explained in an ironically confusing way, particularly where it said it would include annual percentage rate metrics. An Annual Percentage Rate (APR) is indeed a representation of several metrics and thus it wasn’t clear if the Box would just include some of these individual metrics and conveniently leave out the APR itself.

OnDeck CEO Noah Breslow for example told Forbes only six months ago that annual terms don’t make sense. “The APR overstates the actual cost of the loan to the borrower,” he said. He was not alone in thinking that way. Several studies have concluded too that merchants don’t always even know what APR represents. Lendio for example, found that two-thirds of small businesses selected the total dollar cost of a loan as the easiest to understand. Only 17.4% said the APR was the easiest.

And there’s another thing, the fact that CAN doesn’t just do loans, they also do a significant amount of merchant cash advances. What role could an APR have there? While the Box’s final system won’t be decided until after the conclusion of a 90-day national engagement period that begins next month, one can only imagine that it might have a Schumer Boxer feel to it.

Via: NerdWallet

The syntactic ambiguity in the announcement however was unintentional. A spokesperson for the group (Known as the Innovative Lending Platform Association) said that the SMART Box will indeed include Annual Percentage Rates.

But that’s where loans are concerned…

When AltFinanceDaily asked about merchant cash advances, Daniel Gorfine, vice president and associate general counsel of OnDeck; Parris Sanz, Chief Legal Officer of CAN Capital and Azba Habib, assistant general counsel of Kabbage, submitted the following joint response:

“As part of the SMART Box initiative, we are interested in engaging with providers of MCA products. Based on consistent assumptions about a small business’s future sales volumes and its ability to deliver the contracted amount of receivables within the period of time estimated during underwriting, the SMART Box could apply to MCA products.”

So long as SMART Box disclosure is voluntary, an MCA company could perhaps employ their own version of it. It just might come sans APR given the product’s history with state regulations. The Association is emphatic however that this concept could be used by MCA companies and others in the small business financing space. After all, the initiative is rooted in transparency for the small business owner, they say.

In September, the Association “will encourage those interested in promoting the responsible development of the small business lending industry to voluntarily adopt or support the model disclosure.”

Given the level of influence these companies have on the industry, the voluntary nature of the SMART Box has the potential to spark an industry-wide box revolution. MCA companies however would need to structure transparent disclosure around their contractual frameworks. But even that could be a good thing. One commercial financing broker for example, posted a redacted service fee agreement to the DailyFunder forum earlier this week that purported to show another broker trying to charge a merchant a 26% premium (26% of the funding amount) for their work. Despite this unusually high cost, the charge itself was hard to find, hidden among fine print on an otherwise benign looking page. Naturally, others in the industry did not respond kindly to it. Even other brokers referred to it as “outrageous,” “nonsense,” or “bs.”

Their reactions make clear that there is a desire for transparency even among the group most often blamed for the lack thereof. Some of the industry’s forward thinkers have told AltFinanceDaily that a system like a SMART Box is the future of the industry whether one agrees with it or not. And if not for the sake of small businesses and regulators, then for the sake of being able to compete fairly against companies that may be relying on truly hidden fees.

SMART Box. All aboard the transparency train?