Stairway to Heaven: Can Alternative Finance Keep Making Dreams Come True?

April 28, 2016

The alternative small-business finance industry has exploded into a $10 billion business and may not stop growing until it reaches $50 billion or even $100 billion in annual financing, depending upon who’s making the projection. Along the way, it’s provided a vehicle for ambitious, hard-working and talented entrepreneurs to lift themselves to affluence.

Consider the saga of William Ramos, whose persistence as a cold caller helped him overcome homelessness and earn the cash to buy a Ferrari. Then there’s the journey of Jared Weitz, once a 20 something plumber and now CEO of a company with more than $100 million a year in deal flow.

Their careers are only the beginning of the success stories. Jared Feldman and Dan Smith, for example, were in their 20s when they started an alt finance company at the height of the financial crisis. They went on to sell part of their firm to Palladium Equity Partners after placing more than $400 million in lifetime deals.

Their careers are only the beginning of the success stories. Jared Feldman and Dan Smith, for example, were in their 20s when they started an alt finance company at the height of the financial crisis. They went on to sell part of their firm to Palladium Equity Partners after placing more than $400 million in lifetime deals.

The industry’s top salespeople can even breathe new life into seemingly dead leads. Take the case of Juan Monegro, who was in his 20s when he left his job in Verizon customer service and began pounding the phones to promote merchant cash advances. Working at first with stale leads, Monegro was soon placing $47 million in advances annually.

The industry’s top salespeople can even breathe new life into seemingly dead leads. Take the case of Juan Monegro, who was in his 20s when he left his job in Verizon customer service and began pounding the phones to promote merchant cash advances. Working at first with stale leads, Monegro was soon placing $47 million in advances annually.

Alternative funding can provide a second chance, too. When Isaac Stern’s bakery went out of business, he took a job telemarketing merchant cash advances and went on to launch a firm that now places more than $1 billion in funding annually.

All of those industry players are leaving their marks on a business that got its start at the dawn of the new century. Long-time participants in the market credit Barbara Johnson with hatching the idea of the merchant cash advance in 1998 when she needed to raise capital for a daycare center. She and her husband, Gary Johnson, started the company that became CAN Capital. The firm also reportedly developed the first platform to split credit card receipts between merchants and funders.

BIRTH OF AN INDUSTRY

Competitors soon followed the trail those pioneers blazed, and the industry began growing prodigiously. “There was a ton of credit out there for people who wanted to get into the business,” recalled David Goldin, who’s CEO of Capify and serves as president of the Small Business Finance Association, one of the industry’s trade groups.

Competitors soon followed the trail those pioneers blazed, and the industry began growing prodigiously. “There was a ton of credit out there for people who wanted to get into the business,” recalled David Goldin, who’s CEO of Capify and serves as president of the Small Business Finance Association, one of the industry’s trade groups.

Many of the early entrants came from the world of finance or from the credit card processing business, said Stephen Sheinbaum, founder of Bizfi. Virtually all of the early business came from splitting card receipts, a practice that now accounts for just 10 percent of volume, he noted.

At first, brokers, funders and their channel partners spent a lot of time explaining advances to merchants who had never heard of them, Goldin said. Competition wasn’t that tough because of the uncrowded “greenfield” nature of the business, industry veterans agreed.

Some of the initial funding came from the funders’ own pockets or from the savings accounts of their elderly uncles. “I’ve met more than a few who had $2 million to $5 million worth of loans from friends and family in order to fund the advances to the merchants,” observed Joel Magerman, CEO of Bryant Park Capital, which places capital in the industry. “It was a small, entrepreneurial effort,” Andrea Petro, executive vice president and division manager of lender finance for Wells Fargo Capital Finance, said of the early days. “A number of these companies started with maybe $100,000 that they would experiment with. They would make 10 loans of $10,000 and collect them in 90 days.”

That business model was working, but merchant cash advances suffered from a bad reputation in the early days, Goldin said. Some players were charging hefty fees and pushing merchants into financial jeopardy by providing more funding than they could pay back comfortably. The public even took a dim view of reputable funders because most consumers didn’t understand that the risk of offering advances justified charging more for them than other types of financing, according to Goldin.

Then the dam broke. The economy crashed as the Great Recession pushed much of the world to the brink of financial disaster. “Everybody lost their credit line and default rates spiked,” noted Isaac Stern, CEO of Fundry, Yellowstone Capital and Green Capital. “There was almost nobody left in the business.”

RAVAGED BY RECESSION

Perhaps 80 percent of the nation’s alternative funding companies went out of business in the downturn, said Magerman. Those firms probably represented about 50 percent of the alternative funding industry’s dollar volume, he added. “There was a culling of the herd,” he said of the companies that failed.

Life became tough for the survivors, too. Among companies that stayed afloat, credit losses typically tripled, according to Petro. That’s severe but much better than companies that failed because their credit losses quintupled, she said.

Who kept the doors open? The firms that survived tended to share some characteristics, said Robert Cook, a partner at Hudson Cook LLP, a law office that specializes in alternative funding. “Some of the companies were self-funding at that time,” he said of those days. “Some had lines of credit that were established prior to the recession, and because their business stayed healthy they were able to retain those lines of credit.”

The survivors also understood risk and had strong, automated reporting systems to track daily repayment, Petro said. For the most part, those companies emerged stronger, wiser and more prosperous when the crisis wound down, she noted. “The legacy of the Great Recession was that survivors became even more knowledgeable through what I would call that ‘high-stress testing period of losses,’” she said.

ROAD TO RECOVERY

The survivors of the recession were ready to capitalize on the convergence of several factors favorable to the industry in about 2009. Taking advantages of those changes in the industry helped form a perfect storm of industry growth as the recession was ending.

The survivors of the recession were ready to capitalize on the convergence of several factors favorable to the industry in about 2009. Taking advantages of those changes in the industry helped form a perfect storm of industry growth as the recession was ending.

They included making good use of the quick churn that characterizes the merchant cash advance business, Petro noted. The industry’s better operators had been able to amass voluminous data on the industry because of its short cycles. While a provider of auto loans might have to wait five years to study company results, she said, alternative funders could compile intelligence from four advances within the space of a year.

That data found a home in the industry around the time the recession was ending because funders were beginning to purchase or develop the algorithms that are continuing to increase the automation of the underwriting process, said Jared Weitz, CEO of United Capital Source LLC. As early as 2006, OnDeck became one of the first to rely on digital underwriting, and the practice became mainstream by 2009 or so, he said.

Just as the technology was becoming widespread, capital began returning to the market. Wealthy investors were pulling their funds out of real estate and needed somewhere to invest it, accounting for part of the influx of capital, Weitz said.

At the same time, Wall Street began to take notice of the industry as a place to position capital for growth, and companies that had been focused on consumer lending came to see alternative finance as a good investment, Cook said.

For a long while, banks had shied away from the market because the individual deals seem small to them. A merchant cash advance offers funders a hundredth of the size and profits of a bank’s typical small-business loan but requires a tenth of the underwriting effort, said David O’Connell, a senior analyst on Aite Group’s Wholesale Banking team.

The prospect of providing funds became even less attractive for banks. The recession had spawned the Dodd-Frank Financial Regulatory Reform Bill and Basel III, which had the unintended effect of keeping banks out of the market by barring them from endeavors where they’re inexperienced, Magerman said. With most banks more distant from the business than ever, brokers and funders can keep the industry to themselves, sources acknowledged.

At about the same time, the SBFA succeeded in burnishing the industry’s image by explaining the economic realities to the press, in Goldin’s view.The idea that higher risk requires bigger fees was beginning to sink in to the public’s psyche, he maintained.

Meanwhile, loans started to join merchant cash advances in the product mix. Many players began to offer loans after they received California finance lenders licenses, Cook recalled. They had obtained the licenses to ward off class-action lawsuits, he said and were switching from sharing card receipts to scheduled direct debits of merchants’ bank accounts.

As those advantages – including algorithms, ready cash, a better image and the option of offering loans – became apparent, responsible funders used them to help change the face of the industry. They began to make deals with more credit-worthy merchants by offering lower fees, more time to repay and improved customer service. “The recession wound up differentiating us in the best possible way,” Bizfi’s Sheinbaum said of the changes.

His company found more-upscale customers by concentrating on industries that weren’t hit too hard by the recession. “With real estate crashing, people were not refurbishing their homes or putting in new flooring,” he noted.

Today, the booming alternative finance industry is engendering success stories and attracting the nation’s attention. The increased awareness is prompting more companies to wade into the fray, and could bring some change.

WHAT LIES AHEAD

One variety of change that might lie ahead could come with the purchase of a major funding company by a big bank in the next couple of years, Bryant Park Capital’s Magerman predicted. A bank could sidestep regulation, he suggested, by maintaining that the credit card business and small business loans made through bank branches had provided the banks with the experience necessary to succeed.

Smaller players are paying attention to the industry, too, with varying degrees of success. Predictably, some of the new players are operating too aggressively and could find themselves headed for a fall. “Anybody can fund deals – the talent lies in collecting the money back at a profitable level,” said Capify’s Goldin. “There’s going to be a shakeout. I can feel it.”

Smaller players are paying attention to the industry, too, with varying degrees of success. Predictably, some of the new players are operating too aggressively and could find themselves headed for a fall. “Anybody can fund deals – the talent lies in collecting the money back at a profitable level,” said Capify’s Goldin. “There’s going to be a shakeout. I can feel it.”

Some of today’s alternative lenders don’t have the skill and technology to ward off bad deals and could thus find themselves in trouble if recession strikes, warned Aite Group’s O’Connell. “Let’s be careful of falling into the trap of ‘This time is different,’” he said. “I see a lot of sub-prime debt there.”

Don’t expect miracles, cautioned Petro. “I believe there will be another recession, and I believe that there will be a winnowing of (alternative finance) businesses,” she said. “There will be far fewer after the next recession than exist today.”

A recession would spell trouble, Magerman agreed, even though demand for loans and advances would increase in an atmosphere of financial hardship. Asked about industry optimists who view the business as nearly recession-proof, he didn’t hold back. “Don’t believe them,” he warned. “Just because somebody needs capital doesn’t mean they should get capital.”

Further complicating matters, increased regulatory scrutiny could be lurking just beyond the horizon, Petro predicted. She provided histories of what regulation has done to other industries as an indication of the differing outcomes of regulation – one good, one debatable and one bad.

Good: The timeshare business benefitted from regulation because the rules boosted the public’s trust.

Debatable: The cost of complying with regulations changed the rent-to-own business from an entrepreneurial endeavor to an environment where only big corporations could prosper.

Bad: Regulation appears likely to alter the payday lending business drastically and could even bring it to an end, she said.

Still, regulation’s good side seems likely to prevail in the alternative finance business, eliminating the players who charge high fees or collect bloated commissions, according to Weitz. “I think it could only benefit the industry,” he said. “It’ll knock out the bad guys.”

Signs of Slowdown? Lending Club Increases Rates, Adjusts Forecast

April 21, 2016 Should online lenders prepare for a downturn already? Lending Club has a cue.

Should online lenders prepare for a downturn already? Lending Club has a cue.

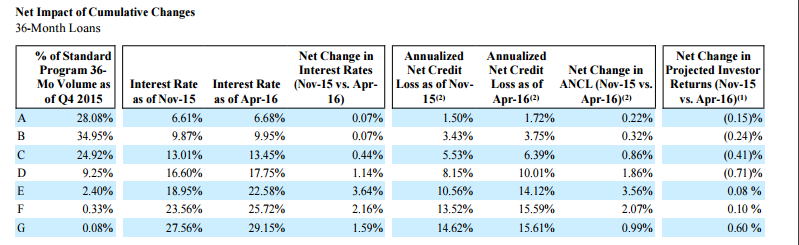

In a SEC filing on Thursday (April 21) the marketplace lender notified the bureau that it will increase interest rates by 23 basis points and also updated its loss projections.

The hike in rates were concentrated in Grades D – G, identified by the company as underperforming pockets of loans representing 5 percent of the loan volume.

“The population eliminated from the credit policy was mainly characterized by high indebtedness, an increased propensity to accumulate debt and lower credit scores,” the filing said.

The rate hike comes as online lenders look to securitize debt and continue to pursue permanent sources of capital. The industry’s meteoric rise can be attributed to its lenient lending standards but as competition increases the lenders still look to bring more borrowers into the fold. Publicly listed companies like Lending Club have to walk the tightrope between growth and risk.

“Over the past few months the Lending Club marketplace has made a number of proactive changes to reflect the general evolution of interest rates and prepare for a potential slowdown in the economy,” Lending Club said in its filing.

And as alternative lending companies look to disrupt traditional models of lending, several of them are hiring top banking talent for the task.

Lending Club also announced that it hired former McKinsey chief of digital banking, Sameer Gulati as its chief operating officer and promoted chief marketing officer Scott Sanborn to president.

In their new roles, Gulati will head operations and corporate strategy and Sanborn will oversee the company’s product lines (personal loans, small business and patient and education financing) as well as marketing and product development.

SCORCHED EARTH – Controversial Bill Could Eliminate Marketplace Lending, Merchant Cash Advance and Nonbank Business Loans in Illinois (and starve small businesses in the process)

April 9, 2016

The State of Illinois wants to make it a Class A misdemeanor for providing small businesses with quick, easy working capital.

The world’s strangest bill, dubbed the Small Business Lending Act, could send marketplace lenders, nonbanks, and merchant cash advance companies to prison for up to 1 year if applicants don’t submit at the very least, their most recent six months bank statements, the previous year’s tax return, a current P&L, a current balance sheet, and an accounts receivable aging.

Loans in which the monthly payments exceed at least 50% of the business’s monthly net income would be illegal, which implies that any business that is either breaking even or running at a loss would be banned from obtaining a loan from alternative sources.

This is not an April Fools’ prank. Not even preemption granted under the National Bank Act or Federal Deposit Insurance Act is safe.

Introduced into the State Senate under the pretense that it would squash predatory lenders, the bill’s licensing and compliance proposal would also effectively outlaw marketplace lending and securitizations by making the sale of loans illegal unless it’s to a bank or another state-licensed party. Even merchant cash advances are referenced specifically but almost as an afterthought and defined in such a way that even traditional factoring companies may be in jeopardy.

No licensee or other person shall pledge, assign, hypothecate, or sell a small business loan entered into under this Act by a borrower except to another licensee under this Act, a licensee under the Sales Finance Agency Act, a bank, savings bank, community development financial institution, savings and loan association, or credit union created under the laws of this State or the United States, or to other persons or entities authorized by the Secretary in writing. Sales of such small business loans by licensees under this Act or other persons shall be made by agreement in writing and shall authorize the Secretary to examine the loan documents so hypothecated, pledged, or sold.

At a time when most fintech lenders are advocating for smart regulation, the State of Illinois apparently wants to end all nonbank commercial finance under $250,000 completely, with the exception of one organization (which we’ll get to shortly).

At a time when most fintech lenders are advocating for smart regulation, the State of Illinois apparently wants to end all nonbank commercial finance under $250,000 completely, with the exception of one organization (which we’ll get to shortly).

There are some exemptions granted under this proposal of course. Loans over $250,000 aren’t subject to it, nor are any loans made by Illinois-based banks or credit unions, that is unless they are acting as the agent for another party like say perhaps a marketplace lender.

Hidden inside is also an exemption for nonprofit lenders, a loophole left open for Accion Chicago, the nonprofit masterminds behind the bill who seem to want the entire state’s lending market all for themselves.

Illinois State Senator Jacqueline Collins Introduced This Bill

Senator Collins introduced the legislation as an amendment to Senate Bill 2865 on April 6th. A former journalist, she’s now the chairwoman of the Illinois Senate Financial Institutions Committee. Among her self-professed accolades is that she “has played a key role in addressing predatory lending and high foreclosure rates in Chicago through legislation that protects homebuyers and homeowners with subprime mortgages.” She lists the Mortgage Rescue Fraud Act, the landmark Sudan Divestment Act and the Payday Loan Reform Act among her major legislative accomplishments.

It’s no surprise then that sections of the bill are borrowed straight out of the Payday Loan Reform Act. Collins isn’t acting on her own however…

Chicago City Treasurer Kurt Summers

In January, Senator Collins joined Chicago City Treasurer Kurt Summers in a call for “new legislation to protect small business owners from misleading and dishonest predatory lenders.” In a closed-door hearing, the committee supposedly heard from business owners, advocates and elected officials on predatory lending.

“Chicago’s small business community deserves protection from the unchecked greed of predatory lenders,” Treasurer Summers said. “While access to capital is the number one concern of small business owners across the state, bank and commercial loans continue to decline, steering them to underhanded lenders. As we continue to urge banking partners to increase their local investment, this new, common-sense legislation would ensure transparency in lending that so often puts our entrepreneurs at risk.”

Of note is his use of the phrase “banking partners” since this bill has bankers all over it, as we’ll get into shortly. Summers represents the Chicago Mayor’s office and the Mayor’s office says they’ve launched this campaign thanks to partners like Accion Chicago.

Hon. Kurt Summers, Treasurer, City of Chicago from City Club of Chicago on Vimeo.

Accion Chicago and the Mayor’s Office

Last year, Mayor Rahm Emanuel announced a joint campaign with Accion Chicago to help small businesses avoid predatory lending.

Accion Chicago, ironically makes business loans themselves, having originated 535 loans totaling $4.8 million in 2014 with a maximum loan size of $100,000.

Who is Accion Chicago really?

The Small Business Lending Act virtually ensures that small business loans under $250,000 only be facilitated by banks and nonprofits. Isn’t it convenient then that Accion Chicago is not only a nonprofit, but also funded and staffed by banks?

According to their 2014 annual report, Citibank and JPMorgan Chase were two of their three largest supporters (the third was the US Treasury!). Below are some of the figures:

$100,000+

- Citibank

- JPMorgan Chase

$50,000 – $99,999

- Bank of America

$20,000 – $49,999

- Fifth Third Bank

- PNC Bank

- U.S. Bank

$5,000 – $19,999

- American Chartered Bank

- Alliant Credit Union

- BMO Harris Bank

- First Bank of Highland Park

- First Eagle Bank

- First Midwest Bank

- Ridgestone Bank

- State Bank of India

- The PrivateBank

- Wells Fargo Bank

About a dozen more banks gave less than $5,000.

JPMorgan Chase has also been a partner of the annual Taste of Accion fundraising event, and was the lead sponsor in 2014, a spot that costs $30,000. Benefactor sponsorships which cost $20,000 each were comprised of American Chartered Bank, Capital One, Northern Trust Company, and Wintrust Bank. And the lesser sponsorships? Again, mostly banks.

JPMorgan Chase has also been a partner of the annual Taste of Accion fundraising event, and was the lead sponsor in 2014, a spot that costs $30,000. Benefactor sponsorships which cost $20,000 each were comprised of American Chartered Bank, Capital One, Northern Trust Company, and Wintrust Bank. And the lesser sponsorships? Again, mostly banks.

You know who hasn’t donated to Accion Chicago? Marketplace lenders and merchant cash advance companies.

Accion Chicago raised only $1.4 million in 2014 from public support, the bulk of which came from banks or related traditional financial institutions. So is it just a coincidence that this predatory lending bill they’re supporting grants exemptions to all the banks from compliance?

Accion Chicago’s 2014 Board of Directors includes executives from:

- American Chartered Bank (chairman)

- First Eagle Bank

- JPMorgan Chase

- Ridgestone Bank

- MB Financial Bank

- Talmer Bank & trust

- Citibank

- First Midwest Bank

The 2014 committees were made up almost entirely of bank executives from:

- First Eagle Bank

- The PrivateBank

- Ridgestone Bank

- U.S. Bank

- JPMorgan Chase

- Forest Park National Bank & Trust Co.

- MB Financial Bank

- FirstMerit Bank

- Wintrust Bank

- Standard Bank & Trust Co.

- First Midwest Bank

- Wells Fargo Bank

- Seaway Bank & Trust Co.

- Metropolitan Capital Bank

- Evergreen Bank Group

- First Financial Bank

- PNC Bank

Thanks to the impartial work of these good citizens, they have discovered that small businesses should only be working with banks or nonprofits funded and staffed by banks and have craftily devised a bill to legislate all the alternatives out of existence.

If this was really about predatory lending, then they screwed up big time

All coincidences aside, some of the bill’s rules have nothing to do with protecting borrowers, like the required $500,000 surety bond to become licensed for example. Compare that to California’s $25,000 licensed lender surety bond. And the restriction on being able to sell or securitize a loan, how does that help small businesses?

These requirements and others suggest that it’s about preventing all alternatives from existing in the marketplace, rather than predatory alternatives. The losers would undoubtedly be small businesses and the Illinois job market. Senator Collins and Treasurer Summers, both of whom have a strong track record of empowering their constituents financially, may have underestimated or overlooked the likely negative consequences of this bill.

The nonbanks

Several nonbank trade groups are reportedly in the process of formulating a response.

The Commercial Finance Coalition for example, a nonprofit coalition of financial technology companies, told AltFinanceDaily that they are concerned about the impact this will have on the Illinois job market and will indeed have representatives on the ground in Illinois.

They also wanted to make known that they welcome support from marketplace lenders, nonbanks and merchant cash advance companies in these efforts and that interested parties should email Mary Donahue at mdonohue@commercialfinancecoalition.com

To contact Senator Jacqueline Collins who introduced the bill, call her at 217-782-1607.

Collude, not collide: Why Online Lenders Want to Work with Banks

April 8, 2016 Don’t look now but online lenders are in cahoots with the banks they want to disrupt.

Don’t look now but online lenders are in cahoots with the banks they want to disrupt.

Last week (April 4th), Spanish banking giant Santander shut down 450 branches and partnered with Atlanta-based Kabbage to speed up the underwriting process to provide same day loans.

Today, online consumer lender Avant announced a similar deal with Birmingham, Alabama-based Regions Bank to offer loans anywhere between $1,000 to $35,000. Regions will use Avant’s platform on its website to sell unsecured loans where borrowers get an immediate credit decision and are approved or rejected immediately, with funds being available the very next day.

“Working with Avant, we will be able to offer a better online experience, while maintaining our commitment to responsible lending — something that benefits customers, the community and our shareholders,” said Logan Pichel, executive vice president and head of Consumer Lending for Regions Bank. That said, Regions does not typically approve borrowers with a credit score below 700 while Avant’s customers average a 650 credit score.

So why are lenders befriending the banks they wanted to fight? And what’s in it for banks? Access to a bigger customer banks and quick loan approvals. Banks want to tap into the lean and loose loan processing model that online lenders have become popular for, throwing open a hitherto market of risky borrowers.

Last year, JP Morgan Chase partnered with OnDeck to speed up small business loans for some of the bank’s 4 million customers. As banks tend to lean towards working with alt lenders rather than building competitive products in-house, the industry will only see more such partnerships. As for Avant, the company has more such deals in the pipeline, Adam Hughes, Avant chief operating officer said.

Any bets on who might be next?

Q1 Update: Here are Five Partnership Deals Lenders Struck

April 6, 2016

It’s the end of Q1 and it’s time for that scorecard and see what lenders were up to. The year has been favorable for marketplace and online lenders so far. The Fed kept rates unchanged, small business borrowing peaked in February and many of these companies made impressive hires. As companies prepare for the second quarter, here are some of the key partnerships made by online lenders so far this year.

Opus-OnDeck

The year started with a bang for alt lending posterboy OnDeck Capital with a referral arrangement with California-based Opus Bank. OnDeck will finance Opus’ small business clients requiring up to $500,000 through lines of credit, flexible term loans and quicker processing.

Prosper-HomeAdvisor

Home improvement loans have been a cash cow for San Francisco-based Prosper Loans. Last month, (March 14th), marketplace HomeAdvisor entered into an exclusive multi-year contract with Prosper to provide home improvement loans after the company quietly terminated a similar contract with Lending Club.

As of 2014, approximately 8 percent of Prosper borrowers said their loan was for home improvement. Orchard, in its analysis states that these loans may in part be a substitute for traditional home equity lines of credit, which used to be easier to obtain prior to the housing crash.

Bizfi-West Coast Banking Group,

Small business lender Bizfi struck a deal with Western Independent Bankers, a trade association of community banks in the west coast to be the exclusive alternative finance lender for small businesses that are members of the association.

The New York-based alternative lender also signed on the New York State Restaurant Association to provide equipment financing, invoice financing and lines of credit for 2,000 restaurants that are members.

Avant-Loandepot

Consumer lending company loandepot and marketplace lender Avant launched a borrower referral program. Under the mutual borrower program, the two companies will have access to each other’s customer base to “expand credit options to responsible borrowers.”

Kabbage-NFIB, Santander

Atlanta-based Kabbage landed itself a sweet deal with the National Federation of Independent Business, throwing open a potential market of 325,000 small businesses where members can access lines of credit of up to $100,000 and flexible term loans.

Kabbage also debuted in the UK with Santander Bank which will use Kabbage’s technology to underwrite quick loans up to 100,000 pounds the same day for loans that typically take 2-12 weeks to process.

Watch out Bank Tellers, Robots are Coming for your Job

March 31, 2016 Watch out bank tellers, robots are coming for your job.

Watch out bank tellers, robots are coming for your job.

Investment in private fintech companies and upstarts has grown ten fold from $1.8 billion in 2010 to $19 billion in 2015 and in the same time, bank staff has been slimming down as investors bet on automated finance to eventually overthrow banking. Already, 46 percent of private funding has gone to lending companies selling cheaper loans easily.

The ambition to oust bank behemoths however will need continuous fueling. As things stand now, these lenders are nowhere close to managing that coup. Revenue impact from the digital banking upstarts cause a one percent dent in the $850 billion global banking revenue.

It may be negligible but not to be neglected, investors might say. In the US, online lenders like Lending Club and Prosper Loans sold loans worth $8 billion last year and are looking at a target market of $254 billion, 8 percent of the total consumer credit market.

In its report, Citigroup predicts that US and European banks will shed 1.7 million jobs by 2025 as the banking sector undergoes its own “Uber moment,” forcing banks to automate some lines of business. Anthony Jenkins, former Barclays CEO translates this to halving the number of branches and people over the next few years. If this is an eventuality, different markets will take different paths to get there.

While Nordic and Dutch banks have cut total branch levels by around 50 percent from recent peak levels, branch openings in the top US cities including Seattle, Denver and Dallas have increased between 2-17 percent in the last five years. Part of the reason is because customers still have to visit a branch for identity verification but mostly the benefits (easy access, brand recall) of having a bank branch in wealthy states outweighs the costs involved. “With wealth concentrated in the top cities in the US, a strong branch presence in these cities allows banks to capture wealth,” the report said.

Though the transition of the branch’s role from transactions to advisory/consultancy is imminent, the pace has been gradual, about 11-13 percent since peak pre-crisis. That number could reach 30 percent by 2025. As for the US, there are 15 percent less tellers than there were in 2007.

But the banks want in and are willing to pay. Citigroup and Goldman Sachs have been active in seeding fintech rivals. In the last five years, Citigroup has invested in 13 companies including Square.

Is it time to make another David and Goliath reference?

OnDeck, UK Trade Group Work on Fintech Policy

March 17, 2016 Don’t look now but OnDeck is getting knee-deep in fintech policy.

Don’t look now but OnDeck is getting knee-deep in fintech policy.

The online lender said that it will partner with UK’s Innovate Finance, a fintech trade group to launch a Transatlantic Policy Working Group to exchange intelligence and information on regulatory and policy issues governing fintech.

The group will work on universal fintech issues like the use of data, building a payments infrastructure for financial inclusion, open source APIs in banking and automated investment advice through robo advisors, when kicking off its first meeting at Google’s Washington DC office.

“The transatlantic policy working group represents a great opportunity to share key insights, best practices and knowledge between US and UK fintech stakeholders,” said Daniel Morgan, head of policy and regulation at Innovate Finance “It will help drive real change in the public policy arena when it comes to the development and growth of a vibrant fintech sector.”

Venture capital investment in fintech companies more than doubled last year compared to 2014, hitting an all time high of $14 billion, up 106 percent from $7 billion in 2014. The UK attracted a total of $623 million in fintech investment in 2014 and Innovate Finance committed to increasing that number to $8 billion by 2020 in venture and institutional investment.

The Dual Aura of Fora – How Two College Friends Built Fora Financial and Became the “Marketplace” of Marketplace Lending

February 16, 2016A recent Bloomberg article documented the hard-partying lifestyle of two young entrepreneurs who struck it rich when they sold their alternative funding business. The story of their beer-soaked early retirement in a Puerto Rico tax haven came complete with photos of the duo astride horses on the beach and perched atop a circular bed.

But two other members of the alternative-finance community have chosen a different path despite somewhat similar circumstances. Jared Feldman and Dan B. Smith, the founders of New York-based Fora Financial, are about the same age as the pair in that Bloomberg article and they, too, recently sold an equity stake in their company. Yet Smith and Feldman have no intention of cutting back on the hours they dedicate to their business or the time they devote to their families.

They retained a share of Fora Financial that they characterized as “significant” and will remain at the head of the company after selling part of it to Palladium Equity Partners LLC in October for an undisclosed sum. Palladium bought into a company that has placed more than $400 million in funding through 14,000 deals with 8,500 small businesses. It expects revenue and staff size to grow by 25 percent to 35 percent this year.

The deal marks Palladium’s first foray into alternative finance, although it has invested in the specialty-finance industry since 2007, said Justin R. Green, a principal at the firm. His company is appointing two members to the Fora Financial board.

Palladium, which describes itself as a middle-market investment firm, decided to make the deal partly because it was impressed by Smith and Feldman, according to Green. “Jared and Dan have a passion for supporting small businesses and built the company from the ground up with that mission,” he said. “We place great importance on the company’s management team.”

Negotiations got underway after Raymond James & Associates, a St. Petersburg, Fla.-based investment banking advisor, approached Palladium on behalf of Fora Financial, Green said. RJ&A made the overture based on other Palladium investments, he said.

The potential partnership looked good from the other point of view, too. “We wanted to make sure it was the right partner,” Feldman said of the process. “We wanted someone who shared the same vision and knew how to maximize growth and shareholder value over time and help us execute on our plans.”

It took about a year to work out the details of the deal Feldman said. “It was a grueling process, to say the least,” he admitted, “but we wanted to make sure we were capitalized for the future.”

It took about a year to work out the details of the deal Feldman said. “It was a grueling process, to say the least,” he admitted, “but we wanted to make sure we were capitalized for the future.”

The Palladium deal marked a milestone in the development of Fora Financial, a company with roots that date back to when Smith and Feldman met while studying business management at Indiana University.

After graduation, Feldman landed a job in alternative funding in New York at Merchant Cash & Capital (today named Bizfi), and he recruited Smith to join him there. “That was basically our first job out of college,” Feldman said.

It struck Smith as a great place to start. “It was the easiest way for me to get to New York out of college,” he said. “I saw a lot of opportunity there.”

The pair stayed with the company a year and a half before striking out on their own to start a funding company in April 2008. “We were young and ambitious,” Feldman said. “We thought it was the right time in our lives to take that chance.”

They had enough confidence in the future of alternative funding that they didn’t worry unduly about the rocky state of the economy at the time. Still, the timing proved scary.

Lehman Brothers crashed just as Smith and Feldman were opening the doors to their business, and all around them they saw competitors losing their credit facilities, Smith said. It taught them frugality and the importance of being well-capitalized instead of boot-strapped.

Their first office, a 150-square-foot space in Midtown Manhattan, could have used a few more windows, but there was no shortage of heavy metal doors crisscrossed with ominous-looking interlocking steel bars. The space seemed cramped and sparse at the same time, with hand-me-down furniture, outdated landline phones and a dearth of computers. Job seekers wondered if they were applying to a real company.

“It was Dan and I sitting in a small room, pounding the phones,” Feldman recalled. “That’s how we started the business.”

At first, Smith and Feldman paid the rent and kept the lights on with their own money. Nearly every penny they earned went right back into the business, Feldman said. The company functioned as a brokerage, placing deals with other funders. From the beginning, they concentrated on building relationships in the industry, Smith said. “Those were the hands that fed us,” he noted.

By early 2009, Smith and Feldman started raising capital from friends and family members so that they could fund deals themselves. About that time, they developed a computer platform to track the payments they received from funding companies where they placed deals.

Smith and Feldman’s first credit facility came from Entrepreneur Growth Capital. The stake enabled them to begin handling deals on their own instead of passing them along to funders. At the same time, they expanded their computing platform to handle entire deals.

From there, Smith and Feldman expanded their computing capability to help with accounting, underwriting and other functions. A combination of staff and outside developers guided the platform’s evolution. Today, three full-time in-house tech people handle programming.

Smith and Feldman emphasize that they don’t consider Fora Financial a tech company, but Green said the company’s platform helped cinch the deal. “We view Fora Financial as a technology-enabled financial services company,” he maintained.

While building the platform and expanding the business, Fora Financial secured mezzanine financing from Hamilton Investment Partners LLC, a company that bases its investments on the strength of management teams. “I am industry-agnostic,” said Douglas Hamilton, managing partner and and cofounder. “Dan and Jared are one of the best young teams I have encountered in my 35 years of doing private investing.”

Meanwhile, Fora Financial moved six times to larger accommodations. The company’s 116 employees now occupy 26,000 square feet in Midtown, with half of the staff working in direct sales and the other half devoted to back office, underwriting, finance, IT, customer service, collections and legal duties.

Meanwhile, Fora Financial moved six times to larger accommodations. The company’s 116 employees now occupy 26,000 square feet in Midtown, with half of the staff working in direct sales and the other half devoted to back office, underwriting, finance, IT, customer service, collections and legal duties.

Seventy percent of the company’s business flows from its inside sales staff and the rest comes from ISOs, brokers and strategic partners, Feldman said. “Most of the industry is the opposite,” he noted.

Finding salespeople presents a challenge in New York, where they’re in great demand. “We’ve invested a lot of money in finding the right salespeople,” Feldman said. “We also have to make sure that we’re right for them.” The sales staff includes recent graduates and experienced people from other sectors of financial-services or other businesses, Feldman noted.

“We don’t hire from within the industry,” Smith added. “From Day One, we’ve been training our staff our way and not bringing in tainted brokers.” That way, the company can make sure salespeople hew to the company’s ethical approach to business, he maintained. It’s part of creating a company culture, he said.

The Fora Financial culture also includes strict compliance with state and federal regulation because until recently Smith and Feldman owned the entire company, Feldman said. “Regulatory compliance is a core value with us and has been for some time,” he noted, adding that it’s also resulted in conservatism and due diligence.

Those traits have not gone unnoticed, according to Robert Cook, a partner at Hudson Cook, LLC, a Hanover, Md.-based financial-services law firm that has worked extensively with the company. “Fora was one of the first clients in this small-business funding area that took compliance to heart,” Cook said. “As time has gone on, we’re seeing more and more companies make compliance part of their culture, but Fora was one of the early adapters in this area.”

Those traits have not gone unnoticed, according to Robert Cook, a partner at Hudson Cook, LLC, a Hanover, Md.-based financial-services law firm that has worked extensively with the company. “Fora was one of the first clients in this small-business funding area that took compliance to heart,” Cook said. “As time has gone on, we’re seeing more and more companies make compliance part of their culture, but Fora was one of the early adapters in this area.”

Top management at alternative finance companies often talk about compliance, and the discussion too often ends there and doesn’t filter down through the ranks, Cook said. But that’s not the case at Fora Financial, he maintained. “It’s throughout the organization,” he said of the company Smith and Feldman founded. “From a compliance attorney’s standpoint, that’s always a great sign.”

Nurturing a penchant for compliance and dedicating a company legal and compliance department to pursuing it became a factor in Palladium’s decision to become involved with the company, Feldman said.

The focus on compliance also spread to the way Fora Financial brings brokers on board, Smith said. The company scrutinizes potential partners carefully before taking them on, he maintained.

“We probably missed out on some business as the industry grew because we were more cognizant of doing things the right way, but that paid off in the long run and some of our competitors have followed suit,” Smith said.

Compliance first became particularly important when Fora Financial added small-business loans to their initial business of providing merchant cash advances. They began making loans because lots of businesses don’t accept cards, which serve as the basis for cash advances.

On a cash basis, the current portfolio is 75 percent to 80 percent small-business loans. Loans started to surpass advances during the fourth quarter of 2014. The shift gained momentum after the company began funding through its bank sponsor, Bank of Lake Mills, in the third quarter of 2014.

Growth of loans will continue to outstrip growth of cash advances because manufacturers, construction companies and other businesses usually don’t accept cards, Smith said. If a customer qualifies for both, Fora Financial helps decide which makes the most sense in a specific case, Feldman added.

“We don’t sell our loans – we carry everything on the balance sheet and assume the risk,” Feldman said. “If it’s not good for the customer, it’s going to come back and hurt the performance of our portfolio over time,” he noted.

That thinking helped the company recognize the importance of adding loans to the mix. “We were one of the first companies (in the alternative-finance industry) to get our California lending license,” Feldman said. The company obtained the license in 2011 and got to work on lending. Offering loans required some retooling because the underwriting criteria differ so much from those in the cash advance business, Feldman said.

With the help of several law firms, they made sense of regulation from state to state and began offering the loans one state at a time, Smith said. “We wanted to make sure we rolled it out the right way,” Feldman noted.

As the company was changing, Smith and Feldman saw a need to rebrand. Initially, they called their company Paramount Merchant Funding to reflect their merchant cash advance offerings. When they added small-business loans to the mix, they used several additional names. Now, they’ve brought both functions and all of the names together under the Fora Financial brand. Fora means marketplace in Latin and seems broad enough to cover products the company might add in the future, Feldman said.

Smith and Feldman are contemplating what form those future products might take, but they declined to mention specifics. “We’re constantly getting feedback from customers on what they need that we’re not currently delivering,” Feldman said. “We have ideas in the pipeline.”

Despite changes in the business, Smith and Feldman have managed to remain true to timeless values in their personal lives. Smith grew up near Philadelphia in Fort Washington, Pa., and Feldman is a native of Roslyn, N.Y. Both now reside in Livingston, N.J. and occasionally ride the train together to work in New York. Smith is married and has two children, while Feldman and his wife recently had their first child.

“We’re at it everyday,” Feldman said of their work-oriented lifestyle. “When we’re out of the office, we’re traveling for work. So is the rest of the team. We’re only going to go as far as our people.”

And what about that other pair luxuriating in the Caribbean? As Feldman put it: “New Jersey is a long way from Puerto Rico.”

—

Learn more about Fora Financial at www.forafinancial.com