Why You Specifically Need An MCA Accountant for Your MCA Business

September 11, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies.To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

Doing the books for a merchant cash advance (MCA) business isn’t like doing the books for other types of businesses. That’s something that seems pretty intuitive for those of us in the industry to understand, but often I see many business owners still trying to handle finances themselves or hand it off to a general accountant who isn’t well-versed in the MCA world, which leads to unfortunate messes that require some costly cleanup work. The reality is that while any accountant can keep basic, or even complex financial records, managing the finances of an MCA business requires more than just a surface-level understanding.

Doing the books for a merchant cash advance (MCA) business isn’t like doing the books for other types of businesses. That’s something that seems pretty intuitive for those of us in the industry to understand, but often I see many business owners still trying to handle finances themselves or hand it off to a general accountant who isn’t well-versed in the MCA world, which leads to unfortunate messes that require some costly cleanup work. The reality is that while any accountant can keep basic, or even complex financial records, managing the finances of an MCA business requires more than just a surface-level understanding.

Take a situation I encountered recently: a business owner decided to use their regular accountant to handle their books, deciding that the cost of an MCA industry-qualified accountant was too much for him at that point in time. The accountant he picked was a competent elderly gentleman who produced the financials regularly and on time, and things appeared to be going smoothly until his investors realized their syndication income had been reported incorrectly. The accountant, unfamiliar with MCA-specific accounting, treated the income like a standard loan repayment and the business owner hadn’t noticed the misreporting when he passed the report on to his financiers. The investors were confused and frustrated with the mistaken report, and felt like they weren’t getting a clear picture of the company’s financial health and cash flow situation. I was actually able to help him clear up the issue, but the whole mess and subsequent (thankfully temporary) mistrust could have been avoided entirely if the accountant was someone who understood the specifics of the MCA business.

Handling the finances of an MCA business isn’t just about tracking the cash coming in and out. There are particular rules around recognizing income, such as how to deal with syndication fees, manage different types of funding, and correctly categorize income like commissions and fees. It’s also critical to understand how to report income for tax purposes versus what’s required for investor reporting. For example, recognizing income too soon or too late can have a big impact on your cash flow, tax obligations, and even how your business is perceived by others.

I’ve seen businesses try to use standard accounting methods and find themselves with financial statements that don’t accurately reflect their operations. In one case, a company overstated its income because it applied a generic accounting approach. This not only increased their tax burden but also strained their cash flow. They needed someone who understood the nuances of the MCA world to correct these issues, adjust the income recognition methods, and align them with industry standards.

Another challenge everyday CPAs struggle with is keeping up with the constant changes in MCA deals – from advances in different repayment stages to syndication agreements with external investors. Without careful tracking, discrepancies can quickly arise, and they’re often not noticed until they’ve become significant problems. Even for businesses using cash basis reporting because their revenue is under $10 million annually, it’s crucial to handle things correctly. Deferring tax liabilities by timing income recognition can be a smart move, but only if done accurately. Otherwise, there’s a risk of audits or having to pay back taxes with penalties. I’ve helped businesses navigate these tricky waters after they ran into trouble because their previous accountant didn’t know when to use cash basis versus accrual basis reporting.

A good MCA accountant knows how to navigate the specifics of your business. They understand what to watch out for, how to manage the unique aspects of the industry, and how to avoid problems that could end up costing you time, money, or reputation. I’ve seen too many businesses suffer preventable setbacks by either doing it themselves or relying on someone who didn’t have the right knowledge. The cost of hiring an accountant who specializes in MCA is minimal compared to the potential financial losses from mishandled books or compliance errors.

At the end of the day, having an accountant who understands the MCA industry isn’t just a nice-to-have; it’s a necessity. The complexities of this business require a specific set of skills, and working with someone who gets that can help you keep your business running smoothly and avoid unnecessary headaches in the future. Make sure you have the right support in place to protect your business and keep things on the right track.

Leading Fintech MoneyThumb Acquired by Iron Creek

August 29, 2024San Diego, Calif. (August 29, 2024) – MoneyThumb, a leader in automated document evaluation and fraud detection solutions announced today that it has been acquired by Iron Creek Partners LLC (“Iron Creek”), a private investment firm with a focus on investments in the software, data, communications, and business services industries. Iron Creek led the investment group, which also included Main Street Capital Corporation (NYSE: MAIN). The transaction will provide growth capital to help meet MoneyThumb’s strong industry demand, which has recently produced 100% year-over-year annual growth. The transaction closed on August 19, 2024.

Ryan Campbell, previously heading up MoneyThumb’s business development since 2017, has been named as the new chief executive officer and has joined the investor group. Ryan has played an integral role in leading MoneyThumb’s sales, marketing and business development strategy. Ralph Mayer, the company’s founder will step down as CEO and assume an advisory role and retain his board seat.

Founded in 2014, MoneyThumb is an industry leading underwriting automation software that improves workflows for funders, lenders, and accountants by converting and analyzing pdf financial documents in seconds. The company also helps detect fraud with its AI file tampering detection tool that identifies fraudulent activity in seconds, giving lenders a powerful defense against risk and loan losses.

“This acquisition underscores MoneyThumb’s proven technology and strong industry demand, and supports our long-term growth objectives,” said Ryan Campbell. “This partnership marks an exciting milestone for our company and with the support of Iron Creek, we are well-poised to accelerate our growth, continue to deliver exceptional software solutions for our customers and help lenders manage risk and deliver more capital faster to small businesses.”

“MoneyThumb has built a highly successful business through its algorithm-driven software, product innovation and a meticulous approach to delivering value and service to their customers,” said John Bingaman, Founder and Managing Principal of Iron Creek Partners LLC. “We look forward to working closely with MoneyThumb’s talented team to continue to grow the business and broaden the product suite.”

Financial terms of the transaction were not disclosed.

For more information on MoneyThumb, please visit www.moneythumb.com.

About MoneyThumb

MoneyThumb is an advanced automation software solution that streamlines the lending underwriting process by converting bank statements instantly into actionable data. By exponentially increasing efficiency, accuracy and the detection of fraud – MoneyThumb empowers lenders and accountants to make faster, more informed and accurate decisions. MoneyThumb is headquartered in Encinitas, California, and serves customers globally. For more information visit www.moneythumb.com.

About Iron Creek

Iron Creek is a sector-focused, stage-independent private investment firm based in Santa Fe, NM, seeking attractive investment opportunities primarily in the software, data, communications, and business services industries. Iron Creek seeks to partner with strong management teams and to support its portfolio companies’ growth by leveraging its network of relationships and its sector experience.

About Main Street Capital Corporation

Main Street (www.mainstcapital.com) is a principal investment firm that primarily provides long-term debt and equity capital to lower middle market companies and debt capital to middle market companies. Main Street’s portfolio investments are typically made to support management buyouts, recapitalizations, growth financings, refinancings and acquisitions of companies that operate in diverse industry sectors. Main Street seeks to partner with entrepreneurs, business owners and management teams and generally provides “one stop” financing alternatives within its lower middle market investment strategy. Main Street’s lower middle market companies generally have annual revenues between $10 million and $150 million. Main Street’s middle market debt investments are made in businesses that are generally larger in size than its lower middle market portfolio companies.

Main Street, through its wholly owned portfolio company MSC Adviser I, LLC (“MSC Adviser”), also maintains an asset management business through which it manages investments for external parties. MSC Adviser is registered as an investment adviser under the Investment Advisers Act of 1940.

Media Contact

Tracy Rubin

JCUTLER media group

Tracy@jcmg.com

Velocity Capital Group Welcomes Jesse Guzman as New Chief Revenue Officer

August 28, 2024 Cedarhust, New York – 08/28/2024 – Velocity Capital Group is thrilled to announce the appointment of Jesse Guzman as its new Chief Revenue Officer (CRO). With a distinguished career in revenue leadership, Jesse brings a wealth of experience and a proven track record of driving growth and innovation in the financial services industry.

Cedarhust, New York – 08/28/2024 – Velocity Capital Group is thrilled to announce the appointment of Jesse Guzman as its new Chief Revenue Officer (CRO). With a distinguished career in revenue leadership, Jesse brings a wealth of experience and a proven track record of driving growth and innovation in the financial services industry.

Jesse Guzman joins Velocity Capital Group after serving as Chief Revenue Officer at Nexi from 2020 to 2024, where he played a pivotal role in the company’s growth and successful rebranding. Before his tenure at Nexi, Jesse was the Director at Arcarius LLC from 2017 to 2020, where he honed his expertise in financial strategy and revenue optimization.

In his new role at Velocity Capital Group, Jesse will leverage his extensive industry experience to lead the company’s revenue strategies, focusing on expanding funding options for merchants and enhancing support for Independent Sales Organizations (ISOs). His fresh ideas and innovative approach are expected to propel Velocity Capital Group to new heights, further solidifying its position as a leader in the alternative finance space.

“We are incredibly excited to welcome Jesse Guzman to the Velocity Capital Group team,” said Jay Avigdor, President & CEO of Velocity Capital Group. “Jesse’s deep understanding of the industry, combined with his visionary leadership, will be instrumental in helping us achieve our ambitious goals. We are confident that his expertise will enable us to provide even more funding to merchants and offer our ISOs the best service they’ve ever experienced.”

Jesse Guzman expressed his enthusiasm about joining the company, stating, “Velocity Capital Group has an outstanding reputation for innovation and excellence in the alternative finance industry. I am excited to bring my experience and fresh perspective to the team and to contribute to the company’s continued success. Together, we will explore new opportunities to better serve our clients and partners.”

About Velocity Capital Group

Velocity Capital Group is a leading provider of revenue-based financing solutions for small and medium-sized businesses. Leveraging advanced analytics and a deep understanding of the SMB sector, Velocity Capital Group offers tailored funding solutions that drive sustainable growth. With a commitment to innovation and customer service, the company partners with Independent Sales Organizations (ISOs) to deliver exceptional value to clients nationwide.

Media Contact:

Bogdan Klubuk

Marketing Director

Velocity Capital Group

Bogdan@velocitycg.com

www.Velocitycg.com

OppFi Shares More About The Bitty Advance Deal

August 7, 2024 OppFi, a publicly traded fintech with a $430M market cap, discussed its recent investment in Bitty Advance during its regular quarterly earnings call today. OppFi acquired a 35% stake in the company with the option to acquire a majority in 2027.

OppFi, a publicly traded fintech with a $430M market cap, discussed its recent investment in Bitty Advance during its regular quarterly earnings call today. OppFi acquired a 35% stake in the company with the option to acquire a majority in 2027.

“This acquisition is intended to serve as the foundational piece of our new small business financing vertical,” said OppFi CEO Todd Schwartz. “Bitty is a credit access company that offers revenue-based financing and other working capital solutions. Bitty generates income through origination and service fee income and therefore does not have balance sheet or credit risk.”

Special mention was made about Craig Hecker, who is still the majority owner, and his great leadership.

“I’m personally looking forward to collaborating with Craig and helping him and his team take Bitty to the next level of profitable growth by leveraging OppFi’s expertise in data analytics, marketing and automation,” Schwartz said.

During the Q&A session, Dave Storms of Stonegate Capital asked Schwartz to elaborate on any exciting short-term synergies the deal might present for OppFi. This was his response:

Todd Schwartz: I think Craig is a talented operator and obviously someone who has a lot of experience in the small business space. We think the collaboration between our two companies is going to yield great results. To remind everyone, Craig has a business that currently is in origination, so he’s earning his income from origination and servicing. We think that has a lot of optionality. He also has a really good digital platform. We believe in this digitization of small business and think there’s a lot of growth there. I think when you take a lot of the things that we do well and the things that Craig’s doing well, there’s a lot of complementary skill sets.

And I think it’s going to yield great results. I think we’ve done a lot of research on the SMB market and we feel that there is supply/demand imbalance. And we feel that there’s ability to not only take market share, but as the addressable market continues to go online to search for working capital options, that there potentially is even growth in the total addressable market. So we’re excited. We think there’s some accretion to earnings that we mentioned in this year and then for the future but we feel really good about taking our time there. We’ve kind of started to talk about it for over a year and a half. And so I think we’re just happy that we’ve fulfilled on our and delivered on our promise that we’re going to create, that OppFi is going to create a brand that has best suite of best-in-class digital financial service products that address supply/demand imbalance and credit access. And we feel like we’re on our way. We have all the ingredients to be able to do that and will yield great results for us.

WTF, From Credit Card Processing to Funding Deals

August 6, 2024“My first name is William, my son’s name is Torre and he’s my partner, and our last name is Failla, so WTF was the name of the acronym that we came up with.”

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

WTF Merchant Services, a real name and double entendre that makes it instantly unforgettable to any client that hears it, has an unusual story. Its CEO Will Failla is a veteran professional poker player that has won more than $6.6 million from tournaments over the course of his career according to a site that tracks players. It’s through friends he made at the card tables that he began to learn about a unique business that some of them were involved in, funding merchants based on their credit card processing sales. After a lot of encouragement and advice over the years, Failla was intrigued enough to look into doing it himself.

“I approached my son who was a business major and a finance major out of Hofstra and I said to him, ‘you’re graduating any day now so why don’t we do some diligence, look into this business and see what you think.'”

His son, Torre, who is now the company’s CFO, signaled his approval so long as they paced themselves and mastered the most fundamental component of it first, the credit card processing side of the business. Thus 2021 kickstarted WTF Merchant Services as a shop on Long Island that focused entirely on boarding merchant accounts. They started by approaching their friends, family, and contacts and then expanded it to where they had a referral incentive program and continued to acquire more and more accounts.

The most attractive part of the business to them is the residual revenue component to it. “That’s the greatest. That’s what made us get into it because now we get paid every month. As long as you keep that customer, you get paid every month,” Failla explained.

And keeping those clients means providing great customer service, which he said they’ve placed a strong emphasis on. They’ve also gotten a firsthand look at the financial trends of the various businesses they’ve worked with, something they figured would come in handy for when they were ready to take the next step.

“We didn’t do an MCA deal until the beginning of this year,” Failla said. “We really wanted to learn the business in and out, and then we were just an ISO.”

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

The evolution from credit card processing to funding is straight out of the old MCA playbook of the mid-2000s, but with a notable difference here, they haven’t abandoned their roots. Unlike many modern funding ISOs who focus entirely on commissions paid out on funding, WTF is requiring their funding clients to switch their merchant accounts to them, assuming it’s a business that processes cards. And if they can do the funding deal on a split of the processing, all the better.

“When you do the split, it’s so much easier because you take, let’s say 15 or 20% or whatever the merchant can handle at the time,” Failla said. “It’s just so much better of a direction to get paid because it doesn’t hit their bank, it doesn’t hurt them as much. When they see it coming out daily like that, it’s a little different. When it comes out of the credit cards it’s just early and it helps a lot. Mindset changes.”

The company’s traditional approach has already attracted the attention of some of their peers in the industry who like the idea of residual income but don’t have the time or the patience to worry about merchant accouts.

“We have different MCA offices that we actually do this with already,” Failla said. “We do all their credit card processing. We handle all the back-end. We handle all the front-end. All they do is give us the referral and they become what we call a referral partner, and they get paid every single month as long as we keep the account.”

Will was sure to give credit to those that have helped shorten his learning curve along the way. He has since discovered that others in the poker scene are also in the same business as he and it’s created a valuable community. WTF even has a poker table in its office as a sort of tribute to his background which he has not actually retired from. The Hendon Mob poker tracker states that Will recently placed 259th out of 10,112 players in the World Series of Poker in Las Vegas earlier this month. Meanwhile, the company name itself, a bold strategy, seems to be working out so far.

“If you look under our logo, it says our names right underneath it. William, Torre Failla, and listen there’s going to be some pushback, but the amount of pushback we’ve had is so minimal that I think it’s worth it, and we’re going to stick with it as long as we can.”

New Lender Designed to Support Underserved SMEs

July 23, 2024A new specialist lender has today been launched in response to evolving SME funding needs.

Rapital is set to transform the financial landscape to support both brokers and SME businesses facing difficulty in securing funding from existing lenders and banks.

Rapital will focus on offering a direct route for clients with challenging credit situations, such as poor credit, existing loans, CCJs and defaults with loans ranging between £5,000 and £250,000. With a focus on offering fast funding, Rapital aims to make decisions in as little as three hours so SMEs can access the cash boost they need quickly.

Access to funding is an evergreen issue for the UK’s vital SME community, with many struggling to get approval from traditional lenders. Indeed, according to the National Association of Commercial Finance Brokers’ (NACFB) annual lender and broker survey, 32% of new clients successfully funded by its members last year had been previously denied funding elsewhere – a 3% increase from 2022. Rapital has been launched to help close the gap and enable SMEs who might have been denied financing from traditional lenders to get the cash boost they need to succeed.

Access to funding is an evergreen issue for the UK’s vital SME community, with many struggling to get approval from traditional lenders. Indeed, according to the National Association of Commercial Finance Brokers’ (NACFB) annual lender and broker survey, 32% of new clients successfully funded by its members last year had been previously denied funding elsewhere – a 3% increase from 2022. Rapital has been launched to help close the gap and enable SMEs who might have been denied financing from traditional lenders to get the cash boost they need to succeed.

Rapital’s ambition is to help turn a “no” into a “yes” for SMEs needing rapid and flexible financing solutions. The service promises an easy, transparent process and same-day funding, empowering businesses to thrive and grow. In these challenging operating conditions, it is vital that smaller businesses have access to rapid and flexible capital. Rapital will offer a much-needed financial lifeline to the business profiles and industries that are often rejected by banks and other SME lenders.

About Rapital

Rapital’s mission is to empower businesses of all sizes, credit backgrounds and industries by providing brokers and SMEs with funding solutions tailored to meet the real-world challenges they encounter.

For media inquiries, please contact:

Rapital Media Team

Email: info@rapital.co.uk

Phone: 0161 884 0767

Website: rapital.co.uk

How The PPP Reporting Oversight Harms MCA Companies

July 18, 2024David Roitblat is the founder and CEO of Better Accounting Solutions, an accounting firm based in New York City, and a leading authority in specialized accounting for merchant cash advance companies.To connect with David or schedule a call about working with Better Accounting Solutions, email david@betteraccountingsolutions.com.

deBanked’s recent story covering the news about how the Small Business Administration (SBA) failed to report many Paycheck Protection Program (PPP) loan charge-offs to credit agencies is a major concern for merchant cash advance companies.

deBanked’s recent story covering the news about how the Small Business Administration (SBA) failed to report many Paycheck Protection Program (PPP) loan charge-offs to credit agencies is a major concern for merchant cash advance companies.

As the AltFinanceDaily article explained, a new report from the Office of the Inspector General (OIG) found that the SBA did not report 37% of PPP loan charge-offs, and missed deadlines 97% of the time. The OIG report stated that the SBA’s automated system was supposed to report these loans, but it did not always work correctly. As a result, many delinquent borrowers could still get new loans because their bad debt wasn’t reported. The report also pointed out that a large portion of early PPP loan charge-offs were linked to potential fraud, which makes the lack of reporting even more serious.

This oversight could cause real problems for our industry. As an accountant working with MCA companies for over a decade, I understand firsthand how important accurate credit reporting is for making sound and fully informed decisions on which merchants our clients choose to invest in and help advance.

For MCA companies, this incomplete reporting leaves a critical gap in the information that funders rely on. Without accurate credit information, it’s harder to assess the risk of advancing capital to any particular merchant, which can lead to higher chances of defaults and financial losses when you don’t have a complete history that includes any times they’d skipped payments or defaulted. The missing data from the SBA means MCA companies might unknowingly fund high-risk businesses, which ultimately harms the cash advance company itself.

To work through this situation, funders need to take stock of how they evaluate prospective merchants to work with.

First, it’s important to do thorough background checks using multiple sources of information. Relying on just one credit report isn’t enough, especially now that we know there might be gaps. Cross-referencing data from various sources will provide a more complete picture of a merchant’s credit history.

We can also require merchants to provide more documentation and financial information before approving funding deals, removing a complete reliance on credit reporting agencies that have now proven themselves fallible. Pairing up the complete history that they provide along with their credit reports, and continuous tracking of the deal on a strong internal MCA CRM that lets you know of any hiccups, is a proactive approach that helps in making informed funding decisions.

It’s vital to develop strong risk management strategies. This might include setting stricter funding criteria, diversifying the types of businesses we lend to, and keeping enough reserves to cover potential losses. By being cautious and prepared, we can protect our companies from the financial risks posed by incomplete credit reporting, and eliminate our over reliance on that one source of information.

Let’s use this opportunity to ensure we are making the best funding decisions possible, and continue to have healthy companies built on stable foundations.

eBay Brings Back Revenue Based Financing Product

July 12, 2024eBay announced that Liberis had been onboarded as one of its “Seller Capital” partners this week, making it the second official partner after Funding Circle (which was recently acquired). Liberis, homegrown in the UK, expanded to the US in 2020 and offers a revenue based financing product described by eBay as a “Business Cash Advance.” While eBay has partnered with similar companies in the UK for years, eBay customers in the US have seen this before.

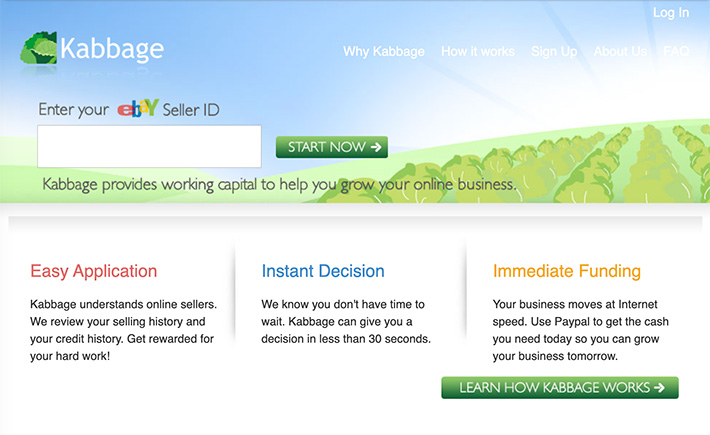

In 2010, for example, Kabbage was arguably the first company to offer revenue based financing to eBay customers, which AltFinanceDaily first covered 13 years ago. And they had it all to themselves until PayPal began to muscle its way in with a similar product starting in 2013. Given that eBay owned PayPal, PayPal held a distinct advantage until the two companies split in 2015. Still, PayPal continued to be the default payment service for eBay until 2018.

Kabbage continued to thrive anyway, evolving beyond the platform at least until covid when Kabbage suddenly imploded and was sold to American Express. PayPal’s working capital product also continued to thrive at least until 2023 when it announced a dramatic pullback after elevated charge-offs.

The result is that in 2024, eBay sellers can now look toward getting funding via Liberis.

“As a pioneer in ecommerce and the home to small businesses in more than 190 markets, eBay understands the challenges small businesses encounter in securing fast, flexible and transparent financing,” said Avritti Khandurie Mittal, VP & General Manager of Global Payments and Financial Services at eBay in the official announcement. “eBay Seller Capital is aimed at fueling our sellers’ growth by providing them with tailored financing solutions that meet the unique needs of their businesses. The addition of Business Cash Advance to our suite of offerings in partnership with Liberis enables us to expand capital availability for our sellers on flexible terms – when they need it the most.”

“We understand the unique challenges eBay sellers face when securing financing through traditional means,” adds Rob Straathof, CEO of Liberis. “Through eBay Seller Capital, Liberis will empower sellers with access to fast and responsible financing. We’re thrilled to partner with eBay to support eBay sellers to operate and grow their businesses.”