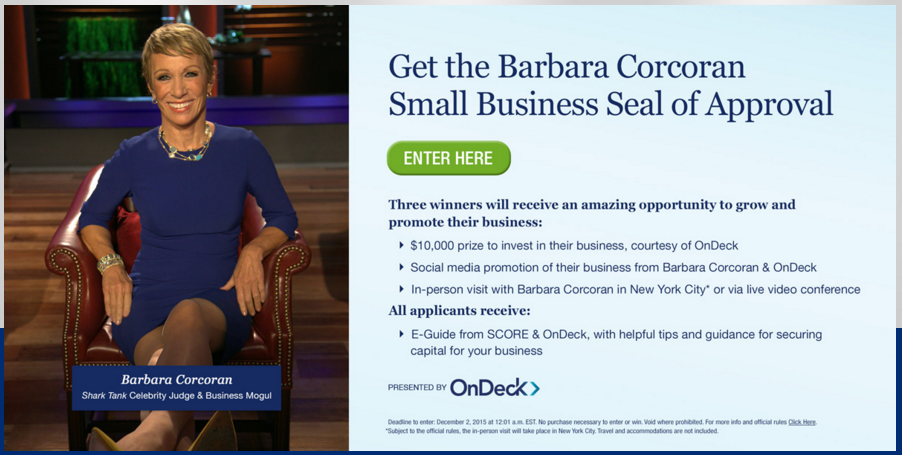

Shark Tank’s Barbara Corcoran Teams Up With OnDeck for Small Business Contest

November 29, 2015 Barbara Corcoran, co-founder of The Corcoran Group and famous Shark Tank investor, has teamed up with small business lender OnDeck to support entrepreneurs through a contest. Three winners will be chosen for a $10,000 prize and they’ll also get to meet Barbara Corcoran.

Barbara Corcoran, co-founder of The Corcoran Group and famous Shark Tank investor, has teamed up with small business lender OnDeck to support entrepreneurs through a contest. Three winners will be chosen for a $10,000 prize and they’ll also get to meet Barbara Corcoran.

Contest applicants are asked to enter what they would spend the $10,000 on to grow their business. The deadline to enter is December 2nd, 2015.

The partnership is significant because it marks yet another time that a Shark has crossed paths with online business lenders. Just one year ago, Kevin O’Leary became a spokesperson for IOU Financial.

I'm thrilled to announce a new partnership between O'Leary Financial & @IOUCentralInc this morning! http://t.co/ECJl1K5ZUC #smallbusiness

— Kevin O'Leary (@kevinolearytv) October 2, 2014

Also around that time, Kevin Harrington, an original Shark Tank investor before Mark Cuban or Lori Greiner, co-founded his own small business lending marketplace, Ventury Capital. Straight out of the OnDeck or merchant cash advance playbook, Ventury’s FAQ says their system “deducts a fixed, daily payment directly from your business bank account each business day.”

Watch Kevin Harrington explain his company here:

Of course there was the time that a merchant cash advance company (Total Merchant Resources) actually went on Shark Tank and pitched the sharks…

It seems that the show and the real world have a lot in common.

How Kaaj is Accelerating Small Business Lending

October 8, 2025Utsav Shah first met Kristen Castell at AltFinanceDaily CONNECT MIAMI this past February. At the time, Shah and his partner Shivi Sharma were freshly promoting a new AI technology to simplify small business lending. It’s called Kaaj, described as a core intelligence layer that bolts into a lender or broker’s CRM and handles all of the early-stage application intake and underwriting work. Shah had been familiar with the fintech accelerator Castell directs, the Center for Advancing Financial Equity (CAFE), which she was speaking about at the conference, but he had never actually met her in person until then.

“That’s really when we learned deeply about what CAFE’s mission is and how it works with a lot of startups, a very unique mission and very unique approach to work with startups and bring the ecosystem together,” said Sharma. “So we loved it and decided to apply this Fall.”

They applied into the exclusive accelerator program and were one of six companies to be selected, an honor considering hundreds of companies apply for entry on a bi-annual basis. As previously noted on AltFinanceDaily, it’s an eight-week program, some of which takes place on location at the Fintech Innovation Hub on the University of Delaware campus. The rest is virtual but there are in-person field trips like a recent one to Washington DC, for example. AltFinanceDaily has sponsored the last three accelerator cohorts which in the most recent cohort includes headline names like JPMorgan, PNC, Discover, Barclays, Capital One, M&T Bank, WSFS BANK, BNY Mellon, Prudential, Fulton Bank, County Bank, Best Egg, United Way, NeighborGood Partners, and the Delaware Bankers Association.

Kaaj, based in San Francisco, was already getting noticed beforehand. The company won the Fintech Meetup Startup Pitch Competition in March and secured a $50,000 prize, for example. Their technology is especially suited for equipment financing companies, MCA providers, small business lenders, SBA lenders, factors, and more.

Kaaj, based in San Francisco, was already getting noticed beforehand. The company won the Fintech Meetup Startup Pitch Competition in March and secured a $50,000 prize, for example. Their technology is especially suited for equipment financing companies, MCA providers, small business lenders, SBA lenders, factors, and more.

“So imagine that you’re a lender, and you get hundreds of applications in a day, and you don’t really know where you want to focus your time on,” Shah said to AltFinanceDaily. “‘What do these 100 deals mean for me, for my business? Are they even qualifying against my criteria, etc.’ So what Kaaj does, it provides very quick intelligence, within the first three minutes.”

Shah explained that as soon as someone submits a package with documents, they get analyzed from top to bottom, like KYC/KYB, the bank statements, and more. This helps lenders (and brokers) decide how to prioritize their time. Utsav’s background in technology has played a major role in building this out as he comes with a decade of AI experience and was building autonomous cars before building Kaaj.

“Time wins deals or time kills deals,” said Shah. “Either way that you want to look at it, if we can give that time back to them, if we can reduce that turnaround time on each individual deal and focus on those higher profitability deals for these companies or these lenders, then they can start really feeding the top line and the bottom line, because they’re not having to hire a bunch of folks.”

Sharma said that equipment finance is slightly more complex than MCA, for example, but that as a $1.4 trillion industry, it’s a market that’s ripe for innovation. Sharma used to work in commercial lending herself and has seen firsthand how manual processes and outdated technology slow things down and hurt not only the lenders but the borrowers in the process.

“I have worked on small business lending, commercial lending, payments fraud, onboarding fraud, a lot of that,” Sharma said. “I spotted a lot of challenges in that space and a clear lack of good technological solutions that really help these lenders scale efficiently.”

Shah, meanwhile, said that ultimately it’s about helping the end-user, the business borrower.

“We are very focused on solving for small businesses, because the final mission of the company is to get better access to capital for small businesses,” he said.

The Great Concession, How the MCA Product Effectively Proved It Was Right All Along

September 26, 2025 There was no greater irony than the State of Texas banning ACH debits from sales-based financing providers at the same time that the State of Washington was celebrating the coming age of sales-based financing. In Texas, for example, the motivation for curbing sales-based financing was built on the premise that “this type of financing has raised significant concerns about predatory lending and that state attorneys general as well as the Federal Trade Commission have obtained high-profile judgments against such financing for predatory practices.” Meanwhile, in Washington, the motivation for the state holding the opposite opinion was that sales-based financing “increases access to capital for small businesses in Washington state, particularly those that have been historically underserved or underbanked.”

There was no greater irony than the State of Texas banning ACH debits from sales-based financing providers at the same time that the State of Washington was celebrating the coming age of sales-based financing. In Texas, for example, the motivation for curbing sales-based financing was built on the premise that “this type of financing has raised significant concerns about predatory lending and that state attorneys general as well as the Federal Trade Commission have obtained high-profile judgments against such financing for predatory practices.” Meanwhile, in Washington, the motivation for the state holding the opposite opinion was that sales-based financing “increases access to capital for small businesses in Washington state, particularly those that have been historically underserved or underbanked.”

How did these states reach the opposite conclusion?

There’s no caveat to how the Washington State program works. The State’s Department of Commerce partnered with Grow America and the operation is backed by a federal grant (SSBCI-21031-0048) to roll out and administer a revenue-based financing program as part of Washington’s State Small Business Credit Initiative. It’s sales-based financing or in this case revenue-based financing (which is the more common phrase these days). Grow America’s revenue-based financing program utters a very familiar phrase in its marketing.

“The months you generate more revenue, you pay a higher amount, when business is slower you pay less,” the company advertises.

This was at one time the signature calling card of a merchant cash advance, but now such features have been repackaged and rebranded into something similar but different, and everybody is doing them.

The Grow America program applies a 20% holdback on adjusted monthly revenue and requires a minimum monthly payment of $1,000 if the 20% holdback does not generate at least $1,000 for the month. Merchants can get approved for anywhere from $50,000 to $1 million. The product is marketed as having a 1.24 factor rate and an estimated 14.27% APR with a 3-year term. As industry participants are aware, increasing sales would translate into increasing payments, which means a rapidly paid off loan could potentially result in a final outcome APR in the triple digits, far and away from the “estimate.”

The irony is that the notable benefits of a similar product, merchant cash advances, which have no minimum monthly payments, no fixed term, and are not absolutely repayable, are eliminated when restructured in this way and presented as “revenue-based financing loans.” Revenue-based financing loans take the underlying structure of MCAs (payments tied to sales) and then strip away the benefits. However, when structured as loans, the argument often goes that they are likely to be cheaper, which may be true on average, but is not always true.

Indeed, Grow America leads specifically with price as for why its product, similar to its privately owned competitors, are the better option:

“There are a lot of online lenders offering revenue-based loans that promise instant approvals, but their terms are intentionally confusing, and the fees are high,” Grow America advertises. “Our lenders aren’t like that. They’re mission driven.”

In Texas, the author of the bill that banned debits from such financing providers “informed the [legislative] committee that commercial sales-based financing has become a popular financing option for small businesses desperate for credit and that, unlike traditional loans, this type of financing is repaid as a percentage of future sales or revenue.”

Indeed, it is very popular. The largest providers or brokers of such financing today whether structured as a purchase or loan, are household names like Amazon, Walmart, Shopify, Intuit, Stripe, DoorDash, PayPal, Square, GoDaddy, Wix, Squarespace and more. Some structure them as a purchase and call it a merchant cash advance and some structure it as a loan and call it revenue-based financing. In either case, payments are tied to the percentage of future sales or revenue.

In egregious cases of wrongdoing one way or another, such incidents have historically been a result of deceptive marketing or payments from a merchant exceeding the contracted amount. In New York, when transactions are structured as a purchase, courts generally look to make sure that the agreements have a reconciliation provision in the agreement, whether the agreement has a finite term, and whether there is any recourse should the merchant declare bankruptcy. Legally speaking, the products have become pretty well defined and understood in the court system.

Like Washington State, GoDaddy, which recently announced its new merchant cash advance program, markets its product in an almost identical fashion.

“If your sales go up, the MCA will be paid sooner; if the sales are slow, it’ll take longer,” GoDaddy says.

Same message.

Washington State requires merchants to make a minimum payment every month and a balloon payment if not fully repaid within 3 years. GoDaddy, by contrast, advertises no minimum payment amount, no set payment schedule, no penalties, and no late fees. One’s a loan, one’s a purchase.

While the best course of action is best left to the merchants, there appears to be a near-universal concession that the underlying nature of how merchant cash advance agreements were contemplated, payments tied to sales, made strong logical business sense all along. Washington State emphasizes this fact.

“We know that your business has its own needs and loans with fixed payment amounts may not be the best option for you,” they advertise. “The revenue-based financing fund offers loans with flexible payback terms so you can grow your business immediately and pay back your loan based on your varying revenue.”

Recent studies also now highlight the benefits of cash-flow-based underwriting.

In Sharpening the Focus: Using Cash-Flow Data to Underwrite Financially Constrained Businesses, “The paper finds that adding cash-flow information substantially increases the predictive signal of models that rely primarily on the business owners’ personal credit scores and firm characteristics.”

There’s also Square, the largest revenue-based financing provider in the US, that has explained why this system just works better. Square says that they can fund more businesses and have higher payment success rates than if they were to follow more conventional methods of underwriting and repayment.

“Square Loans addresses [the credit] gap by using near real-time business data to assess creditworthiness, evaluating metrics such as transaction volume and revenue patterns to offer short-term loans — with repayment on average in 8 months,” Square wrote in a White Paper. “This allows for a more accurate and timely understanding of a business’s capacity to borrow and repay. And loan repayments are higher during periods when business is stronger and reduced when sales are lower.”

What’s the sentiment these days on payments tied to sales revenue? The market has spoken.

Why Lexington Capital Holdings is Expanding Into the Real Estate Business

September 24, 2025Lexington Capital Holdings is expanding beyond small business lending and into real estate, the company recently revealed. Lexington, a Long Island-based financial marketplace and brokerage led by CEO Frankie DiAntonio, is launching Lexington Estates to buy, sell, rehab, and hold properties long term.

According to DiAntonio, deals involving real estate have already been a part of their regular broker product mix for a long time, but when deciding whether or not they wanted to lend against real estate on their own or become the actual buyers and builders, they felt the latter would be more impactful. A syndication fund for these real estate deals, for example, will be open to employees of the firm to participate in. Lexington’s existing operation already has about 50 sales reps. Two from that group will move over to the real estate side to join a number of new hires they’re bringing on board to carry this plan out.

“Business is a team sport and I wouldn’t have been able to do any of this without the amazing Lexington team behind me,” DiAntonio said of the company’s success to-date.

Lexington Estates is already closing on its first property on Long Island. While they will make their focus local right out of the gate, they plan to work on deals both residential and commercial throughout the United States within 12 months. DiAntonio cut his teeth on real estate deals by participating in them personally outside of his business and now he’s making it a corporate endeavor. Whether it’s residential, retail, office space, industrial space, or anything else, they plan to evaluate it on the merits of the potential profits.

“I’m looking for deals,” DiAntonio said. “I’m looking for what’s the best bang for our buck.”

DiAntonio views this ambitious plan as one of absolute necessity given the challenges that the younger generation faces with the cost of living going up.

“I strive so hard to put my people in a position where they can make more money than the average American because you can’t even live the average American life and be average anymore,” DiAntonio said. “You actually have to be great just to live an average American life.”

Lexington Estates plans to officially launch on October 12th.

Texas Passes Law Limiting Sales-Based Financing to 1st Positions Only (and more)

May 29, 2025 The Texas House of Representatives has adopted the Senate’s controversial Commercial Sales-Based Financing amendment that prohibits a sales-based financing provider from automatically debiting any merchant in the state unless they are in a perfected 1st position. With the governor’s signature it will be law. As previously outlined, Texas had introduced its own commercial financing disclosure bill which included many extra requirements such as broker registration, state regulatory oversight, and now… a prohibition on any sales-based financing (with a particular aim at MCAs) where payments are debited that is not a true 1st position with a perfected security interest. It bears mentioning that 1st position here means 1st position out of any other claim altogether, not just other MCAs.

The Texas House of Representatives has adopted the Senate’s controversial Commercial Sales-Based Financing amendment that prohibits a sales-based financing provider from automatically debiting any merchant in the state unless they are in a perfected 1st position. With the governor’s signature it will be law. As previously outlined, Texas had introduced its own commercial financing disclosure bill which included many extra requirements such as broker registration, state regulatory oversight, and now… a prohibition on any sales-based financing (with a particular aim at MCAs) where payments are debited that is not a true 1st position with a perfected security interest. It bears mentioning that 1st position here means 1st position out of any other claim altogether, not just other MCAs.

The passed bill, which is the Senate version on the right hand side of this document, includes the following language:

CERTAIN AUTOMATIC DEBITS PROHIBITED.

A provider or commercial sales-based financing broker may not establish a mechanism for automatically debiting a recipient’s deposit account unless the provider or broker holds a validly perfected security interest in the recipient’s account under Chapter 9, Business & Commerce Code, with a first priority against the claims of all other persons.

While the law specifies sales-based financing, broadly encompassing either a purchase transaction (MCA) or a loan where the payments ebb and flow with sales activity (revenue based finance loan), companies with a special bank relationship are exempt from the law. The exemption applies to: “a bank, out-of-state bank, bank holding company, credit union, federal credit union, out-of-state credit union, or any subsidiary or affiliate of those financial institutions.”

Though the House had until Monday to decide on adopting the Senate’s amendment, the 98 Yeas to the 23 Nays made it a done deal at the very end of yesterday’s legislative session. It now simply awaits the governor’s signature.

Dodd-Frank 1071: Regulatory Uncertainty in Small Business Financing

May 28, 2025Jeffrey S. Paige is the Chief Legal Officer of CFG Merchant Solutions. Visit: https://cfgmerchantsolutions.com

A Changing Regulatory Landscape for Commercial Finance in New York & Beyond

When President Trump returned to office on January 20, 2025, he signed several executive orders with significant implications, particularly for New York’s commercial finance sector and the revenue-based financing industry. One such order was a regulatory freeze that could impact rules issued by the Consumer Financial Protection Bureau (CFPB), specifically those concerning small business financing data collection under Dodd-Frank Section 1071. The rationale behind this freeze is that the CFPB, an agency not directly controlled by Congress, exceeded its intended regulatory scope.

Trump’s order not only halts the issuance of new rules but also mandates the withdrawal of any rules previously sent to the Office of the Federal Register. More critically, it directs agency heads to “consider postponing” any rules that have been published but have not yet taken effect, creating a 60-day review period for reassessment of their legal and policy implications.

“Should actions be identified that were undertaken before noon on January 20, 2025, that frustrate the purpose underlying this memorandum, I may modify or extend this memorandum to require that department and agency heads consider taking steps to address those actions,” the order concludes. This places Section 1071 in limbo, leaving financial institutions uncertain about compliance obligations moving forward.

However, New York funders may still need to prepare. Under 12 U.S.C. § 5552 of the Dodd-Frank Act, individual states (including their respective financial regulators and attorneys general) have the authority to enforce federal consumer financial law, specifically, the Consumer Financial Protection Act and 18 enumerated consumer laws such as TILA, EFTA, FDCPA, GLBA, and regulations issued by the CFPB. Simply put, New York has the ability to enforce these laws and regulations, including Section 1071, by bringing suit in federal or state courts or other appropriate proceedings against any “covered person or service provider” as defined and not excluded by the Dodd-Frank Act’s terms. It is therefore prudent for non-exempt lenders and funders to take a proactive approach.

What Is Dodd-Frank 1071?

The Dodd-Frank Wall Street Reform and Consumer Protection Act, enacted in 2010, sought to address vulnerabilities in the financial system exposed during the 2008 financial crisis. On March 30, 2023, Section 1071 amended the Equal Credit Opportunity Act (ECOA), empowering the CFPB to collect and report key data from financial institutions on small business financing. The compliance deadline varies based on the size of the institution, with the earliest deadline set for July 18, 2025, affecting Tier 1 providers, defined as high-volume financial institutions.

The goal of Section 1071 is to identify and address disparities in small business financing by analyzing key metrics such as:

- Demographics of business owners (race, gender, ethnicity).

- Financing terms, rates, and credit outcomes.

- Geographic data, including trends in underserved regions.

By requiring funders to disclose this information, the regulation seeks to foster accountability and ensure that small businesses—especially those owned by minorities and women—have equitable access to credit and capital.

CFPB & Section 1071 Timeline

2010: Dodd-Frank Act Enacted

- Section 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act is established.

2011: CFPB Established

- The Consumer Financial Protection Bureau (CFPB) is created as an independent agency overseeing consumer financial protection laws, including small business lending regulations under Section 1071.

2017: CFPB Faces Legal Challenges

- Industry groups challenge the CFPB’s authority and structure, arguing that it lacks proper congressional oversight.

- Under the Trump administration, regulatory focus shifts toward deregulation, and CFPB rulemaking efforts on Section 1071 slowed down.

2020: U.S. Supreme Court Decision – Seila Law v. CFPB

- The Supreme Court rules that the president can remove the CFPB director at will, weakening its independence but allowing it to continue functioning.

2021: Biden Administration Revives Section 1071 Rulemaking

- The CFPB under Director Rohit Chopra prioritizes implementing Section 1071, aiming to enhance transparency in small business lending.

2022-2023: CFPB Proposes & Finalizes Section 1071 Rule

- The proposed rule is released in 2022, requiring lenders to collect and report loan application data, including business owner demographics.

- In March 2023, the final rule is issued, with compliance deadlines set for 2024 and 2025 based on lender size.

2023-2024: Legal Pushback & Court Challenges

- Industry groups file lawsuits, arguing that Section 1071 creates excessive regulatory burdens and violates constitutional limits on CFPB authority

- In October 2023, a Texas court stays the rule for certain plaintiffs, pausing enforcement for some lenders.

- In 2024, additional lawsuits escalate concerns over the rule’s implementation.

January 20, 2025: Trump Returns to Office & Freezes Regulations

- On his first day back in office, President Trump issues an executive order freezing pending regulations, including Section 1071.

- The order:

- Blocks new CFPB rulemaking,

- Withdraws rules not yet finalized,

- Delays implementation of already published rules for a 60-day review period.

- President Trump’s justification: The CFPB is an unelected agency that overstepped its authority, and its rules should be reassessed.

2025: Uncertainty & State-Level Action

- The CFPB’s authority remains in question, leaving financial institutions uncertain about compliance requirements.

- New York may independently implement similar reporting requirements, as it has done with previous commercial financing regulations.

- Many New York funders continue preparing for potential state-level enforcement despite the federal freeze.

How Alternative Financing Providers Can Adapt

Funders in the alternative financing space should remain agile and prepare for multiple scenarios. Even if Section 1071 is rolled back, transparency and fair funding practices remain critical for fostering trust and maintaining credibility in the market.

Steps funders can take include:

- Investing in technology to automate compliance processes, ensuring readiness for future regulations.

- Engaging with industry stakeholders to advocate for practical regulatory approaches that balance fairness and business efficiency.

- Maintaining transparency in financing practices to build stronger relationships with merchants and partners.

Looking Ahead

As the financial industry navigates the potential rollback of Dodd-Frank 1071 (Republican Congressman Roger Williams of Texas has introduced H.R. 976 seeking to do just that), alternative financing companies should focus on long-term strategies that prioritize both compliance and innovation. This is especially true in New York, where the legislature is currently considering a bill called the Fair Business Practices Act, modeled after Title X of Dodd-Frank, that would among other things expand the New York Attorney General’s enforcement powers and enhance penalties in this industry sector for UDAP violations. This further signals that New York as well as other states is seeking to fill any void left by the weakening of the CFPB. Whether the regulation remains in effect or is dismantled, financial institutions should stay proactive in adapting to changes while ensuring fair access to capital for small businesses.

Extension on your taxes? Declined. Showing modest profit or a loss for tax purposes ::wink wink:: ? Declined. Didn’t file a tax return? Declined. Co-mingling funds with your personal finances? Declined. Overdrafts or NSFs? Declined. Unaudited financials? Declined. No collateral? Declined. Doing the books with paper and pen? Declined. Have less than 5 employees? Declined. Can’t find a document the bank wants? Declined. Need the money really badly? Declined. Experiencing a downturn? Declined. Have a tax lien? Declined. Have a criminal record? Declined.

Extension on your taxes? Declined. Showing modest profit or a loss for tax purposes ::wink wink:: ? Declined. Didn’t file a tax return? Declined. Co-mingling funds with your personal finances? Declined. Overdrafts or NSFs? Declined. Unaudited financials? Declined. No collateral? Declined. Doing the books with paper and pen? Declined. Have less than 5 employees? Declined. Can’t find a document the bank wants? Declined. Need the money really badly? Declined. Experiencing a downturn? Declined. Have a tax lien? Declined. Have a criminal record? Declined. So what do small businesses need banks for anyway? Checking, payroll, overdraft coverage, debit cards, wires, record keeping, CDs etc. There is a place for banks in 2013 and beyond. Alternative lenders charge more and that’s okay. Ultimately it’s up to the borrowers to decide what they can sustain. It is better to have expensive options than no options at all. There’s endless proof of that when credit dried up five years ago. Small businesses cried foul so the market reacted. And here we are now with

So what do small businesses need banks for anyway? Checking, payroll, overdraft coverage, debit cards, wires, record keeping, CDs etc. There is a place for banks in 2013 and beyond. Alternative lenders charge more and that’s okay. Ultimately it’s up to the borrowers to decide what they can sustain. It is better to have expensive options than no options at all. There’s endless proof of that when credit dried up five years ago. Small businesses cried foul so the market reacted. And here we are now with  Here’s a question that every investor, lender, and underwriter asks at some point, “What is the default rate on a Merchant Cash Advance?” I personally don’t like when Merchant Cash Advance is overgeneralized since every funder offers their own variation of it, has a different tolerance for risk, and calculates under-performing or non-performing accounts in a unique way. Alas, I am not trying to avoid the question but want to make it clear that there is no one-size-fits-all financing model, nor a standard for defaults. I will quote publicly available information though…

Here’s a question that every investor, lender, and underwriter asks at some point, “What is the default rate on a Merchant Cash Advance?” I personally don’t like when Merchant Cash Advance is overgeneralized since every funder offers their own variation of it, has a different tolerance for risk, and calculates under-performing or non-performing accounts in a unique way. Alas, I am not trying to avoid the question but want to make it clear that there is no one-size-fits-all financing model, nor a standard for defaults. I will quote publicly available information though…