Related Headlines

| 12/11/2023 | Cross River: $150M facility to Best Egg |

| 01/03/2019 | Best Egg, SuperMoney strategic partners |

| 04/11/2018 | Best Egg exceeds $5B in loans |

| 04/09/2018 | Best Egg exceeds $5B |

Stories

Best Egg Exceeds $5 Billion in Loans

April 11, 2018 Now four years old, the consumer-lending platform Best Egg has delivered more than $5 billion in personal loans. The Wilmington, DE-based lender does not offer business loans. However, Best Egg CEO Jeffrey Meiler told AltFinanceDaily that they are increasingly making loans to people who are self-employed.

Now four years old, the consumer-lending platform Best Egg has delivered more than $5 billion in personal loans. The Wilmington, DE-based lender does not offer business loans. However, Best Egg CEO Jeffrey Meiler told AltFinanceDaily that they are increasingly making loans to people who are self-employed.

“Structurally, one of the things that has really been a tailwind to this industry is the whole move to the gig economy and people having income that is less regular,” Meiler said. “It has increased demand for what we provide.”

Meiler is referring to, among others, freelancers, who are essentially one-person businesses. Best Egg specializes in personal loans with repayment periods of either 36 or 60 months. Some loans are used for large purchases while the majority are used for consolidating debt or refinancing.

“We mostly cater to people who want to get out of debt,” Meiler said.

Best Egg does all of its marketing internally and has 280 employees.

How Kaaj is Accelerating Small Business Lending

October 8, 2025Utsav Shah first met Kristen Castell at AltFinanceDaily CONNECT MIAMI this past February. At the time, Shah and his partner Shivi Sharma were freshly promoting a new AI technology to simplify small business lending. It’s called Kaaj, described as a core intelligence layer that bolts into a lender or broker’s CRM and handles all of the early-stage application intake and underwriting work. Shah had been familiar with the fintech accelerator Castell directs, the Center for Advancing Financial Equity (CAFE), which she was speaking about at the conference, but he had never actually met her in person until then.

“That’s really when we learned deeply about what CAFE’s mission is and how it works with a lot of startups, a very unique mission and very unique approach to work with startups and bring the ecosystem together,” said Sharma. “So we loved it and decided to apply this Fall.”

They applied into the exclusive accelerator program and were one of six companies to be selected, an honor considering hundreds of companies apply for entry on a bi-annual basis. As previously noted on AltFinanceDaily, it’s an eight-week program, some of which takes place on location at the Fintech Innovation Hub on the University of Delaware campus. The rest is virtual but there are in-person field trips like a recent one to Washington DC, for example. AltFinanceDaily has sponsored the last three accelerator cohorts which in the most recent cohort includes headline names like JPMorgan, PNC, Discover, Barclays, Capital One, M&T Bank, WSFS BANK, BNY Mellon, Prudential, Fulton Bank, County Bank, Best Egg, United Way, NeighborGood Partners, and the Delaware Bankers Association.

Kaaj, based in San Francisco, was already getting noticed beforehand. The company won the Fintech Meetup Startup Pitch Competition in March and secured a $50,000 prize, for example. Their technology is especially suited for equipment financing companies, MCA providers, small business lenders, SBA lenders, factors, and more.

Kaaj, based in San Francisco, was already getting noticed beforehand. The company won the Fintech Meetup Startup Pitch Competition in March and secured a $50,000 prize, for example. Their technology is especially suited for equipment financing companies, MCA providers, small business lenders, SBA lenders, factors, and more.

“So imagine that you’re a lender, and you get hundreds of applications in a day, and you don’t really know where you want to focus your time on,” Shah said to AltFinanceDaily. “‘What do these 100 deals mean for me, for my business? Are they even qualifying against my criteria, etc.’ So what Kaaj does, it provides very quick intelligence, within the first three minutes.”

Shah explained that as soon as someone submits a package with documents, they get analyzed from top to bottom, like KYC/KYB, the bank statements, and more. This helps lenders (and brokers) decide how to prioritize their time. Utsav’s background in technology has played a major role in building this out as he comes with a decade of AI experience and was building autonomous cars before building Kaaj.

“Time wins deals or time kills deals,” said Shah. “Either way that you want to look at it, if we can give that time back to them, if we can reduce that turnaround time on each individual deal and focus on those higher profitability deals for these companies or these lenders, then they can start really feeding the top line and the bottom line, because they’re not having to hire a bunch of folks.”

Sharma said that equipment finance is slightly more complex than MCA, for example, but that as a $1.4 trillion industry, it’s a market that’s ripe for innovation. Sharma used to work in commercial lending herself and has seen firsthand how manual processes and outdated technology slow things down and hurt not only the lenders but the borrowers in the process.

“I have worked on small business lending, commercial lending, payments fraud, onboarding fraud, a lot of that,” Sharma said. “I spotted a lot of challenges in that space and a clear lack of good technological solutions that really help these lenders scale efficiently.”

Shah, meanwhile, said that ultimately it’s about helping the end-user, the business borrower.

“We are very focused on solving for small businesses, because the final mission of the company is to get better access to capital for small businesses,” he said.

AltFinanceDaily Returns as Sponsor of CAFE’s Fintech Accelerator

April 14, 2025AltFinanceDaily is sponsoring CAFE’s Fintech Accelerator program for the Spring 2025 Cohort. This is the 2nd cohort that AltFinanceDaily has been a sponsor of.

“The accelerator offers a hands-on, immersive two month experience where mission-driven founders gain direct exposure to financial institutions, regulators, and investors who are eager to collaborate.”

“With expert-led sessions, customer pitch opportunities and a strong community of like-minded innovators, CAFE provides a scaling opportunity for startups to accelerate growth, navigate complex industry landscapes, and drive meaningful financial inclusion.”

The spring 2025 Cohort companies include DubPrime, GoodTrust, SPARE, Starlight, TAZI, and Trackstar.

The sponsors include Best Egg, American Bankers Association, Cohen Circle, AltFinanceDaily, Delaware Technology Park, JPMorgan, Discover, Growthstage Incubator, NayaOne, and Wolf & Company, P.C.

To learn more visit: https://ftcafe.org/apply/

Meet the CAFE That Can Accelerate Your Fintech Startup

October 14, 2024 Newer fintechs on a mission to advance financial health and wellness for low-to-moderate income individuals and underserved populations may not have to weather the startup journey alone. Inside the Fintech Innovation Hub, situated on University of Delaware’s STAR campus, is the non-profit Center for Advancing Financial Equity (CAFE). Supported by numerous partnerships including the Small Business Administration, Discover, the Small Business Development Center (SBDC), the American Bankers Association, and more, one of its signature initiatives is its bi-annual fintech accelerator, which aims to identify, support and grow extraordinary financial accelerated technologies and innovations. Hundreds of companies apply but only six get selected for each cohort of the accelerator. One of those selected this past Spring, Parlay, offers a powerful tool to improve small business loan applications. Another, Stratyfy, offers interpretable AI solutions that enable financial institutions to make more accurate, efficient, and fair financial decisions in credit risk, fraud, and compliance.

Newer fintechs on a mission to advance financial health and wellness for low-to-moderate income individuals and underserved populations may not have to weather the startup journey alone. Inside the Fintech Innovation Hub, situated on University of Delaware’s STAR campus, is the non-profit Center for Advancing Financial Equity (CAFE). Supported by numerous partnerships including the Small Business Administration, Discover, the Small Business Development Center (SBDC), the American Bankers Association, and more, one of its signature initiatives is its bi-annual fintech accelerator, which aims to identify, support and grow extraordinary financial accelerated technologies and innovations. Hundreds of companies apply but only six get selected for each cohort of the accelerator. One of those selected this past Spring, Parlay, offers a powerful tool to improve small business loan applications. Another, Stratyfy, offers interpretable AI solutions that enable financial institutions to make more accurate, efficient, and fair financial decisions in credit risk, fraud, and compliance.

Being accepted into CAFE requires a startup to already be up and operating.

“[These companies are] in market, the products are built already,” said Kristen Castell, Managing Director of CAFE. “They do have some customers, some of them are enterprise customers like banks, a full time team, and many of them have raised money already.”

Castell tells AltFinanceDaily that the companies applying to the accelerator still need a lot of help in terms of making industry connections, scaling distribution, and developing the right partnerships. It’s an eight-week program, some of which takes place on location at the Fintech Innovation Hub in Delaware. The rest is virtual. Applicants and those selected can be from anywhere in the US. The founders, all connected by some level of common interest, are bound to form a bond throughout the unique experience. Last week for example, the members of the Fall cohort went on a field trip to the Wilmington, Delaware headquarters of Best Egg (F/K/A Marlette), an online lender, and got to learn about their path from being a startup in 2014 to the fintech stalwart they are today.

“This time, we have some opportunities to meet the American Bankers Association in Washington, DC,” Castell said. “We also meet the regulators at CFPB in Washington, DC. There’s some other conference opportunities like another accelerator called RevTech Labs that has an investor conference in Charlotte. So there’s an opportunity to pitch there to investors.”

The learning curve for any company coming through the accelerator is dramatically shortened by the access and guidance they get, whether that be from other fintechs, from bankers, from regulators, or the largest fintech trade association, the American Fintech Council.

At the end of it all there’s a demo day in person at the Fintech Innovation Hub in Delaware, where they present to investors, bankers, academics, industry and community leaders, non-profit organizations and entrepreneurs alike to show what they’re made of.

Castell, a former banker herself that previously worked for JPMorgan and BlackRock, also experienced a taste of being a fintech entrepreneur when she became interested in impact investing. It’s a scene she loves. When the plan for CAFE was in development, the opportunity to be involved with financial inclusion, technology, and startups all in one was something she really wanted to take on.

“It’s really been an incredible opportunity to build the organization, to build the program, to work with all these partners, to bring all these stakeholders that I had mentioned earlier in and we’re not done,” she said. “We’re just getting started.”

The six members of the Fall cohort are Carvertise, GivingCredit, Kredit Academy, Odynn, Salus, and Prismm. Sponsors include the American Bankers Association (ABA), Siegfried Advisory, Delaware Prosperity Partnership (DPP), Wolf & Co, Delaware Tech Park, AltFinanceDaily, and Discover Financial Services.

AltFinanceDaily is expected to attend the demo day in November.

Cross River Bank Raises $100 Million

December 11, 2018Cross River Bank, which provides banking services to fintech companies, announced last week the completion of a funding round of roughly $100 million. This was comprised of a $75 million equity investment from KKR, along with capital from Andreessen Horowitz, Battery Ventures, Rabbit Capital, and funding from new investors CredEase and Lion Tree. This adds to a $28 million raise a little over two years ago.

Cross River, which originated more than $5 billion in loans as of the end of August 2018, has developed partnerships with fintech leaders to build fully compliant and integrated products within the lending marketplace and payment processing spaces. They have about 15 lending platform partners, including fintech clients Affirm, Best Egg, RocketLoans, Coinbase and TransferWise.

According to the announcement, this new capital will be used to allow Cross River to continue building a complete banking platform where fintech companies can leverage best-in-class banking technology coupled with compliance.

“Cross River offers solutions to fintech companies by giving them access to a full suite of banking solutions and services in a single, fully compliant and innovative platform, making it an increasingly attractive and valuable franchise in a dynamic marketplace,” said Dan Pietrzak, Member and Co-Head of Private Credit at KKR, Cross River’s leading investor.

According to its website, Cross River was named “most innovative bank” by LendIt in 2017 and 2018. Founded in 2008, the Fort Lee, NJ, business-oriented bank has more than 180 employees.

Marlette Closes Proprietary Securitization Deal Worth $205 Million

August 3, 2016After a personal-loan bond sale last month, marketplace lender Marlette Funding closed its first proprietary securitization worth $205 million. “MFT” consists of Best Egg collateral financed via three classes of Notes and one class of Certificates.

Best Egg is Marlette’s personal loan platform with $2 billion in originations since 2014. This transaction, done through Goldman Sachs was the second securitization of unsecured consumer loans originated by Cross River Bank on the platform. In July, Marlette securitized personal loan bonds worth $180 million in Single A notes rated by Kroll Rating Agency.

This news comes at a time as online lenders and marketplaces alike feel the need to diversify sources of capital. “Accessing the securitization markets represents the third major component of a diversified funding plan, which also includes building strong relationships with institutional investors and developing on-balance sheet asset backed credit facilities,” said Paul Ricci, CFO of Marlette Funding.

5 Tips for Better MCA Collections

February 3, 2023Shaya Gorkin is an experienced attorney and the COO of Monetaria Group, a premier collections agency specializing in merchant cash advance and commercial debt recovery. To connect with Shaya, email shaya@merelcorp.com.

With the benefit of our collective decade of experience working in collections for the merchant cash advance industry, our team at Monetaria Group has come to understand all too well the importance of recovering funds for our clients and all the difficulties associated with that. The MCA sector poses distinct obstacles and challenges for collections; but, by implementing the correct systems and strategies, we’ve found that outstanding payments be recovered, without it having to be a painful and drawn-out experience.

Here are five key strategies for better MCA collections that we have implemented with our clients, that can help you too:

1. Be familiar with the industry you’re being asked to advance.

Often, MCA companies offer small businesses short-term funding in their moments of need. This means that the funders are betting on the business’s ability to take advantage of the opportunity being offered to them and turn the ship around, enabling them to repay the advance without any complications or issues.

To ensure you are giving your company the best chance of getting its money back, it is essential for funders to have an understanding of the industry and the businesses they are working with to be able to evaluate their advance worthiness and anticipate fluctuations in repayment ability.

2. Establish relationships and overcommunicate.

Having strong relationships goes a long way in MCA collections, for both the funders and their clients. Establishing trust and open communication with clients will inevitably lead to a better understanding of their specific needs and challenges. Additionally, it goes without saying that developing positive customer relationships can lead to more successful negotiations and repayment agreements.

3. Be proactive and offer solutions.

Instead of passively waiting for merchants to default, proactively reach out to them to check in and see if it’s time to discuss reconciliation and other solutions. This shows a willingness to work with them and allows for potential issues to be addressed before they become major problems.

4. Utilize the best available technology.

Over the past decade, the merchant cash advance space has seen an explosion in the creation CRMs and softwares to service and assist the MCA businesses. Utilizing these technologies will greatly improve the efficiency and effectiveness of your business and will be a great asset in ensuring you are collecting all that is owed to you. Look for the services that offer the features you need, such as custom reports, client breakdowns, automated payment reminders, online portals for customers to make payments, and data analytics- they are all out there ready to assist you.

5. Have a contingency plan.

Despite your best efforts, some merchants will still default. Having a well-crafted contingency plan in place that doesn’t put all your eggs in one basket will minimize the potential negative impact on your business. This includes doing a very thorough underwriting of the merchant’s business. Additionally, be prepared to explore your options in terms of collecting what is owed to you. This may include selling the debt, restructuring the payment, hiring a qualified third-party debt recovery agency, or legal action.

Having all these in place will more than adequately prepare you for a successful MCA collections experience, and help you avoid all the stress and headaches it can present otherwise.

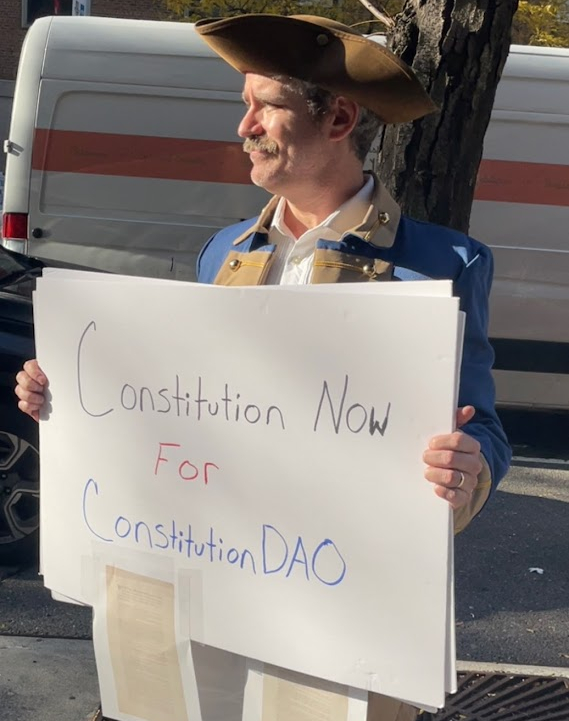

So We Didn’t Buy The Constitution

November 18, 2021 An internet movement started last week to buy one of the only remaining original copies of the United States Constitution reached a roaring climax on Thursday night and then descended into chaos and confusion as almost no one seemed to know what the outcome was, how auctions work, who was bidding on the movement’s behalf, or anything at all.

An internet movement started last week to buy one of the only remaining original copies of the United States Constitution reached a roaring climax on Thursday night and then descended into chaos and confusion as almost no one seemed to know what the outcome was, how auctions work, who was bidding on the movement’s behalf, or anything at all.

Several news outlets reported that the Decentralized Autonomous Organization, aka DAO (pronounced “Dow”), representing the internet movement, had won, including the crypto-focused outlet Coindesk. The DAO raised approximately $47 million via ethereum contributions in a matter of just days from a total of more than 17,437 people who joined in (yours truly included). Knowing that, most people were lured into believing that the winning bid of $43.2 million had to have been the DAO. Unfortunately, the contributors seemed largely unaware of the hefty fees charged on top by Sotheby’s, the 8.875% sales tax, and more. I wrote about this two days prior.

This snafu seems to have been expected by those skeptical of an internet movement. Having actually stood outside of Sotheby’s earlier in the day in full George Washington-esque garb, I was asked by someone seemingly connected to a bidder if the DAO was aware of the added fees. I told them what I knew, but I couldn’t speak in the affirmative for the other 17,436 people.

Having also crossed paths with Julian Weisser, however, a Core team member and nice fellow, it was clear that he was extremely knowledgeable about all the details involved. Weisser was also the first team member to officially announce the loss on the discord.

“@everyone – We did not win the bid for the copy of the U.S. constitution.

While this wasn’t the outcome we hoped for, we still made history tonight with ConstitutionDAO. This is the largest crowdfund for a physical object that we are aware of—crypto or fiat. We are so incredibly grateful to have done this together with you all and are still in shock that we even got this far.

Sotheby’s has never worked with a DAO community before. We broke records for the most money crowdfunded in less than 72 hours. We have educated an entire cohort of people around the world – from museum curators and art directors to our grandmothers asking us what eth is when they read about us in the news – about the possibilities of web3. And, on the flip side, many of you have learned about what it means to steward an asset like the U.S. constitution across museums and collections, or watched an art auction for the first time.

We had 17,437 donors, with a median donation size of $206.26. A significant percentage of these donations came from wallets that were initialized for the first time.

You will be able to get a refund of your pro rata amount (effectively minus gas fees) through Juicebox. Please expect more details from us about this tomorrow – our team has not slept in the past week, and we are giving people the night to get some rest before we’re back at it tomorrow AM.

Every one of you were a part of this. We want to also thank our partners in this work: Alameda Research, Endoament, FTX US, Juicebox, Morning Brew, and SyndicateDAO”

Once the results finally started to kick in, feelings were mixed. Discord members were torn between feeling completely bamboozled or excited to use a DAO to make some other kind of meaningful purchase. The leadership behind the organization’s official twitter account signed off for the night early after working around the clock for about a week to even put the entire thing together.

Once the results finally started to kick in, feelings were mixed. Discord members were torn between feeling completely bamboozled or excited to use a DAO to make some other kind of meaningful purchase. The leadership behind the organization’s official twitter account signed off for the night early after working around the clock for about a week to even put the entire thing together.

gn everyone we’ll be back tomorrow

thanks for all your love and support. can’t wait to shape the next leg of this journey with you all 🙂 🌙 📜 https://t.co/Vhtiglpntg

— ConstitutionDAO (📜, 📜) (@ConstitutionDAO) November 19, 2021

By any measure, the dollars involved were astounding. This particular copy of the Constitution last sold in 1988 for the price of $165,000. Sotheby’s pegged the current value at $15 – $20 million. With $47 million in hand, winning seemed a strong possibility. The one major problem, however, is that with the blockchain being a public ledger, the rival bidder already knew the DAO’s best bid.

Overall, it was a rather strange experience, no doubt made more unusual by my throwing down eth and then donning a costume on the Upper East Side of Manhattan to the bewilderment of many locals.

Was this ultimately a loss for crypto or still a win? Only time will tell…